A small inside day fits the idea of a multi day consolidation unfolding.

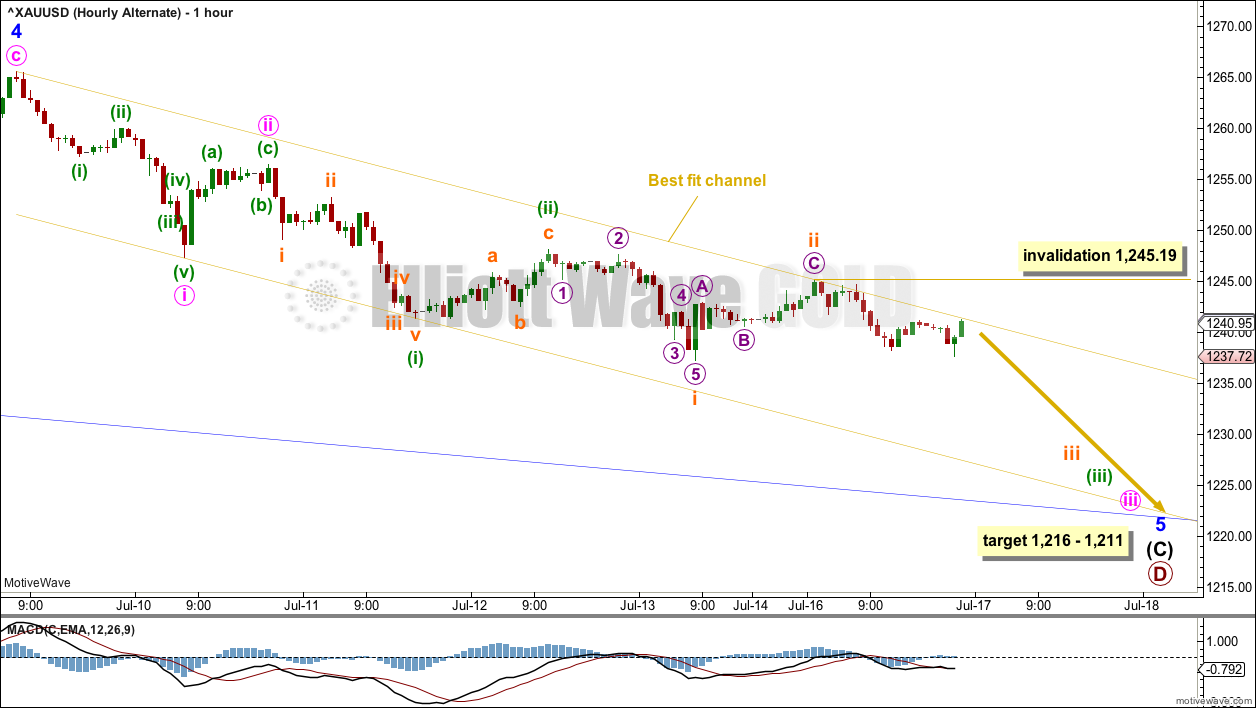

Summary: While price remains within the best fit channel, which is drawn on all hourly charts, then allow for the possibility that the new alternate hourly wave count could be correct. It is possible that minor wave 4 was over very quickly at the last high on the 9th of July and minor wave 5 downwards is underway. A bearish signal today from On Balance Volume means this possibility must now be considered.

If price breaks above the upper edge of the channel and then makes a new high above 1,245.19, then minor wave 4 would still be continuing sideways for a few days.

The mid term target is 1,216 – 1,211. Downwards movement may be limited to no lower than 1,123.08.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

At the end of this week, it may be a good idea to note that neither Gold nor Silver have made new swing lows below the prior major swing lows of December 2017. This week both markets moved lower and came even closer to those lows, but both have failed by a small margin. This must be interpreted as bullish, until proven otherwise.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

There are six weekly charts published in the last historic analysis. All but two expect more downwards movement at this time; the two bullish wave counts would be invalidated below 1,236.54. Because the remaining four bearish wave counts all expect the same movement next only one shall be published on a daily basis. Members should keep the other wave counts in mind. They will be published on a daily basis if they begin to diverge from the triangle wave count.

