Downwards movement was expected. Friday closed with a small red candlestick fitting both Elliott wave counts nicely.

Summary: Downwards movement should continue next week. The lower volume for Friday supports the main wave count which expects a correction to 1,172 most likely. If the alternate is to remain viable it must prove itself next week with a strong increase in momentum, an increase in volume, and a new low below 1,142.82. A new low below 1,131.09 would provide full and final confirmation of the alternate and invalidation of the main wave count.

Click on charts to enlarge.

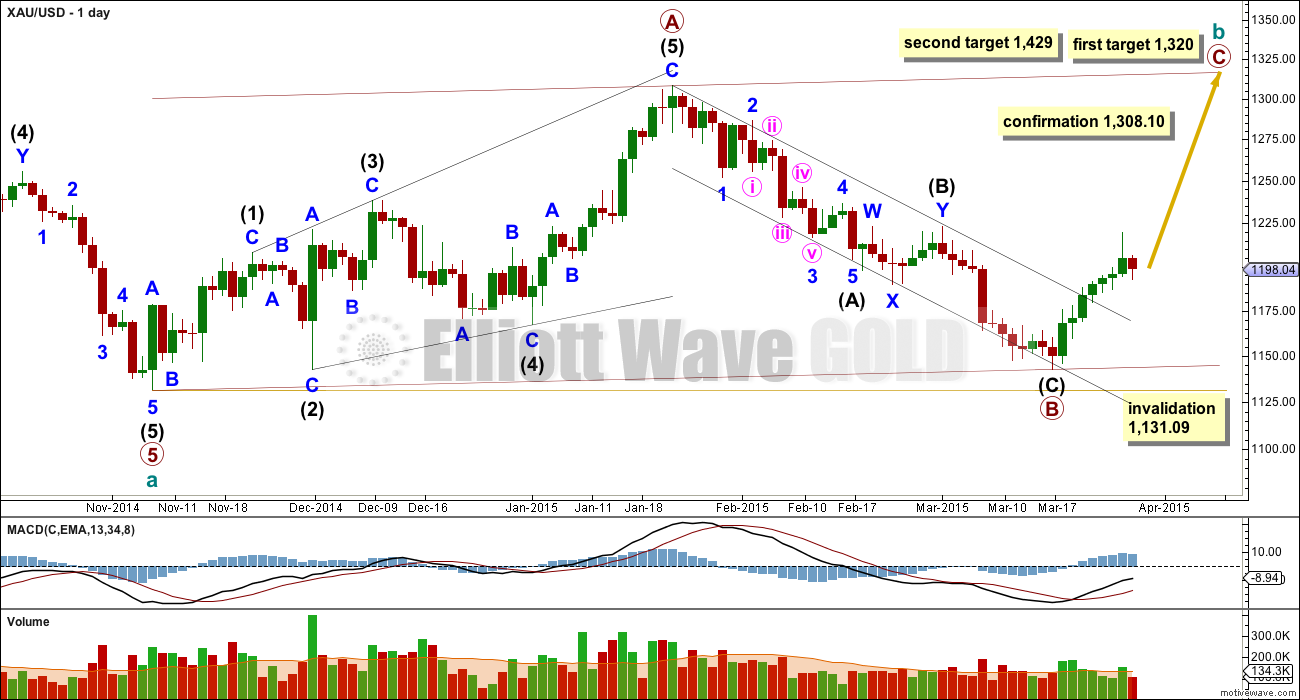

Main Daily Wave Count

There are more than thirteen possible corrective structures that cycle wave b may take. At this stage it is unclear what degree to label this big movement. I will leave labelling as is at primary degree, but it is equally possible that this degree may be moved down one level and primary wave A is an incomplete zigzag.

Cycle wave b may be a single zigzag as labelled, but may also be a double zigzag with the first zigzag unfolding as labelled. It may be a triangle with only primary wave A zigzag incomplete, or a double combination within a zigzag for primary wave W incomplete. It may be a flat correction with primary wave A as an unfolding zigzag. All these structures are equally likely. Of all Elliott waves, B waves exhibit the greatest variety in form and structure and are the hardest to label correctly as they unfold.

