Downwards movement was expected to continue for the week, which is exactly what has happened.

The Elliott wave structure is used to indicate when and where bounces may occur. Candlestick patterns and volume are used to guide the Elliott wave count.

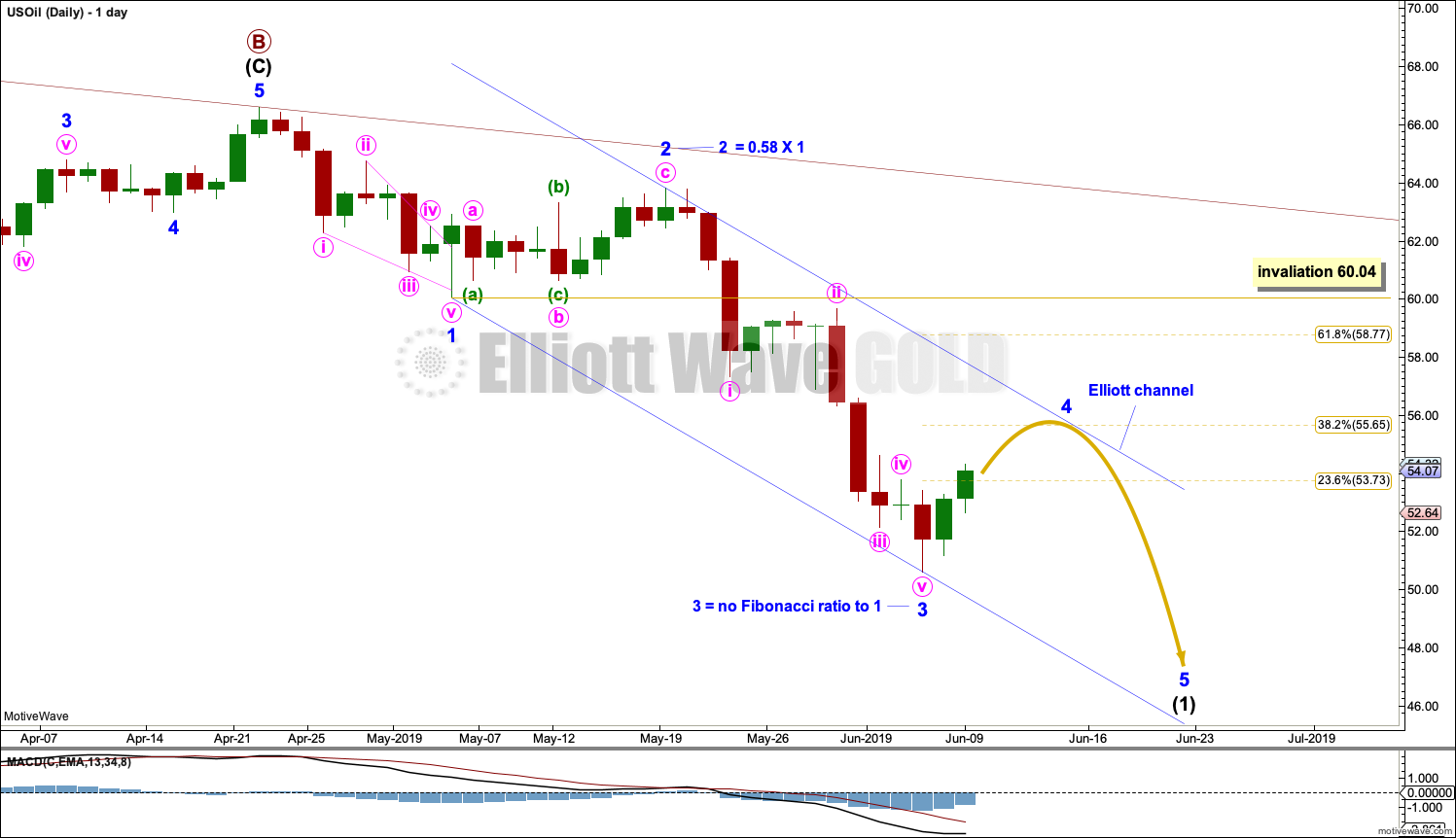

Summary: A relatively shallow bounce for a fourth wave may continue next week. It may be a time consuming sideways consolidation that may find resistance about the upper edge of the Elliott channel. It may last a total of about two weeks. The target is 55.65. The bounce should not move above 60.04.