MAIN ELLIOTT WAVE COUNT

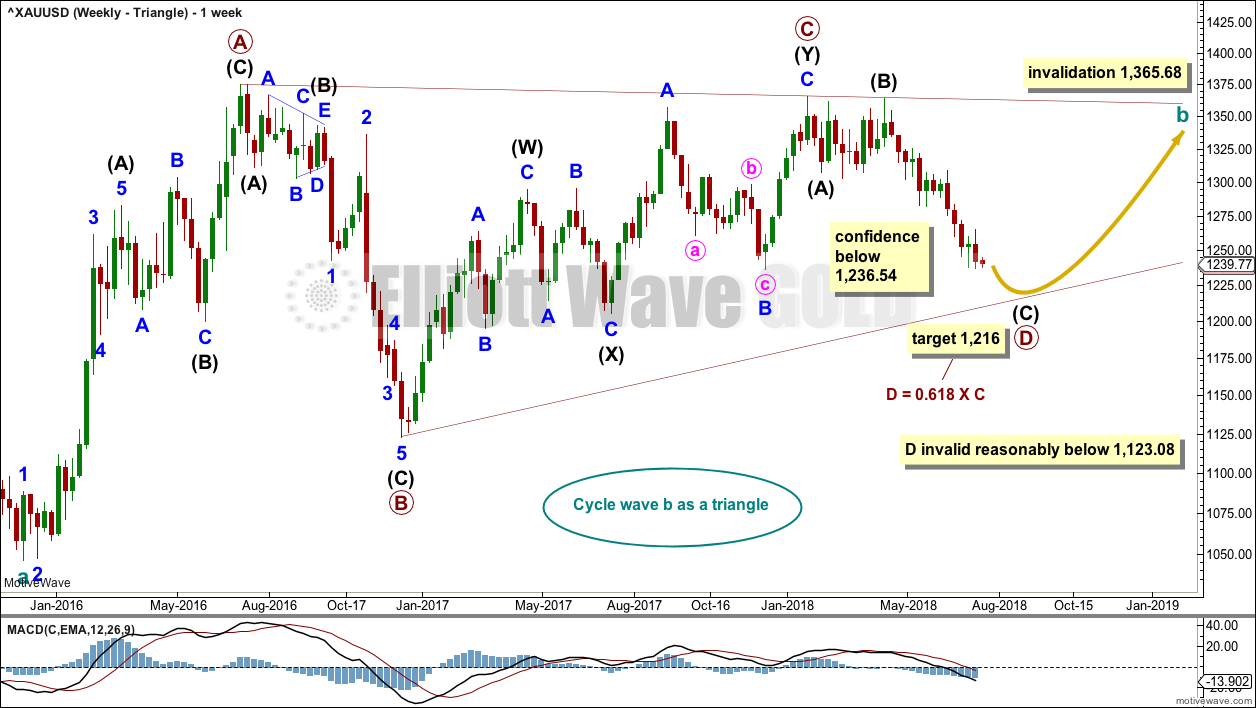

WEEKLY CHART – TRIANGLE

The triangle so far has the best fit and look. If price shows a combination or flat may be more likely, then those ideas may be published on a daily basis. The flat and combination ideas expect movement reasonably below 1,123.08, or perhaps a new low below 1,046.27.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

One triangle sub-wave tends to be close to 0.618 the length of its predecessor; this gives a target for primary wave D.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

DAILY CHART – TRIANGLE

Primary wave D may be unfolding lower as a single zigzag, and within it intermediate waves (A) and (B) may be complete.

The target is widened to a $5 zone calculated at two degrees. This should have a reasonable probability.

Within intermediate wave (C), it looks likely that all of minor waves 1, 2 and 3 may now be over. Minor wave 4 may now be about two thirds complete if it is a flat or combination, or it may be only about halfway complete if it is a triangle.

Minor wave 2 fits as a double zigzag, and was shallow. Given the guideline of alternation, minor wave 4 may most likely be a flat, combination or triangle; it may be very shallow, but it may also be deep in order to exhibit alternation with minor wave 2.

Minor wave 2 lasted 18 days, and it shows up on the weekly chart. Fourth waves for Gold are often quicker than second waves; minor wave 4 may last about one or two weeks.

Minor wave 4 may not move into minor wave 1 price territory above 1,282.20.

Adjust the channel to fit as an Elliott channel drawn using Elliott’s first technique. If it is long lasting enough, then minor wave 4 may find resistance about the upper edge of this channel.

A bearish signal today from On Balance Volume means that the possibility that minor wave 4 may have been over very quickly on the 9th of July must be considered. It would have poor proportion with minor wave 2, but fourth waves can be quicker than second waves for Gold. If it was over at the last high, it would have been a single zigzag, exhibiting very poor alternation with the double zigzag of minor wave 2. The lack of alternation is a bigger problem than poor proportion. This idea is outlined in a new alternate hourly chart below.

