Advice on how to manage short positions is given this week with an hourly chart to support members trading.

Summary: The target is at least a new low below 47.06; it should be comfortably below that point. Beware that bounces may be brief and shallow. The hourly chart may be used to manage a trailing stop for traders with a shorter time horizon. Traders with a longer horizon may use prior support, about 50.50.

New updates to this analysis are in bold.

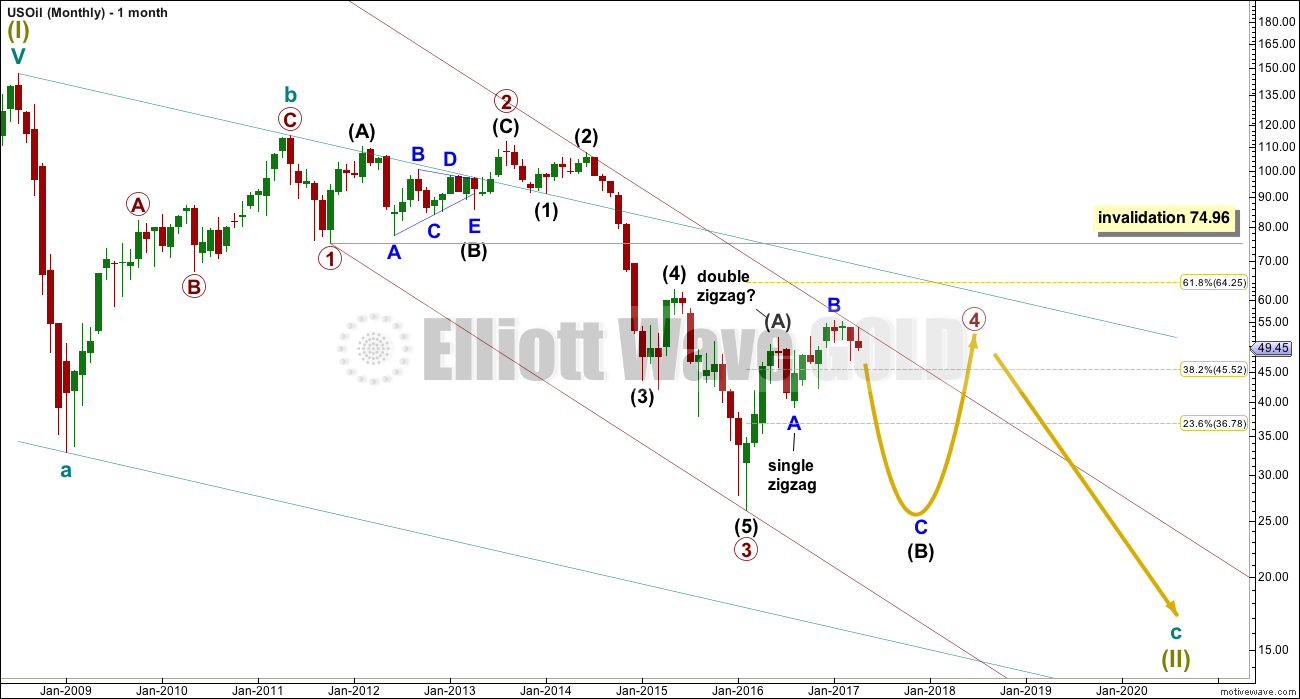

MONTHLY ELLIOTT WAVE COUNT

Within the bear market, cycle wave b is seen as ending in May 2011. Thereafter, a five wave structure downwards for cycle wave c begins.

Within cycle wave c, at this stage it does not look like primary wave 5 could be complete. That would only be possible if primary wave 4 was over too quickly.

Primary wave 1 is a short impulse lasting five months. Primary wave 2 is a very deep 0.94 zigzag lasting 22 months. Primary wave 3 is a complete impulse with no Fibonacci ratio to primary wave 1. It lasted 30 months.

Primary wave 4 is likely to exhibit alternation with primary wave 2. Primary wave 4 is most likely to be a flat, combination or triangle. Within all of these types of structures, the first movement subdivides as a three. The least likely structure for primary wave 4 is a zigzag.

Primary wave 4 is likely to end within the price territory of the fourth wave of one lesser degree; intermediate wave (4) has its range from 42.03 to 62.58.

