Yesterday’s technical analysis of Gold expected a little more upwards movement, with a fourth wave correction along the way. Price moved slightly lower and sideways. The Elliott wave structure is incomplete and the wave count remains the same.

Summary: Minor wave A may be very close to completion. Upwards movement should continue to a target at 1,328 to 1,330.

Click on charts to enlarge.

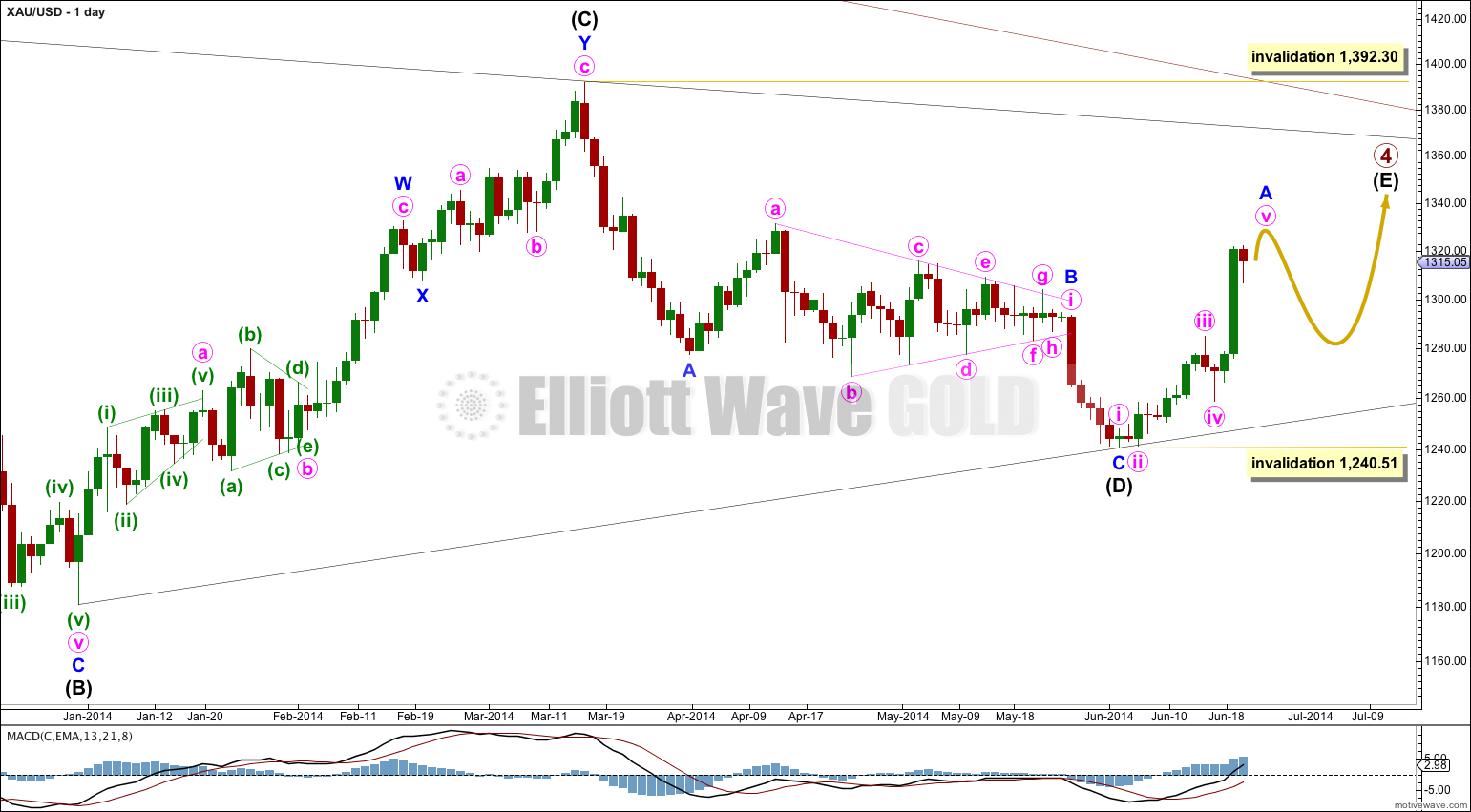

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

This wave count expects primary wave 4 is a huge triangle. The triangle is now within the final wave of intermediate wave (E) which should subdivide as a zigzag.

Intermediate wave (E) is most likely to fall short of the (A) – (C) trend line. It may also overshoot this trend line, but that is less common.

Within the zigzag of intermediate wave (E) minor wave B may not move beyond the start of minor wave A at 1,240.51.

So far within primary wave 4 intermediate wave (A) lasted 43 days, intermediate wave (B) lasted 88 days, intermediate wave (C) lasted 53 days and intermediate wave (D) lasted 56 days. Intermediate wave (E) may last a total of about 43 to 56 days. So far it has only lasted 13 days.

