Last analysis of Silver was invalidated with downwards movement below 19.595. Members of Elliott Wave Gold were aware of a new alternate for Gold, which also works for Silver. But I did not have time to update the Silver wave count.

Downwards movement is incomplete.

Click on the charts below to enlarge.

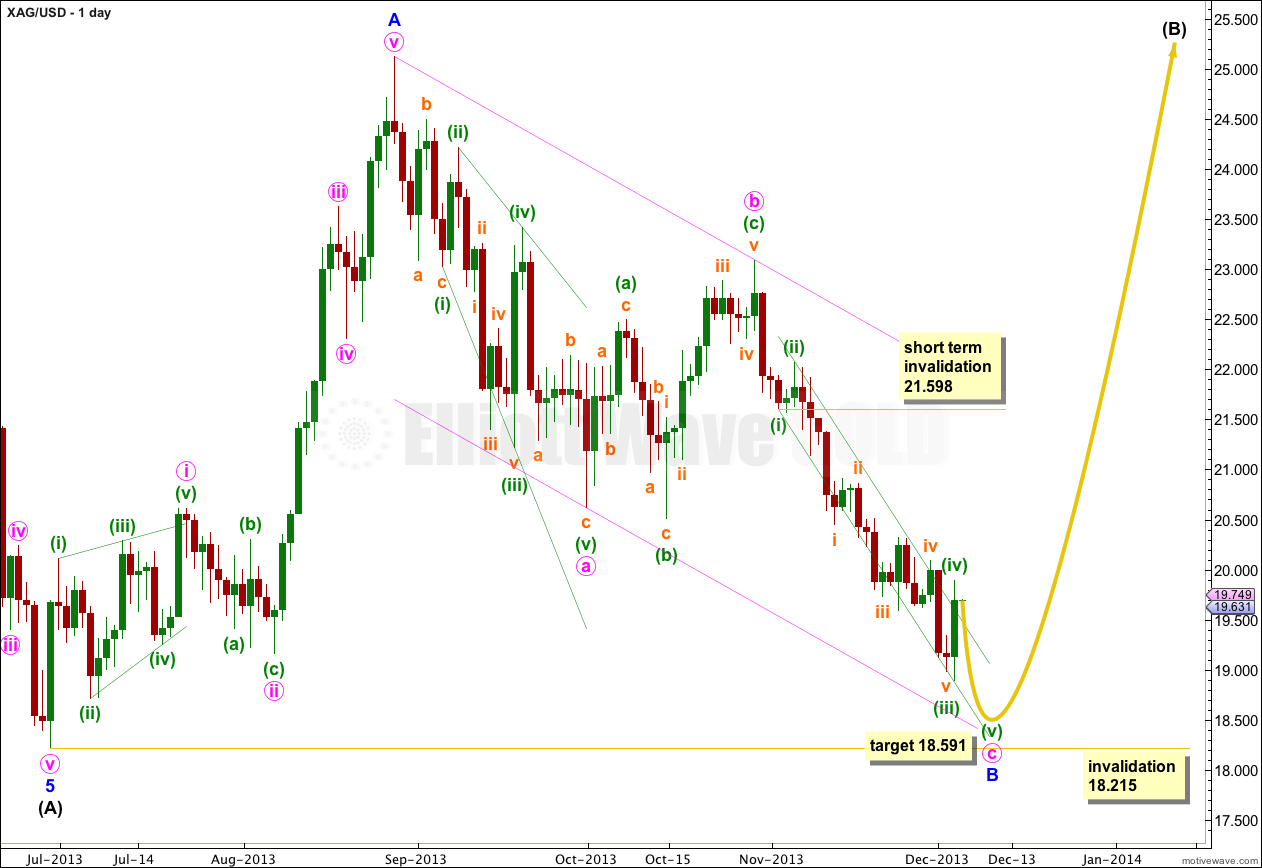

Minor wave B is an almost complete zigzag, which is within a bigger zigzag trending upwards one degree higher for intermediate wave (B). Because within intermediate wave (B) minor wave A subdivides as a five wave structure, minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 18.215.

Within minor wave B minute wave a subdivides nicely as a leading expanding diagonal. Within the leading diagonal all the subwaves are zigzags except the third wave which is an impulse. For this piece of movement this structure has the best fit.

Minute wave b is labeled as an expanded flat correction. Within it minuette waves (a) and (b) both subdivide as three wave zigzags, and minuette wave (b) is a 106% correction of minuette wave (a). There is no Fibonacci ratio between minuette waves (a) and (c).

Minute wave c is an incomplete impulse. At 18.591 minute wave c would reach equality in length with minute wave a.

The narrow channel drawn about minute wave c is drawn using Elliott’s first technique. Draw the first trend line from the ends of minuette waves (i) to (iii), then place a parallel copy upon the end of minuette wave (ii). Minuette wave (iv) has breached this channel; sometimes fourth waves do this. When they do we redraw the channel using Elliott’s second technique when they are over. I would not expect to see too much more of a breach.

I would expect minuette wave (iv) to end within the price territory of the fourth wave of one lesser degree; subminuette wave iv price territory is from 19.595 to 20.323.

When minuette wave (iv) is over then one final downwards wave for minuette wave (v) would be required to complete the entire structure for minor wave B.

