GOLD: Elliott Wave and Technical Analysis | Charts – December 6, 2019

Summary: The downwards trend may resume to new lows next week. The Elliott wave target is at 1,348.

A target calculated from the triangle is about 1,431.

For the very short term, a new swing high above 1,514.29 would add some confidence in a more bullish outlook. The target would then be at 1,567, 1,635 or 1,693.

For the bigger picture, the bearish Elliott wave count expects a new downwards trend to last one to several years has begun. The alternate bearish wave count looks at the possibility that one final high to 1,559 is required first.

The bullish Elliott wave count expects a primary degree fourth wave has completed and the upwards trend has resumed.

Grand SuperCycle analysis is here.

Monthly charts were last published here.

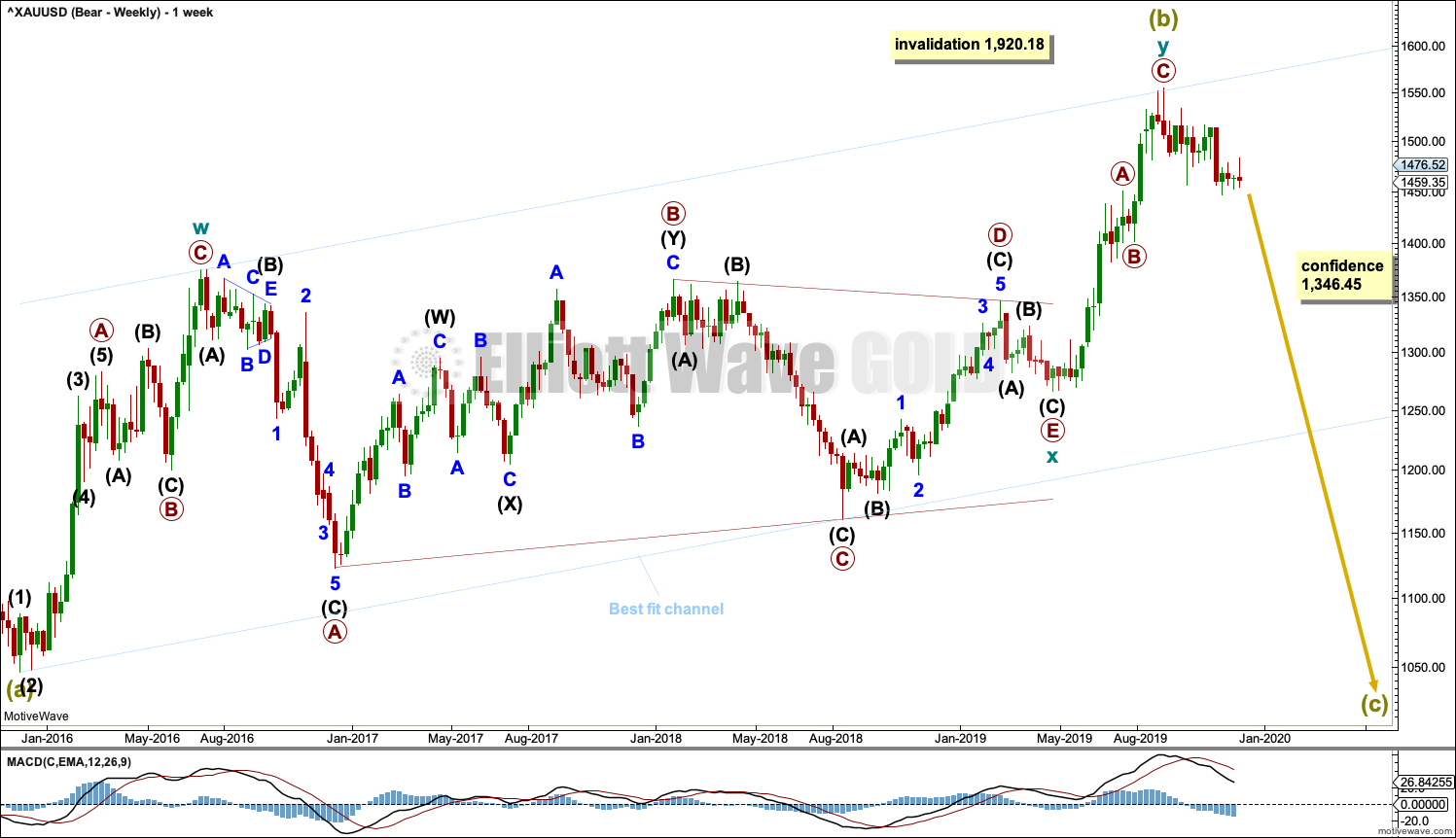

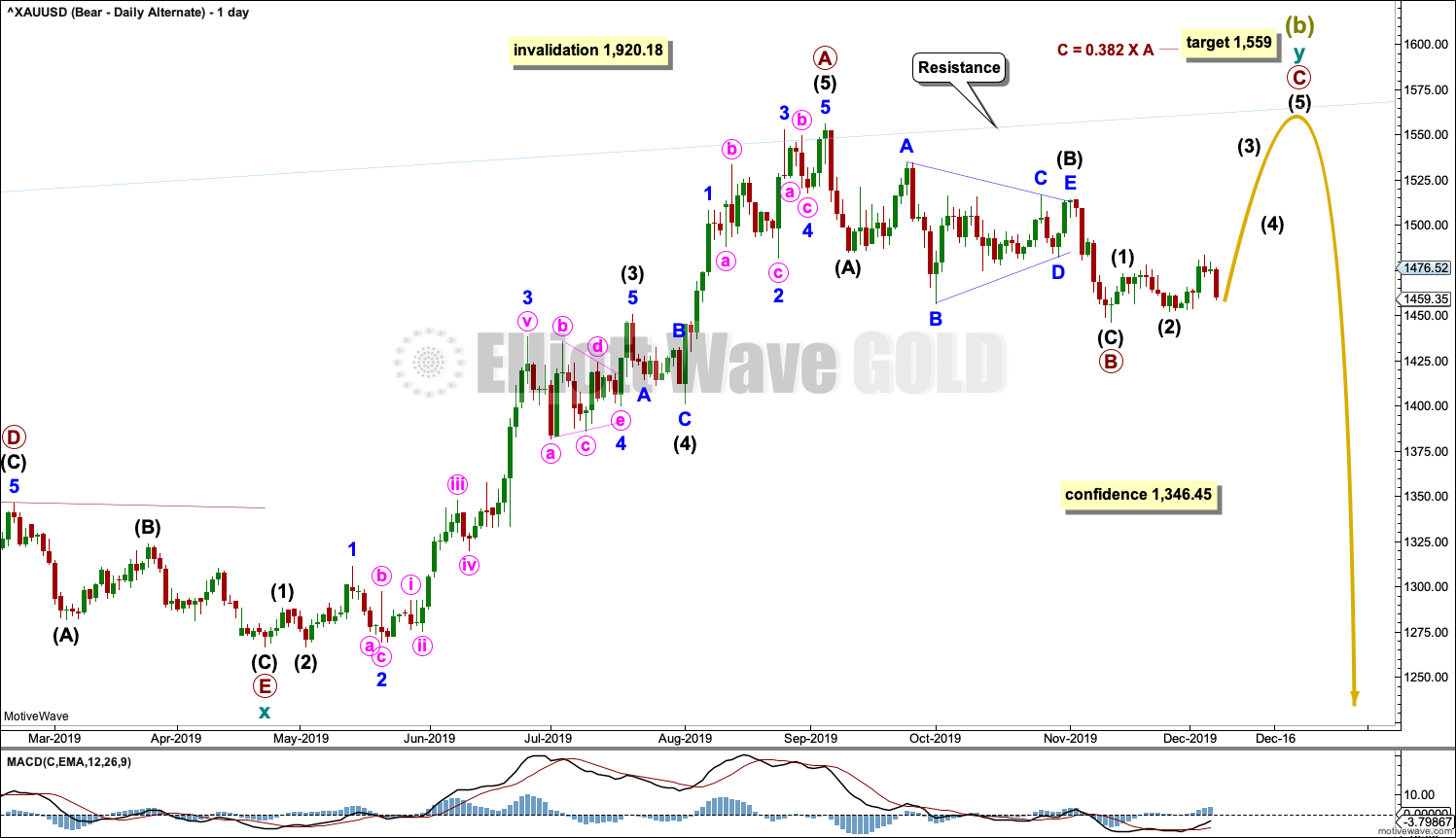

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

It is possible that Super Cycle wave (b) is complete as a double zigzag.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

A new low below 1,346.45 would add strong confidence to this wave count. At that stage, the bullish Elliott wave count would be invalidated.

