by Lara | Apr 22, 2021 | Dogecoin

BTCUSD, XMRUSD, ETHUSD, XRPUSD: Elliott Wave and Technical Analysis | Video – April 22, 2021 Updated Elliott wave charts with technical charts fully notated will be published in comments below. Please enable JavaScript to view the comments powered by...

by Lara | Apr 16, 2021 | Dogecoin

Dogecoin: Elliott Wave and Technical Analysis | Video – April 16, 2021 Updated Elliott wave charts with technical charts fully notated will be published in comments below. Please enable JavaScript to view the comments powered by...

by Lara | Apr 15, 2021 | Bitcoin

Bitcoin: Elliott Wave and Technical Analysis | Video – April 15, 2021 Technical analysis charts and a brief comment will be published in comments below. Please enable JavaScript to view the comments powered by...

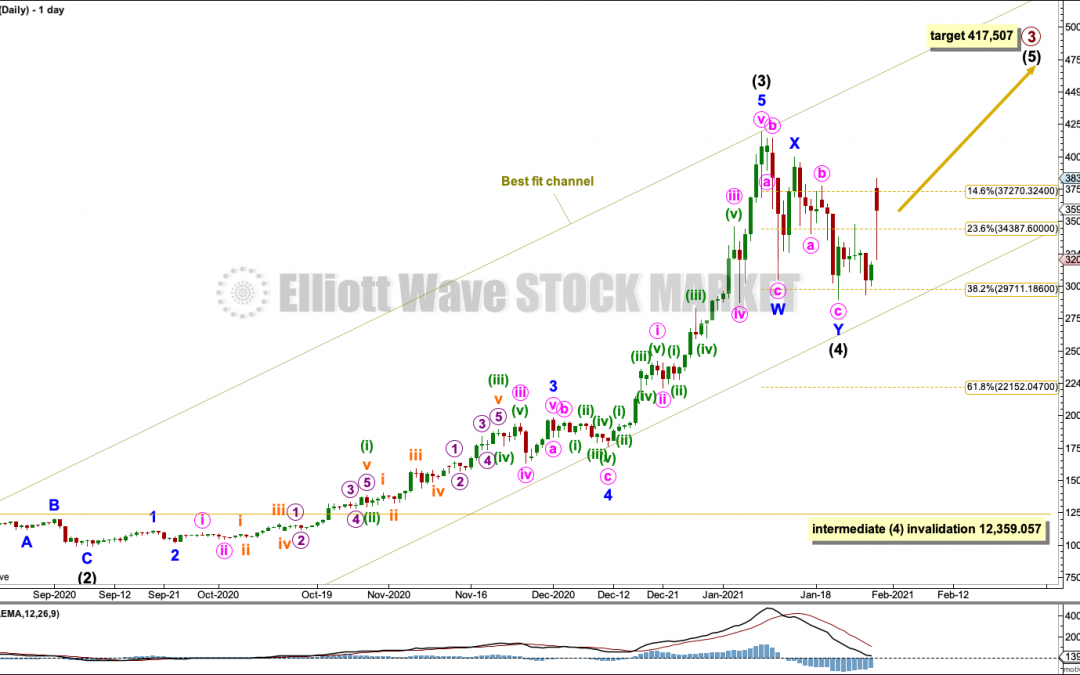

by Lara | Jan 29, 2021 | Bitcoin, Public Analysis

BTCUSD: Elliott Wave and Technical Analysis | Charts – January 29, 2021 Last Bitcoin analysis, on 18th January, expected a pullback to continue and end within a target zone from 29,711 to 28,269. The pullback did continue and reached 28,953.37, right in the...