If price does come up to touch the upper edge of the channel, that may be used as an entry opportunity to join the downwards trend.

When this bounce or consolidation is complete, then a target may be calculated for the fifth wave down to end. That cannot be done yet.

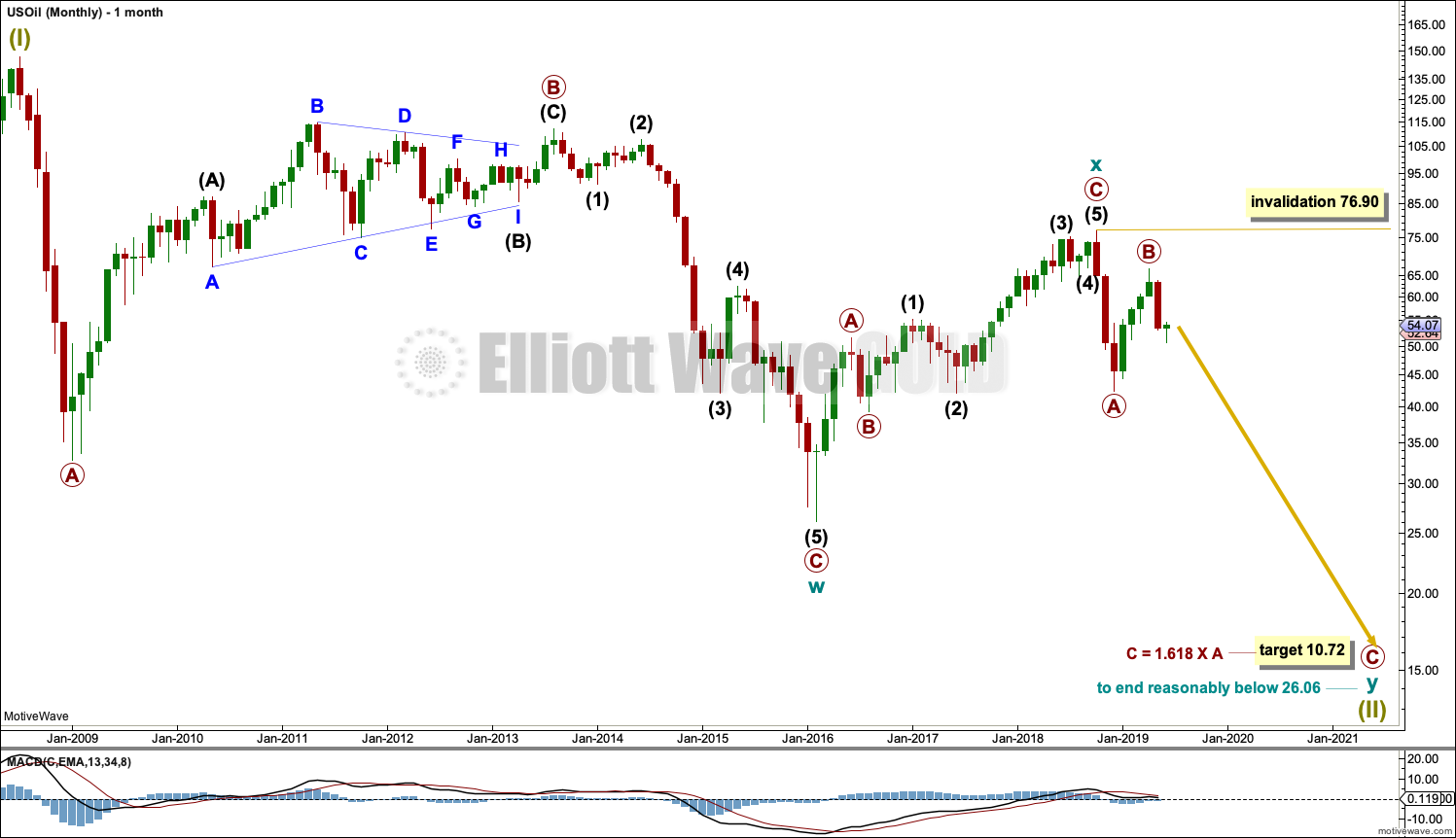

The final target is now calculated at 10.72.

