I had expected one more green candlestick for Wednesday’s session to end about 1,179 – 1,182. This is not what happened. Downwards movement has clarified the structure for minor wave 2 a little further.

Summary: This correction is still not over most likely. I expect downwards movement to about 1,137, followed by one last upwards wave to 1,179 – 1,183. If this target is met in three more days minor wave 2 may last a Fibonacci eight days.

Click on charts to enlarge.

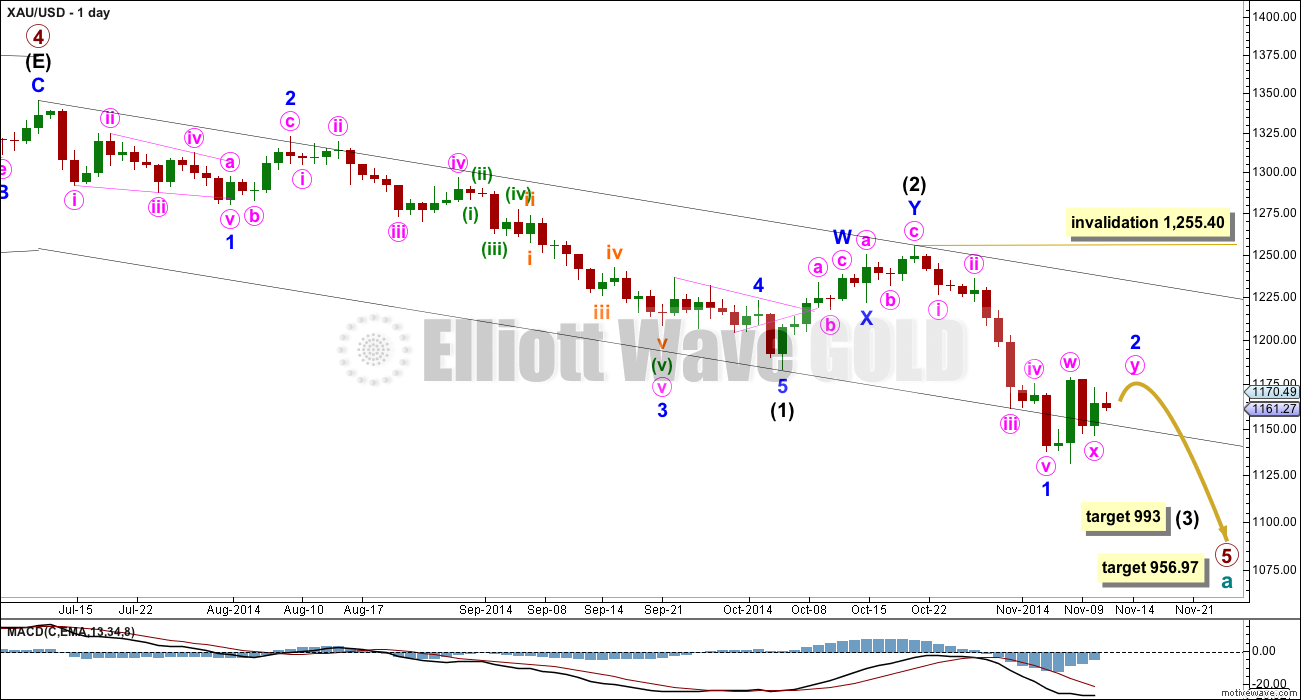

Main Wave Count

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. Intermediate wave (2) is a relatively shallow 45% double zigzag correction.

Intermediate wave (1) lasted a Fibonacci 13 weeks. I would expect intermediate wave (3) to be extended in both price and duration. If it lasts a Fibonacci 21 weeks it would be 1.618 the duration of intermediate wave (1). So far intermediate wave (3) is in its third week.

Intermediate wave (3) may only subdivide as an impulse, and at 993 it would reach 1.618 the length of intermediate wave (1).

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (3) must move far enough below the end of intermediate wave (1) to allow room for upwards movement for intermediate wave (4) which may not move into intermediate wave (1) price territory.

Minor wave 2 may not move beyond the start of minor wave 1 above 1,255.40.

Because this is a second wave correction within a third wave one degree higher it may be more quick and shallow than second waves normally are. At this stage I expect minor wave 2 to only reach up to about the 0.382 Fibonacci ratio at 1,182.75.

If minor wave 2 exhibits a Fibonacci duration it may end in another three days to total a Fibonacci eight.

The black channel is a base channel about intermediate waves (1) and (2): draw the first trend line from the start of intermediate wave (1) to the end of intermediate wave (2), then place a parallel copy on the end of intermediate wave (1). Intermediate wave (3) has breached the lower edge of the base channel which is expected.