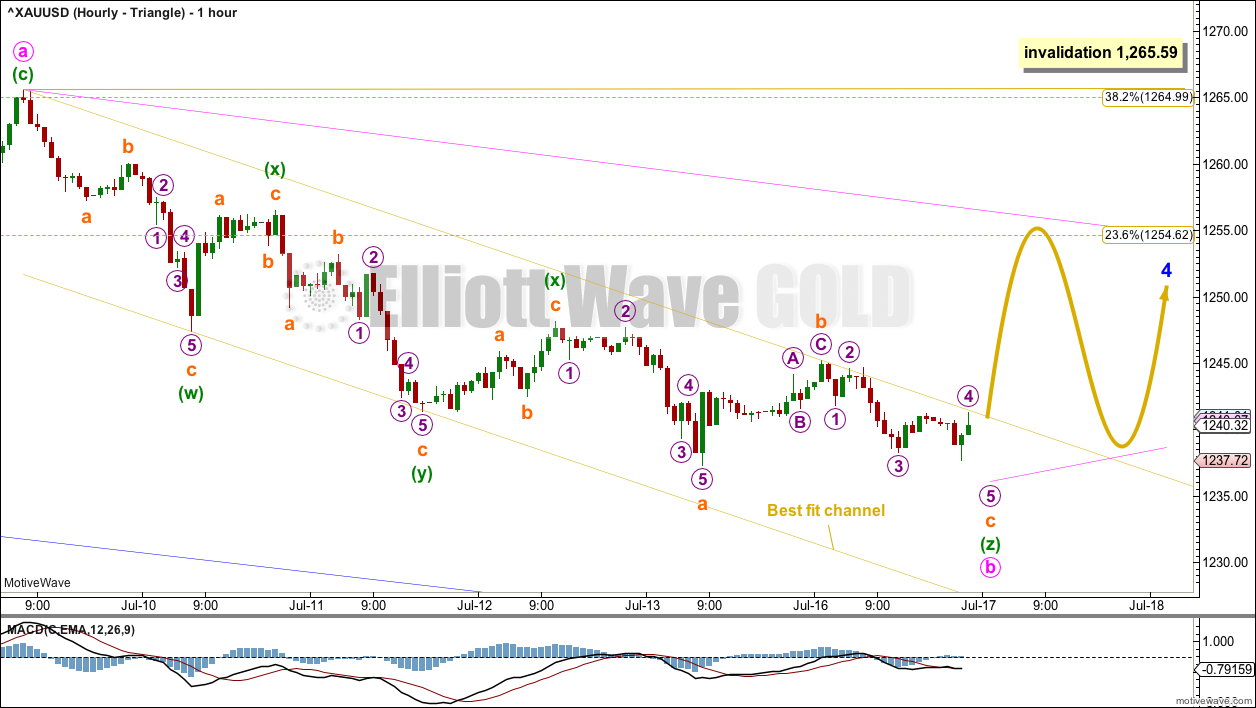

HOURLY CHART – TRIANGLE

If minor wave 4 is unfolding as a triangle, then within it both of minute waves a and b may now be complete. Minuette wave (b) may be completing as a rare triple zigzag. The third zigzag in the triple labelled minuette wave (z) is today slightly relabelled because the last downwards wave looks like an incomplete five and not a complete three. If a five down is unfolding, then subminuette wave c of minuette wave (z) may be incomplete.

Only one sub-wave within a triangle may subdivide as a multiple. All remaining sub-waves must now be single corrective structures, most likely zigzags.

Minute wave c may not move beyond the end of minute wave a above 1,265.59. A reasonable target range for minute wave c may be about 0.80 to 0.85 the length of minute wave b.

Minute wave d of a contracting triangle may not move beyond the end of minute wave b. Minute wave d of a barrier triangle may end about the same level as minute wave b, so that the b-d trend line is essentially flat. In practice this means that minute wave d may end slightly below minute wave b and the triangle would remain valid.

Finally, minute wave e may not move beyond the end of minute wave c.

A triangle would expect a few more days or so of choppy and overlapping sideways movement in an ever decreasing range.