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil is still within a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil continues.

This Elliott wave corrective structure is a double zigzag, which is a fairly common structure. The correction is labelled Super Cycle wave (II).

The first zigzag in the double is complete and labelled cycle wave y. The double is joined by a three in the opposite direction labelled cycle wave x, which subdivides as a zigzag. The second zigzag in the double may now have begun, labelled cycle wave w.

The purpose of a second zigzag in a double zigzag is to deepen the correction when the first zigzag does not move price deep enough. To achieve this purpose cycle wave y may be expected to move reasonably below the end of cycle wave w at 26.06. The target calculated would see this expectation met.

Cycle wave y is expected to subdivide as a zigzag, which subdivides 5-3-5.

Cycle wave w lasted 7.6 years and cycle wave x lasted 2.7 years. Cycle wave y may be expected to last possibly about a Fibonacci 5 or 8 years.

If it continues higher, then primary wave B may not move beyond the start of primary wave A above 76.90.

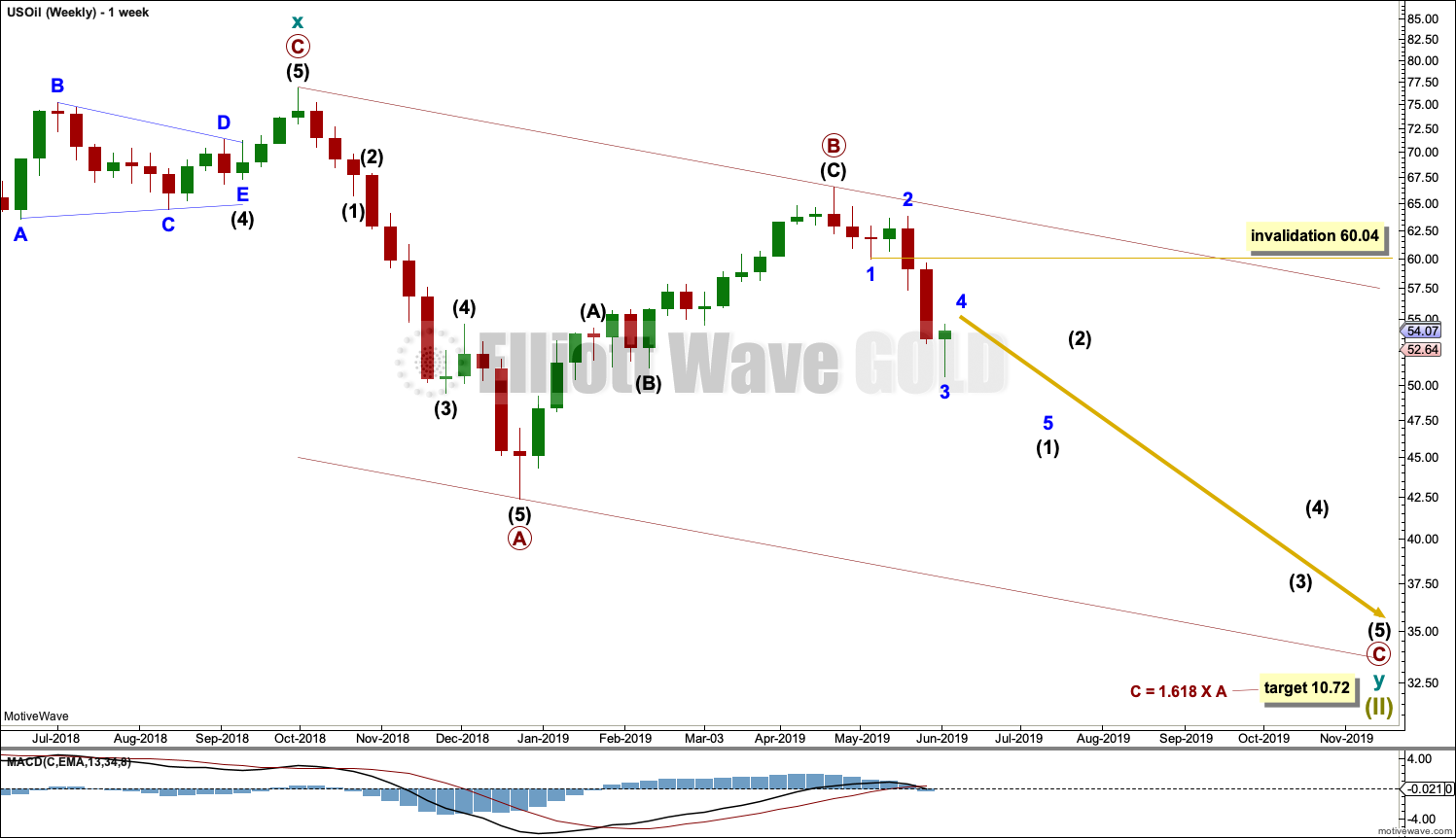

WEEKLY CHART

This weekly chart is focussed on the start of cycle wave y.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Primary wave A may be a complete five wave impulse at the last low.

Primary wave B may now be a complete single zigzag at the last high.

Primary wave C may have just begun. Primary wave C must subdivide as a five wave structure.

Primary wave A lasted 12 weeks, just one short of a Fibonacci 13.

Primary wave C may be longer in time as well as price. If cycle wave y lasts a Fibonacci 5 years, then primary wave C within it may take as long as a Fibonacci 233 weeks.

Intermediate wave (1) within primary wave C may be subdividing as an impulse. Within the impulse, minor wave 4 may not move into minor wave 1 price territory above 60.04.

