Price has reacted strongly downwards after moving slightly higher to perfectly touch the long term bear market trend line, which was expected. A red daily candlestick was printed as expected.

Summary: Assume the trend remains the same until proven otherwise. Assume the larger bear market remains intact while price remains below the bear market trend line.

If the Magee trend line is breached by one or two full daily candlesticks above it, then the alternate wave count would be preferred. On Balance Volume today warns the alternate may be correct.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

MAIN ELLIOTT WAVE COUNT

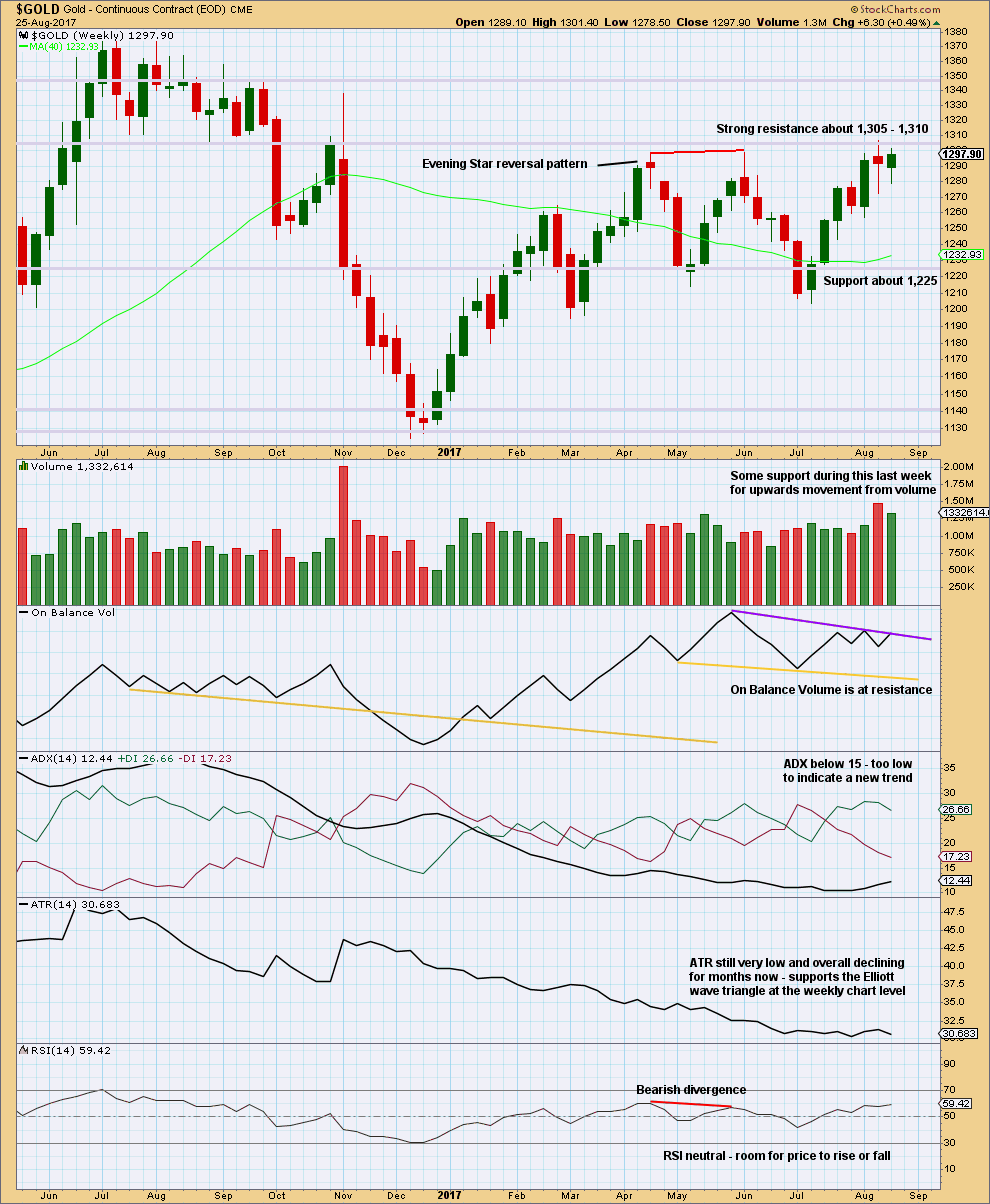

WEEKLY CHART

The Magee bear market trend line is added to the weekly charts. This cyan line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012. This line should provide strong resistance.

