Last week’s analysis expected it was fairly likely price may continue to fall at least slightly below 16.82. This is what has happened.

Summary: Assume the trend remains the same until proven otherwise. Draw a channel about downwards movement on an hourly chart to contain it all. Only when that channel is breached expect the downwards wave is over.

New updates to this analysis are in bold.

Last monthly chart is here.

ELLIOTT WAVE COUNT

MONTHLY CHART

A very large zigzag may be unfolding downwards for Super Cycle wave (a).

The first wave down within a zigzag must subdivide as a five. Cycle wave a will fit as a five wave impulse.

Cycle wave b may be any corrective structure. It may not move beyond the start of cycle wave a above 49.752.

The two weekly charts below look at two different structures for cycle wave b.

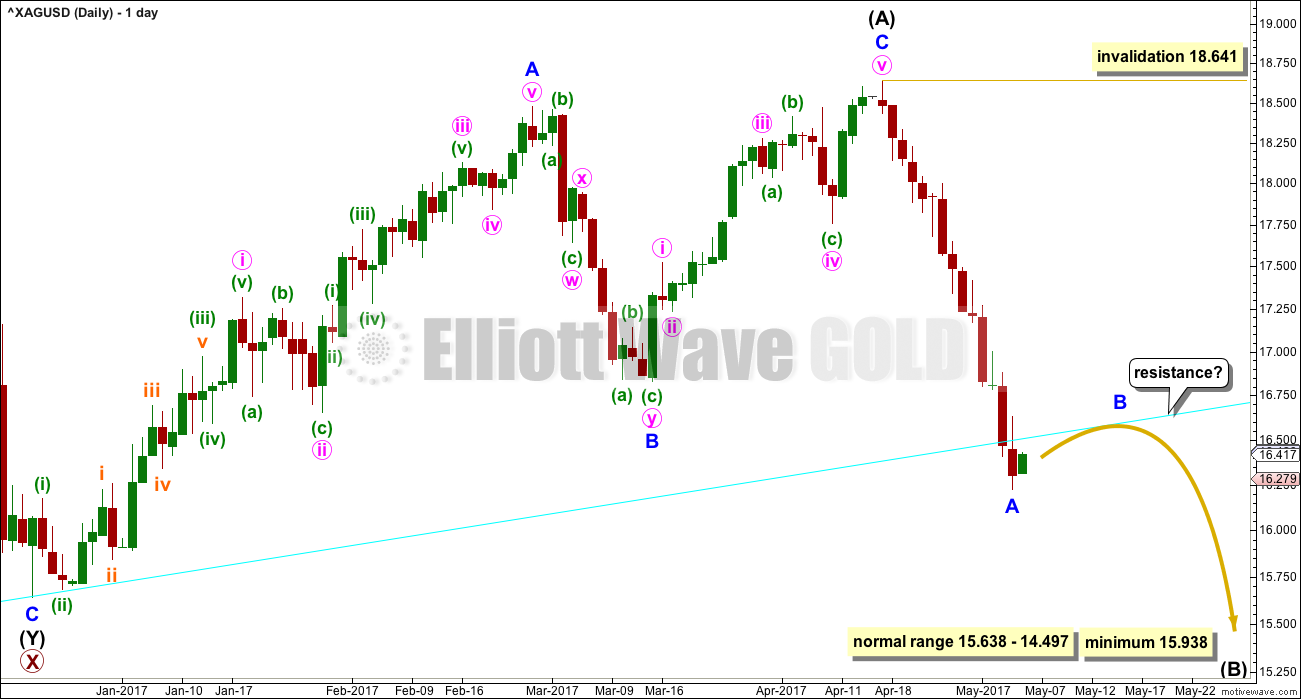

FIRST WEEKLY CHART

Cycle wave b may be completing as a double combination: zigzag – X – flat. The second structure, a flat correction for primary wave Y, may be underway.

Within a flat correction, intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 15.938. The common range for intermediate wave (B) is from 1 to 1.38 the length of intermediate wave (A).

Intermediate wave (B) may make a new price extreme beyond the start of intermediate wave (A), as in an expanded flat, which are very common structures.