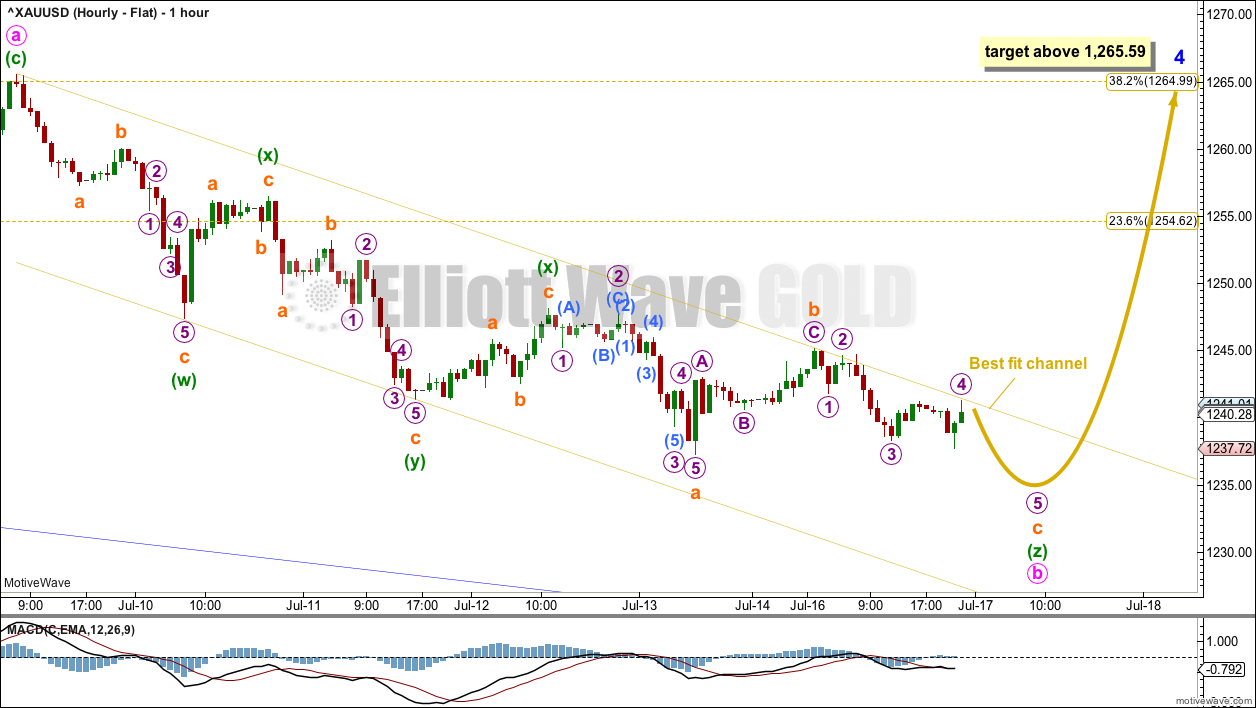

HOURLY CHART – FLAT

Minor wave 4 may be a flat correction.

Within the flat, minute wave a subdivides as a three, a single zigzag. Minute wave b may now be a triple zigzag, which may be almost complete.

The maximum number of corrective structures in a multiple is three. When a third zigzag may be complete, then the entire wave should be complete. If this downwards movement is correctly labelled as a triple zigzag, then minute wave b should be over at Friday’s low. This labelling does have a very good fit and the best look.

Minute wave c would be very likely to make at least a slight new high above the end of minute wave a at 1,265.59 to avoid a truncation and a very rare running flat. Minute wave c must subdivide as a five wave structure, either an impulse or an ending diagonal. An impulse is much more common for C waves within flats.

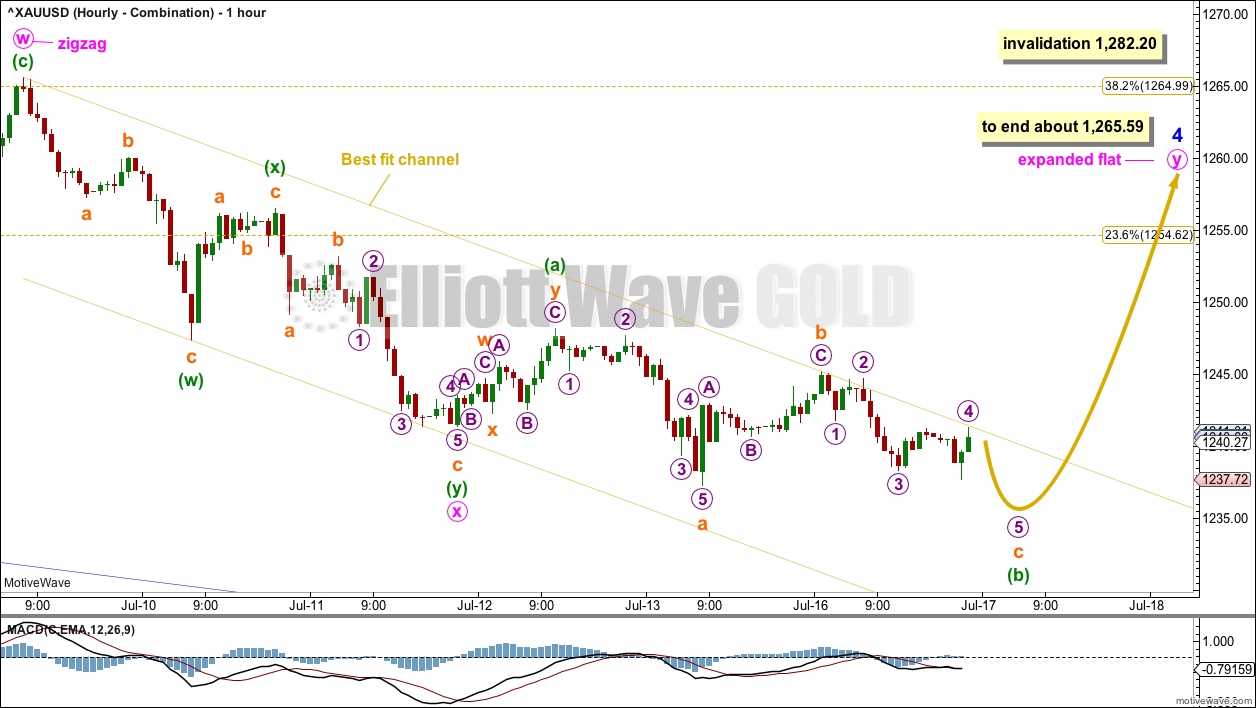

HOURLY CHART – COMBINATION

It is essential to also consider an alternate to a triangle. There have been times I have labelled a triangle unfolding, or possibly even complete, and then the triangle is invalidated and the structure turns out to be something else, usually a combination.

If a combination is unfolding, then the first structure in the double may be a complete zigzag labelled minute wave w.