To use this trend line in the way Magee describes, we should assume that price will find resistance at the line if it gets back up there. If the line is breached (by at least one or two full daily candlesticks above it), it will be signalling a major trend change from bear to bull. At that point the alternate Elliott wave count should be preferred.

At this stage, a triangle still looks possible and has the best fit for cycle wave b. It has strong support now from declining ATR and MACD hovering about zero.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a developing zigzag at the weekly chart level, and minor wave B within it shows up with one red weekly candlestick.

Primary wave C may have ended at the Magee trend line. At this stage, price has closed back well below the line, so the overshoot is acceptable. For the line to be breached one or two full daily candlesticks need to close above the line and not be touching the line.

Note: The Magee trend line is sitting slightly differently on the main daily chart to the weekly charts. The weekly charts show a small overshoot, but the daily chart shows price exactly touched the line. The line is drawn from exactly the same price points and all charts are on a semi-log scale. The difference is in how Motive Wave formats the primary chart.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C may now have completed its 36th week. A double zigzag may be expected to be longer lasting than single zigzags within a triangle, and so this continuation of primary wave C is entirely acceptable and leaves the wave count with the right look at this time frame.

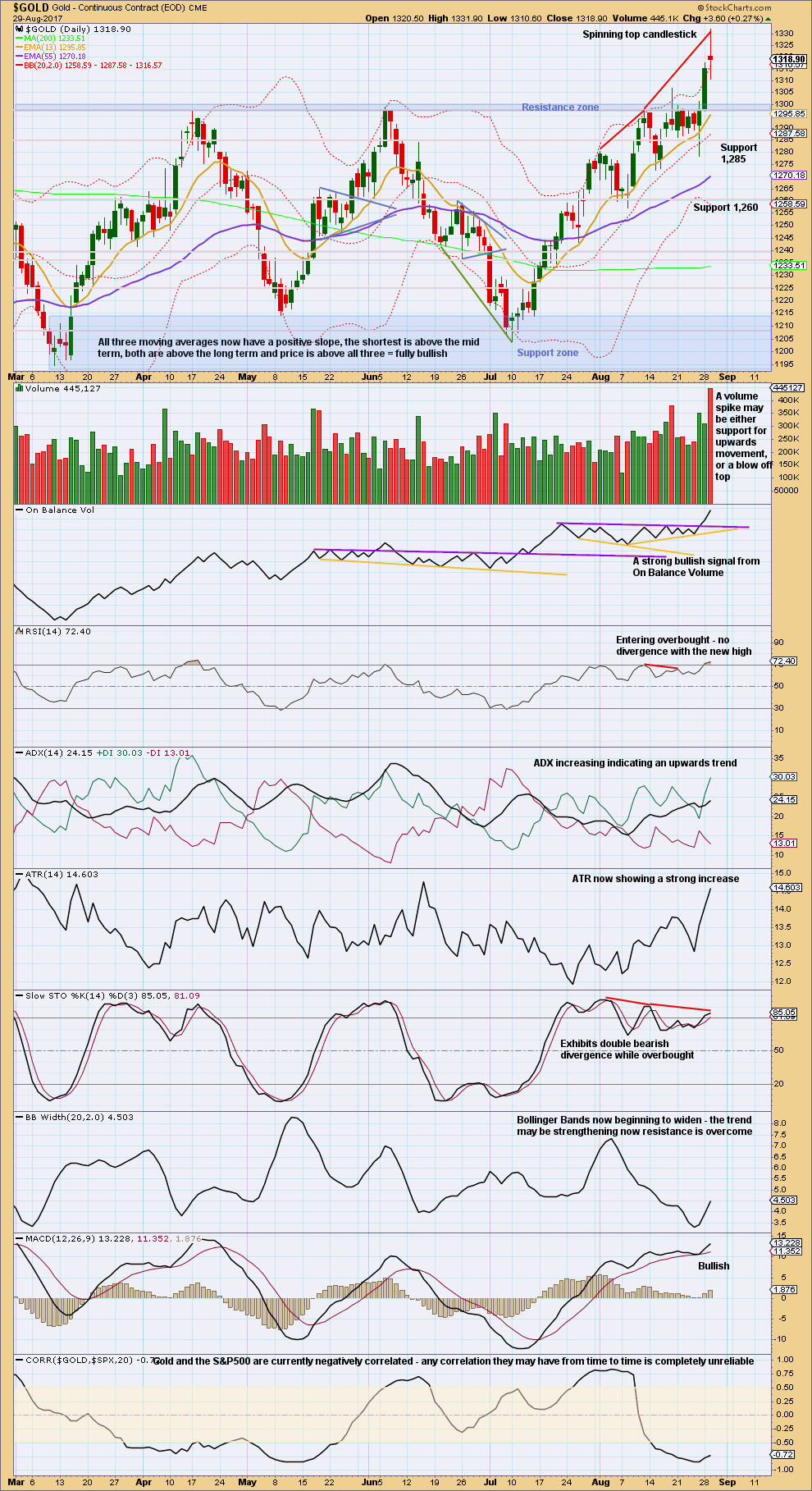

DAILY CHART

The cyan Magee trend line should offer very strong resistance. This wave count does not expect it to be breached.

On this daily chart, drawn on a semi-log scale, price has exactly touched the trend line and reacted downwards from there. While price remains below the Magee trend line but within the dark blue Elliott channel, both wave counts will be valid and it will be uncertain what direction may be next.

A breach of the blue Elliott channel by downwards movement would see this main wave count further increase in probability. That would indicate a trend change.

Intermediate wave (Y) may now be a complete zigzag. Minor wave C within it may now be a complete five wave impulse.

This wave count now requires a trend change.

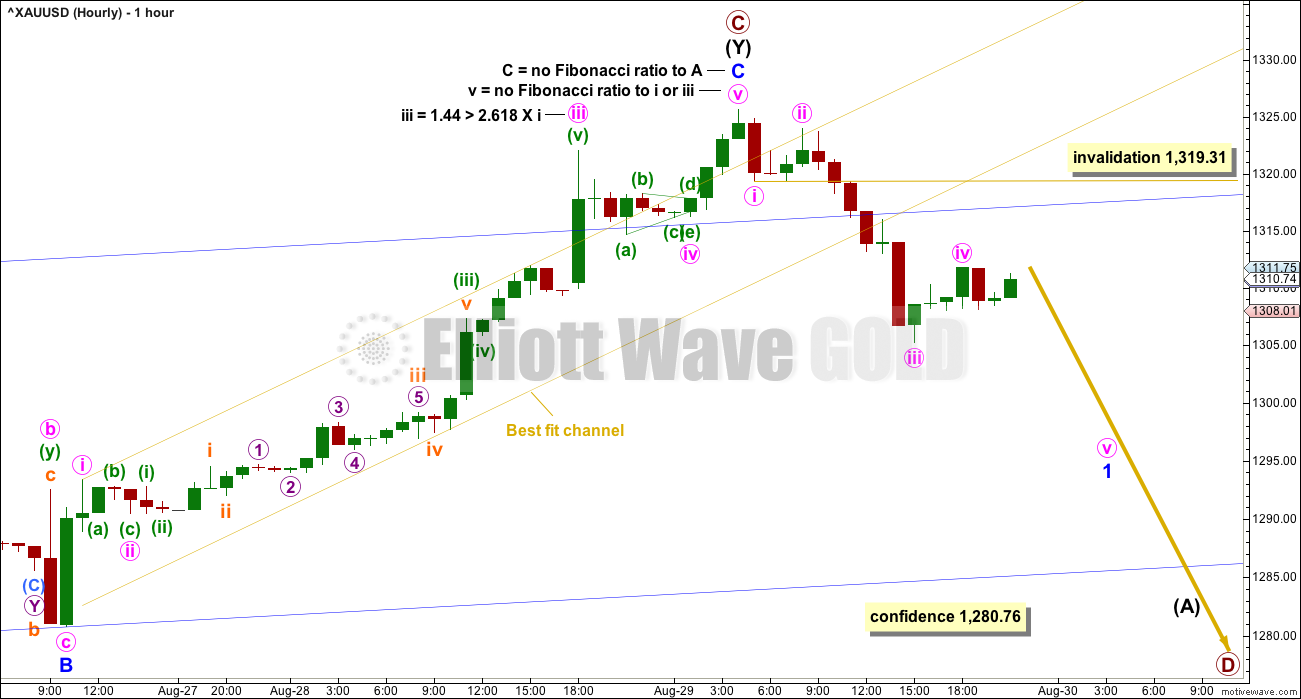

HOURLY CHART

If primary wave C is over and primary wave D downwards is now beginning, then a clear five down should develop first at the hourly chart level, then at the daily chart level.