A wide best fit channel is added in light blue. This channel contains all of Super Cycle wave (b) and may provide resistance and support. Copy this channel over to daily charts. Along the way down, the lower edge of the channel may provide support and in turn initiate a bounce.

Super Cycle wave (c) must subdivide as a five wave structure, most likely an impulse. It may last several years. It would be very likely to make new lows below the end of Super Cycle wave (a) at 1,046.27 to avoid a truncation.

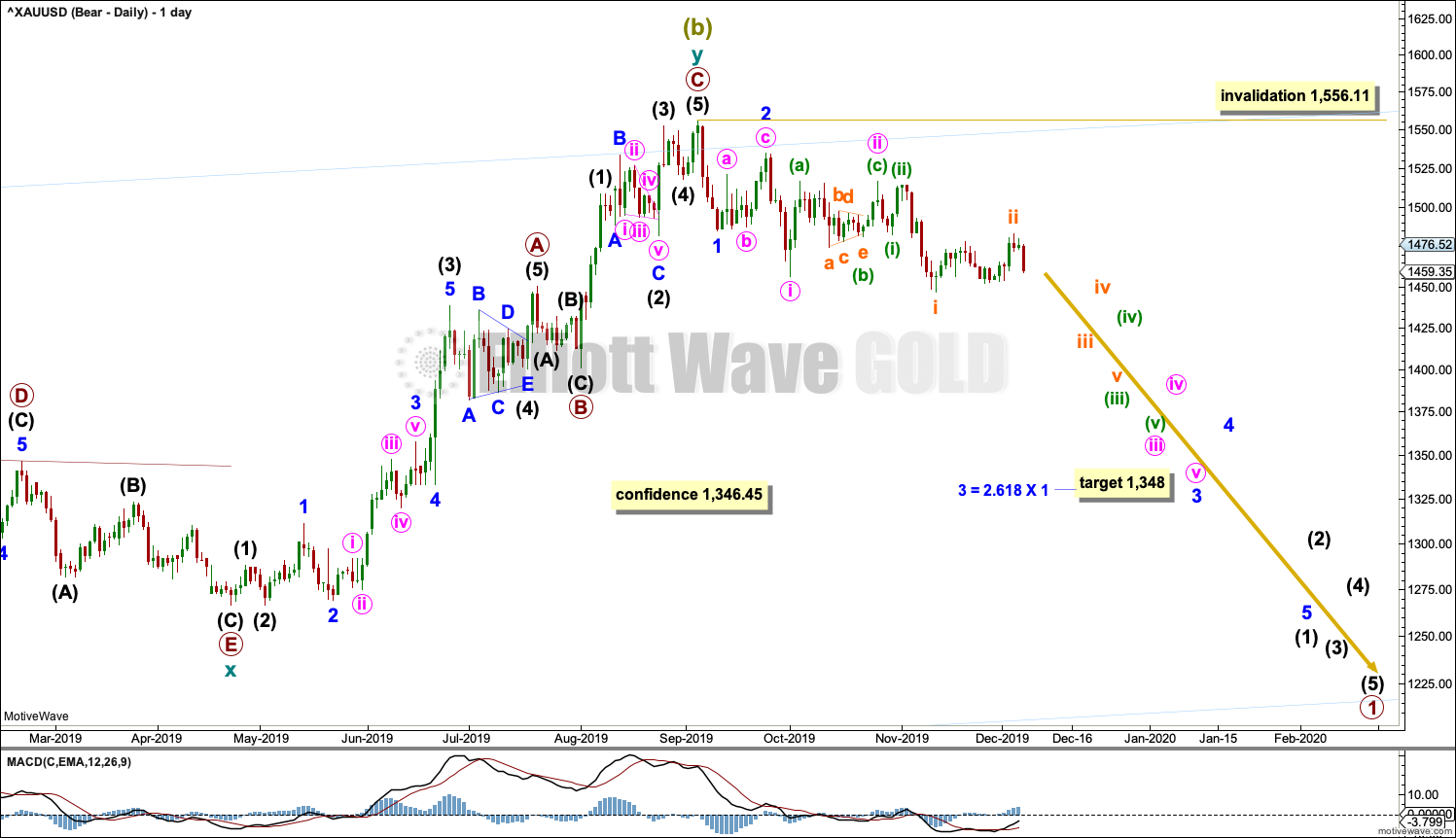

DAILY CHART

Classic analysis now reasonably supports this wave count.

Cycle wave y may be a complete zigzag. Within both of primary waves A and C, there is good proportion between intermediate waves (2) and (4). Within both of primary waves A and C, there is good alternation in structure of intermediate waves (2) and (4).

Within cycle wave y, there is no Fibonacci Ratio between primary waves A and C.

If there has been a trend change at Super Cycle degree, then a five down needs to develop on the daily and weekly charts. So far that is incomplete. It will be labelled intermediate wave (1).

