I have expected Gold to remain range bound, but within that range to complete the structure with a little upwards movement. With price moving lower during Thursday’s session I want to consider another alternate idea.

Summary: It is most likely that Gold will remain range bound for still another one or two days, with slightly higher movement. Eventually it should break out to the downside.

This analysis is published about 7:36 p.m. EST. Click on charts to enlarge.

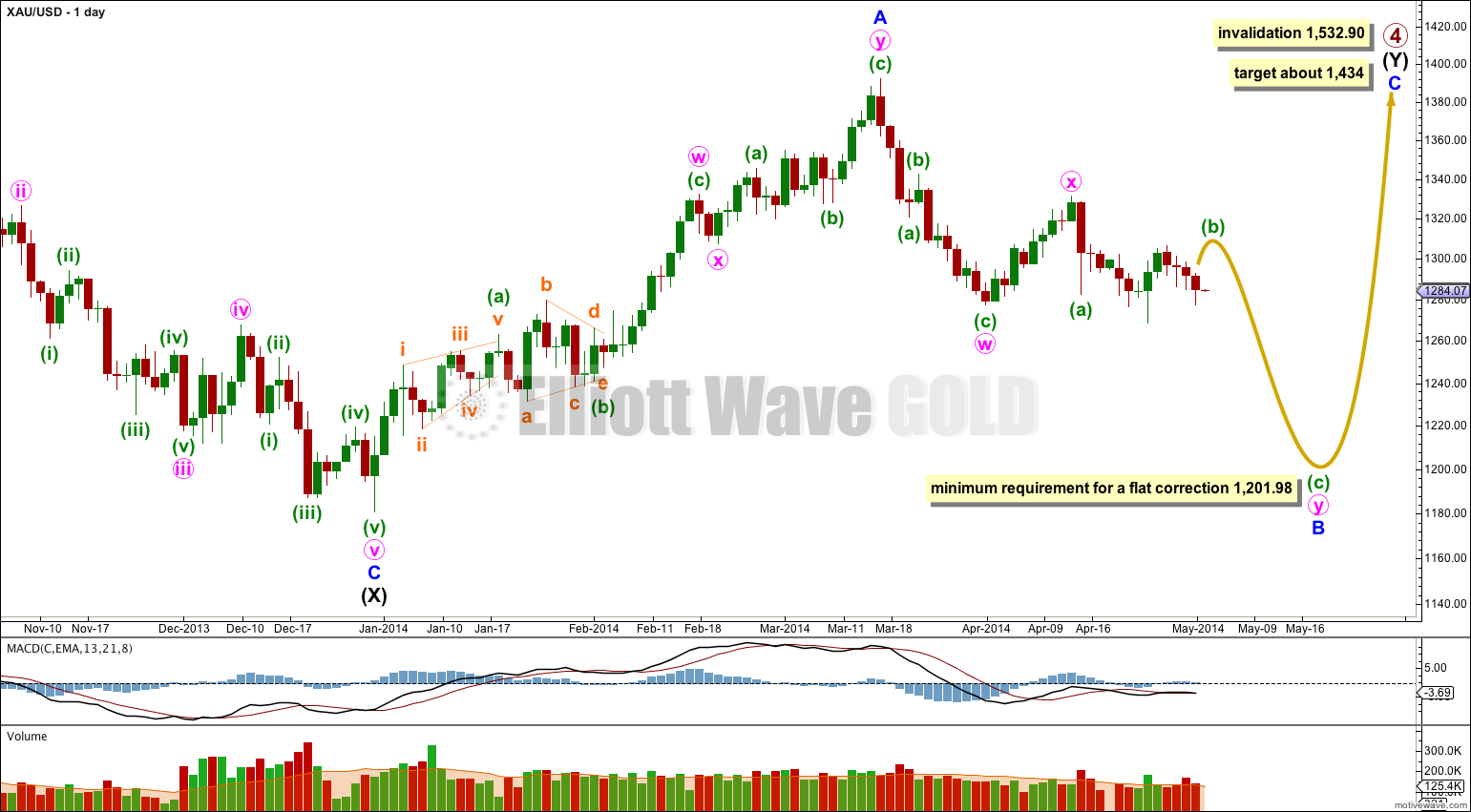

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure fits best as an incomplete double zigzag. Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

Within the double zigzag of minor wave B we may be seeing alternation between minute waves w and y. Within minute wave w its A and C waves are somewhat close to equality (but not close enough to say they have an acceptable ratio of equality). Within minute wave y we may be seeing a ratio of 1.618 or 2.618 between its A and C waves, with its A wave being the shorter of the two.

Within minor wave B minute wave w lasted 11 days and minute wave x lasted 9 days. So far minute wave y has lasted 14 days and it still has a long way down to go. It looks like it will be longer lasting than minute wave w. It may last a total Fibonacci 21 or 34 days.

At this stage I will discard yesterday’s alternate daily wave count which saw minute wave x incomplete. If minute wave x is incomplete it would now be much longer in duration than minute wave w, giving that wave count a very strange look and reducing its probability significantly.