Within the first five down, minute wave iv may not move into minute wave i price territory above 1,319.31.

When minor wave 1 downwards may be complete, then the invalidation point must move up to the high at 1,325.67. A deep bounce for minor wave 2 may not move beyond the start of minor wave 1.

A new low below the lower edge of the dark blue channel would add substantial confidence to this main wave count. A new low below 1,280.76 would add further confidence.

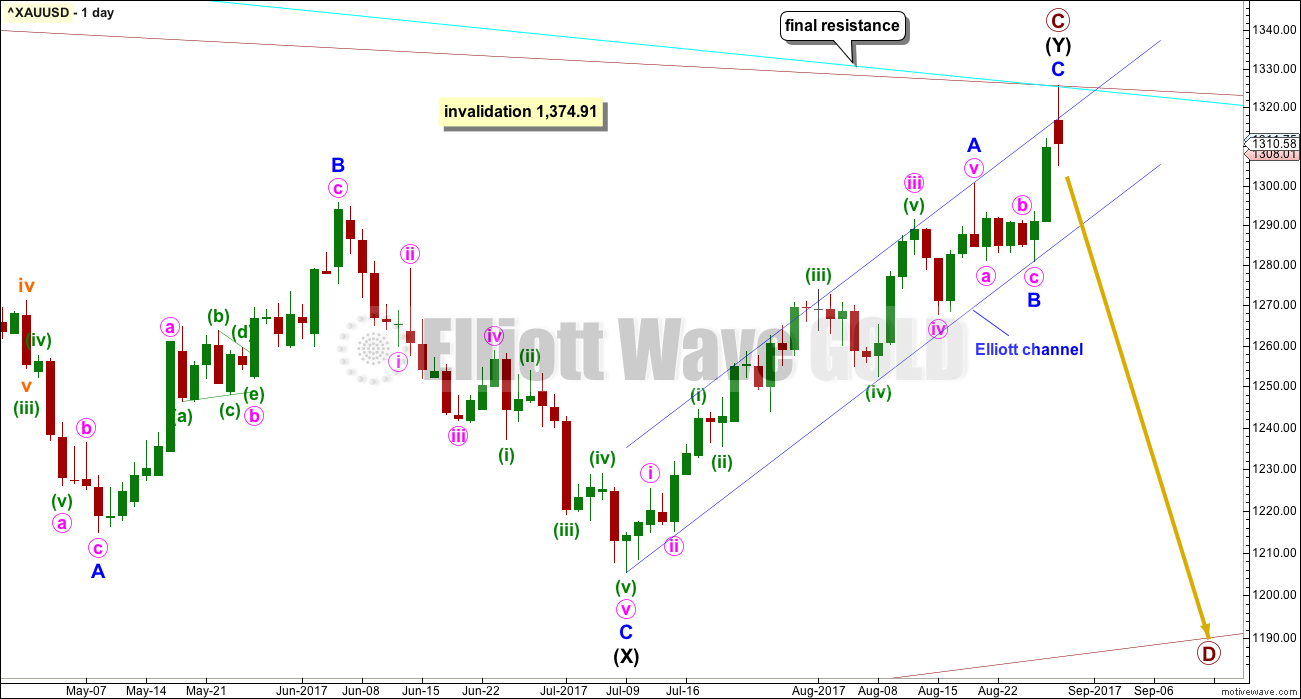

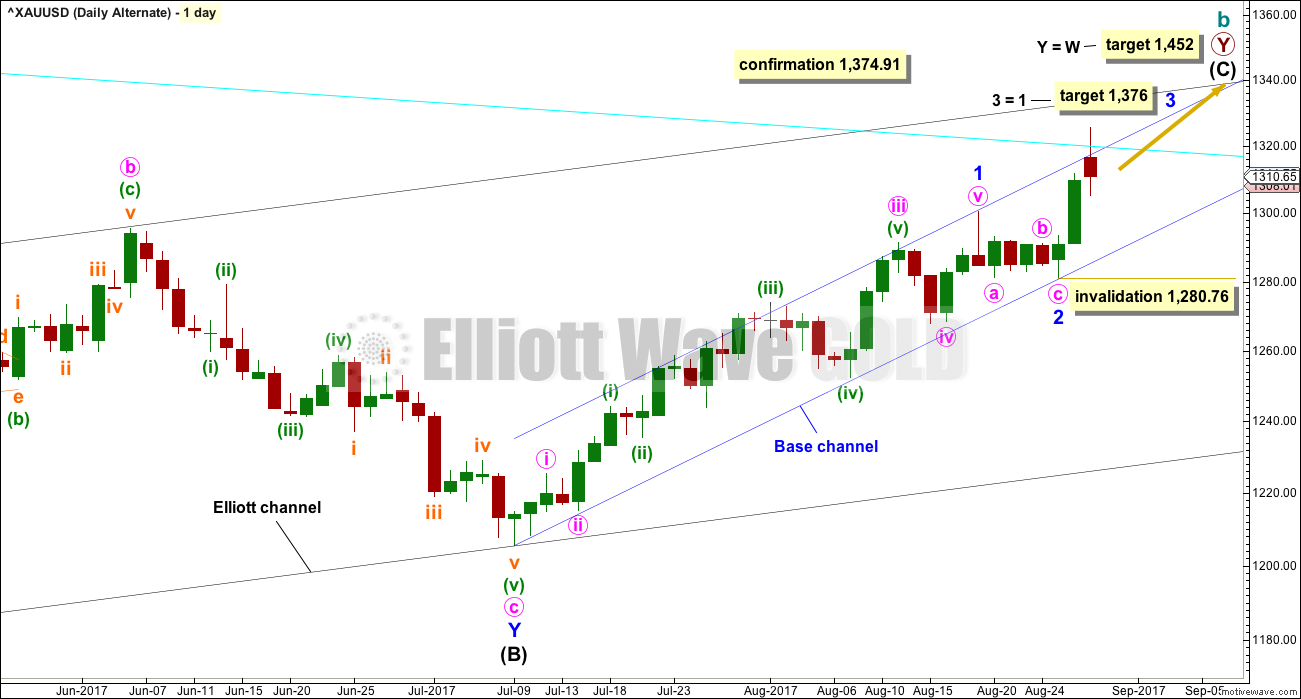

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b fits best at this stage as a triangle (main wave count), it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Along the way up, some resistance should be expected at the cyan Magee trend line. Because this wave count requires price to break above the Magee trend line, it must be judged to have a lower probability for this reason. This trend line is tested multiple times and goes back to 2011. It is reasonable to expect price to find resistance there, until proven otherwise.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

DAILY CHART

Intermediate wave (C) may be unfolding as an impulse.

Within the impulse, minor waves 1 and 2 would now be complete.

Minor wave 2 may have ended at Friday’s low. However, it is unusual for second wave corrections to be this shallow.

With minor wave 1 a very long extension, the Fibonacci ratio of equality is used for a target for minor wave 3 now.

Within minor wave 3, no second wave correction may move beyond its start below 1,280.76.