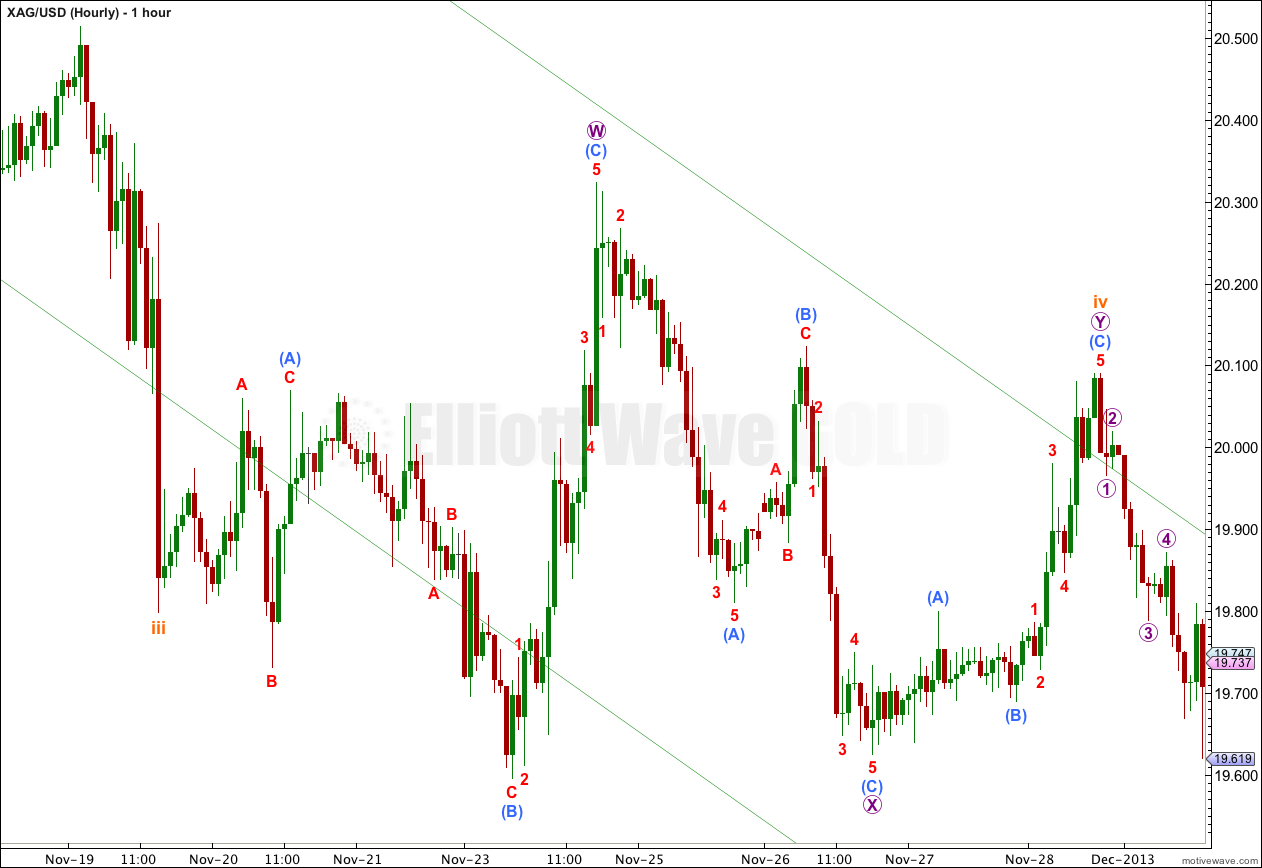

For this wave count to be correct it is important to check the subdivisions of subminuette wave iv. This portion of the hourly chart shows this correction.

Subminuette wave iv subdivides as a double combination: expanded flat – X – zigzag. It cannot be over at the high labeled micro wave W at 20.323 because the following downwards movement labeled micro wave X subdivides very clearly as a three wave structure, and so could not be a fifth wave because fifth waves must subdivide as fives.

This is the key to the current wave count, and the reason why I expect downwards movement is incomplete.

Within the correction for minuette wave (iv) the structure is an incomplete expanded flat.

Subminuette wave a subdivides as a three. Subminuette wave b also subdivides as a three, a double combination. Subminuette wave b is a 200% correction of subminuette wave a. This is much longer than the maximum common length of a B wave within a flat, but no rules are broken and the subdivisions fit perfectly. The common length of 100% to 138% is a guideline of what is most likely; it is not a rule of the maximum allowable length.

Within a flat a general guideline would be the deeper the B wave, the longer the C wave. This C wave is very long indeed which fits the overall behaviour of flat corrections.

At 20.184 micro wave 5 within subminuette wave c would reach equality in length with micro wave 1. This would bring minuette wave (iv) close to the 0.382 Fibonacci ratio of minuette wave (iii) at 20.247.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 21.598.

Lara are you looking for one more down with silver just like gold? Still targeting 18.59 or around that ?

Yes, I am. Because this downwards movement is an impulse and the wave count is incomplete; it requires one final fifth wave down.

The fifth wave doesn’t have to make a new low, it could be truncated. But it’s most likely to make a new low.

It doesn’t have a lot of space to move in!