Draw a channel about the zigzag of primary wave y using Elliott’s technique for a correction. Draw the first trend line from the start of primary wave A to the end of primary wave B, then place a parallel copy on the end of primary wave A. The upper edge of this channel may show where bounces along the way down find resistance. The lower edge of the channel may provide support.

When intermediate wave (1) is complete, then a bounce for intermediate wave (2) may be a multi-week bounce that may find resistance at the upper edge of the Elliott channel.

DAILY CHART

Note that monthly and weekly charts are on a semi-log scale, but this daily chart is on an arithmetic scale. This makes a slight difference to trend channels.

The daily chart this week focusses on the structure of intermediate wave (1) within primary wave C.

Intermediate wave (1) may be unfolding as an impulse. Within intermediate wave (1), minor waves 1 through to 3 may now be complete. Minor wave 3 shows an increase in downwards momentum beyond that of minor wave 1. This wave count fits with MACD.

Minor wave 2 was a relatively deep zigzag lasting 10 sessions. Minor wave 4 may exhibit alternation as a shallow flat, combination or triangle. The preferred target would be the 0.382 Fibonacci ratio of minor wave 3. Minor wave 4 may last about two weeks, or it may be longer lasting as sideways corrections do tend to be longer lasting than zigzags.

Minor wave 4 may find resistance about the upper edge of the blue Elliott channel. Draw this channel with the first trend line from the ends of minor waves 1 to 3, then place a parallel copy on the end of minor wave 2.

Minor wave 3 did not exhibit a Fibonacci ratio to minor wave 1. Minor wave 5 would be likely to exhibit a Fibonacci ratio to either of minor waves 1 or 3, with equality in length with minor wave 1 at $6.55 the most likely. When minor wave 4 is complete and the start of minor wave 5 is know, then the Fibonacci ratio may be applied to calculate a target for minor wave 5 to end. That cannot be done yet.