Minute wave y must subdivide as a zigzag to take price down to 1,201.98 or below.

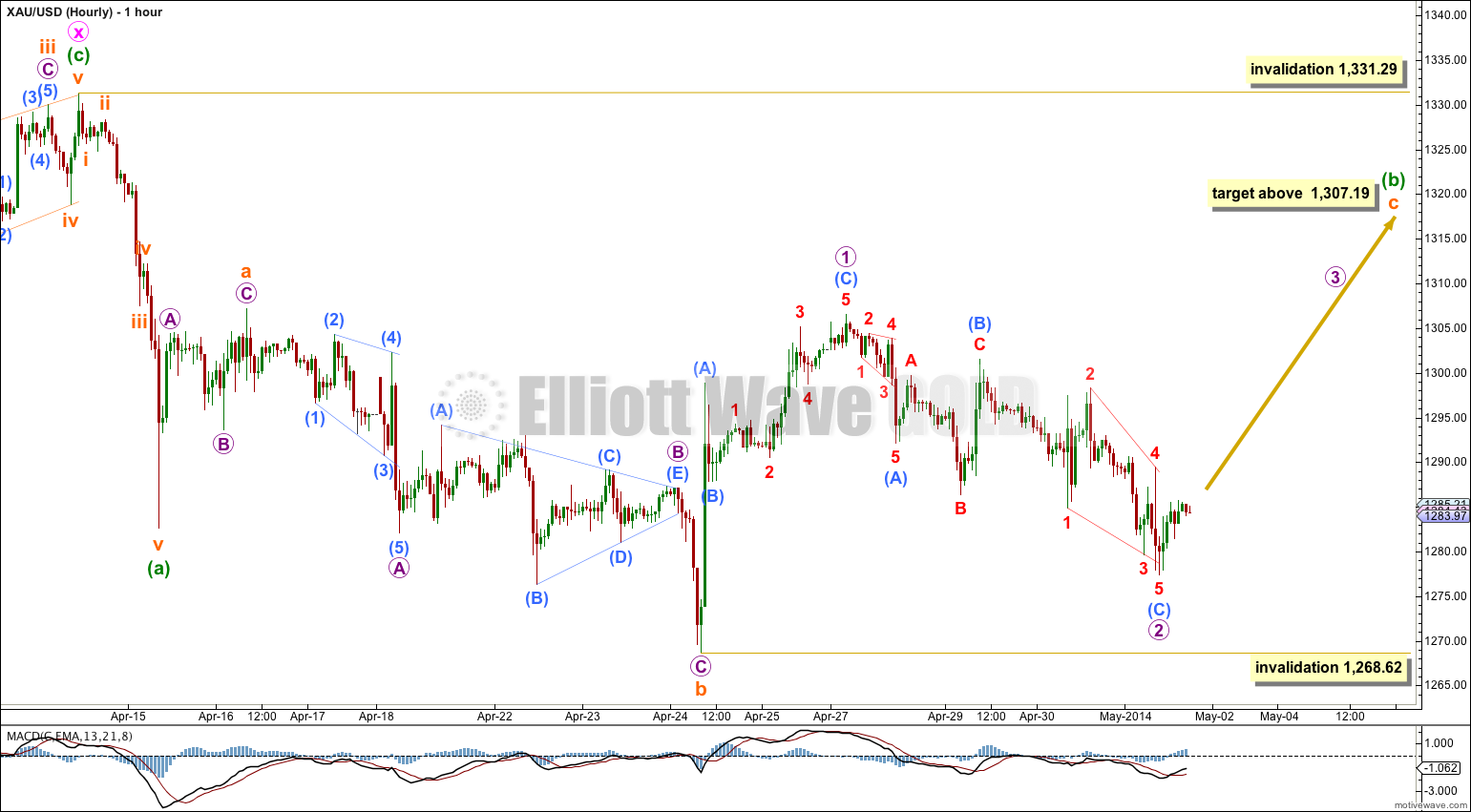

Within the zigzag of minute wave y minuette wave (b) is still most likely incomplete and I will still expect a new high above 1,307.19 as very likely before it is over.

There are more than thirteen possible corrective structures a B wave may take, and they are the most difficult of all waves to analyse because there is so much variation between them. For this reason when a B wave is unfolding it is essential to consider various alternate wave counts.

Within minuette wave (b) subminuette waves a and b subdivide best as three wave structures, with subminuette wave b a 157% correction of subminuette wave a. This indicates an expanded flat may be completing.

Subminuette wave c may be either an impulse or ending diagonal. Ending diagonals require all their subwaves to be single zigzags. Micro wave 1 subdivides best as a zigzag so subminuette wave c is most likely an ending diagonal. The diagonal would most likely be contracting to end before 1,331.29.

Within the diagonal micro wave 2 again moved lower. Micro wave 2 is now .77 the length of micro wave 1, which is nicely within the common length of second (and fourth) waves of diagonals, between .66 to .81 of first (and third) waves. If it continues further it may not move below the start of micro wave 1 at 1,268.62.