The bigger picture for cycle wave b would expect primary wave Y to end about the same level as primary wave W about 21.062. The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double normally ends about the same level as the first.

The maximum number of corrective structures is three within combinations (and double zigzags). This maximum applies to sub-waves W, Y and Z. Within these structures, they may only be labelled as simple A-B-C corrections (or A-B-C-D-E in the case of triangles). They may not themselves be labeled multiples as that would increase the number of corrections within the structure beyond three and violate the rule.

X waves are joining structures and they are not counted in the maximum total of three (otherwise the maximum would be five). X waves may be any corrective structure, including multiples.

FIRST DAILY CHART

Intermediate wave (B) may be unfolding as a zigzag. Within Intermediate wave (B), minor wave A looks like an impulse. Minor wave B may not move beyond its start above 18.641.

Now that price has broken below the cyan support line this line may offer resistance. It may force minor wave B to be shallow.

If price breaks back above this line, then it may offer some support again.

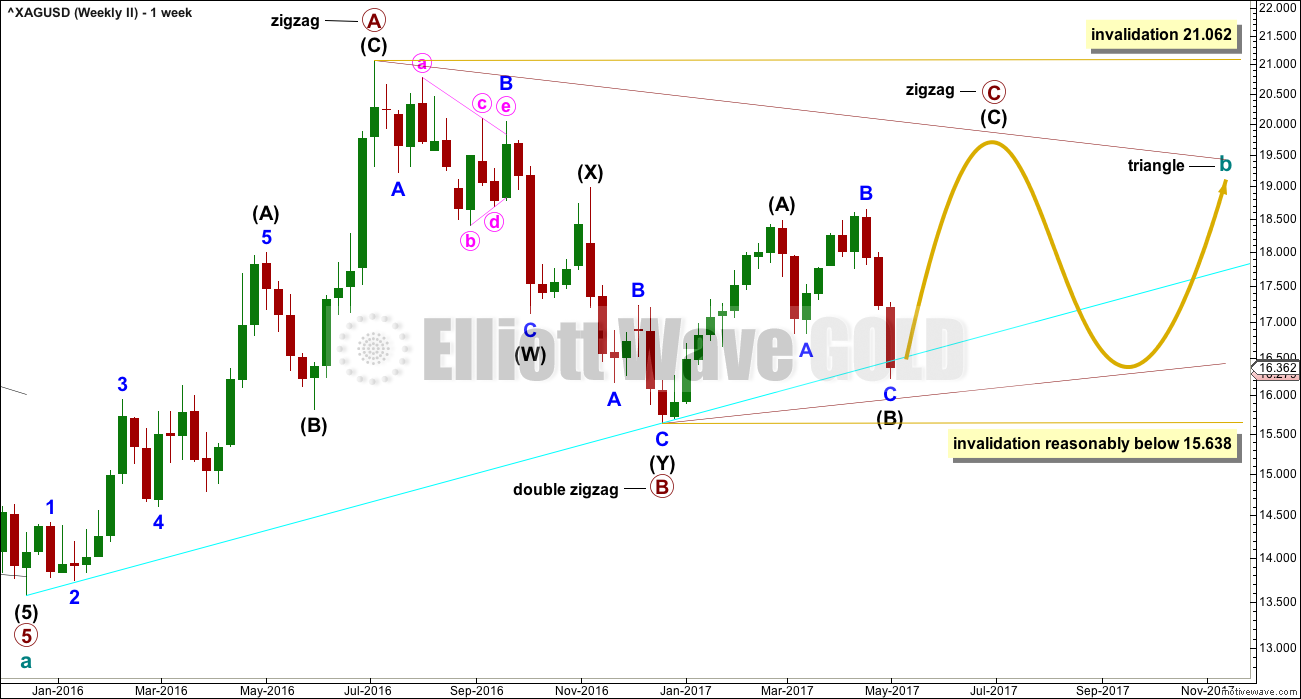

SECOND WEEKLY CHART

It is also possible that cycle wave b may be completing as a triangle. Only because combinations are more common than triangles is this a second wave count.

Within a triangle, only one of the sub-waves may be a more complicated multiple. Primary wave B subdivides as a double zigzag. Primary waves C, D and E may only be single threes.