The double may now be joined by a corrective structure in the opposite direction labelled minute wave x. X waves within combinations may be any corrective structure, including multiples (although this is not common).

Within combinations, the maximum number of corrective structures is three: this maximum refers to W, Y and Z. Each of W, Y and Z may only subdivide as a single corrective structure labelled A-B-C (or A-B-C-D-E as in the case of triangles). They may not subdivide as multiples because that would increase the total number of structures in the combination beyond three, breaking the Elliott wave rule.

This is the most commonly misapplied Elliott wave rule I see others make. Any Elliott wave labelling that has W-X-Y-Z and each of W, Y and Z themselves labelled W-X-Y-Z breaks this Elliott wave rule and has no predictive value. Use this as a quick and easy way to tell if the labelling of combinations you are considering is worthy of your time and attention.

Because minor wave 2 was a double zigzag this is the least likely structure for minor wave 4 to unfold as. A double combination is labelled in the same way, but is a very different structure. Multiple zigzags have a strong slope, like single zigzags usually do. Multiple combinations are sideways movements, so they rarely have a slope.

If minor wave 4 is a double combination, then minute wave y may be either a flat or a triangle. A flat correction is much more common within a combination and so more likely. Minuette wave (b) may be almost complete, and minute wave y may be an expanded flat correction.

While double combinations are fairly common structures, triple combinations are extremely rare. When a second structure in a multiple is complete, the probability that the whole correction is complete is extremely high.

ALTERNATE HOURLY CHART

It is possible that minor wave 4 was over at the last high on the 9th of July, and minor wave 5 may now be underway.

Minor wave 5 may only subdivide as either an impulse or an ending diagonal. An impulse is more likely; these are much more common.

If minor wave 5 is unfolding as an impulse, then its middle has not yet passed. There is too much overlapping; a series of three first and second waves may now be complete. A reasonable increase in downwards momentum may occur in the next one or two days as these third waves complete. Look out for strongest momentum to occur at the ends of any one of these third waves.

Within subminuette wave iii no second wave correction may move beyond the start of its first wave above 1,245.19.

The best fit channel is drawn exactly the same way on all hourly charts today. While price remains below the upper edge, then this wave count shall remain possible. If price breaks above the upper edge, this wave count would reduce in probability.