TECHNICAL ANALYSIS

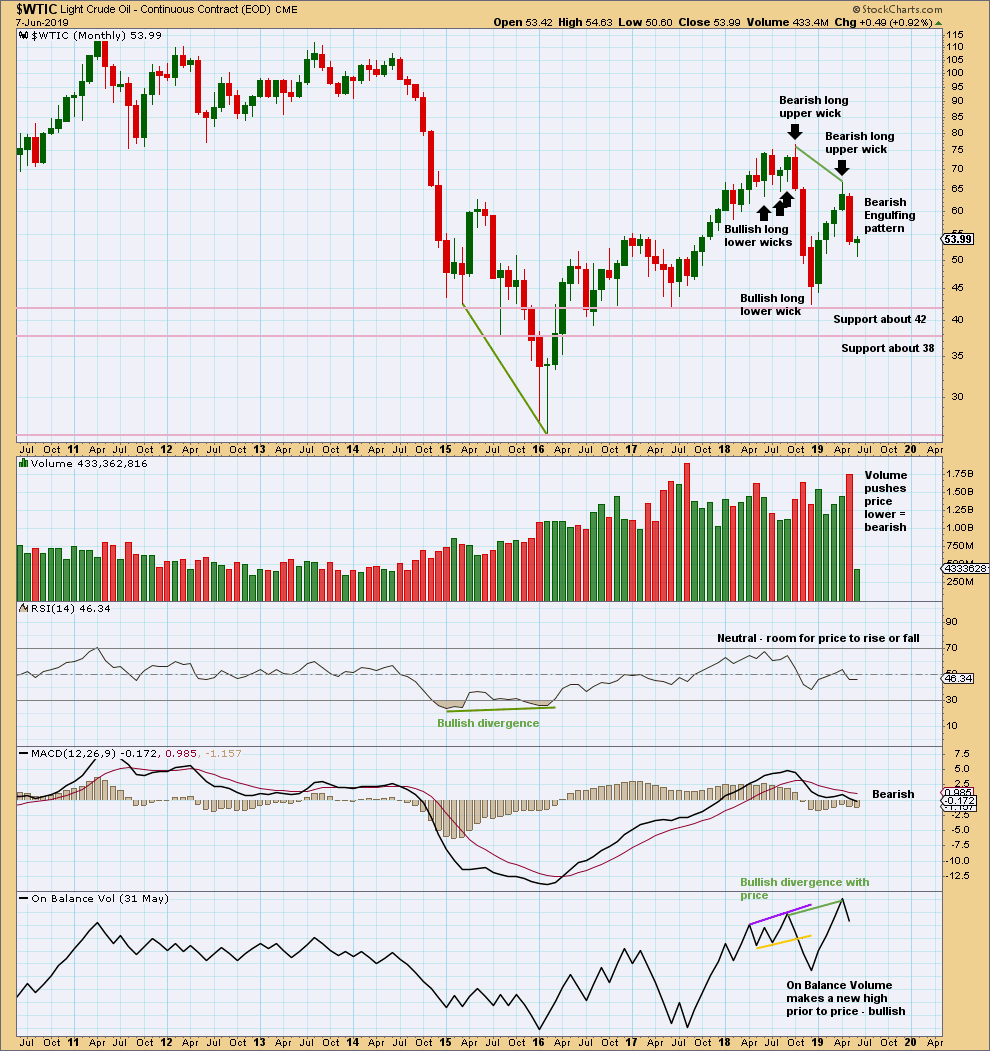

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

May has closed with a strong Bearish Engulfing candlestick pattern, which has strong support from volume. This supports the Elliott wave count.

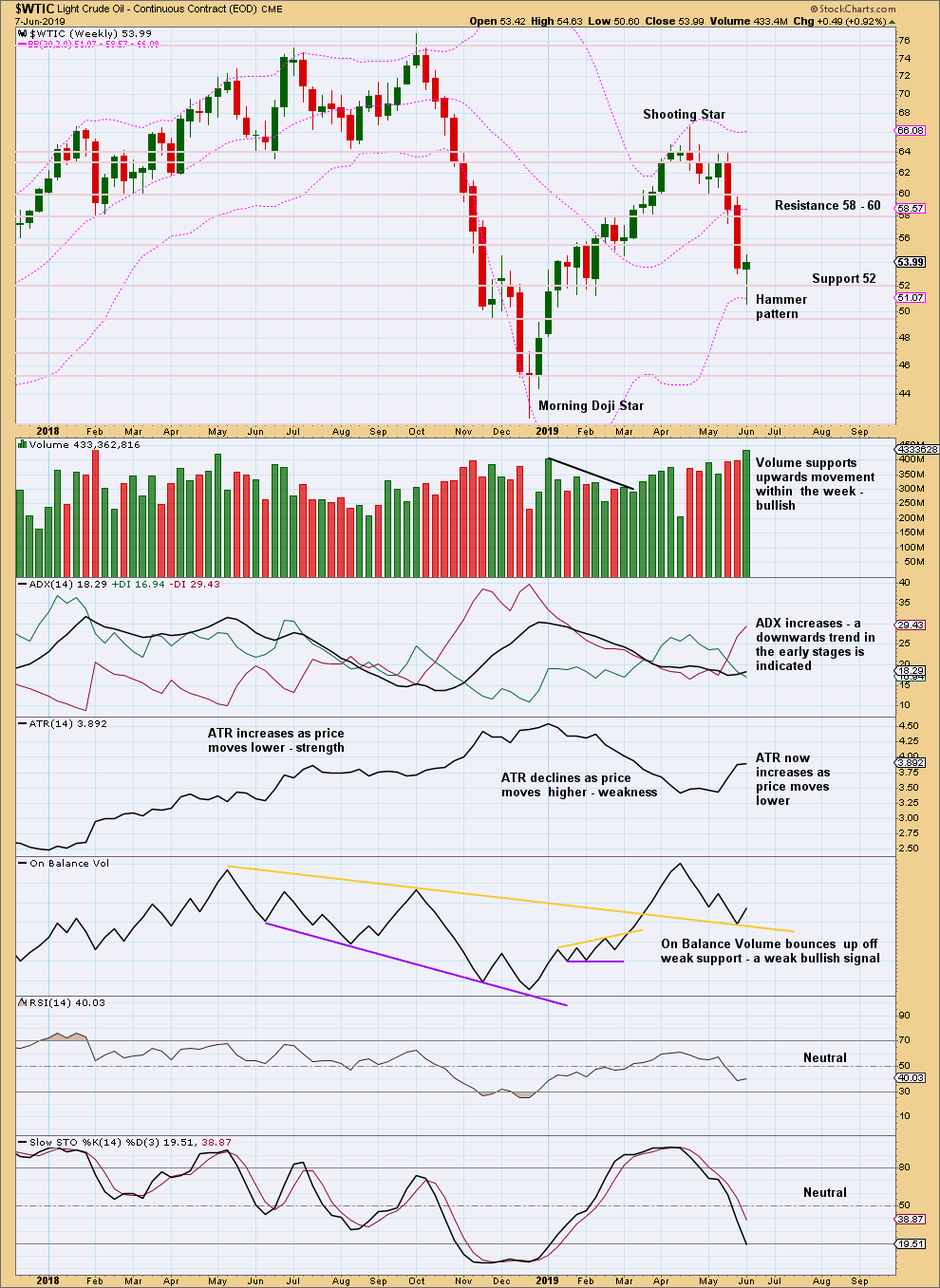

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week the bullish candlestick pattern, bullish short-term volume, and a bullish signal from On Balance Volume all support the short-term expectation for the Elliott wave count for a bounce or consolidation to continue here.