If primary wave 4 is incomplete, then it looks like it may not remain contained within the channel. Sometimes fourth waves overshoot channels and this is why Elliott developed a second technique to redraw the channel when it does not contain a fourth wave.

Primary wave 4 is most likely to be shallow to exhibit alternation in depth with primary wave 2. So far it has passed the 0.382 Fibonacci ratio at 45.52. It may now continue to move mostly sideways in a large range.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

At this stage, primary wave 4 has completed intermediate wave (A) only. Intermediate wave (B) is incomplete.

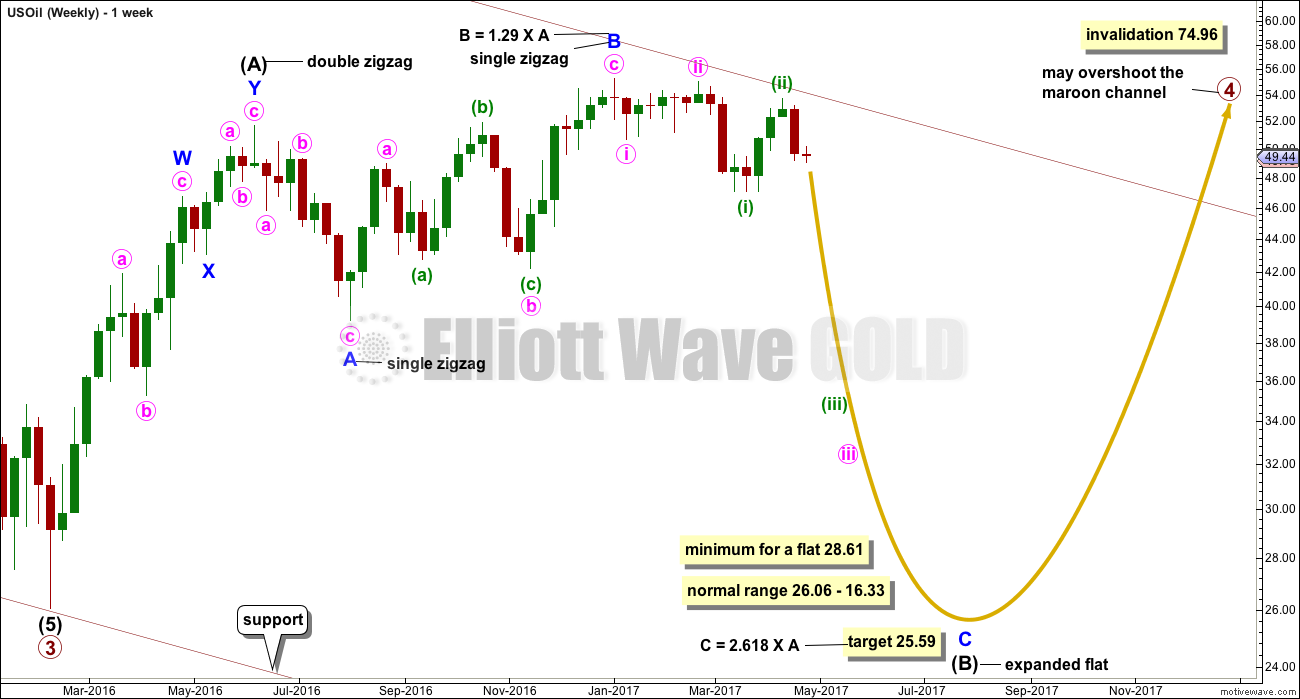

WEEKLY ELLIOTT WAVE COUNT

The whole structure of primary wave 4 is seen here in more detail.

The first wave labelled intermediate wave (A) is seen as a double zigzag, which is classified as a three.

Intermediate wave (B) is also a three. This means primary wave 4 is most likely unfolding as a flat correction if my analysis of intermediate wave (A) is correct. Flats are very common structures.

Intermediate wave (B) began with a zigzag downwards. This indicates it too is unfolding most likely as a flat correction.

Within intermediate wave (B), the zigzag upwards for minor wave B is a 1.29 correction of minor wave A. This indicates intermediate wave (B) may be unfolding as an expanded flat, the most common type.

