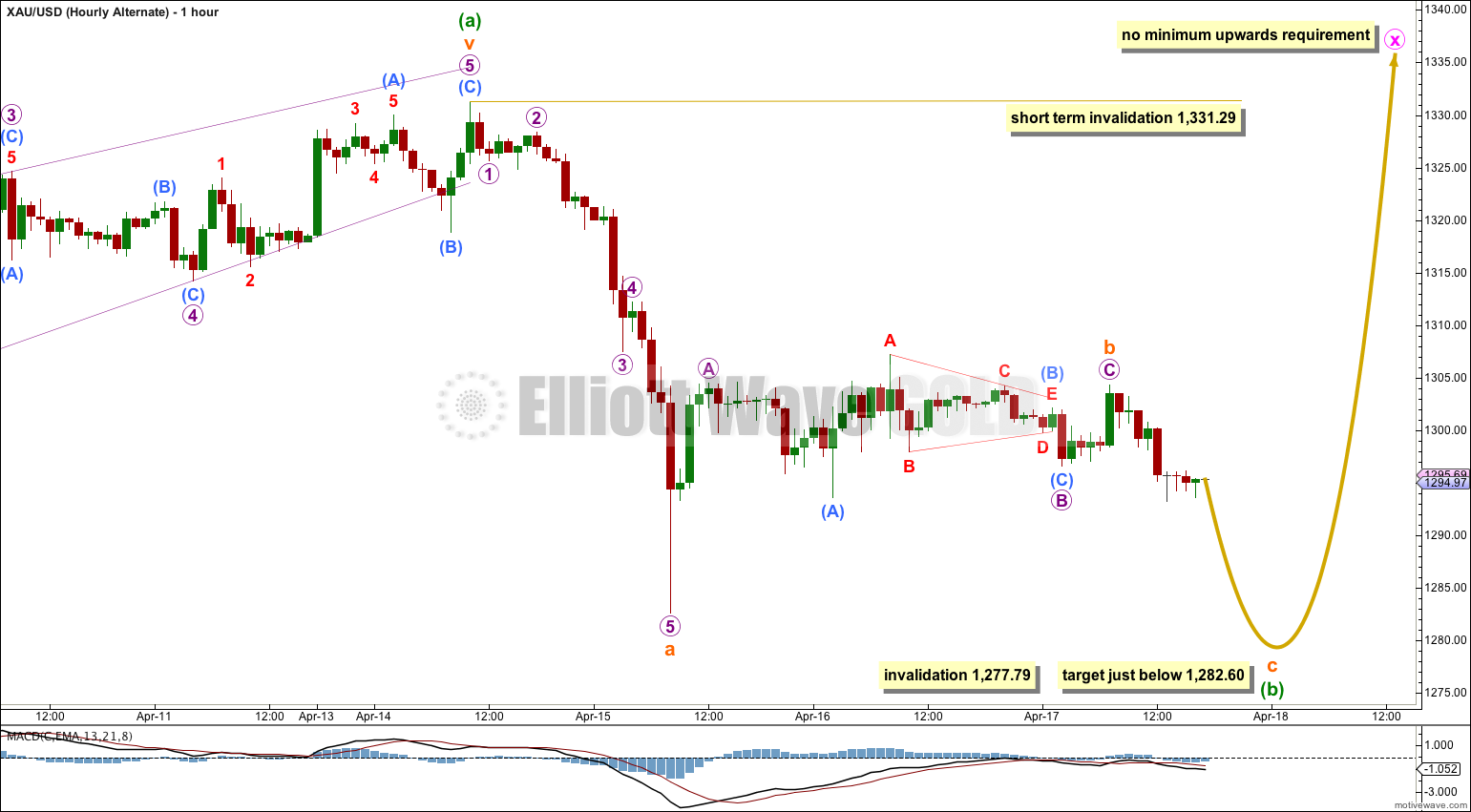

Yesterday’s analysis expected a little upwards movement to about 1,313 before some downwards movement to just below 1,282.60, but not below 1,277.79. Price moved sideways in a very small range.

Summary: The structure of the downwards wave is still most likely incomplete. From here I expect to see more downwards movement to just below 1,282.60 but not below 1,277.79. This may be over in one or two more sessions. This downwards movement is a short correction against the short / mid term upwards trend.

This analysis is published about 9:07 p.m. EST. Click on charts to enlarge.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure: either a flat correction (main hourly wave count) or a double zigzag (alternate hourly wave count). Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

This main wave count follows the idea that minor wave B may be unfolding as a flat correction. Within the flat correction minute wave a subdivides as a single zigzag. Minute wave b within the flat must reach a minimum of 90% the length of minute wave a at 1,380.82.

Minute wave b is most likely to subdivide as a single or double zigzag in order to reach 1,380.82.

Within a zigzag minuette wave (a) must subdivide as a five wave structure. It fits best as a complete impulse, with an ending contracting diagonal for it’s fifth wave.

Minuette wave (a) may have lasted nine days. I would expect minuette wave (b) to last at least three days, and maybe up to eight or nine days. So far it has lasted four days and the structure is incomplete. It it ends after one more day it would have lasted a Fibonacci five days.

So far minuette wave (b) looks like it is completing as a zigzag. Within it subminuette wave a subdivides best as an impulse. Subminuette wave b upwards is now complete. Subminuette wave c downwards may have begun.

Subminuette wave c downwards is very likely to make a new low below subminuette wave a at 1,282.60 to avoid a truncation. Subminuette wave c must subdivide as a five wave structure, either an impulse or an ending diagonal.

Minuette wave (b) may not move beyond the start of minuette wave (a) below 1,277.79.