Typically, Gold begins new trends slowly with overlapping first and second waves, and then momentum builds through the middle of the third wave and may explode at the end of third waves. So far this overlapping movement from the last high in September looks typical for this market.

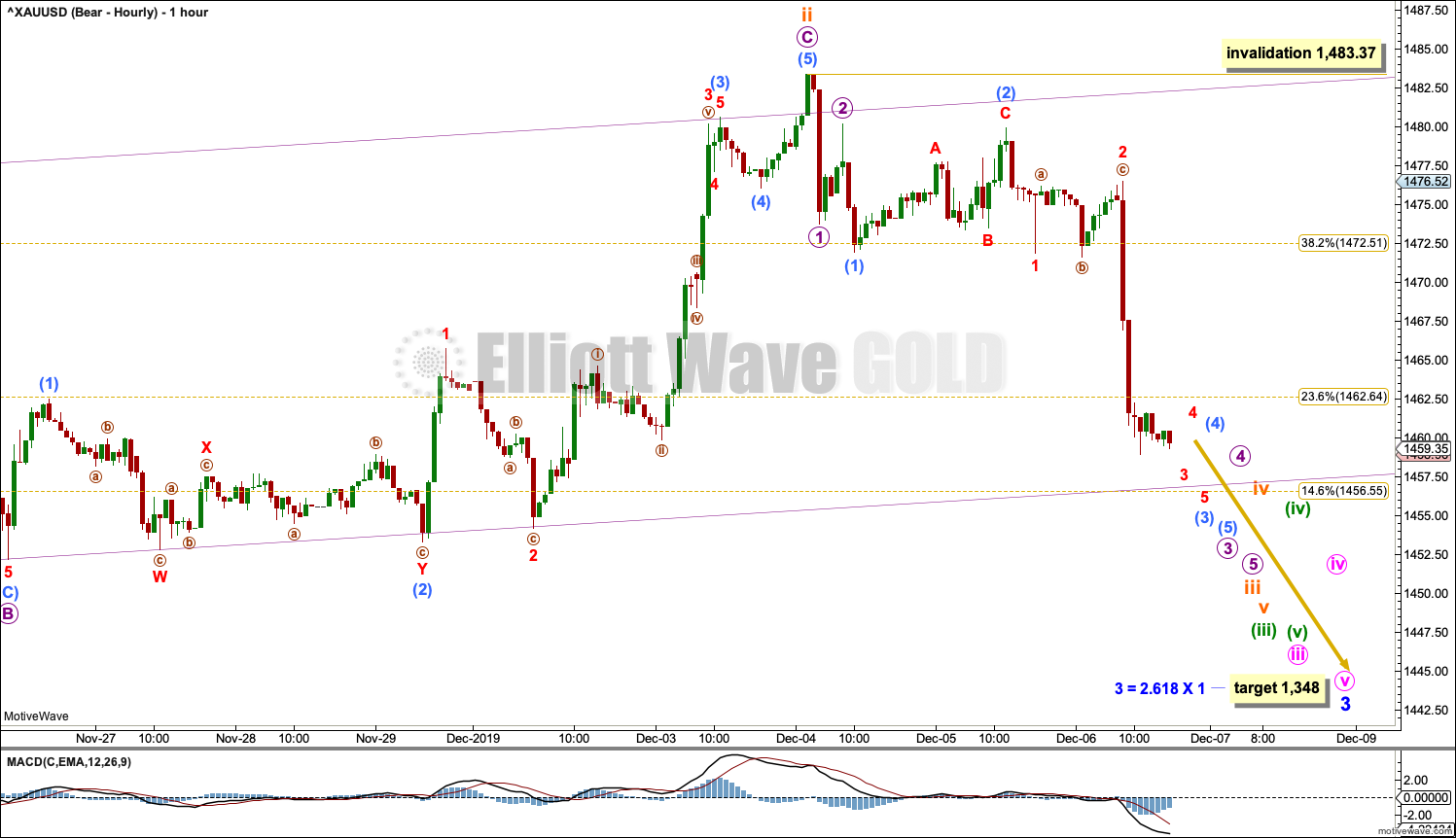

HOURLY CHART

Subminuette wave ii may be a complete zigzag.

There may now be a series of four overlapping first and second waves (at the daily chart level) with a further three overlapping first and second waves visible at the hourly chart level. This suggests a downwards breakout may now come very soon.

Within subminuette wave iii, no second wave correction may move beyond its start above 1,483.37.

ALTERNATE DAILY CHART

It is possible that the double zigzag for Super Cycle wave (b) may be incomplete and may yet require one more high.

Within cycle wave y, primary wave A may have been over at the last high.

Primary wave B may be complete as a single zigzag. Within the zigzag, intermediate wave (C) is just 3.56 short of equality in length with intermediate wave (A). Intermediate wave (B) is a running contracting triangle.

It is possible for this wave count that primary wave B could continue lower as a double zigzag. Primary wave B may not move beyond the start of primary wave A below 1,266.61.

A new low now below 1,446.68 would see primary wave B relabelled as a double zigzag, continuing lower.

Primary wave C would be expected to find strong resistance and end at the upper edge of the blue best fit channel copied over from the weekly chart.