The normal range for intermediate wave (B) within a flat correction for primary wave 4 is from 1 to 1.38 the length of intermediate wave (A) giving a range from 26.06 to 16.33.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

Within the larger expanded flat correction of primary wave 4, intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 28.61 or below.

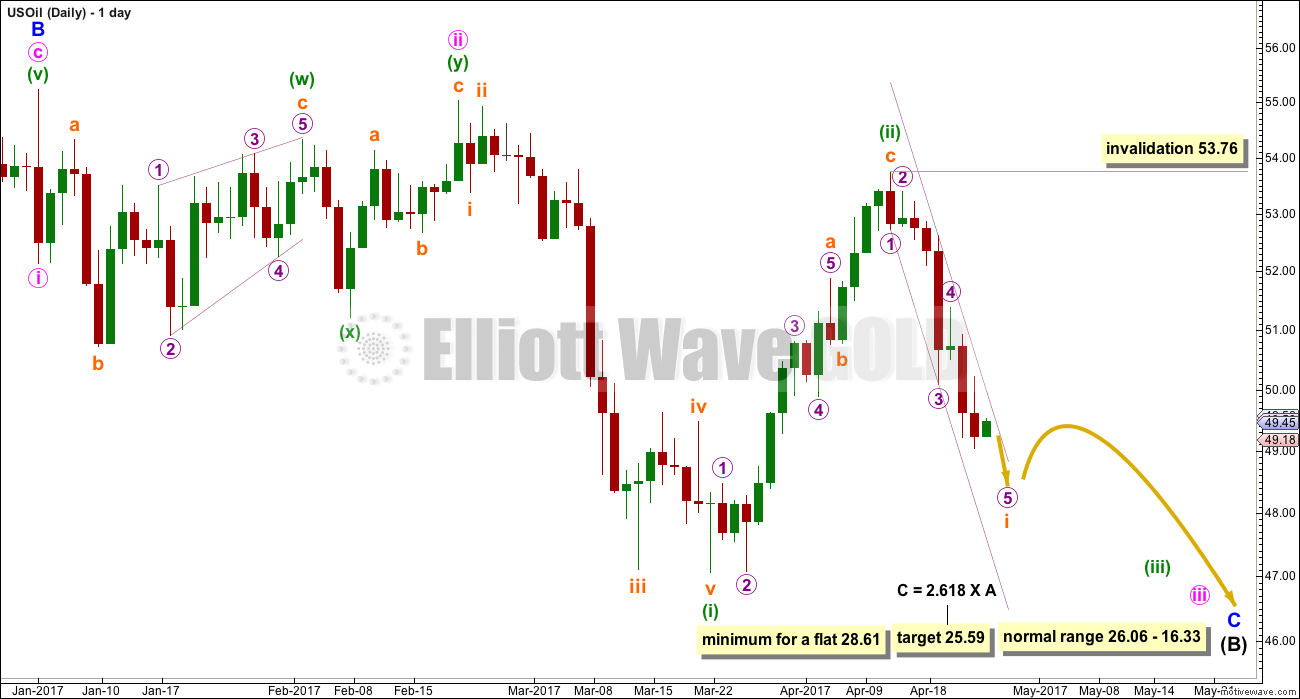

DAILY ELLIOTT WAVE COUNT

Minor wave C downwards must subdivide as a five wave structure.

Within minor wave C, minute waves i and ii should be complete and minute wave iii must be incomplete. Upwards movement, which is labelled minuette wave (ii), cannot be minute wave iv as it overlaps back into minute wave i price territory.

Within minute wave iii, minuette wave (i) is complete and minuette wave (ii) is complete.

Minuette wave (iii) must make a new low below the end of minuette wave (i) at 47.06. It must move far enough below that point to allow for subsequent upwards movement for minuette wave (iv) to unfold and remain below minuette wave (i) price territory.

Within minuette wave (iii), no second wave correction may move beyond the start of its first wave above 53.76.

At this stage, within minor wave C, corrections should now be expected to be relatively brief and shallow lasting maybe up to a about three days at most. There should now be a strong downwards pull from the middle of a third wave.

