Yesterday’s analysis expected to see more choppy overlapping movement. Tuesday has ended with a small doji candlestick, which fits the expectations exactly.

Summary: It is most likely that Gold will remain range bound for another one or two days, with slightly higher movement.

This analysis is published about 6:50 p.m. EST. Click on charts to enlarge.

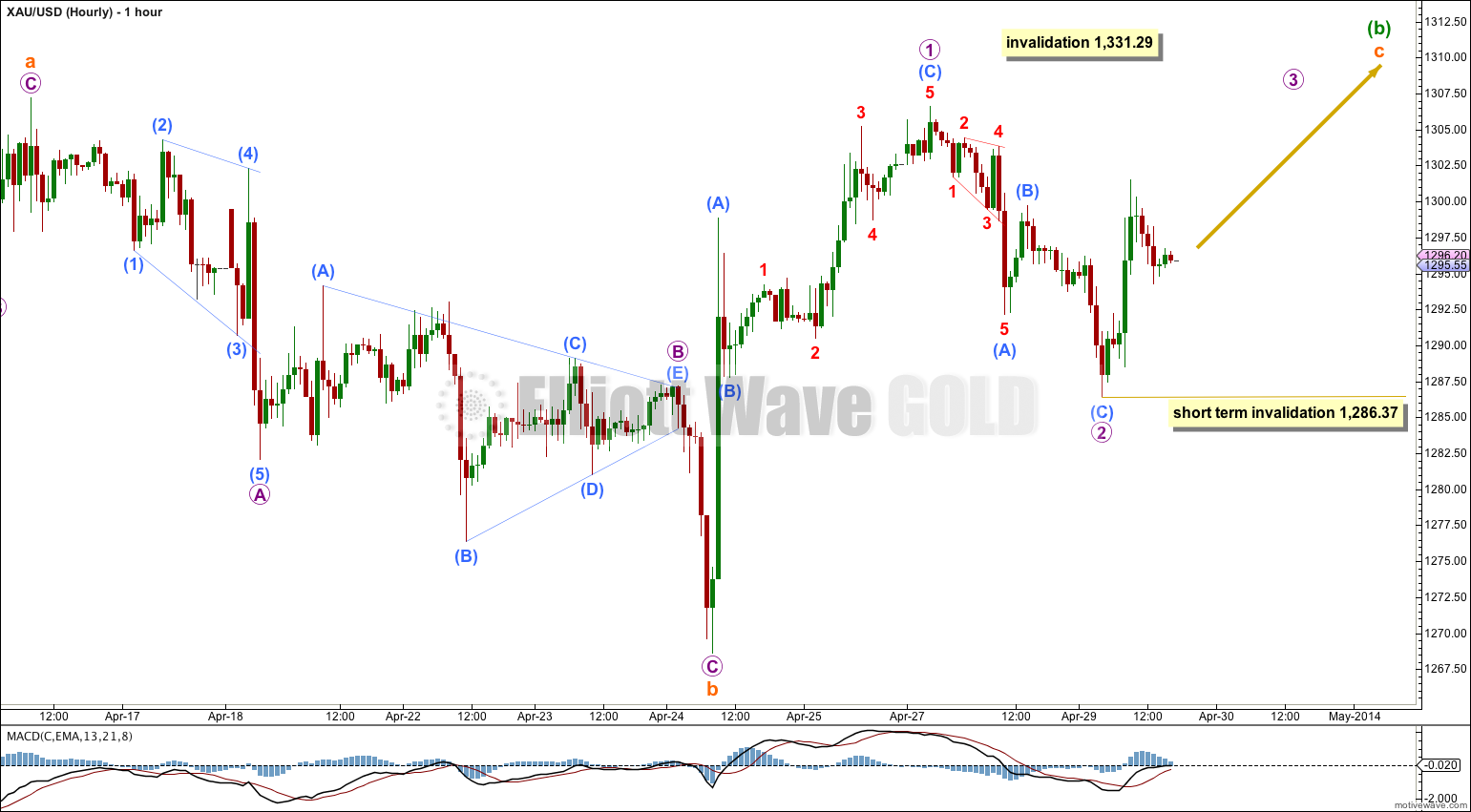

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure fits best as an incomplete double zigzag. Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

Within the double zigzag of minor wave B we may be seeing alternation between minute waves w and y. Within minute wave w its A and C waves are somewhat close to equality (but not close enough to say they have an acceptable ratio of equality). Within minute wave y we may be seeing a ratio of 1.618 or 2.618 between its A and C waves, with its A wave being the shorter of the two.