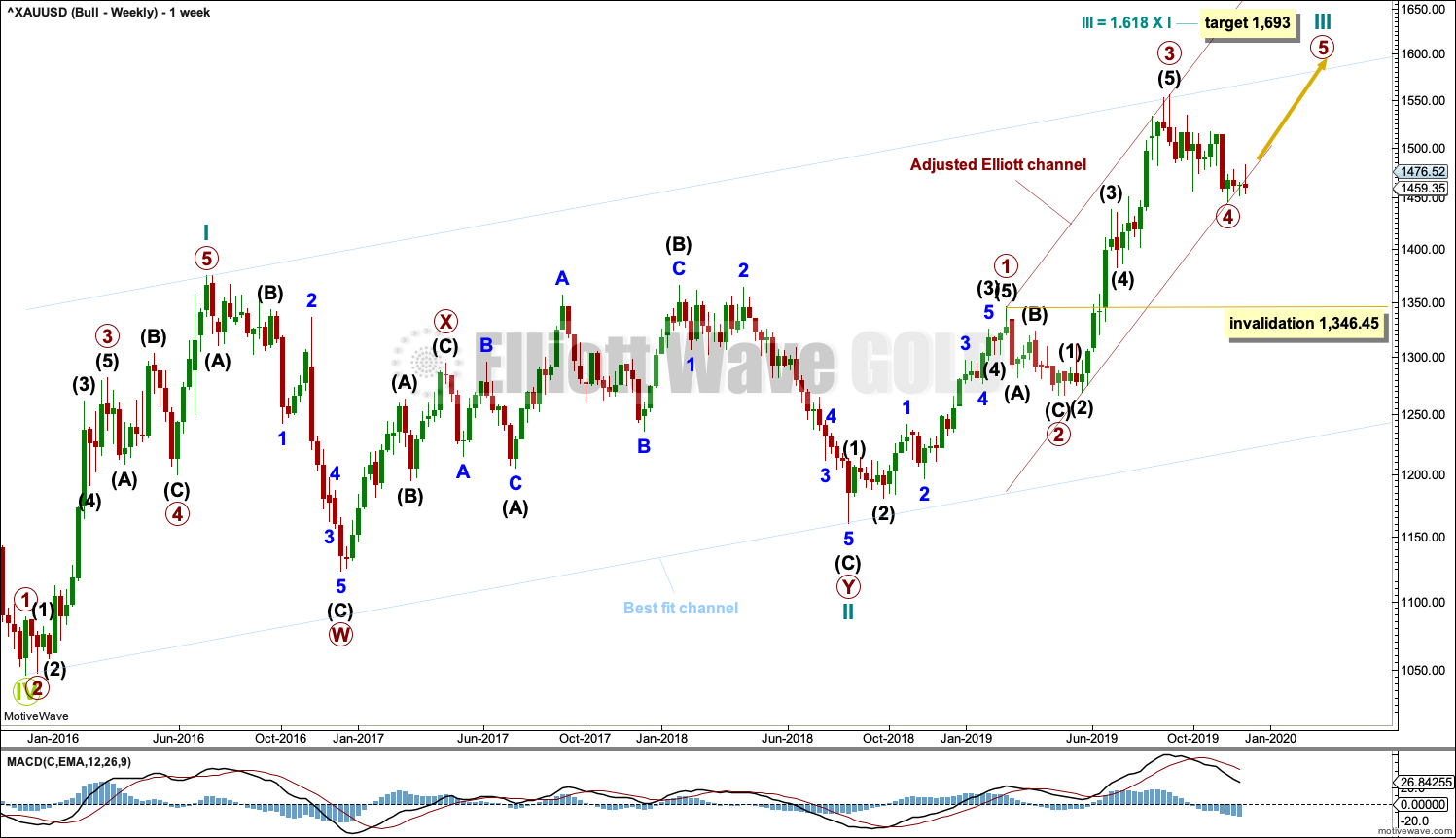

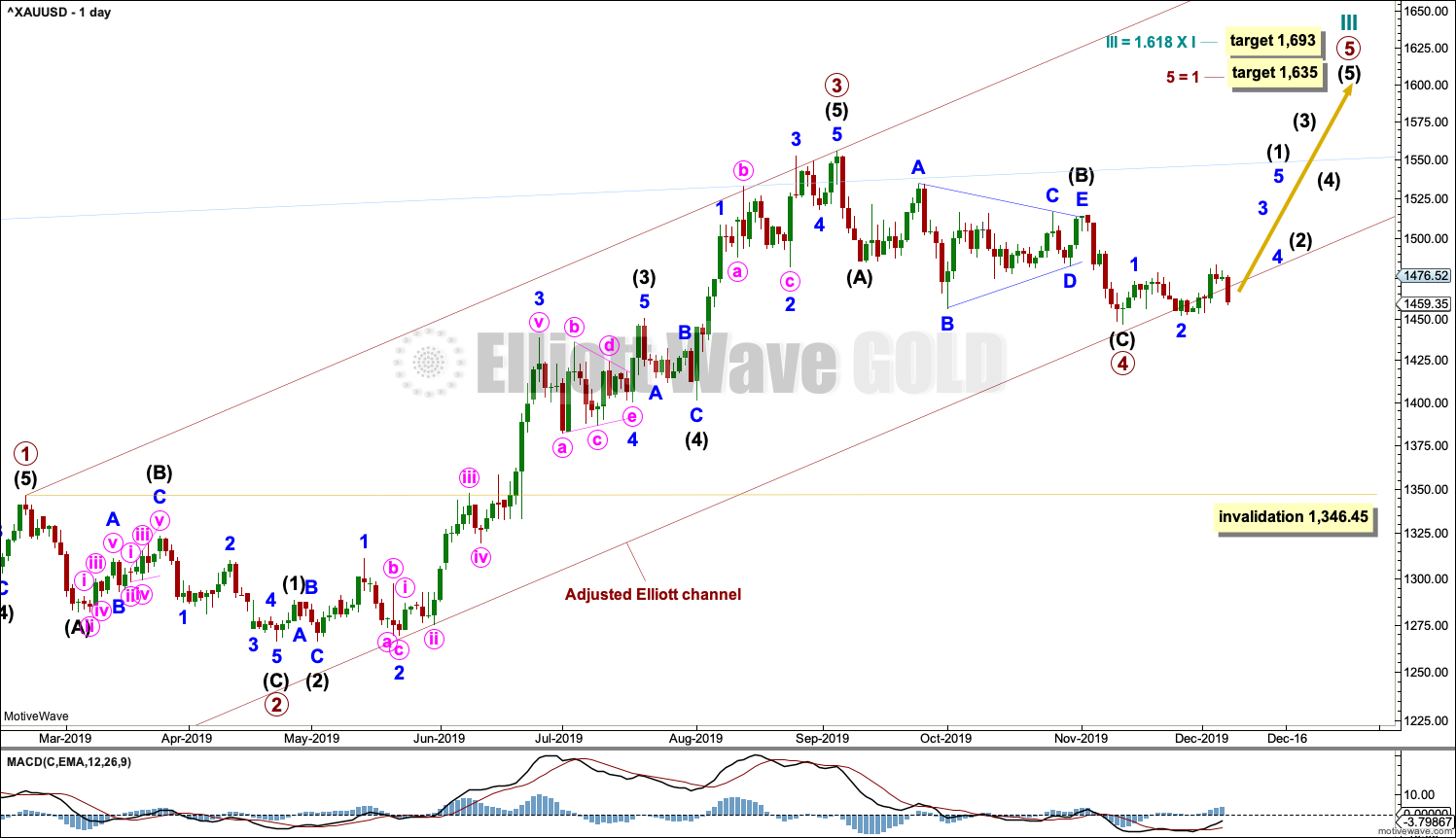

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, which is one reason why the bearish wave count is preferred because it has a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. Primary wave 3 has now moved above the end of primary wave 1 meeting a core Elliott wave rule. It has now moved far enough to allow room for primary wave 4 to unfold and remain above primary wave 1 price territory. Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Cycle wave III so far for this wave count would have been underway now for 68 weeks. It exhibits some support from volume and increasing ATR. This wave count has some support from classic technical analysis.

The channel drawn about cycle wave III is an adjusted Elliott channel. The lower edge is pulled lower.

Add the wide best fit channel to weekly and daily charts.