TECHNICAL ANALYSIS

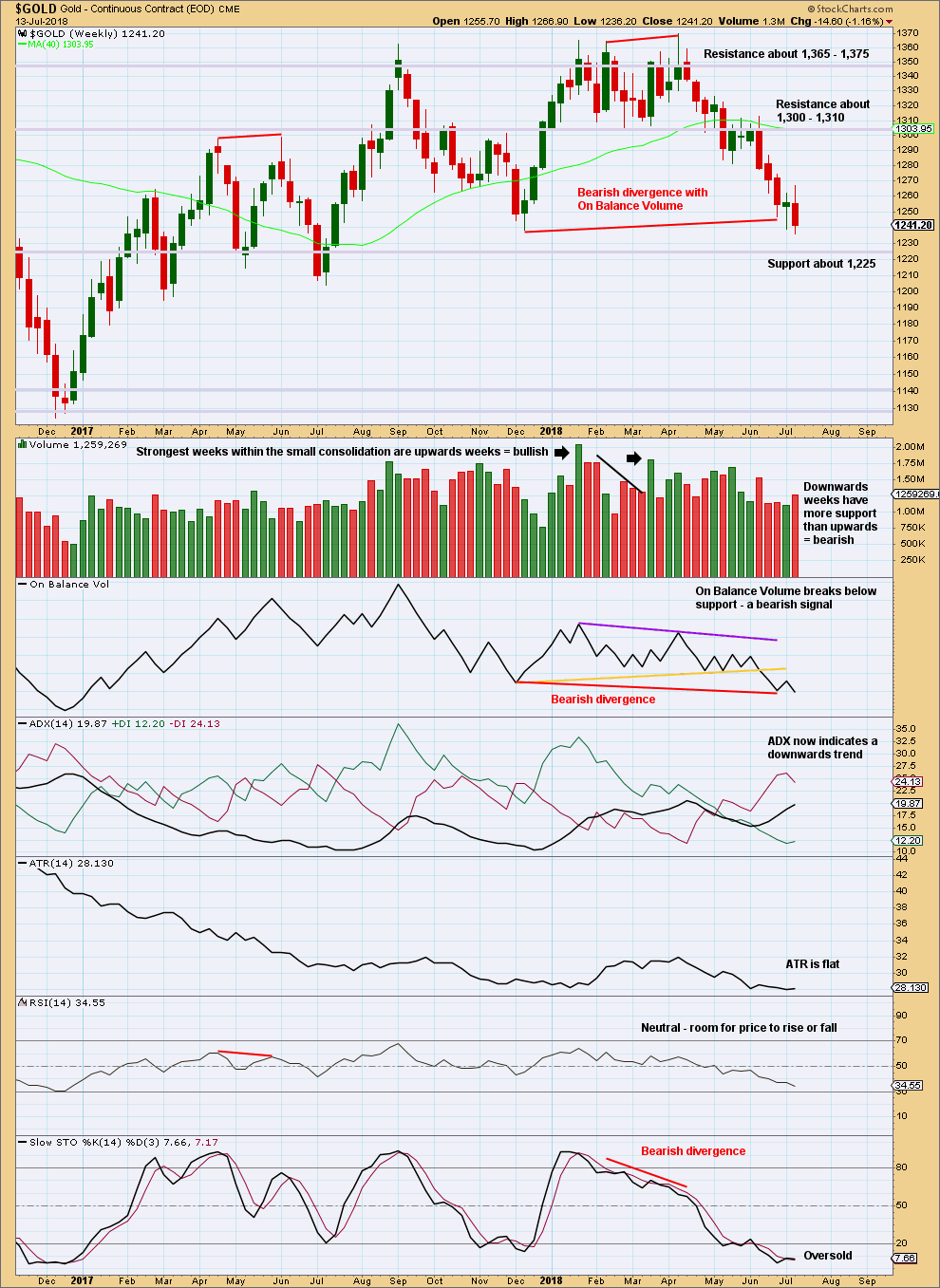

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A downwards week last week has support from volume.

There is single but weak bullish divergence between price and Stochastics.

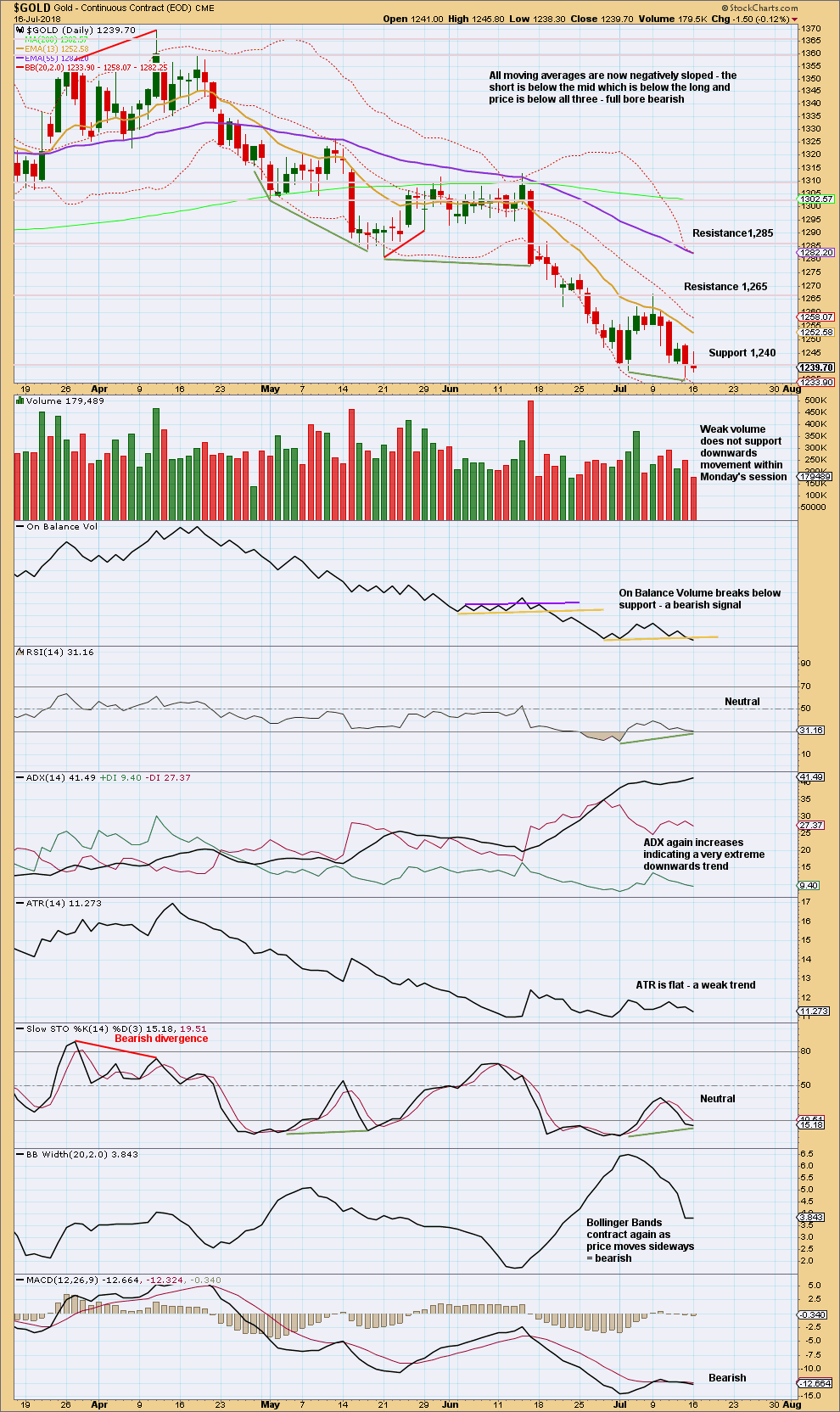

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The new low for Friday exhibits bullish divergence with RSI, Stochastics and possibly also On Balance Volume (although with On Balance Volume, it is essentially flat this is week).