Within minor wave B minute wave w lasted 11 days and minute wave x lasted 9 days. So far minute wave y has lasted 11 days and it still has a long way down to go. It looks like it will be longer lasting than minute wave w. It may last a total Fibonacci 21 or 34 days.

Minute wave x is still most likely complete as a single zigzag. Minute wave y has most likely begun. Minute wave y must subdivide as a zigzag to take price down to 1,201.98 or below.

Within the zigzag of minute wave y minuette wave (b) is still most likely incomplete and I will still expect to see a new high above 1,307.19 before it is over.

There are more than thirteen possible corrective structures a B wave may take, and they are the most difficult of all waves to analyse because there is so much variation between them.

Movement over the last 24 hours indicates a double combination may not be unfolding. I am relabeling minuette wave (b) as a possible expanded flat correction, with subminuette wave c an incomplete ending contracting diagonal. Within an ending diagonal all the subwaves can only subdivide into single zigzags, thus micro waves 1 and 2 are both zigzags. Micro wave 3 must move beyond the end of micro wave 1, and micro wave 4 must overlap back into micro wave 1 price territory. This structure would expect choppy overlapping movement for another one or two days, with a new high above 1,307.19 for subminuette wave c to avoid a truncation and a rare running flat.

Minuette wave (b) may not move beyond the start of minuette wave (a) at 1,331.29.

Alternatively it is just possible that minuette wave (b) is now a completed running flat correction.

Running flats are very rare, and the few that I have seen over the years have B waves which move only slightly beyond the start of their A waves. In this instance subminuette wave b moves substantially below the start of subminuette wave a, as a 157% correction of subminuette wave a. This significantly reduces the probability of this idea.