Minuette wave (b) may not move beyond the start of minuette wave (a) above 1,331.29.

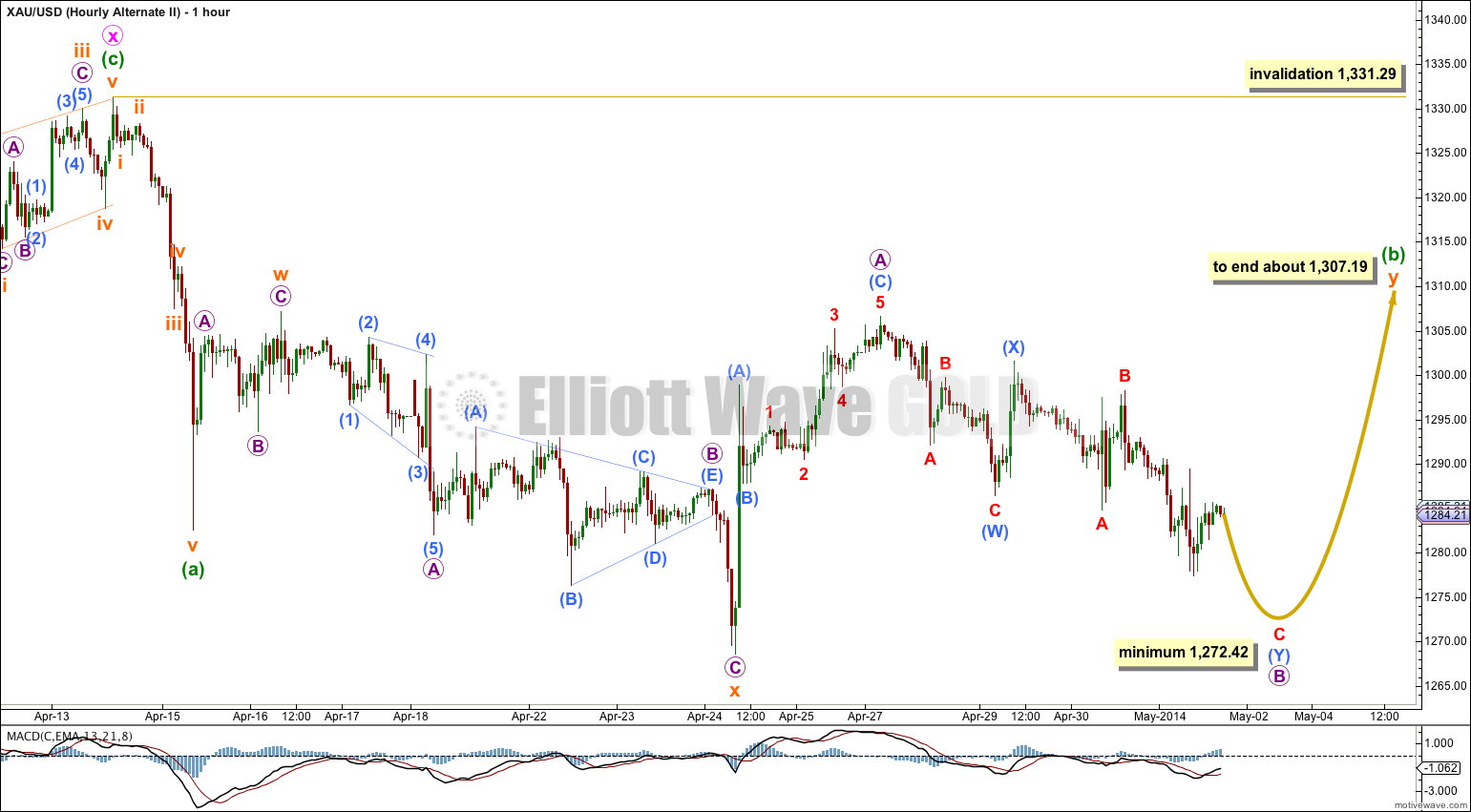

Another structural possibility for minuette wave (b) may be an incomplete double combination.

The purpose of combinations is to take up time and move price sideways, which is what has been happening over the last few days.

If minuette wave (b) is a combination then it would be incomplete. The first structure in the combination was a zigzag, labeled subminuette wave w. The second structure may be either a flat or a triangle, with a flat more common.

Within the possible flat correction of subminuette wave y micro wave B must reach a minimum 90% length of micro wave A at 1,272.42. Thereafter, micro wave C would most likely end at least a little above 1,306.58.

Subminuette wave y would most likely end about the same level as subminuette wave w at 1,307.19.

This alternate expects overall more sideways movement for yet another one or two days.

I have again looked to see if any possible corrective structure could be complete for minuette wave (b). Nothing fits as completed, and I again conclude that Gold will remain range bound for another one or two days yet. It should break out to the downside.

I am still thinking of Minor B may be able consider to be running as a single zigzag and the wave is now on the way Minuette (i) of Minute c. Minuette (i) is running as a leading diagonal. If this wave count is acceptable, then Minute c may run too long for the rest to develop.