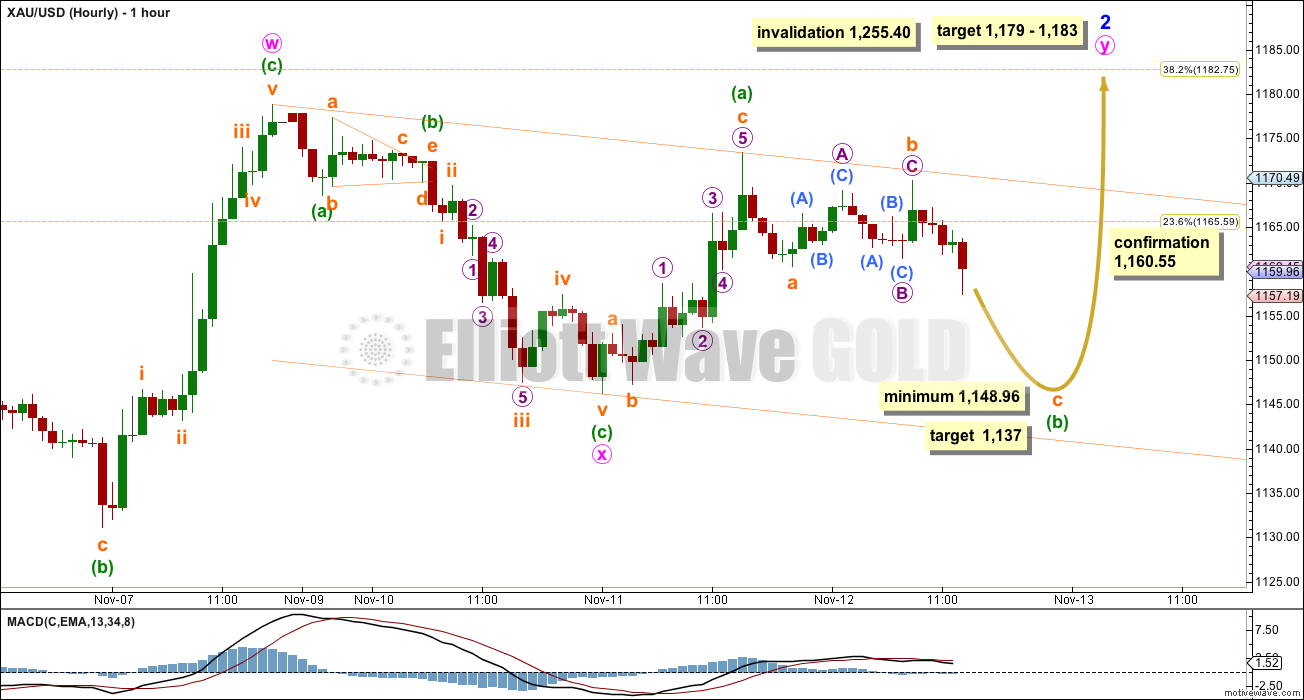

Main Hourly Wave Count

Minor wave 2 must be a double flat correction. The upwards movement for minuette wave (a) within the second structure of this double does not subdivide at all as a five, but it can be seen as a three. This indicates that minute wave y may not be a zigzag. Minute wave y may most likely be either a flat correction or less likely possibly a triangle.

If minute wave y is a flat correction then within it minuette wave (b) must reach a minimum 90% length of minuette wave (a) at 1,148.96.

If this minimum is not met and price moves sideways then minute wave y may be a triangle, and minor wave 2 a double combination. For both a double flat and double combination (with a triangle as the second structure in the double) minor wave 2 should last about another three days.

Within minute wave y at 1,137 subminuette wave c would reach 2.618 the length of subminuette wave a.

I have drawn a best fit orange channel about current movement. Subminuette wave c may find support and may end about the lower orange trend line.

When minuette wave (b) is a complete zigzag then minuette wave (c) should move price higher for one or two days. It would be extremely likely to move at least above the end of minuette wave (a) at 1,173.39 to avoid a truncation. It may end close to the end of minute wave w at 1,179, just below the 0.382 Fibonacci ratio of minor wave 1 at 1,183.

When I know how low minuette wave (b) has moved then I will know what type of flat correction may be unfolding, and so what ratio to apply to the calculation for the target for minuette wave (c). I should be able to do this for you tomorrow, but I do not expect the final target to change much if at all.

When minuette wave (b) downwards has reached the minimum at 1,148.96 and may be seen as a clear three wave structure, then a subsequent trend change and movement above 1,160.55 would invalidate the alternate and confirm this main hourly wave count.