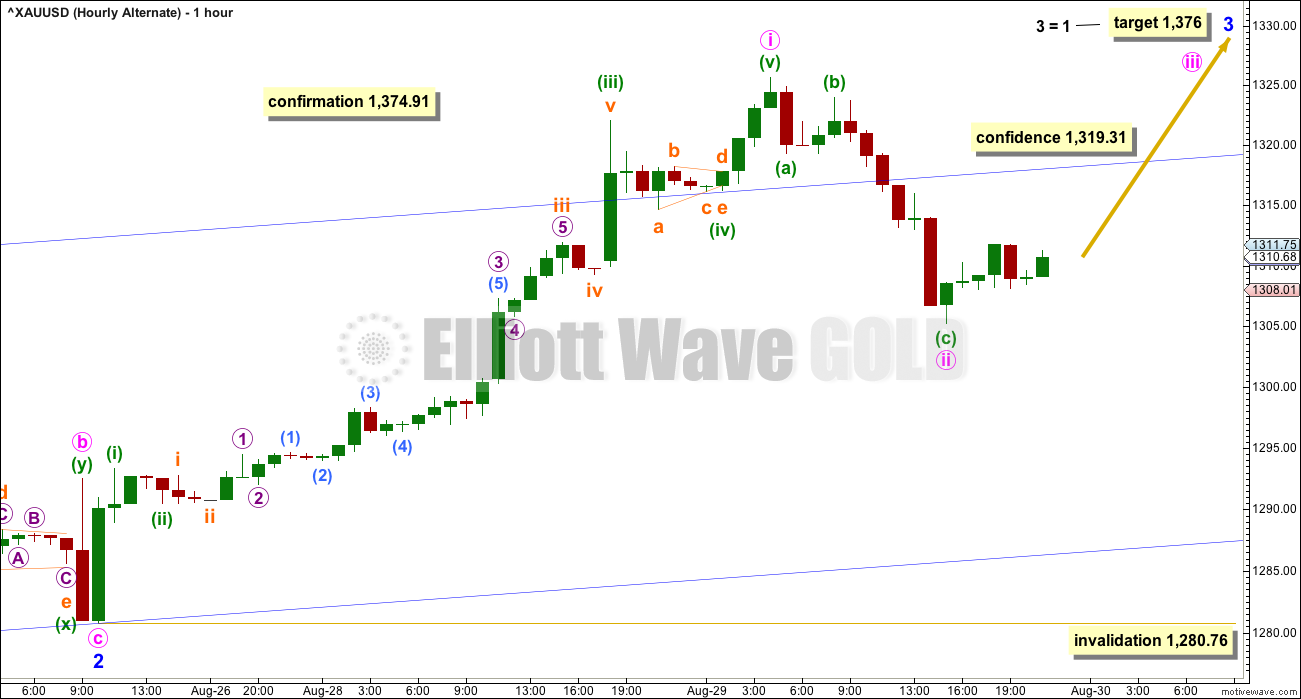

HOURLY CHART

Minor wave 3 has now moved above the end of minor wave 1, but not yet far enough above it to allow room for minor wave 4 to unfold and remain above minor wave 1 price territory.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, the analysis is adjusted slightly today to see only minute waves i and ii complete.

Minute wave ii looks like a complete zigzag at 0.45 the depth of minute wave i. It would most likely be over here. There should now be a very strong upwards pull from the middle of a third wave, forcing minute wave ii to be a little more shallow than normal.

This wave count expects to see a further increase in upwards momentum, and upwards movement for a third wave should have support from increasing volume.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Resistance about 1,305 – 1,310 continues to hold. Each time resistance is tested, and holds, it is strengthened.

Volume is slightly bullish. The long lower wicks on the last two weekly candlesticks is bullish.

The resistance line for On Balance Volume has only been tested twice and is not long held, so it does not offer good technical significance. It offers some weak resistance. If it is breached, that would be a weak bullish signal.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another upwards day completes with a higher high and a higher low. The candlestick has closed red, but the balance of volume was upwards. Volume strongly supports the rise in price.

It is impossible to tell if today’s volume spike is a blowoff top or support for a continuing upwards trend. It is my judgement based upon experience with this market that it may more likely be a blowoff top, because volume today was stronger than any other day over the last six months. We have to go back to the 9th November, 2016, to see a day with stronger volume, and that day marked a trend change.

On Balance Volume, ATR, ADX, MACD and now Bollinger Bands all support the alternate Elliott wave count.

Only my interpretation of today’s volume spike and Stochastics support the main Elliott wave count.