DAILY CHART

Primary wave 4 may be complete as a single zigzag. Primary wave 4 may have lasted 49 sessions, just six more than primary wave 2, which lasted 43 sessions. The proportion remains very good for this part of the wave count.

A target for cycle wave III is calculated also now at primary degree. If price reaches the first target and keeps rising, then the second higher target may be used.

If it continues any further, then primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

If primary wave 4 is a single zigzag, then there is no alternation in structure with the single zigzag of primary wave 2. There is some alternation within the structures: primary wave 2 as a zigzag has intermediate wave (B) as a zigzag, while intermediate wave (B) within the zigzag of primary wave 4 is a triangle. Primary wave 2 is shallow at 0.43 the length of primary wave 1, and primary wave 4 is close to the same at 0.38 the length of primary wave 3. There is inadequate alternation in depth.

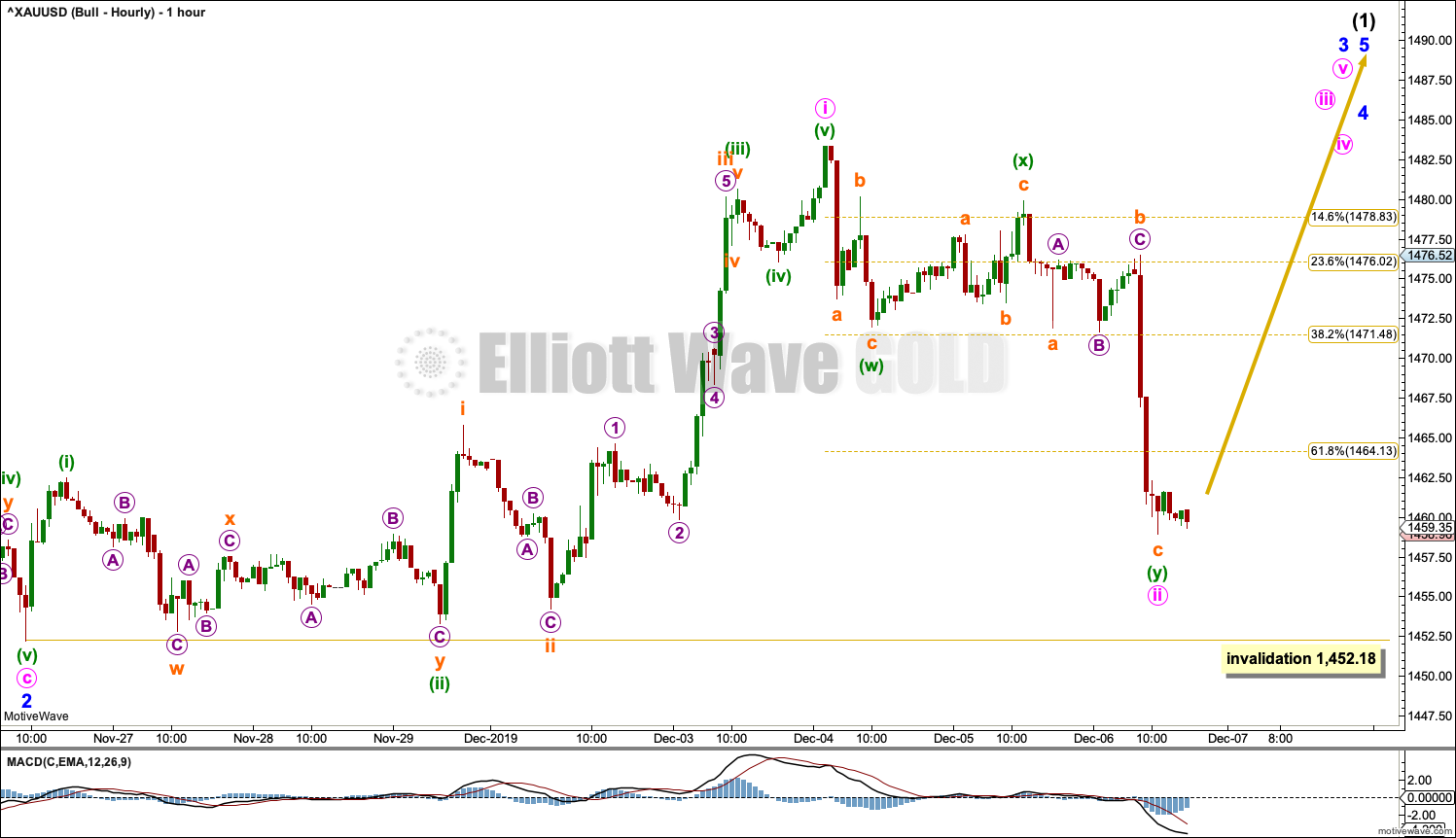

HOURLY CHART

Within primary wave 5, intermediate wave (1) may be an incomplete five wave structure. Within that structure, minor waves 1 and 2 may now be complete.

Minor wave 3 must subdivide as an impulse. Within that impulse, minute waves i and ii may be complete. Minute wave i may have ended at the last high, and minute wave ii may have moved lower on Friday as a double zigzag.

If minute wave ii continues lower, then it may not move beyond the start of minute wave i below 1,452.18.