Within a contracting or barrier triangle, primary wave C may not move beyond the end of primary wave A above 21.062.

Within a contracting triangle, primary wave D (nor any part of primary wave C) may not move beyond the end of primary wave B below 15.638.

Within a barrier triangle, primary wave D should end about the same point as primary wave B. As long as the B-D trend line remains essentially flat the triangle will remain valid. In practice, this means that primary wave D may move slightly below the end of primary wave B (this is the only Elliott wave rule which is not black and white).

The final wave of primary wave E may not move beyond the end of primary wave C. It would most likely fall short of the A-C trend line.

This second wave count expects a large consolidation to continue for months.

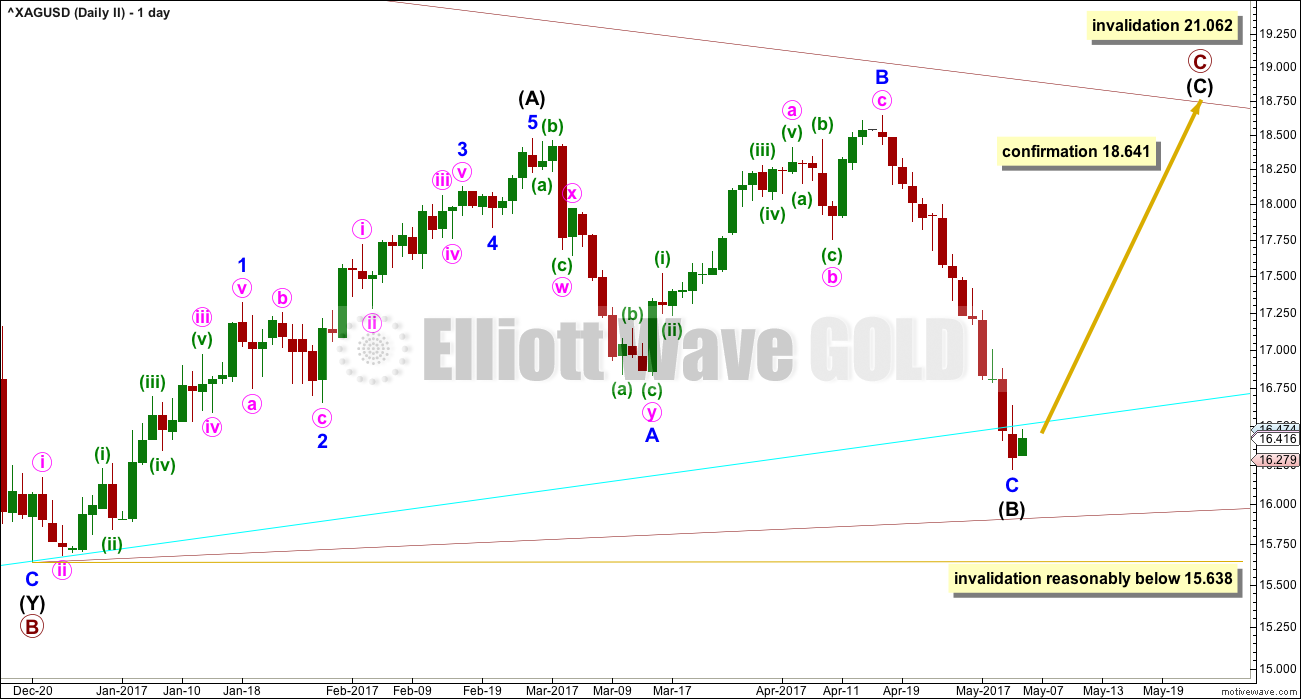

SECOND DAILY CHART

Primary wave C may be an incomplete zigzag.

A new high above 18.641 would at this stage invalidate the first wave count and provide some confirmation of this second wave count.

A new low reasonably below 15.638 would see this second wave count invalidated and the first wave count increase in probability.

2 HOURLY CHART

This channel contains almost all downwards movement. The upper edge is the important point. If price breaks above this, then assume the downwards wave is over and a new upwards wave has begun.

This is the simplest and safest approach to this market at this time.