There is no lower invalidation point for this wave count. The most likely length for minuette wave (b) is between 100% to 138% the length of minuette wave (a), between 1,146 to 1,136.

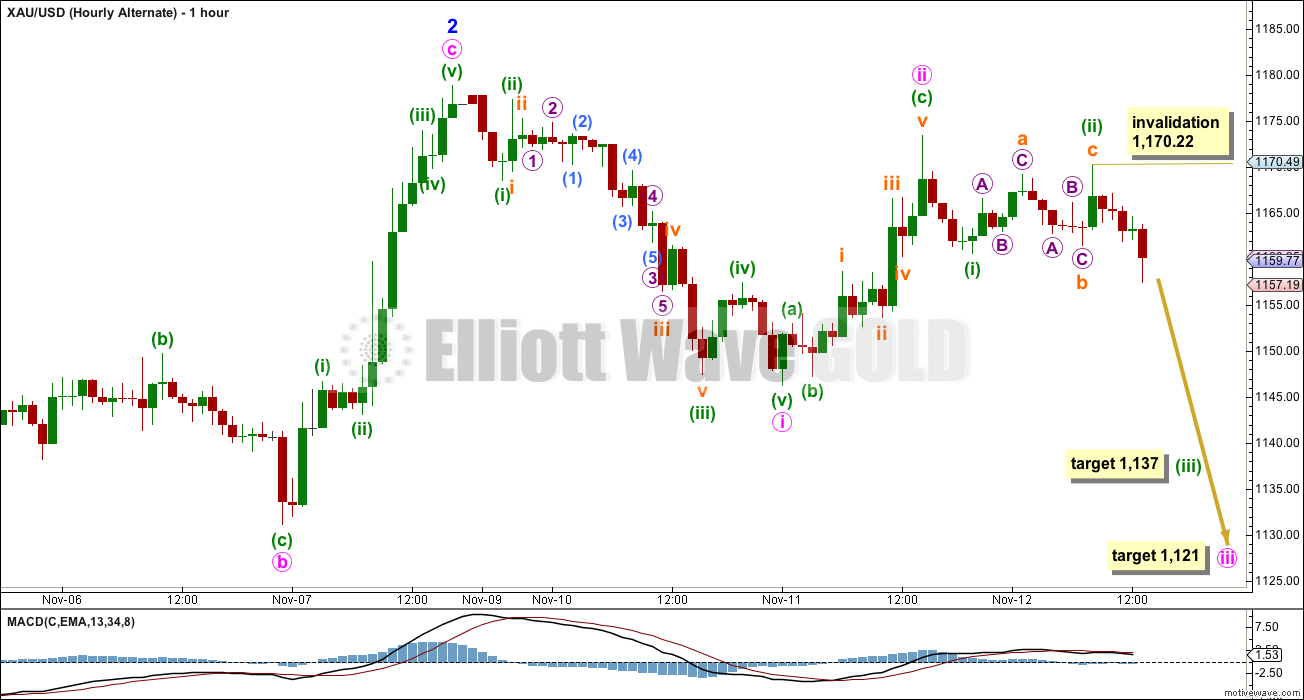

Alternate Hourly Wave Count

This second alternate wave count has a greatly reduced probability today. If the middle of a big third wave has begun then I would not expect to see such a deep time consuming correction for minute wave ii. I expect this alternate wave count to be invalidated within the next 24 hours. Minute wave ii may not move beyond the start of minute wave i above 1,178.83.

If this wave count is correct (and it is technically possible so it must be considered) then a very strong downwards movement is imminent. Sometimes this is how the middle of third waves begin, but I would have expected by this stage to have seen a stronger downwards pull.

Minute wave iii must subdivide as an impulse. Only careful attention to structure (and momentum as a guide) will tell if the main or alternate hourly wave count is correct.

At 1,137 minuette wave (iii) would reach 2.618 the length of minuette wave (a).

At 1,121 minute wave iii would reach 1.618 the length of minute wave i.

Within minuette wave (iii) no second wave correction may move beyond its start above 1,170.22.

When minuette wave (iii) is complete then this alternate wave count diverges from the main wave count. For this alternate at that stage it would expect a small upwards correction for minuette wave (iv) which may not move back into minuette wave (i) price territory above 1,160.55. At that stage movement above 1,160.55 would invalidate this alternate and confirm the main wave count.

I would judge this alternate to still have a less than 5% probability.

This analysis is published about 02:31 p.m. EST.

Yep.

Looks to be unfolding as a triangle?