Monday’s session saw a balance of volume downwards and a red candlestick. Downwards movement during the session lacks support from volume. The market fell of its own weight.

The long upper wick is bearish, and the bearish signal from On Balance Volume should be given weight. This supports the alternate hourly Elliott wave count, but not very strongly.

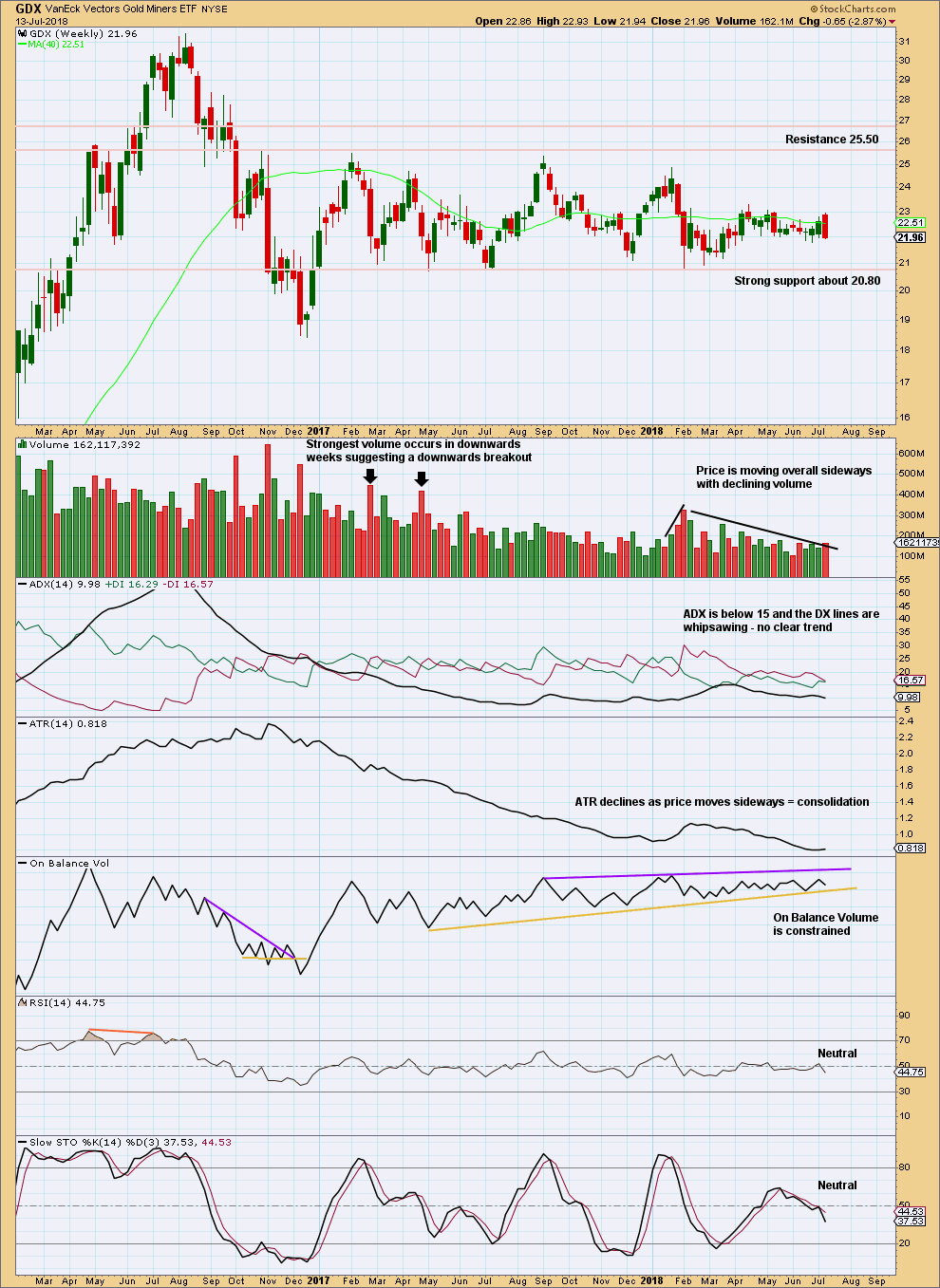

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

There is some support this week for downwards movement from volume.

This weekly candlestick should not be read as a bearish engulfing pattern. For a candlestick reversal pattern to be read as such, there has to be something to reverse. Here, price is moving sideways and not trending.