TECHNICAL ANALYSIS

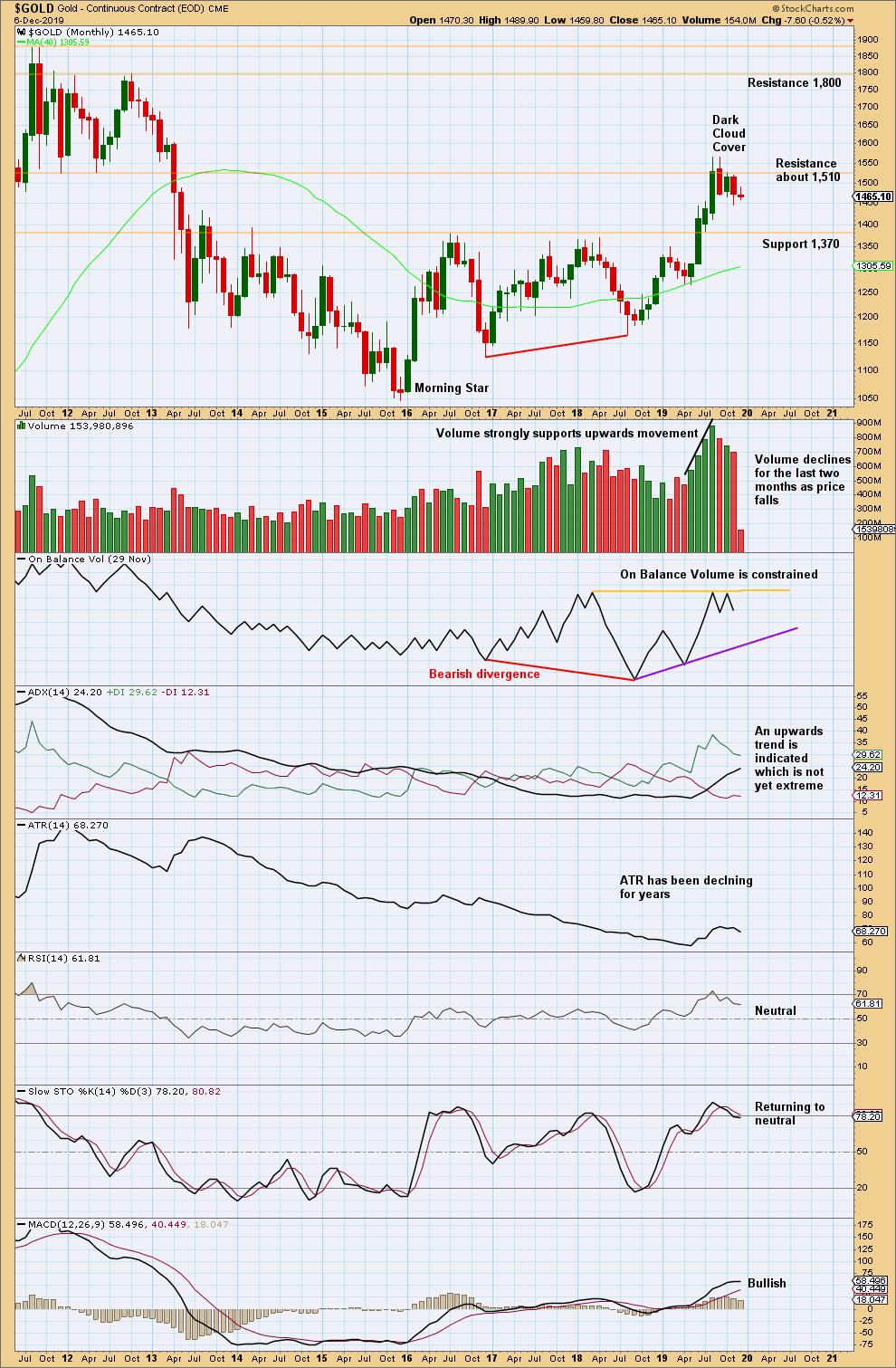

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Overall, this chart is bullish. However, with RSI reaching overbought at the last high, upwards movement may be limited.

The last two months of sideways movement look like a consolidation within an ongoing upwards trend.

Some suspicion regarding the current upwards trend may be warranted by bearish divergence between price and On Balance Volume at the last lows. Also, at the last high price has made a substantial new high above April 2018, but On Balance Volume is flat.

November completes with downwards movement that does not have support from volume. The market has fallen of its own weight.

The all time high for Gold in September 2011 is on the upper left hand side of this chart. Notice upwards movement ended with strong support from volume and early downwards months exhibited volume which was weaker. Strong volume is not required at the beginning of a bearish movement for Gold for it to be sustainable.

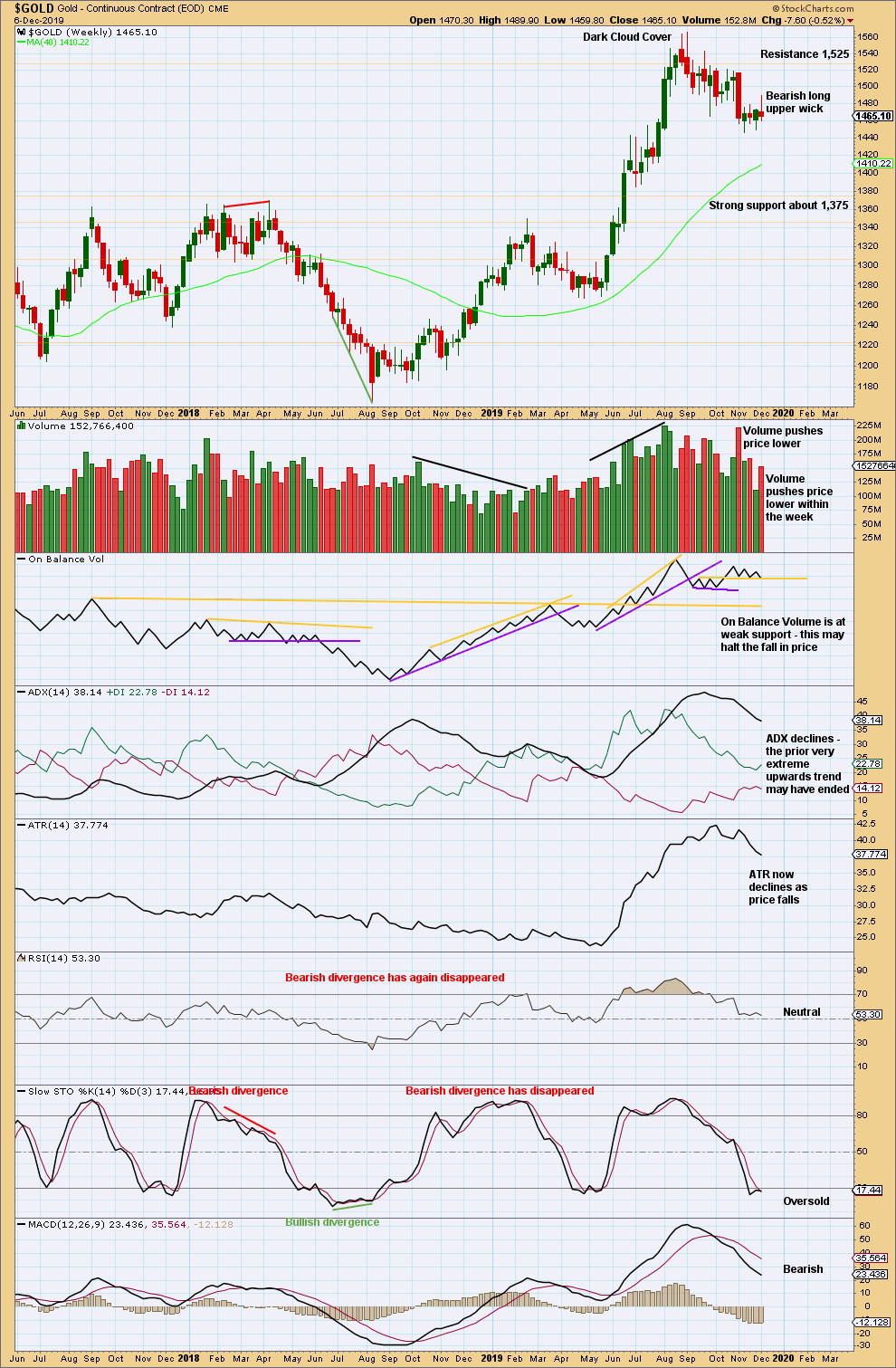

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When trends reach very extreme, candlestick reversal patterns should be given weight. The Dark Cloud Cover bearish reversal pattern is given more bearish weight from the long upper wick.