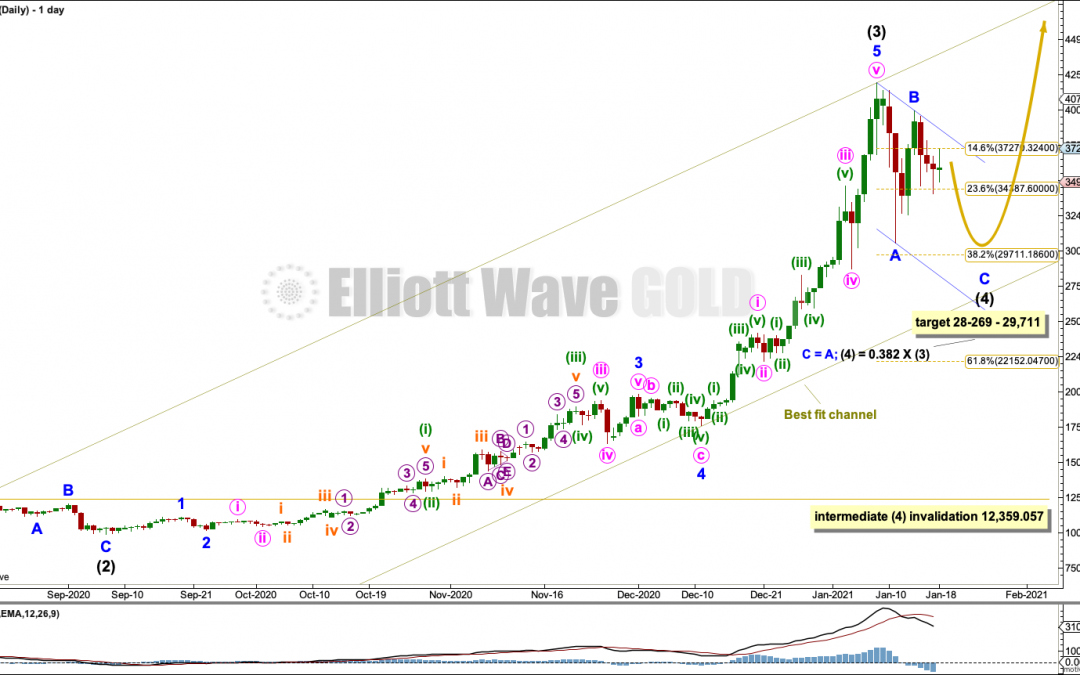

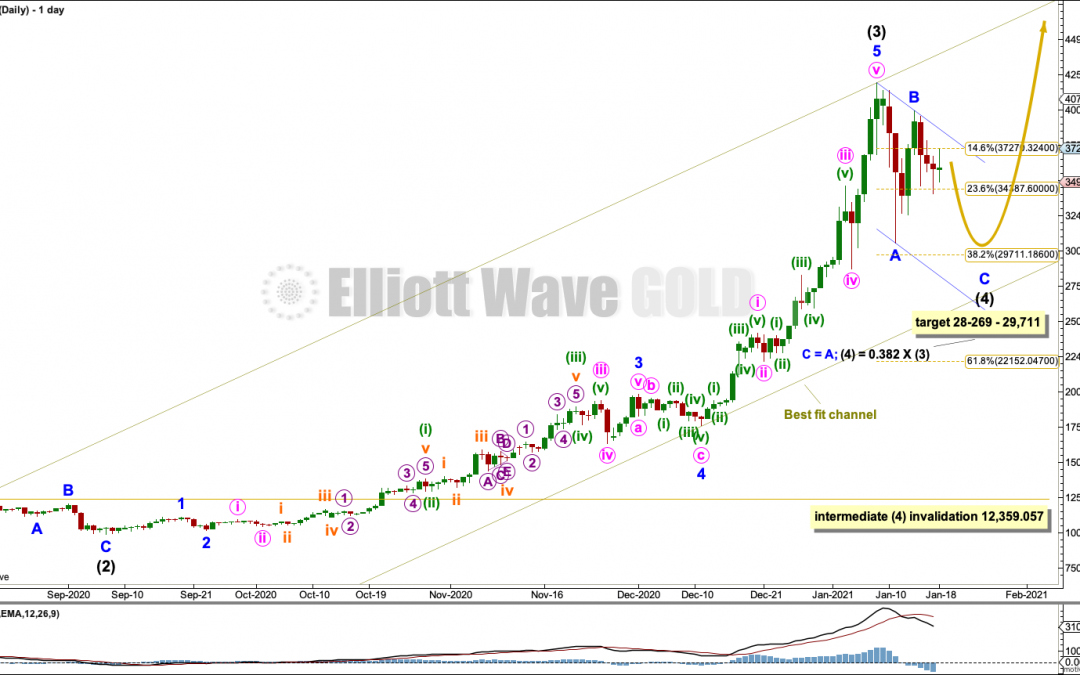

by Lara | Jan 18, 2021 | Bitcoin, Public Analysis

BTCUSD: Elliott Wave and Technical Analysis | Charts – January 18, 2021 The main Elliott wave count in last analysis, on December 17, 2020, expected more upwards movement to a provisional target at 44,872. Bitcoin reached 41,964.96 on January 8, 2021, which was...

by Lara | Jan 18, 2021 | Bitcoin, Public Analysis

BTCUSD: Identifying Bitcoin Highs and Lows | Charts – January 18, 2021 This article analyses technical indicators at highs and lows for Bitcoin. TECHNICAL ANALYSIS WEEKLY Click chart to enlarge. The following characteristics can be noted at the end of prior major...