When the big zigzag labelled primary waves A-B-C is complete I will have alternate wave counts to manage the various possibilities for cycle wave b. When the big zigzag is complete that does not mean that cycle wave b must be complete, and only means that if cycle wave b is a single zigzag it would be complete there. All other possibilities will remain open.

A new high above 1,308.10 would invalidate the alternate and confirm this main wave count at primary and cycle degree.

The upwards wave labelled primary wave A fits only as a five wave structure, a leading expanding diagonal. Within a leading diagonal the first, third and fifth waves are most commonly zigzags, and the fourth wave should overlap first wave price territory. I have tried to see this movement as a three; if it is a three then wave A would end at the high labelled intermediate wave (3) within primary wave A. That would see wave A a leading contracting diagonal, but within it the third wave would be longer than the first. This violates the rule for wave lengths of contracting diagonals so that idea is not a viable wave count. This leads me to the conclusion that primary wave A is a five wave structure and cannot be seen as a three.

Because primary wave A subdivides as a five, primary wave B may not move beyond its start below 1,131.09.

At 1,320 primary wave C would reach equality in length with primary wave A. This would complete a 5-3-5 zigzag trending upwards. At that stage alternate wave counts would be required to manage the various possibilities for cycle wave b.

At 1,429 primary wave C would reach 1.618 the length of primary wave A.

Because primary wave A is a diagonal then it is highly likely primary wave C will be an impulse in order to exhibit alternation. Primary wave C may end about the upper edge of the channel drawn about cycle wave b.

This wave count sill has problems of structure within primary wave 5 of cycle wave a:

– within primary wave 5 intermediate wave (2) is a running flat with its C wave looking like a three and not a five.

– within intermediate wave (5) the count is seven which is corrective; either minor wave 3 or 5 will look like a three wave structure on the daily chart where they should be fives.

It is for these reasons that I will retain the alternate until price confirms finally which wave count is correct and which is invalidated.

The decline in volume for Friday’s session fits this main wave count. If price has entered a correction and not a new trend at a larger degree then it should be expected that during the correction volume declines.

