The third wave is over, and it did not reach the target. The fourth wave is either over or halfway through.

Click charts to enlarge.

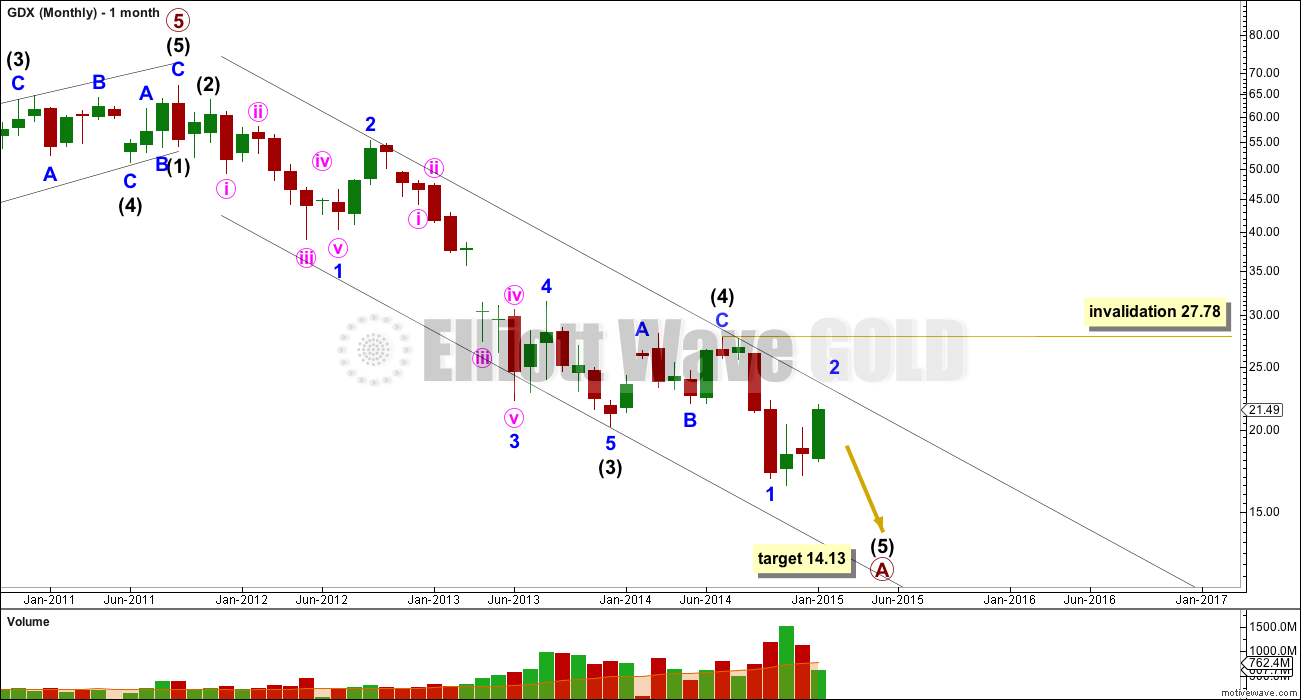

I see an incomplete five wave structure downwards. The final fifth wave for intermediate wave (5) is unfolding. At 14.13 intermediate wave (5) would reach equality in length with intermediate wave (1).

I have changed this monthly chart to a semi log scale to try and get the channel right. This channel is a best fit and may show where minor wave 2 upwards finds resistance. This indicates that the target for minor wave 2 to end may be too high.

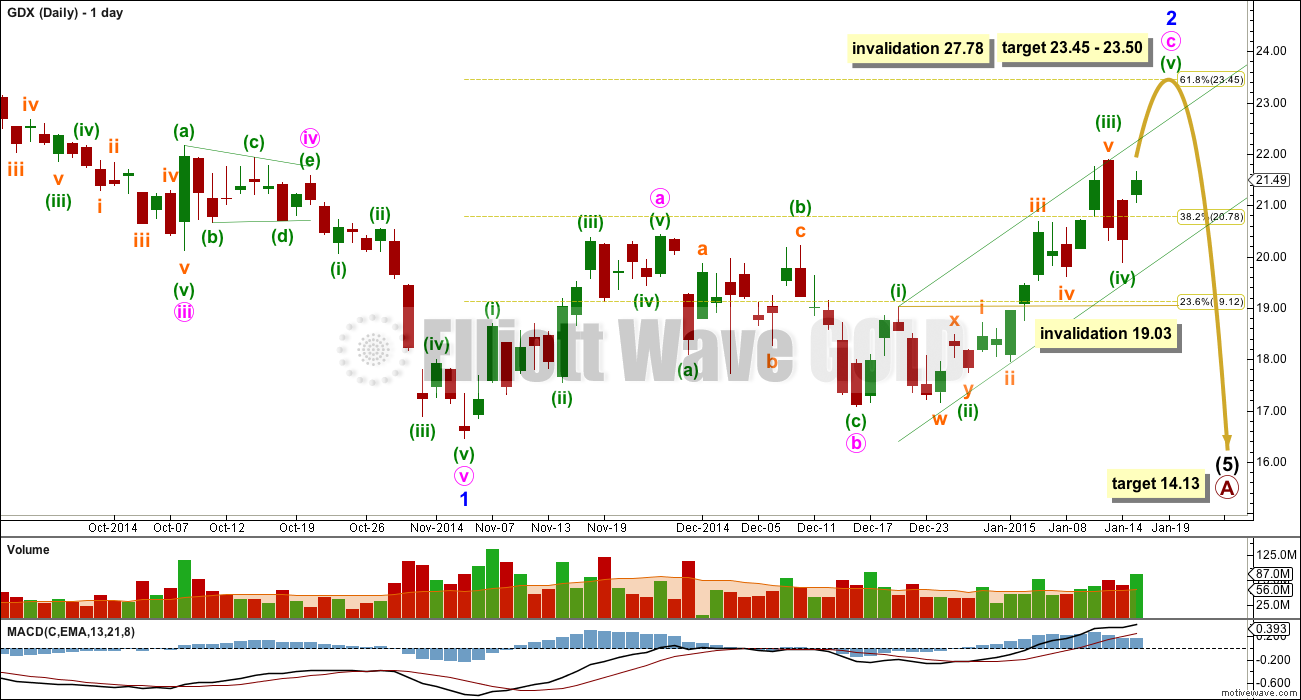

Minuette wave (iii) is over and minuette wave (iv) is either over also, or halfway through.

Minuette wave (ii) was a deep 65% correction, so I would expect minuette wave (iv) to be shallow. So far it is 45% which fits. Minuette wave (ii) was probably a combination lasting 5 days. Minuette wave (iv) may well be more brief if it is a zigzag for alternation.

It is impossible for me to tell if this fourth wave correction is over, but I am confident that GDX needs at least one more upwards wave to complete this structure.

Redraw the channel about minute wave c as shown. Look for upwards movement to find resistance at the upper edge of this channel.

When a final fifth wave up is complete, then a subsequent breach of this channel would provide confirmation that minute wave c is over, and so minor wave 2 should be over. At that point minor wave 3 down should have begun.

Minor wave 2 may not move beyond the start of minor wave 1 at 27.78.

Within minute wave c minuette wave (iv) may not move into minuette wave (i) price territory below 19.03.

I’ll be looking at that later today and will publish GDX for you.

Hi Lara,

Based on the movement/structure in gold and miners lately, does it look like they will be correcting soon, or does it appear more likely that the move up will continue

Lara a timely update. Thanks you.

Thanks Richard posting the update on gold post.

Lara you and your summary are Fabulous, Thanks a million.