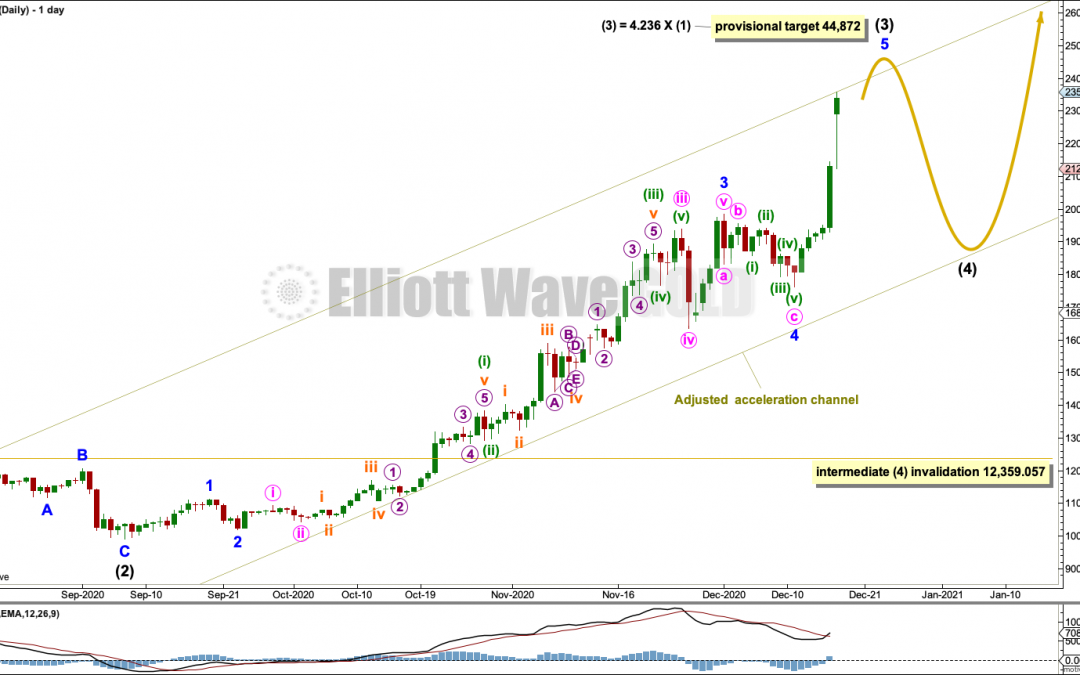

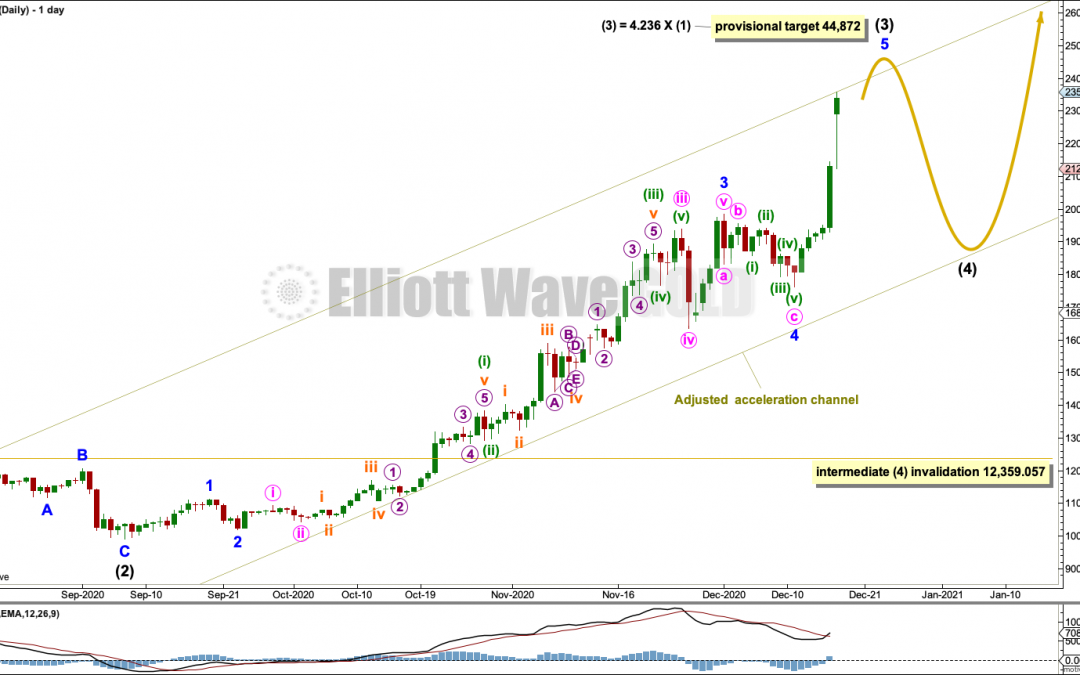

by Lara | Dec 17, 2020 | Bitcoin, Public Analysis

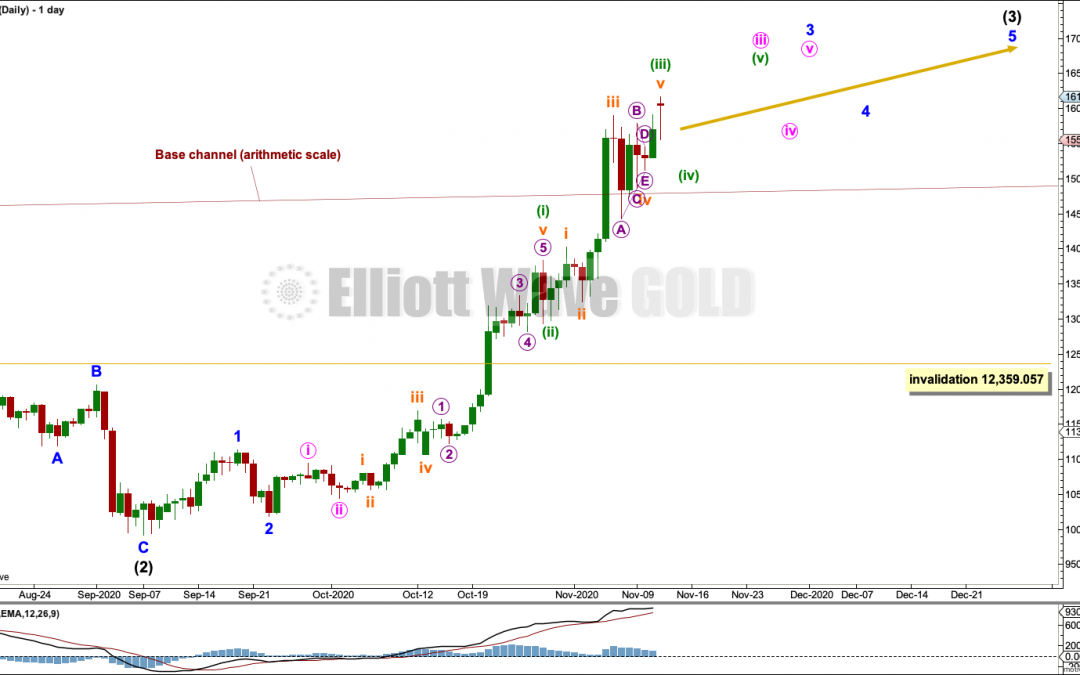

BTCUSD: Elliott Wave and Technical Analysis | Charts – December 17, 2020 The main Elliott wave count in last analysis, on 12th November, expected more upwards movement and a further increase in strength. This is exactly what is happening. Today’s analysis...