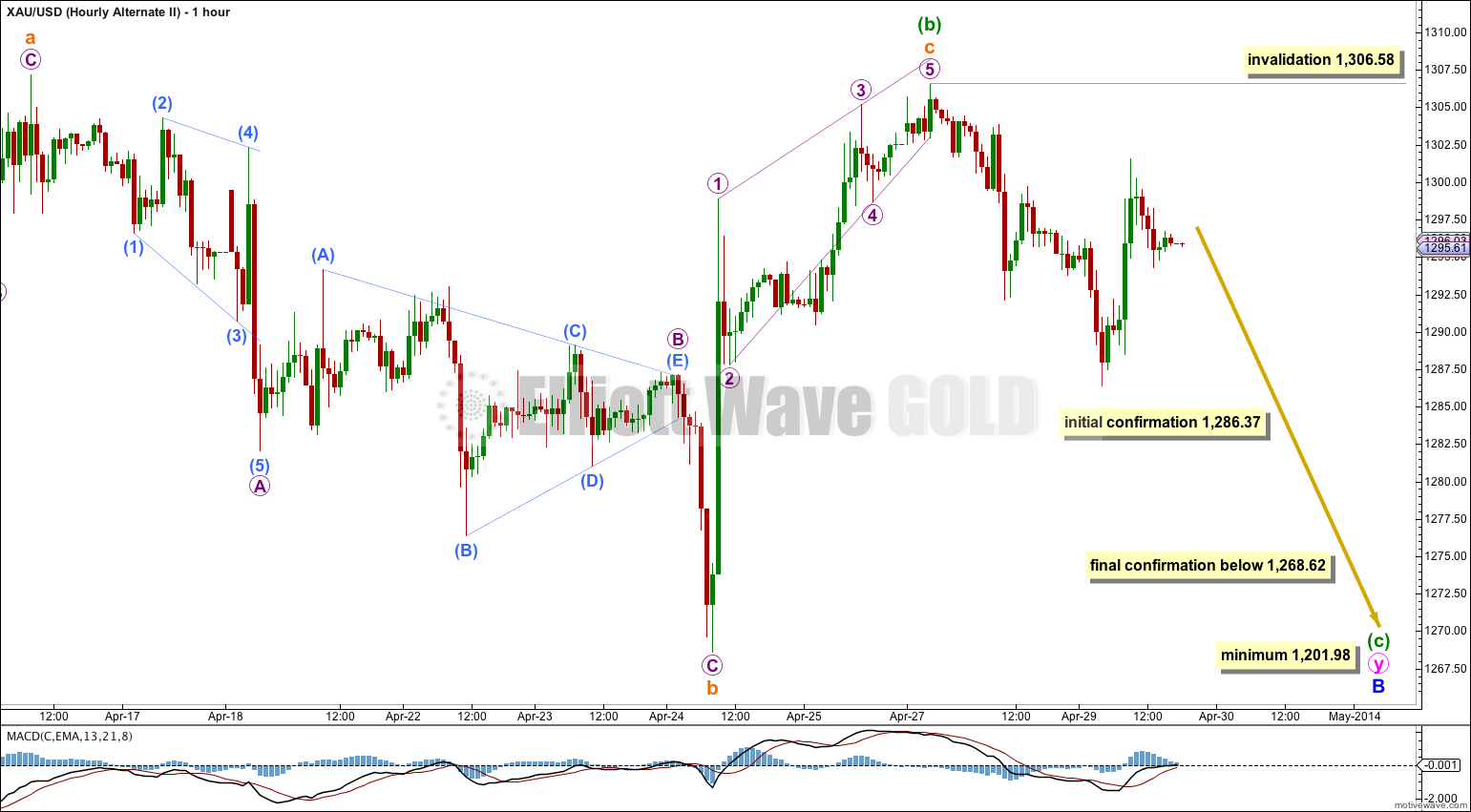

I would consider this idea if we see a new low below 1,286.37 within the next 24 hours, and it would be fully confirmed with a new low below 1,268.62. At that stage I would have confidence that the trend at minor degree would be down and price would fall to at least 1,201.98 and may make a new low below 1,180.84.

Alternate Wave Count.