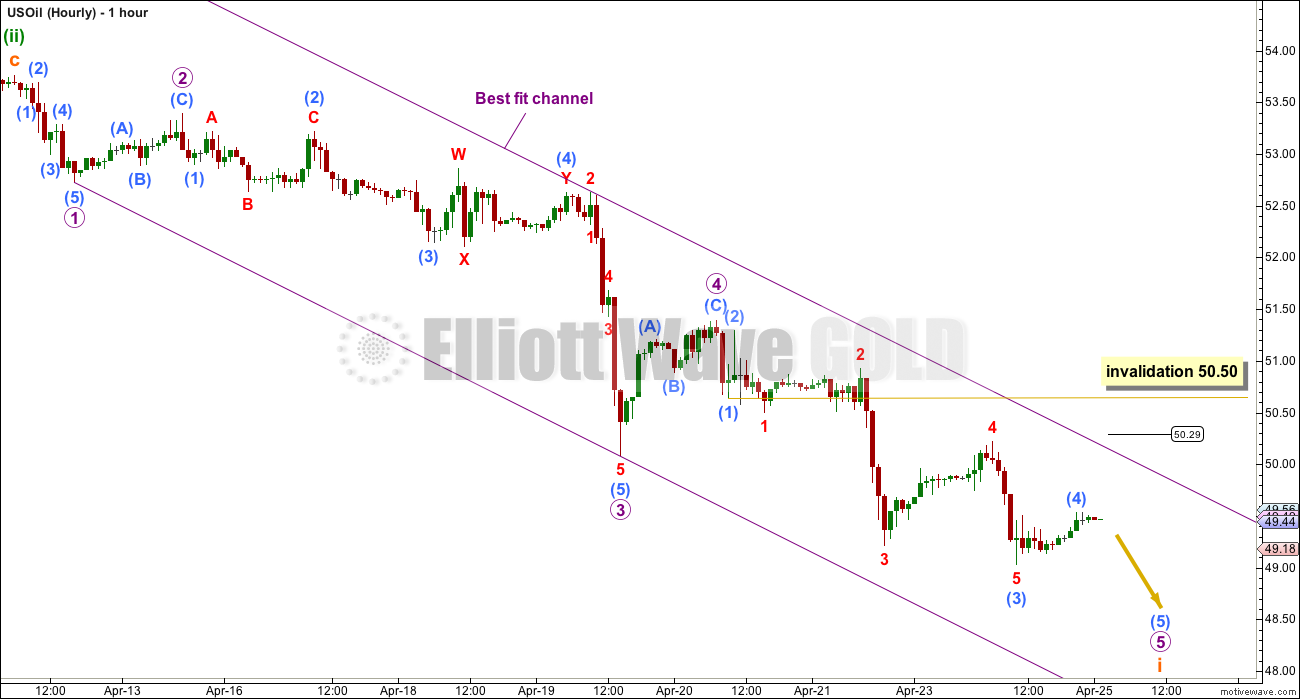

A best fit channel is drawn about the downwards wave labelled subminuette wave i. When price breaches the upper edge of this channel, then subminuette wave i may be over and subminuette wave ii may have arrived. Subminuette wave ii may be expected to be shallow, maybe only 0.236 or 0.382 of subminuette wave i.

This channel is very steep, so it does not have good technical significance. It may be best used to pull down a trailing stop each day to protect profits. Members with a longer time horizon for trading may like to leave the market ample room to move. At this stage, I have pulled my stop down to just above 50.30.

The cyan trend line is drawn from the high labelled minor wave B to the next swing high labelled minute wave ii. This is a Magee trend line for a bear market. Expect that US Oil is most likely in a downwards trend as long as price remains below this cyan trend line.

HOURLY ELLIOTT WAVE COUNT

In order to better manage short positions an hourly chart is added this week. This is not always necessary for Oil analysis, but as members have requested it and it may help, it is provided.

The structure of subminuette wave i may be incomplete, but it is very close to completion. The best fit channel is replicated here and trailing stops may be set by eyeballing the upper edge of the channel; a price point is added to show how I have determined the stop today. To this figure I have added 3X my normal broker spread and ensured my stop is not set at a round number.

Oil may be ready for a small brief shallow correction after the next low. It is up to each member to decide if they exit short positions there or hold on for the target at 25.59.