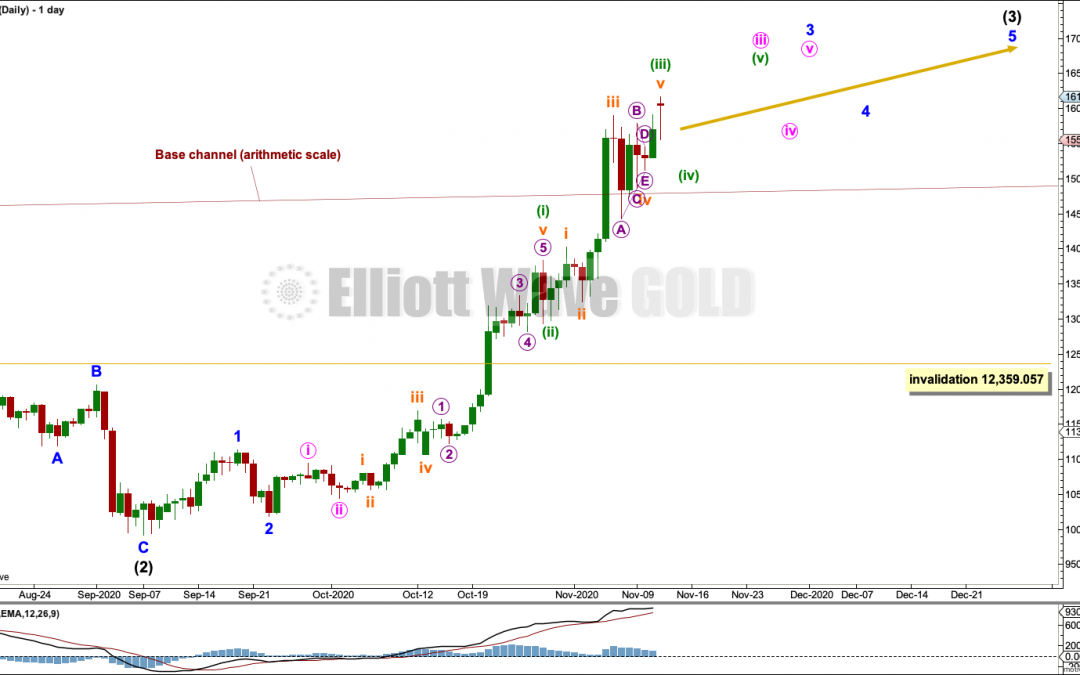

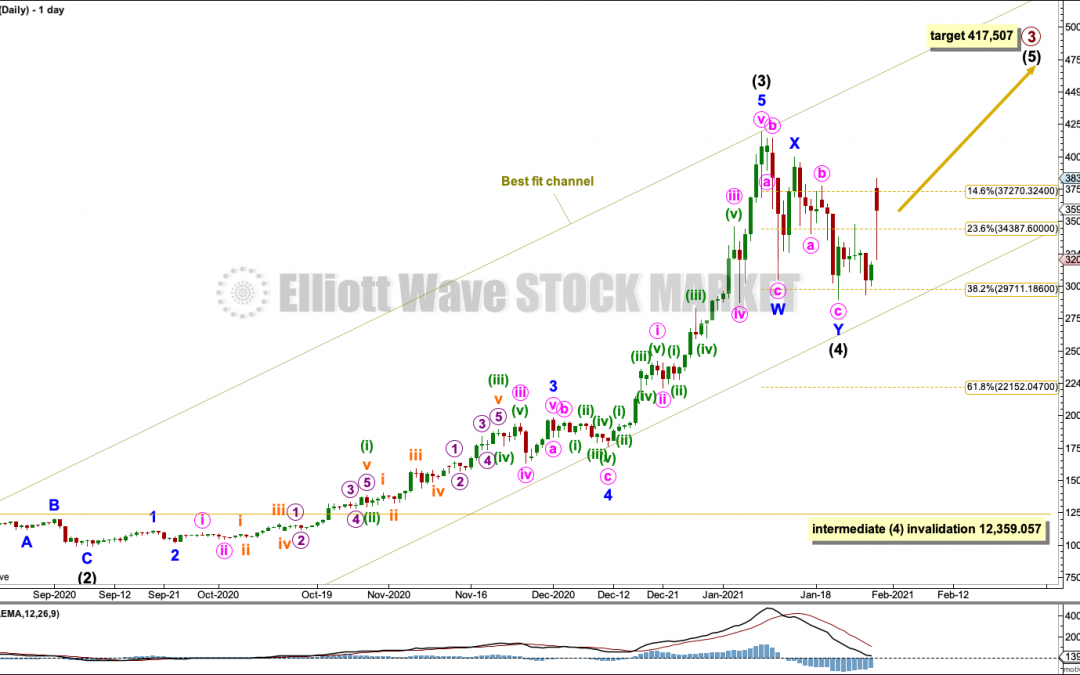

by Lara | Nov 12, 2020 | Bitcoin, Public Analysis

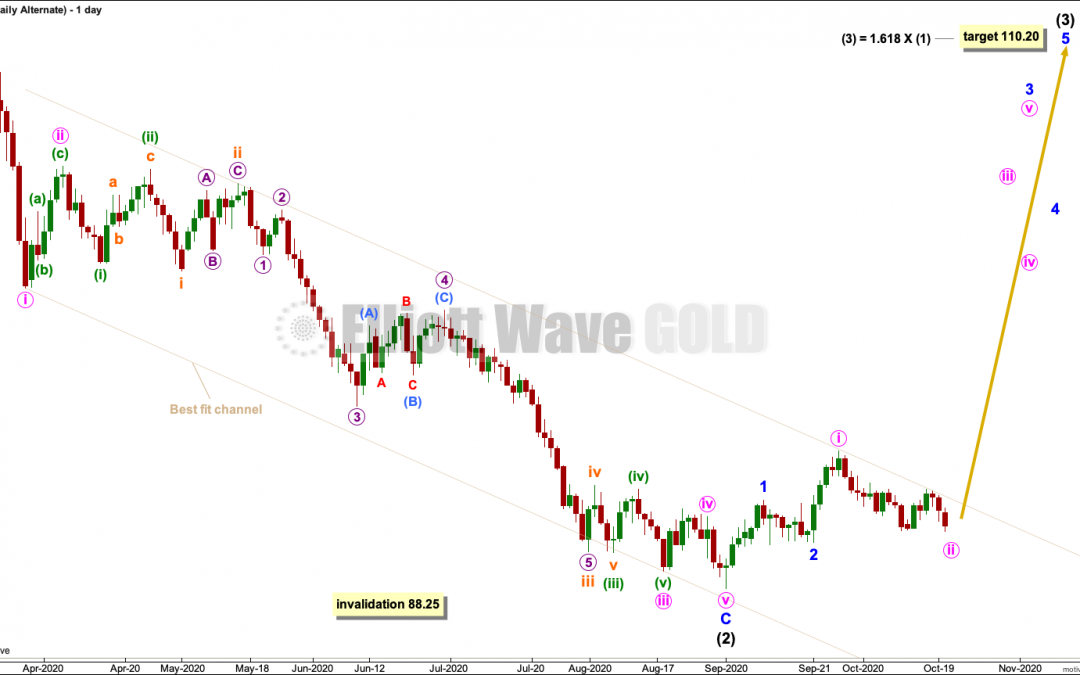

BTCUSD: Elliott Wave and Technical Analysis | Charts – November 12, 2020 In last analysis