TECHNICAL ANALYSIS

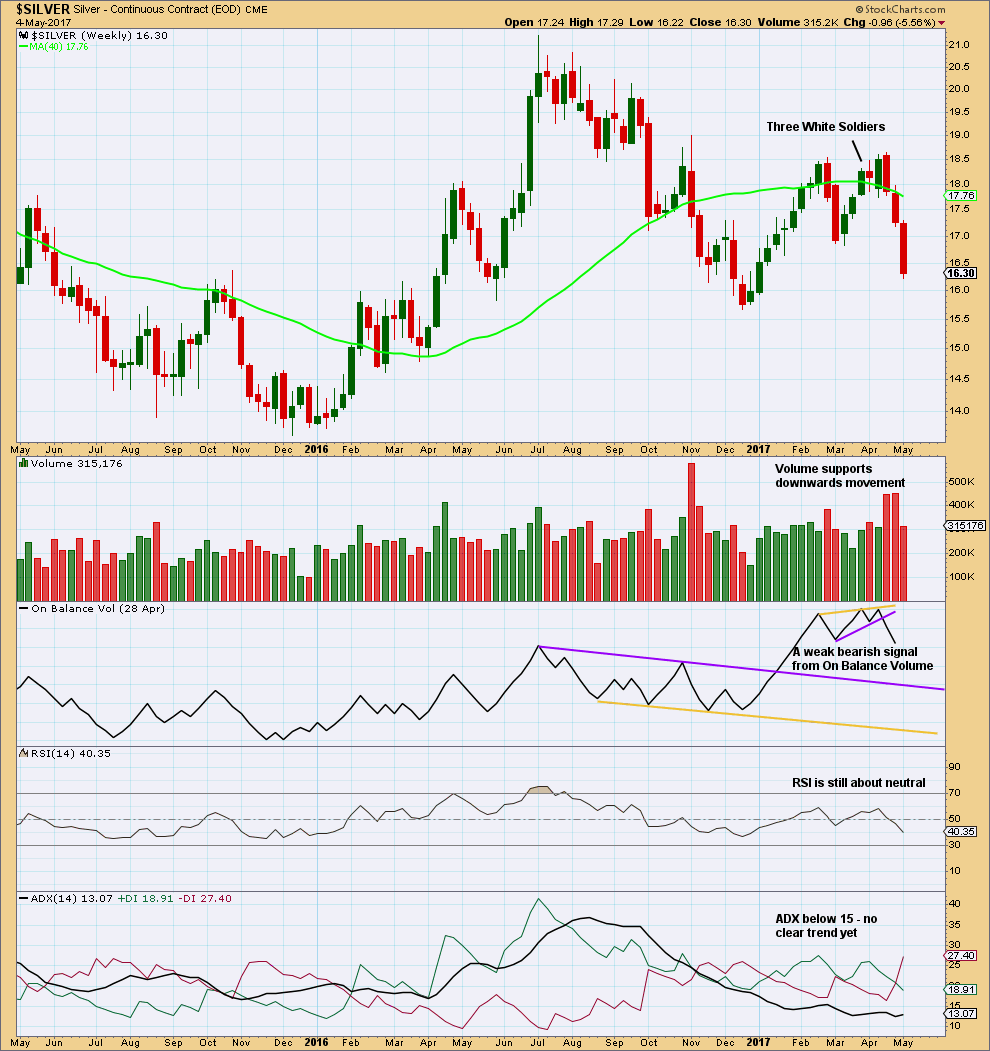

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Unless Friday’s session closes with very strong volume, this week may see a decline in volume for another downwards week. This would complete a Three Black Crows candlestick pattern, the opposite of Three White Soldiers. Coming after some increase, this would be a reversal pattern.

There is room for price to continue to fall here. RSI is not yet oversold.