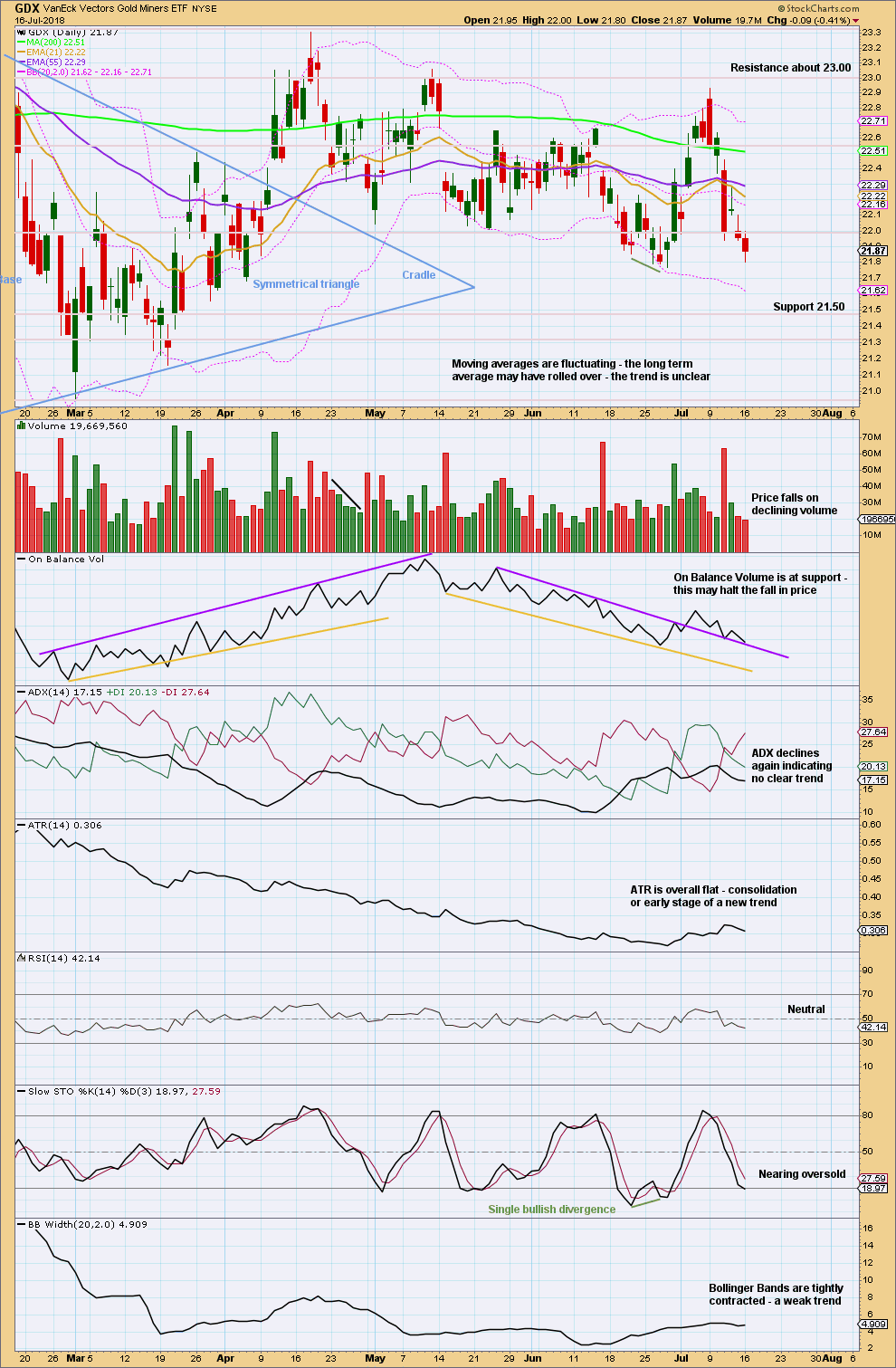

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is at support about 21.80. If it breaks below this support area, then next support is about 21.50.

It looks most likely that at this stage GDX may bounce up about here: Stochastics is almost oversold, On Balance Volume is at support, and volume does not support downwards movement.

Published @ 11:43 p.m. EST.

Today’s action eliminated 2 of the weekly option charts. The triangle is the only one left with a potential near term bottom

It is still possible today that minor 4 could continue. So far this new low could still be minute b (or x) within minor 4. It would now be a 1.41 length of minute wave a (or w) which is just slightly longer than the most common range of up to 1.38 for B waves within flats.

Lets see how strong this downwards movement is when the NY session is closed and I have StockCharts data.

The best fit channel is not working, but the price point which differentiates the alternate wave count from the other three hourly charts is working.

Price remained below 1,245.19 and returned to within the channel, thereafter it’s made new lows.

The idea of minor 4 being over and minor 5 now underway needs to be taken seriously, it has support from On Balance Volume and I give this indicator reasonable weight because it works more often than it fails, by a good margin too.

I’ll be looking at strength within this downwards movement. If it has support from volume I’ll possibly discard the idea that minor 4 could be continuing.

There may still be bullish divergence between price and RSI and Stochastics, that can persist for a few days while price continues to fall as minor 5 comes to an end.

If the alternate hourly count is correct then a low may be approaching either late this week or into next week. The target is not very far away.