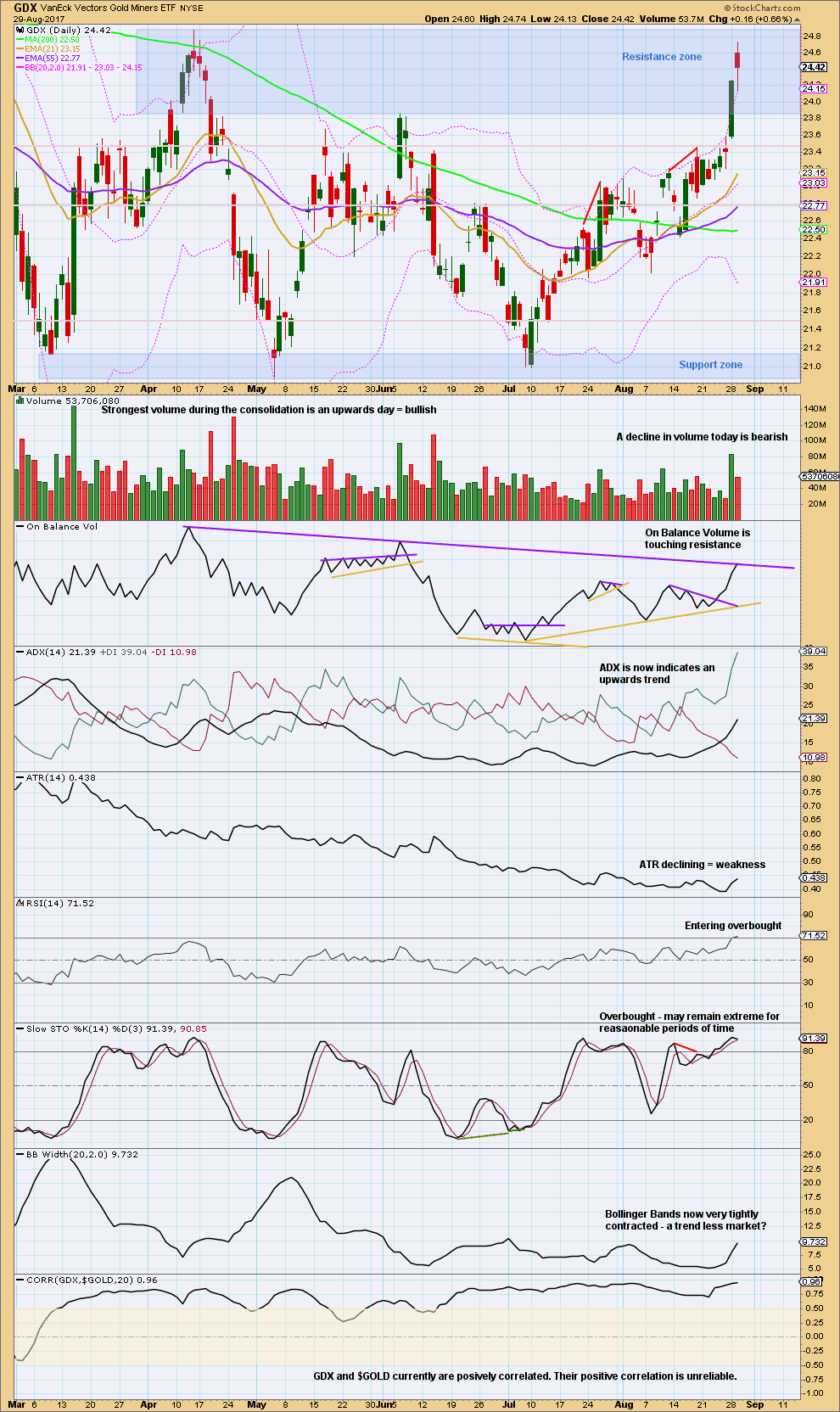

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Resistance on price and On Balance Volume needs to be overcome for a fully bullish look for GDX.

During this consolidation, it is still an upwards day which has strongest volume suggesting an upwards breakout from the large consolidation is more likely than downwards. However, the signal is not clear because the next three strongest days are all downwards days.

GDX looks like the alternate wave count for Gold. This assumes they will continue to hold their positive correlation, which is not a safe assumption to make.

Published @ 10:22 p.m. EST.

sorry everybody, looks like lots of comments were sitting in moderation

not sure why…

It happens to my comment with a attached file after I post comment and do the edit of text.

Hi Lara!!

We are hers.

The lonely bull.

LOL!

https://www.youtube.com/watch?v=Q_fqccLc0aE

🙂 thanks Papudi!

Where is everybody?

I suspect you all think I’ve got this wrong? And you’re all very bullish?

I’m not ready to switch from bear to bull until that bear market trend line is broken. So far it’s holding. That has to be the approach with this market, otherwise I’d be picking a breach of a trend line before it happens. I need to analyse what is here now, not what we think may happen. If that makes sense.

And if I’m right, this is a perfect short entry point.

I’ll wait for price to make a new low below the blue channel first before entering short.

No, I’m here as I’m sure others are too. I have a few early shorts in place with SL at break even at 1322, 17, 15. Will add more at confirmation. I agree that the volume did point to the possible blowout, left deepest long entry to take as much profit as possible. These have been great trades so far. The EW lessons along with alts and end of day updates have really helped… and when I am busy, the channel makes it easy to stay on-track. Excellent work!!

Also watching closely from the short side. We may get another pop higher but that move above the upper B bands strongly suggest a termination move, or at the very least a pause for the cause…

thanks guys! it’s a relief to know you’re still here 🙂

I am here too…. loaded with short

Main hourly chart updated:

Lara, thanks for keeping us updated.

wen cm gold 31000 in mcx price please

wen cm gold 31000 in mcx

Gold may test high volume top at 1338.

With a break above NL of inv HnS and now close to major resistance line that possibility is near.