A very strong downwards week with strong support from volume five weeks ago supports a bearish view.

The bearish long upper wick and push from volume for downwards movement within this last week suggest more downwards movement next week.

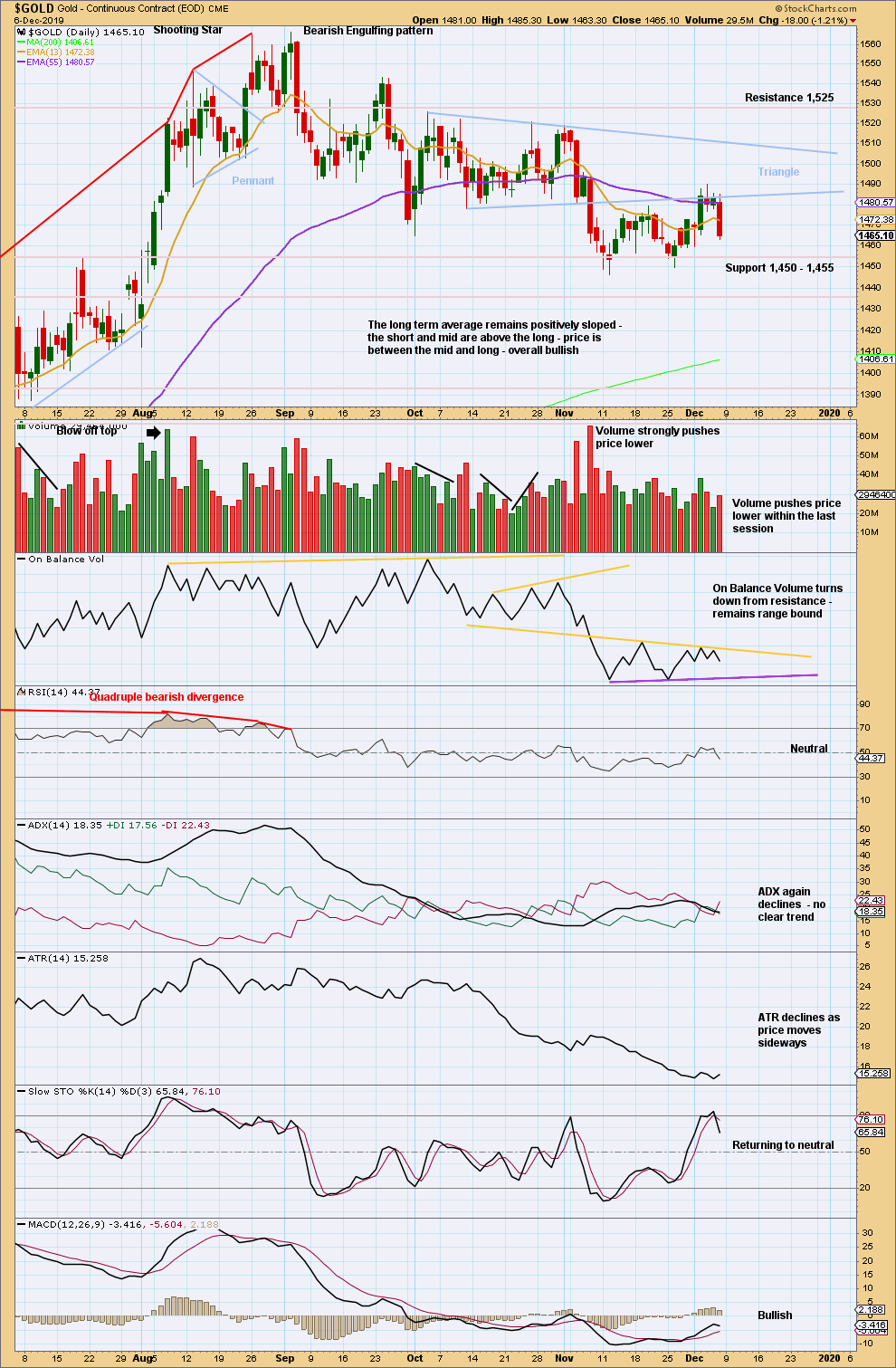

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the last high on the 4th of September, there is now a series of three swing lows and three swing highs.

After a breakout from the triangle, the target is to be about 1,431.

The downwards breakout from the triangle had strong support from volume pushing price lower, so confidence may be had in the breakout. A second back test of resistance at the lower triangle trend line has completed this week; resistance has successfully held there.

At the high this week: price reached resistance, Stochastics reached overbought, and On Balance Volume reached resistance. A turn down from resistance and move by Stochastics back into neutral territory with a strong downwards session on Friday looks like the start of the next downwards wave to a new swing low.