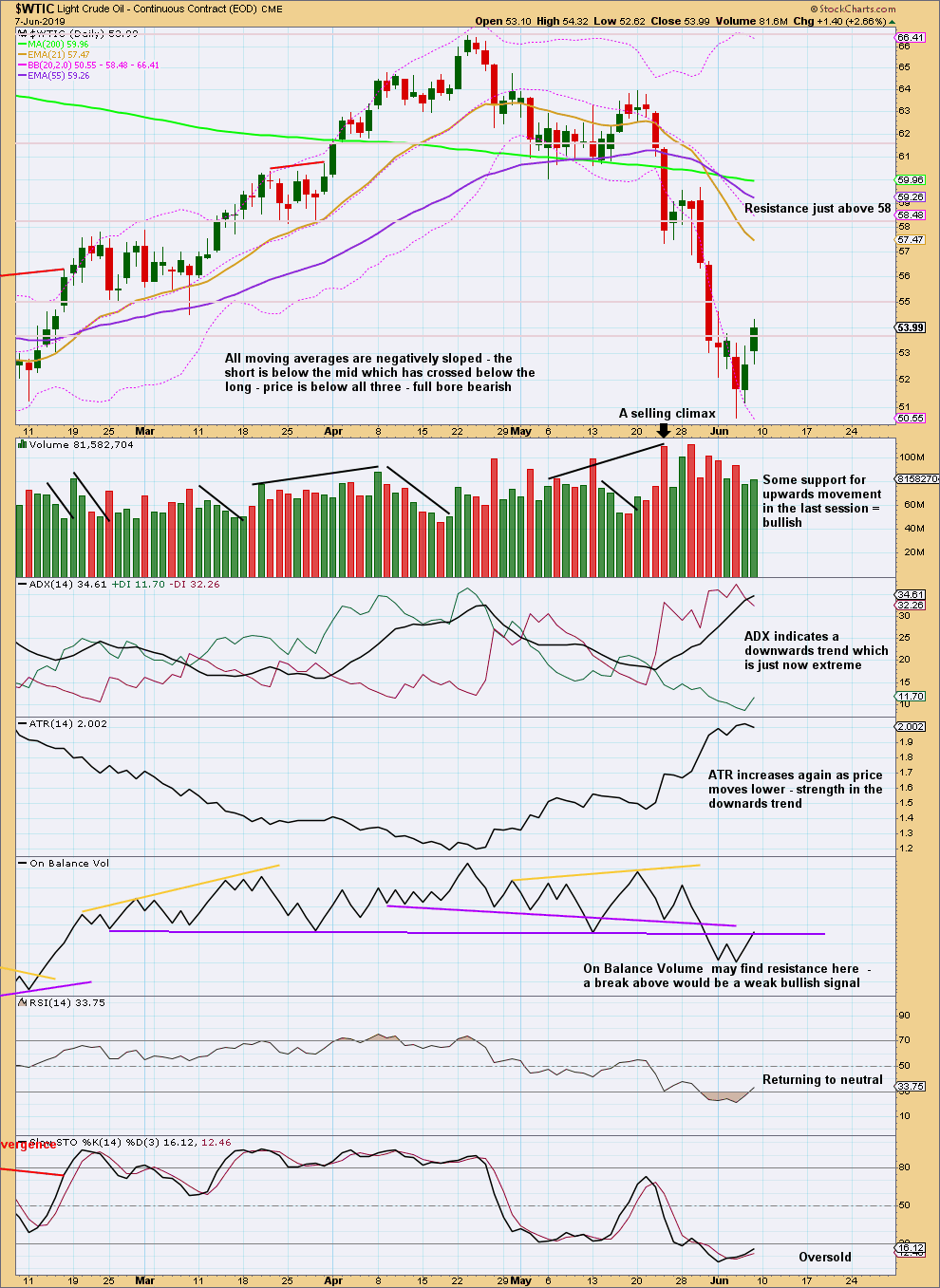

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Some consolidation or a bounce may unfold here to relieve extreme conditions for the short term. For the short term, some support from volume for the last upwards session indicates more upwards movement next week. This should be assumed to be a counter trend movement.

Published @ 01:15 p.m. EST on June 8, 2019.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.