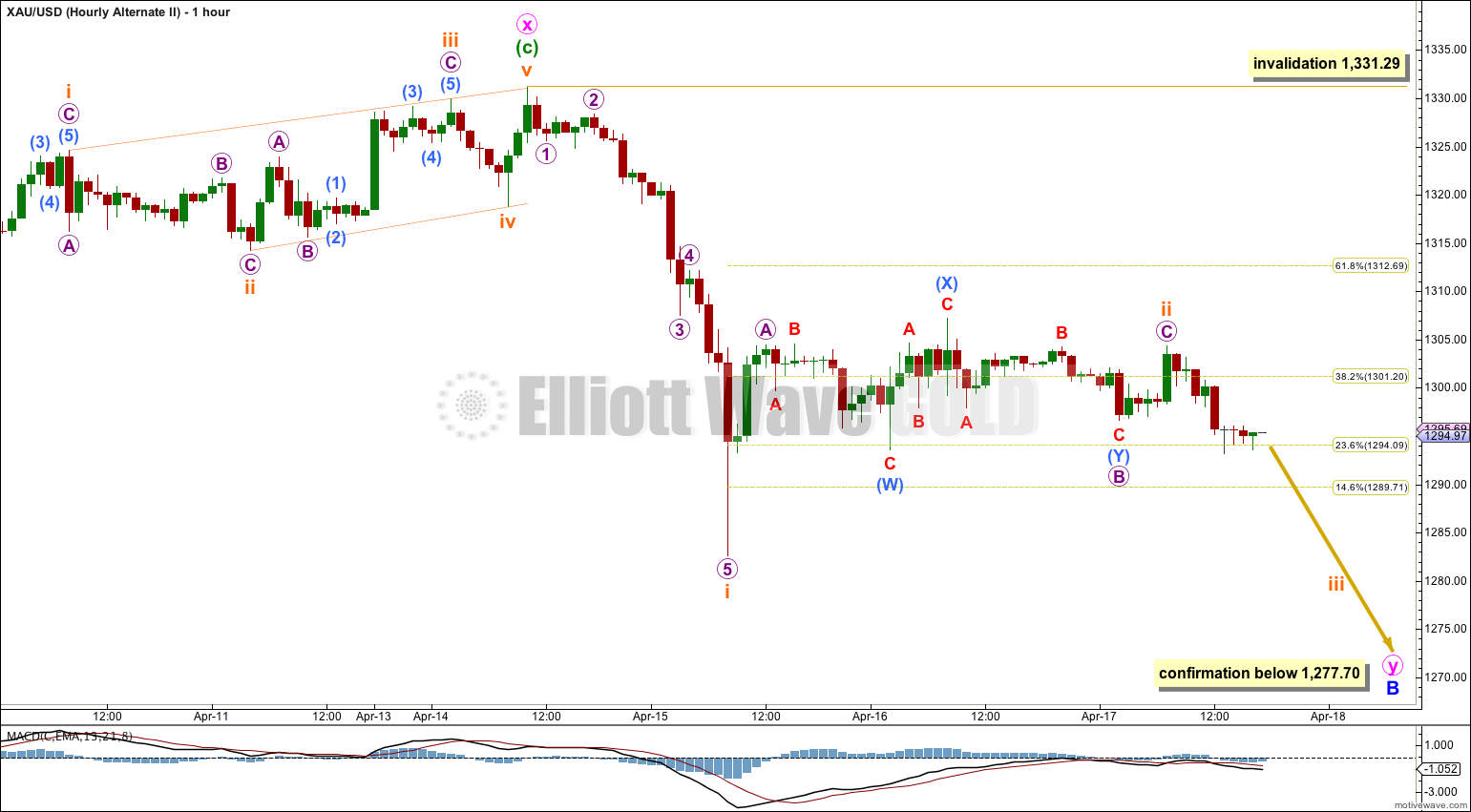

Alternate Hourly Wave Count.

This alternate wave count follows the idea that minor wave B downwards may be unfolding as a double zigzag. The first zigzag downwards is labeled minute wave w. The double should be joined by a “three” in the opposite direction which may subdivide as any corrective structure labeled minute wave x.

At this stage this alternate wave count is again the same as the main wave count with the sole exception of minute wave x not requiring a minimum upwards length.

Minuette wave (b) may not move beyond the start of minuette wave (a) below 1,277.79.

I have taken some more time to look at the last upwards wave labeled here minute wave x to see if it could be a corrective structure. It fits best as a five wave impulse (main hourly wave count), but if my analysis of that is wrong, what if it was a “three”?

I have looked at a single zigzag, double zigzag or rare triple zigzag. A triple zigzag has the least problems, but still does not have as good a fit as an impulse. Because triple zigzags are very rare I expect that a triple zigzag wave count which does not have a perfect fit should never be considered as a viable alternate because the probability would be extremely low.

If minute wave x is complete as a single zigzag (or even a double or triple zigzag) then minute wave y may have begun. Minute wave y must subdivide as a zigzag to take price down to 1,201.98 or below. Within a zigzag the B wave may not move beyond the start of the A wave, and within the A wave no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,331.29.

If this alternate is correct then downwards movement should begin to show an increase in momentum as a third wave unfolds. This should take price below 1,277.70.

Because this alternate (or the variations of it that I have considered) has a low probability I would only use it if it is confirmed with movement below 1,277.70.

I learnt from you the way, the attitude how to look, to review the outlook of the ew, try to think about the possibilities of variations at the changing points, changing junction. I am very appreciate your responsible attitude for us to review back any possibility of “three” structures in the past look in order to predict any coming variation beyond our expectation, I don’t even recall have this possibility (although I have this image ahead) while the chart intrepert so correctly up to this moment. Thanks!