on October 13th, the main Elliott wave count expected a pullback to continue. This was discarded above 12,359.057 in favour of a bullish alternate wave count, which...

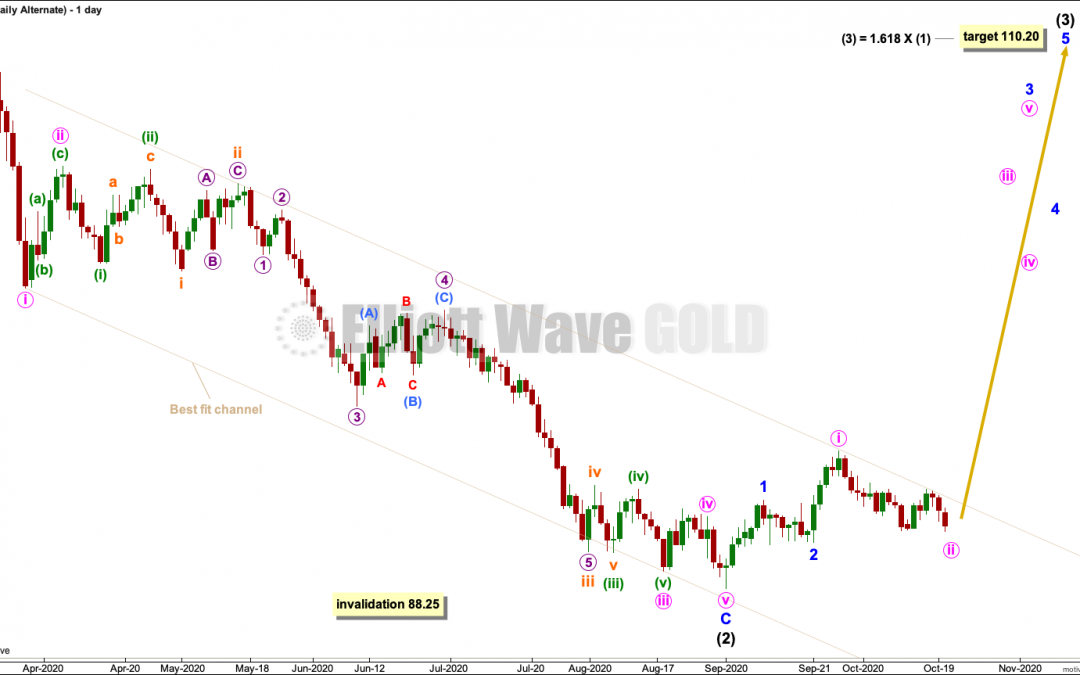

by Lara | Oct 20, 2020 | Public Analysis, USD Index

USD Index: Elliott Wave and Technical Analysis | Charts – October 20, 2020 Both a bull and bear wave counts at the quarterly chart level may remain valid. Summary: The bearish Elliott wave count expects a downwards trend has begun. The long-term target is...