TECHNICAL ANALYSIS

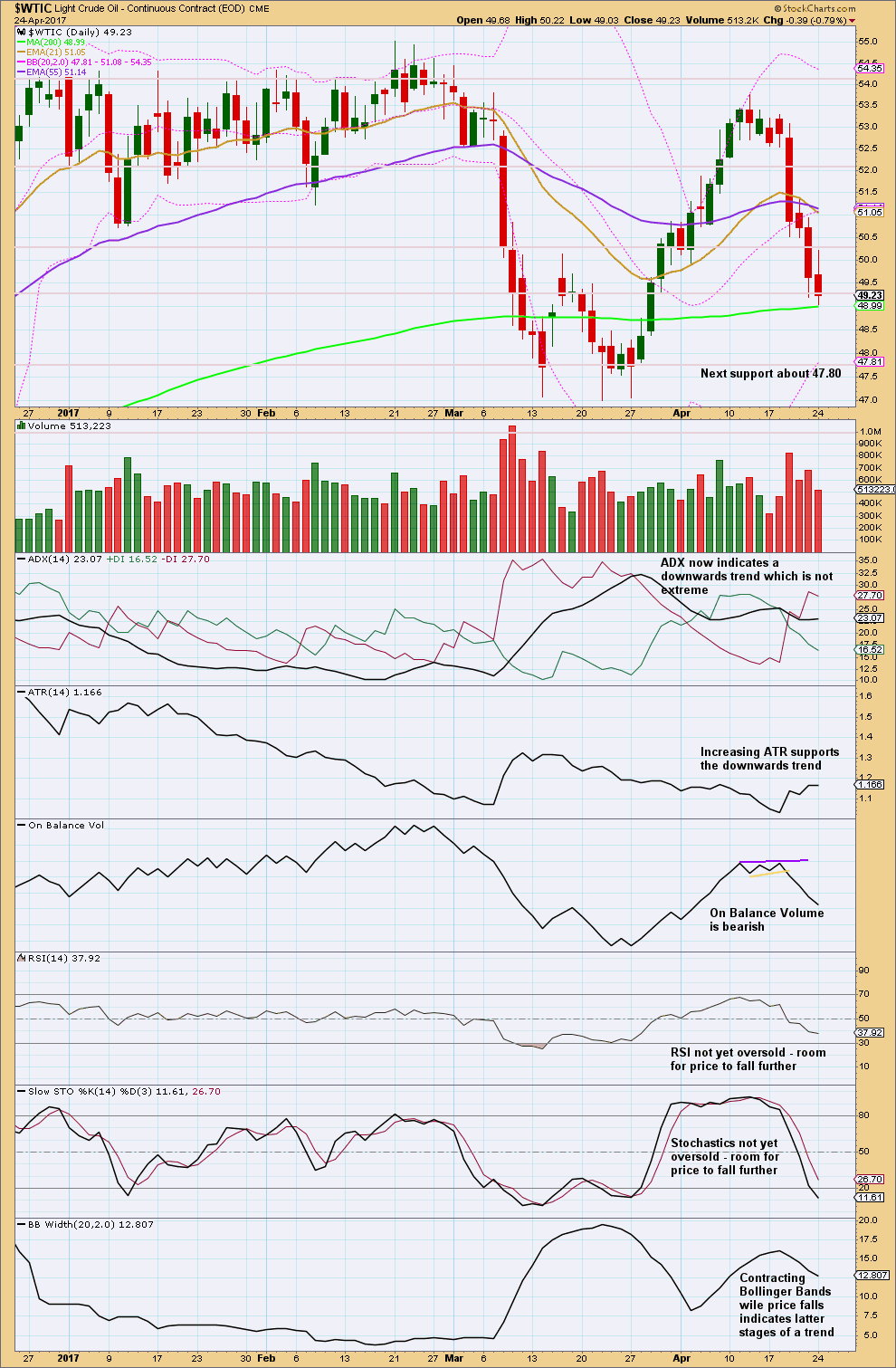

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Some decline in volume overall for the last three sessions indicates a lack of support for downwards movement from volume. However, On Balance Volume remains very bearish.

In looking for a temporary end to this downwards wave, we may look for a day with a long lower wick on a daily candlestick and an increase in volume and RSI reaching oversold or Stochastics being extreme and exhibiting divergence with price at lows. None of these conditions are met yet.

About halfway through a strong trend Oil often exhibits contraction in Bollinger Bands. That has begun to happen now; this trend will be interrupted by a bounce soon.

Oil can trend very strongly and bounces can be brief and shallow. ATR and ADX are very bearish.

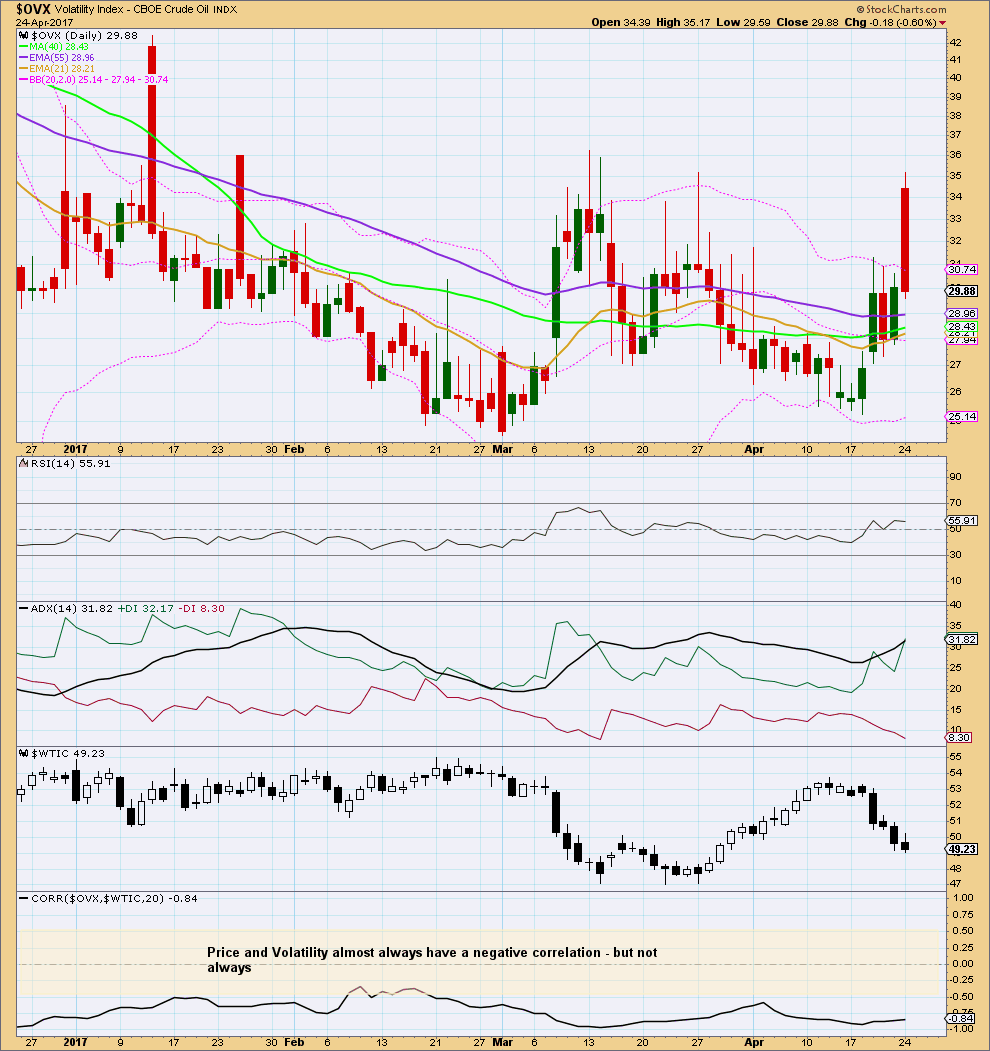

VOLATILITY INDEX

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price rises and volatility should increase as price falls. Divergence from this normal can provide a bullish or bearish signal for Oil.

There is no short term divergence between price and volatility to indicate an end to this downwards wave yet.

This analysis is published @ 02:47 a.m. EST.

Idea from Verne, comment copied over from Gold analysis:

APC may be a good proxy for a short trade on US Oil. For those that cannot access the cash market. A nice clear break below a neckline of a head and shoulders pattern, with support from volume. Clear bearish On Balance Volume supports this.

Shorts may have stops just above the neckline (give the market a bit of room to move). That prior support zone should now offer resistance. Always use a stop, do not invest more than 1-5% of equity in any one trade.