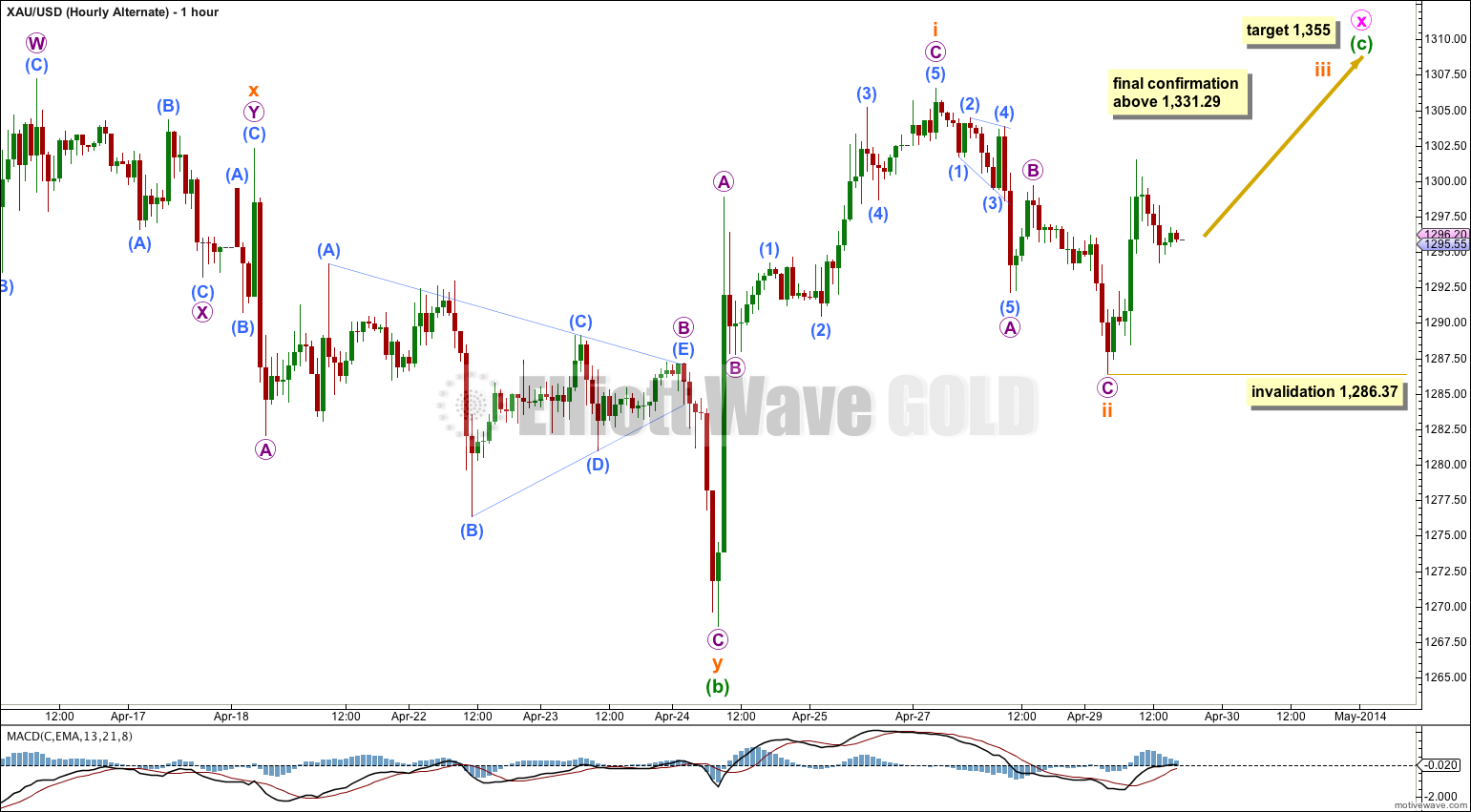

I have moved the degree of labeling within minute wave x down one degree: the first zigzag upwards may not be minute wave x in its entirety and that may only be minuette wave (a) within minute wave x. Minute wave x may be continuing sideways as a flat correction.

Minor wave B downwards is still seen here as a double zigzag: zigzag – X – zigzag. The purpose of double zigzags is to deepen a correction when the first zigzag does not move price deep enough, so this structure would be able to take price down to 1,201.98 or below.

This alternate still has a lower probability than the main wave count because if minute wave x continues higher for a few days it would be substantially longer in duration than minute wave w. This would be unusual for an X wave within a double zigzag, and reduces the probability of this wave count.

There is no upper invalidation point because there is no minimum or maximum requirement for an X wave. However, X waves within double zigzags are normally shallow as this one would be. The only requirement is that an X wave be a corrective structure.

Within the possible flat correction minuette wave (b) is now a 117% correction of minuette wave (a), which indicates an expanded flat. At 1,355 minuette wave (c) would reach 1.618 the length of minuette wave (a).

If price reached up to 1,380.82 or above then I would relabel minor wave B in its entirety as a flat correction.

Minuette wave (c) must subdivide as a five wave structure, either an impulse or an ending diagonal. The first wave up within it now is a completed three, so minuette wave (c) may be an ending diagonal because they require all their subwaves to be single zigzags.

Within subminuette wave iii of the diagonal micro wave B may not move beyond the start of micro wave A below 1,286.37.

Just from a TA perspective, it looks like a clear descending triangle is forming with a price target of $1165ish. This suggests the second structure of Primary 4 may be an expanded flat. This also suggests $1500ish for the final target which would mean a break of the weekly downtrend line. I don’t prefer this.

The flat scenario fits much better for Minor B targeting $1190-$1200 meaning Minor C would target $1420ish in 2-3 months. This fits much better in the grand scheme of things. I normally don’t think this far in advance.

Hi, Chapstick, could you explain what is TA stands for?

TA=Technical analysis, but watch for a false breakout to the upside this afternoon. This fits the main wave count perfectly.

Tomorrow is May first, gold price may start falling tomorrow, I prefer the 2nd wave count.