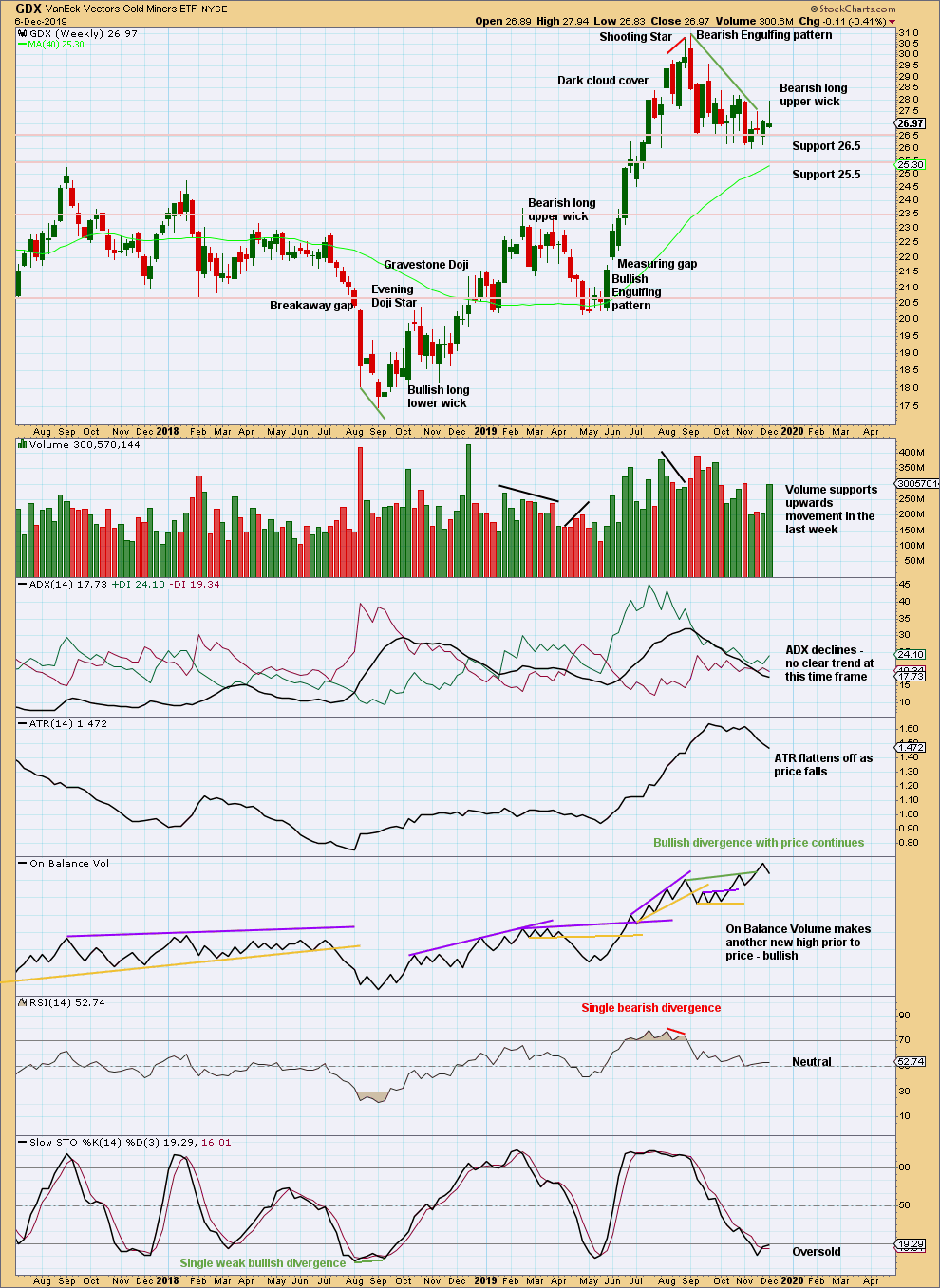

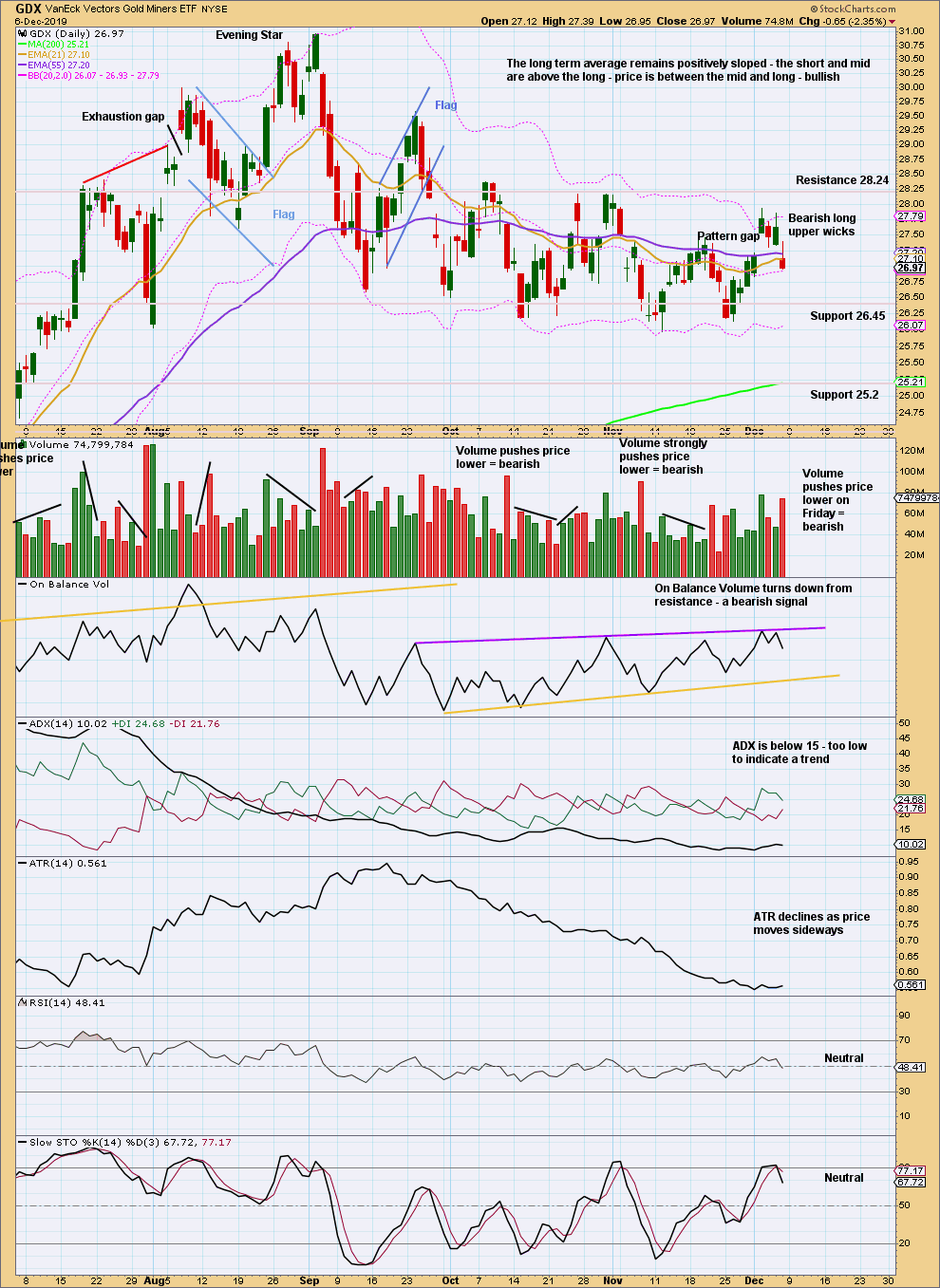

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX, like Gold, often begins a new trend slowly with overlapping and flat or declining ATR. From the last major high at 30.96 a few weeks ago, there has been a strong Bearish Engulfing pattern and strong downwards weeks with greater range and volume than upwards weeks. GDX may have had a trend change. However, bullish divergence between price and On Balance Volume is strong and persistent; it contradicts the view of a trend change.

For the short term, the long upper wick this week suggests more downwards movement next week.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has made a new swing low. There is now a series of four lower swing highs and four lower swing lows and four lower swing highs from the high on the 4th of September. It still looks like GDX may have had a trend change. This view should remain dominant while the last swing high at 28.18 on the 31st of October remains intact.

Closure of the last gap, On Balance Volume turning down from resistance, Stochastics moving back into neutral territory after reaching overbought, bearish long upper wicks, and push from volume all suggest more downwards movement to a new swing low next week.

Published @ 09:18 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated