by Lara | Aug 20, 2021 | Bitcoin, Public Analysis

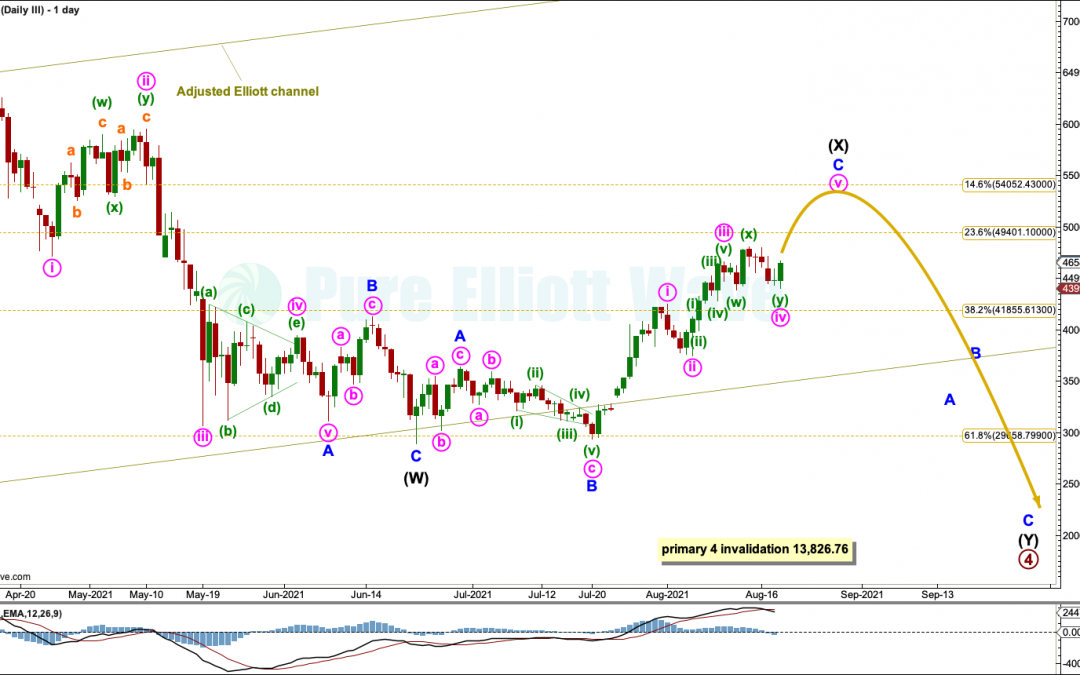

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 19, 2021 Last Bitcoin analysis, on August 11th, expected upwards movement towards a target about 57,669 as most likely. Since August 11th price has mostly moved sideways and a little higher. Summary:...