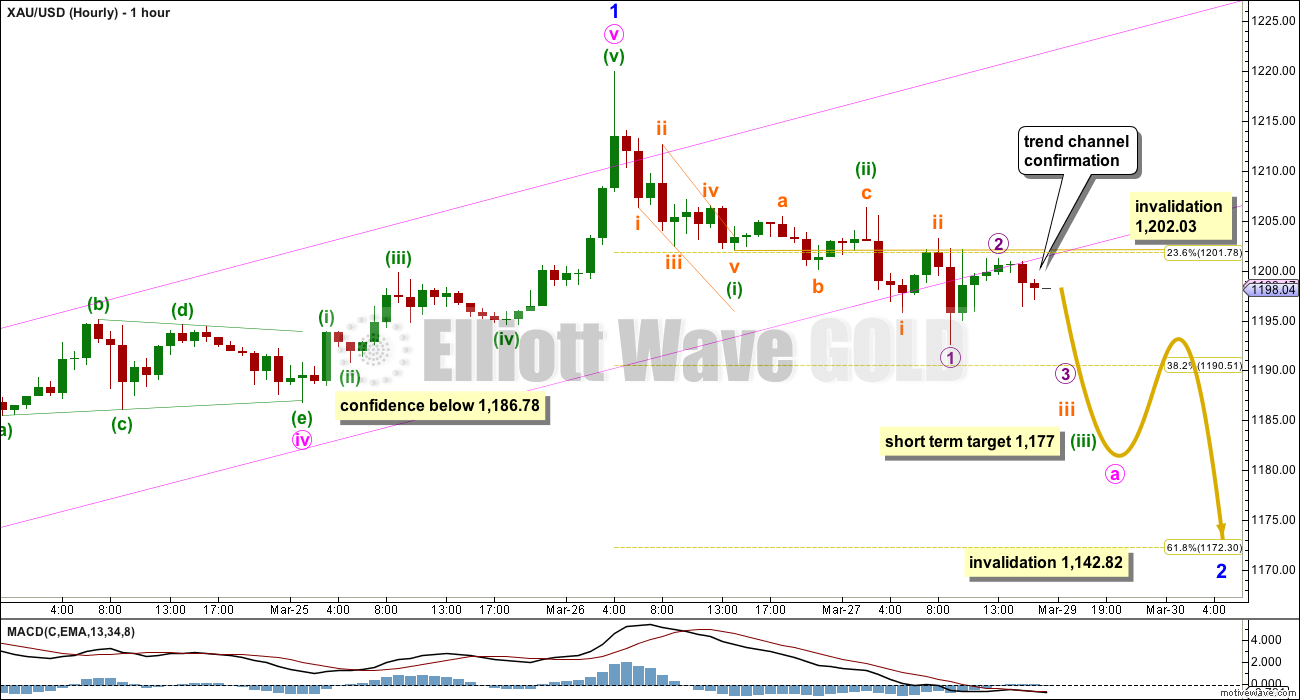

Main Wave Count – First Hourly

This first hourly wave count expects minor wave 2 to be the most likely structure of a zigzag. Within a zigzag minute wave a must subdivide as a five wave structure. So far minuette wave (iii) must be incomplete.

I have tried to see if a third wave could fit in this choppy downwards movement and I cannot resolve it. I have concluded the third wave must be incomplete.

Within minute wave a, when minuette wave (iii) is complete the following sideways correction for minuette wave (iv) may not move back into minuette wave (i) price territory above 1,202.03.

At 1,177 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

This first wave count expects a zigzag downwards to end in another two or four days if minor wave 2 lasts a Fibonacci three or five days in total.

This first wave count does not allow for a new high beyond the start of minute wave a at 1,219.99. When minute wave a subdivides as a five then minute wave b may not move beyond its start.

Main Wave Count – Second Hourly

There are still several possible structures that minor wave 2 may unfold as. The only corrective structure it may not be is a triangle.

This second hourly wave count looks at the possibility that minor wave 2 may be a flat correction.

Within a flat minute wave a must subdivide as a “three”. Here minute wave a may be an incomplete double zigzag. It is common for A waves of second wave corrections to end close to the 0.382 Fibonacci ratio and so minute wave a may end about 1,191.

When minute wave a subdivides as a three then minute wave b must retrace a minimum 90% length of minute wave a, and it may make a new high beyond the start of minute wave a above 1,219.99.

The length of minute wave b in relation to minute wave a tells us what kind of flat may be unfolding, and so what ratio to apply to the target for minute wave c.

This second wave count at this stage has no upper invalidation point.

As more of the structure of minor wave 2 unfolds over the next few days these two hourly wave counts may change. My focus will be on determining when the correction is over.