DAILY CHART

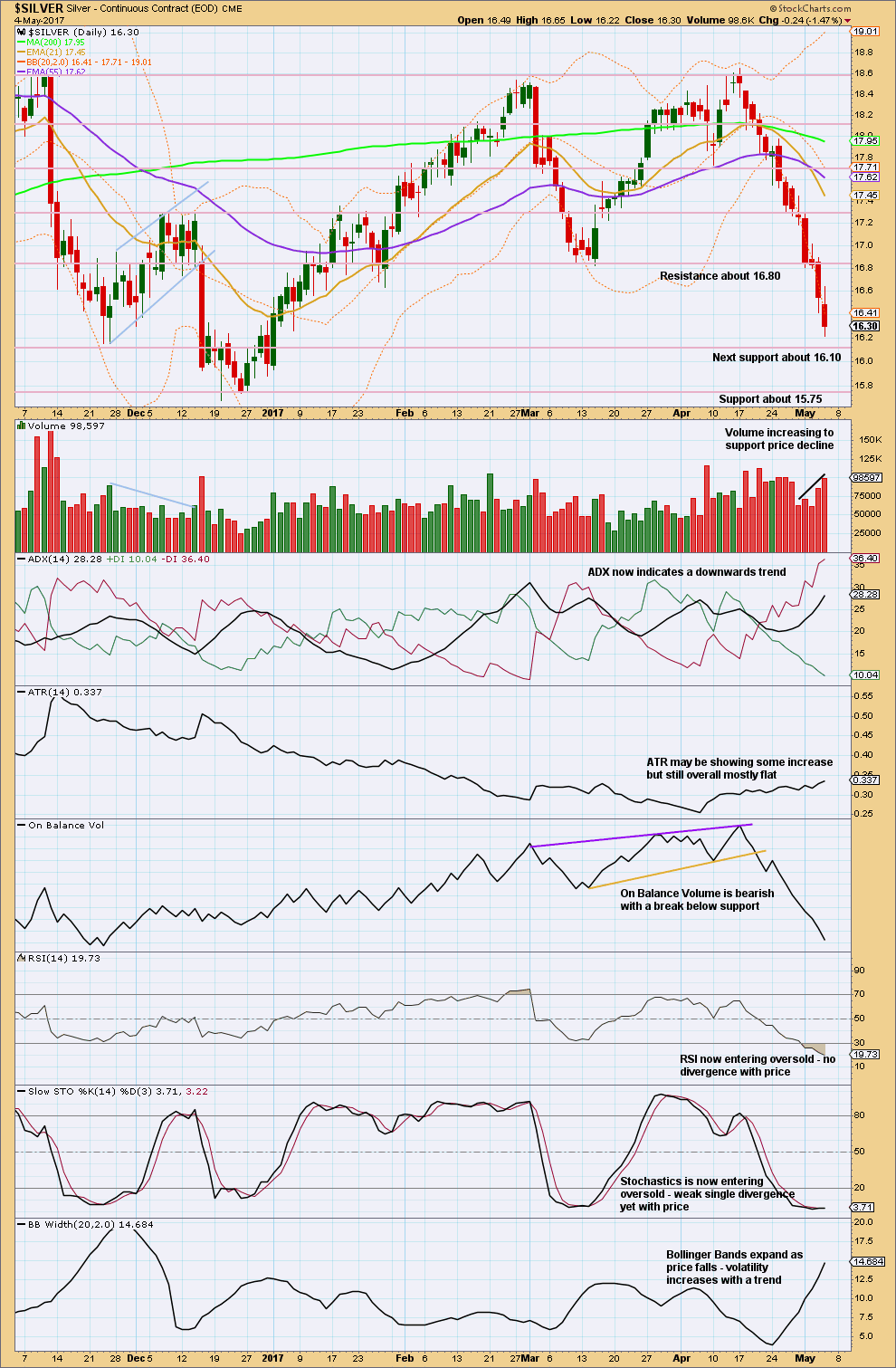

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume is bearish. On Balance Volume is very bearish.

ATR is slightly bearish. Bollinger Bands are bearish.

If RSI exhibits divergence with price at lows, then it would be a strong warning of a low in place, at least temporarily.

RSI can remain extreme for long periods of time during a strong bearish trend for Silver (look back at September 2014 for evidence of this statement). While RSI moving well into oversold is a warning, it does not mean that price has to bounce here.

The best evidence of an end to this downwards trend would be a strong candlestick reversal pattern (such as a Bullish Engulfing pattern) or a strong breach of a channel, which may be drawn on an hourly chart about this fall.

This analysis is published @ 04:16 a.m. EST.

[Note: Analysis is public today for promotional purposes. Member comments and discussion will remain private.]