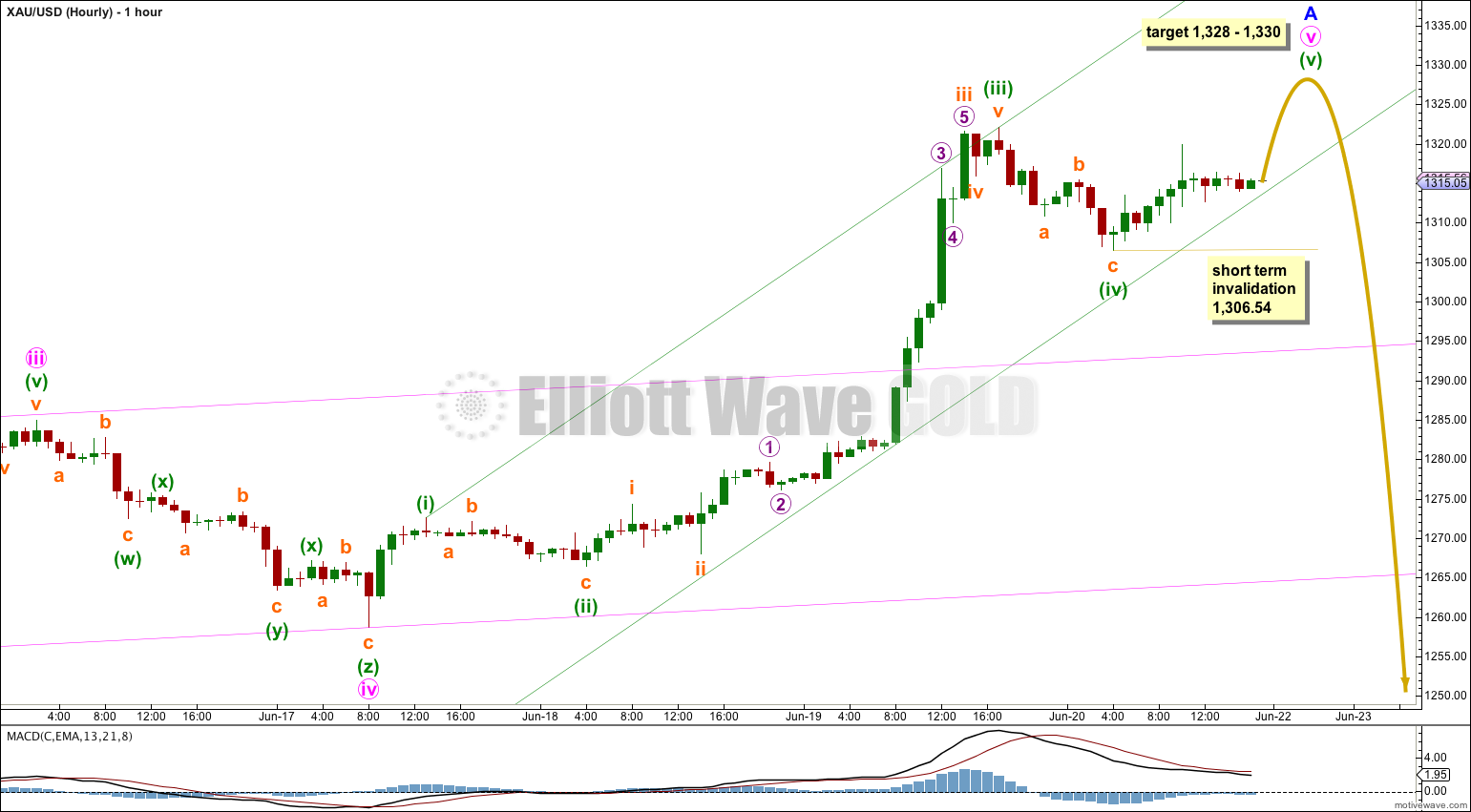

Minor wave A is still incomplete and the wave count expects a little more upwards movement.

I expect that minuette wave (iii) within minute wave v ended earlier than anticipated on Friday. Minuette wave (iii) is 2.95 short of 4.236 the length of minuette wave (i). At 1,328 minuette wave (v) would reach 0.382 the length of minuette wave (iii), and at 1,330 minute wave v would reach 1.618 the length of minute wave iii. This gives us a $2 target zone which may be met on Monday with a final upwards push.

Within minuette wave (v) no second wave correction may move beyond the start of its first wave below 1,306.54. Once minuette wave (v) could be complete this invalidation point no longer applies.

When minor wave A is complete then I will expect minor wave B downwards to begin.

B waves have the greatest variation of all Elliott wave structures. They can be sharp brief zigzags, or they can be very complicated time consuming combinations or triangles. It is impossible to tell which structure will unfold at the start. If they are expanded flats or running triangles then they may contain new price extremes beyond their starts. Members who have been with me from April this year will know the difficulty in analysing the last B wave at minor degree; it turned out to be a very rare nine wave triangle (see the triangle labeled minor wave B within intermediate wave (D) downwards on the daily chart), the only one I have ever seen so clearly on a daily chart. While it was unfolding we had alternate wave counts and premature calls for the structure to be complete. The only thing I was clear on was that when it was over price should break out to the downside, and it did.

This next B wave should last about three weeks, should take price lower, may be very choppy and overlapping, and should find strong support at the lower (B) – (D) trend line on the daily chart if it even got down that low. It may not move beyond the start of minor wave A at 1,240.51.

I have drawn two channels on the hourly chart. The green channel is a best fit about minute wave v. When this channel is clearly breached by downwards movement then I would expect that minor wave A is over and minor wave B has begun. Movement below 1,306.54 (after minuette wave (v) is complete) would provide price confirmation of this minor degree trend change.

Thereafter, movement below the pink channel would provide further confidence in a minor degree trend change.

This analysis is published about 09:30 p.m. EST.

http://www.mql5.com/ru/charts/2028972/xauusd-h4-forex-club-international