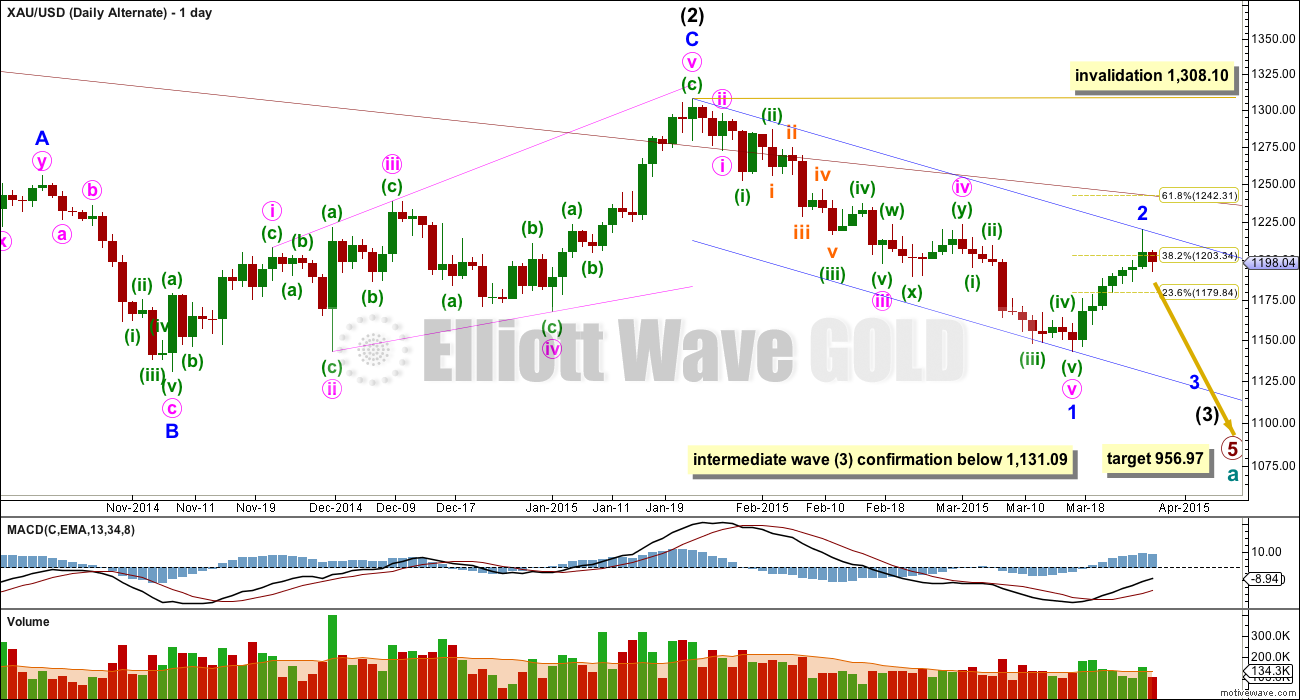

Alternate Daily Wave Count

This alternate wave count sees Gold as still within a primary degree downwards trend, and within primary wave 5 intermediate wave (3) has begun.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 5 may last a total Fibonacci 55 weeks. So far it is now in its 36th week.

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks and one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. The breach of this channel is a warning this wave count may be wrong.

This wave count still has a better fit in terms of better Fibonacci ratios, better subdivisions and more common structures within primary wave 5, in comparison to the main wave count above.

Within intermediate wave (3) minor wave 1 is a long extension. Within minor wave 1 minute waves iv and ii are grossly disproportionate, with minute wave iv more than 13 times the duration of minute wave i. This also reduces the probability of this wave count.

Although the invalidation point is at 1,308.10, this alternate wave count should be discarded long before that price point is reached. If the maroon channel is breached again by one full daily candlestick above it and not touching it then I would discard this alternate wave count.

A new low below 1,131.09 would confirm that intermediate wave (3) down is underway.

The decline in volume for Friday’s session is concerning for this wave count. If minor wave 3 of intermediate wave (3) has just begun volume should increase. Minor wave 2 already has lasted 7 days and is longer than minor degree corrections normally are. Although it is possible that only minute wave a is over and this downwards movement is minute wave b, that would see minor wave 2 far too long in duration. The probability of that idea is very low indeed. So low I hesitate to publish it.

This alternate sees upwards movement as a completed zigzag. Unfortunately, sometimes waves are ambiguous: they are not clearly either threes or fives. With the many subdivisions within this upwards movement it is possible to see it as both a three and a five.

This alternate also expects downwards movement from here. Minor wave 3 should show a clear strong increase in downwards momentum. This is a third wave within a third wave which should gather momentum next week. At 1,055 minor wave 3 would reach equality in length with minor wave 1. This target expects minor waves 1 and 3 to be both extended, so minor wave 5 to end should be shorter.

The channel on this hourly chart is more clearly breached than the main wave count, although for both there is at least one full hourly candlestick below the lower edge of the channel. That is all that is required for a clear channel breach.

For this alternate downwards movement must be a series of overlapping first and second waves. This wave count expects an increase in momentum on Monday.

This analysis is published about 12:32 a.m. EST.

Anyone have a wave count now?

I’m curious if gold is about to begin descent down to 1177 or continue up past 1188? Or anything else expected?

I took some profits in JDST this morning, still holding just under half. It feels like we are in Main Wave – First Hourly, not sure if 1182 was wave a or if we have another push lower. This feels corrective for the last few hours so I think wave a is done, at least that’s how I am playing it right now.

Good trading. Helpful comment thanks.

Thanks. One lesson I learned for myself recently is that I don’t need to trade every single wave. Taking profits as we go here and I’ll be looking to enter long in a few days.

You want someone to stick his neck out on a corrective wave within a corrective wave? I believe that minor 2 is not yet over and the behavior of the miners seems to agree with that belief.

Good morning Richard. I have minute wave a incomplete, so I’ll be expecting another red candlestick for Tuesday. Along the way down two more small fourth wave corrections should move sideways.

Maybe Wednesday will be a small green candlestick or doji for minute wave b?

Lara, a short update like this before market close always appreciated, thanks.

Ditto Davey.

Hey does anyone know of a 3x bear etf for SnP?

SPXS

Are we expecting a decent correction in the S&P?

I don’t trade the S&P at this time.

Thx guys .. I don’t remember Lara’s outlook on the SnP @ the moment but wanted to look into these suggestions a bit

When I trade against equities, 3x bear etf, I use is SPXU for S&P, SDOW for Dow Jones, SQQQ for Nasdaq, and SRTY for Russell 2000.

My DUST target is still at ~20.13 but consistent with Lara’s timing, I think it will take 1-3 more days of declining gold prices to hit that. As you can see, DUST is presently churning through the supply zone at $18.00-$18.50 leftover from March 19. http://scharts.co/1CD5RiX

I still would prefer a Count with new lows even when not that low as 950. Gold-COT looks good. We have a good clearing up but the manipulators are not yet covered enough for a good 3-month buy signal. If you dont know what to do in Gold just take a look at Silver ‘s COT which are bad and closer to a sell signal than otherwise. There the Manipulators have to intervene on Futuremarket. In Gold they manipulate largely in the physical market in cooperation with the central banks and rise their shortposition only at the end of a rally or on significant chartmarks but in Silver they are constrainedto use the Futuremarket consistently .

So it is vey helpfull to watch silver not only Gold.The manipulators still hold a huge shortposition and were rising it the last 2 reports. They are far away from covering. The larg specs and commercial are bad but the manipulators shortposition has just the high when we on pricetops.This is no trendchange for me at 1142 for several months and certainly not for several years. something is wrong.

This looks more than we will see new lows in Silver and most likely in Gold. Maybe 1220 was the top of this correction. If not im sure 1250 will hold.

With 1182 holding, 1188/90 appears limiting with 1202-03 on the outside and possible 1214-15…. Seeking downside break below 20dma 1178/77…. Lets see.

Looks like main – second hourly wage count is out. We appear to be in main first hourly wave count or alternate.

I must be missing something. What makes you say the second hourly wave count is out?

She had a target of the a wave to be 1191 and then retrace significantly for the b wave. We’ve dropped to 1182 already.

I would interpret dropping below 1191 as reducing the probability of the second hourly but not ruling it out.

Off topic. Not sure what Lara’s count is on the S&P, but according to this long term Dow chart, looks like a logical place for an intermediate correction or bear market to start.. from Kimble Charting

I have posted similar super long term chart by Ron Rosen of Delta timing.

SPX is just at 1.34 extension over the 2007 high 1576.

EW count for DOW/SPX by Ron Rosen has been that market is in massive expanded flat ever since market completed super wave 3 in 2000.

This is corrective wave 4 which may end below 666. (If it is true).

A @ 1576

B @ 666

C@ 2119

DJIA clearly didn’t see this chart…

Some good metal and miner charts supporting the main count.

http://www.gold-eagle.com/article/junior-gold-stocks-volume-rules-price

Hi Lara. It’s great that you can make some sense of the choppy movement of minor 2 so far.

I have a query about the magnitude of minor 2 in the 1st hourly count. If minuette 3 were to reach 1177, then minute a should be at least just a bit lower than 1177. Now, if minor 2 were to complete at 1172.30, then would the zigzag become a regular flat? If not, then one of the two price points got to give.

I can see minute a ending a little below 1,177, minute wave b either moving sideways or higher, and minute wave c being either 0.382 or 0.618 the length of minute wave a. The whole movement could be a zigzag ending at 1,172.

I have no problem with seeing it like that. But that doesn’t mean that’s how it will unfold.

It may also be that my degree of labelling is one too low or even one too high.

The only things I’m confident of today are that minor 2 has begun, and it’s not over.