Just in case any new member is wondering, No. That is not my definition of a T&C. My two rules for risk management are absolutely serious. I follow these rules myself. Every. Single. Trade. Risk management is the most important aspect of trading.

Hi Lara

Dors this change your St target Of ~51 for

Wave II?

Thx

http://www.babypips.com/school/undergraduate/sophomore-year/intermarket-correlations/black-crack.html

Oil USD/CAD correlation

Oil has a negative correlation with USD/CAD of about 93% between 2000 through 2016.

Just some other thoughts

No, it does not have a reliable correlation.

The comment in the article is inaccurate.

Any correlation coefficient which spends time in the yellow highlighted zone between 0.5 to -0.5 is not reliable. And furthermore, these two markets are not currently negatively correlated.

Don’t believe anything you read about correlations. Check the math. It’s a better answer.

US Oil hourly chart updated (this will be posted also in the latest Trading Room analysis):

Subminuette ii doesn’t look complete now, the last wave down won’t fit as a five but will fit as a three.

Subminuette ii may be continuing further as an expanded flat correction, very common structures.

I’m seeing this as well Lara…thx!

Good work on CL short Lara!!!

Why thank you very much Sundeep.

So nice to have a big fat profit, isn’t it!

Yes, this call was absolutely spot on Lara!

I only wish that I had waited for your advice in the first place – I put a small short on around 5100 on the way up to 5370 and got my fingers burned a little. Have made up for it in spades now though! 😁

Daily chart updated:

looks like subminuette ii may be over as a brief shallow correction.

The channel is adjusted, but it’s still too steep for reasonable technical significance.

StockCharts data looks a little different; two green daily candlesticks on increasing volume is bullish short term, while the candlestick wicks are about even. StockCharts data looks like subminuette ii could move a bit higher.

I’m still expecting that it will be relatively brief and shallow, and I still don’t want my short position to be whipsawed out only for price to then fall hard in a big third wave. The entry point is just too good.

Updated hourly chart:

End of subminuette i relabelled, subminuette ii labelled as complete. It could move higher, but if it continues at this stage (assuming my analysis at the hourly chart level is correct that is) then it should be mostly sideways.

OR it could continue as an expanded flat.

Either way, if this wave count is correct then there is an imminent hard fall for US Oil ahead.

Hi Lara and experts,

I am a new bee, could you please advise which symbol do you use for trading OIL? How do you match OIL price to that symbol’s price (seems not easy with overlay chart)?

Thanks for your help!

I’m able to trade the WTI crude cash market via CFD’s from my broker, CMC Markets (it’s a New Zealand broker). No symbol, it’s listed as “Crude Oil West Texas Cash”.

The symbol on StockCharts data is $WTIC.

So ask your specific broker what their symbol is for West Texas Light Crude Oil, cash market. If you have the cash option. Then compare price points with the StockCharts data for $WTIC.

And finally if you’re new to trading, then for the love of all things good please take my risk management advice very seriously.

This is the single thing that differentiates very experienced traders from newbies. It is the most important aspect of trading. I’ll keep harping on about it for this reason.

Poor risk management means trades are based upon fear and greed. It’s the reason why newbies wipe out their accounts at least once.

If you learn absolutely nothing else from me but risk management, then I will have done my job well.

Updated hourly chart to manage our short positions:

A more short term approach may now be to move stops down to the last small swing high I have here labelled sub micro wave (4) at 49.83. If that point is breached now by upwards moment then subminuette wave i would be over and submineutte wave ii would be underway.

However, if exiting shorts here be aware that when Oil trends it can be very swift and strong, with brief shallow corrections. Exiting here risks not finding a good reentry point.

A more conservative, and for this market potentially more profitable in the mid term, approach may be to give it room to move and set stops higher about 51.80. This approach may be well rewarded if Oil behaves as it often does when it trends, but it also risks losing much of the profit gained so far if Oil behaves abnormally.

It is impossible for me to tell you with any certainty how Oil will behave on the way down to the target, and so it is left up to each member to manage their short positions.

thank you Lara. I trimmed 25% of my short position.

You’re welcome. We should all have nice profits today on Oil.

Yes indeed. I am actually starting to look at oil-related companies like APC, DVN, MUR, APA. I was a bit conservative on the first few trades using only credit spreads but I think after this current bounce I will be nibbling on USO puts.