by Lara | Aug 11, 2021 | Bitcoin, Public Analysis

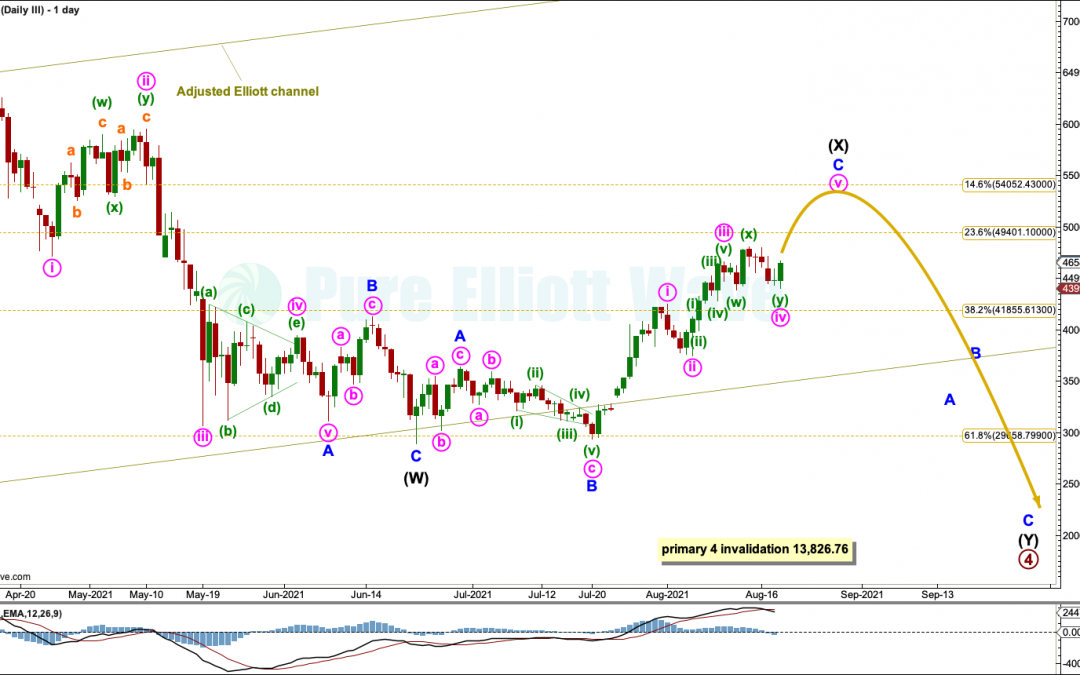

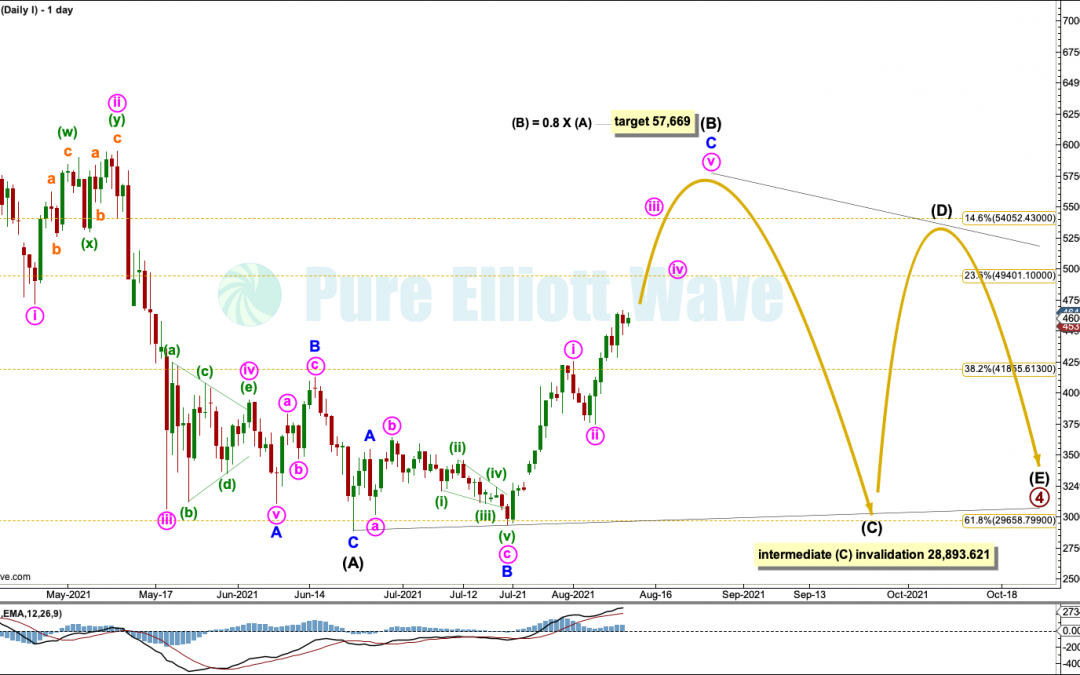

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 11, 2021 Last Bitcoin analysis, on 5th August, expected upwards movement towards a target about 57,669 as most likely. Over the last week this is what has happened. Summary: At this stage, all three...

by Lara | Aug 5, 2021 | Bitcoin, Public Analysis

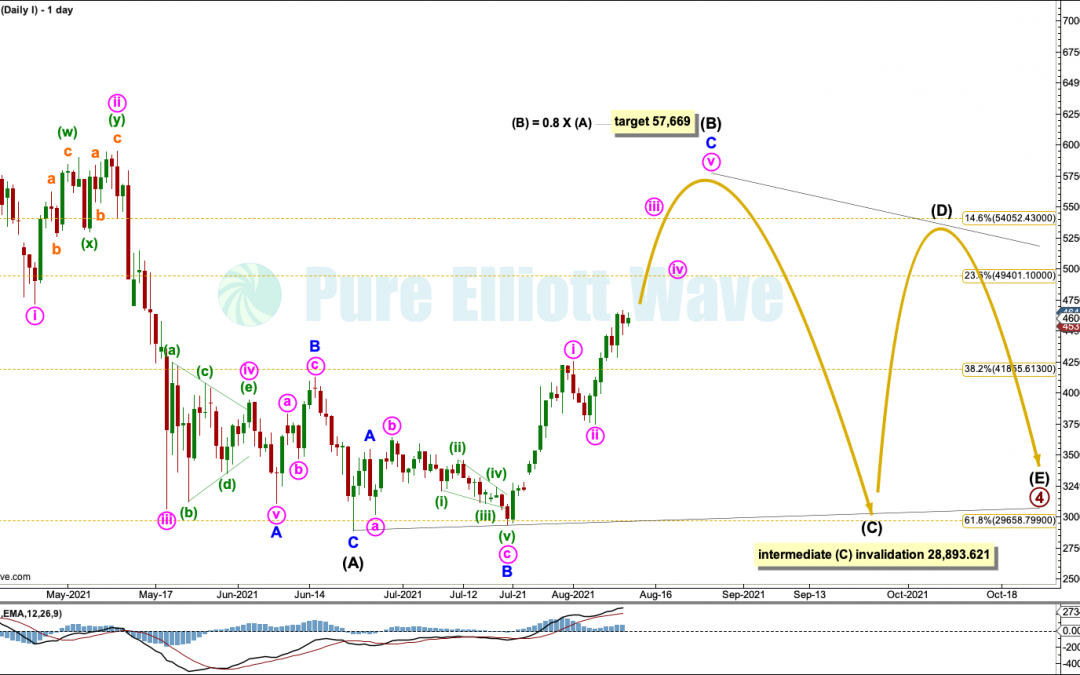

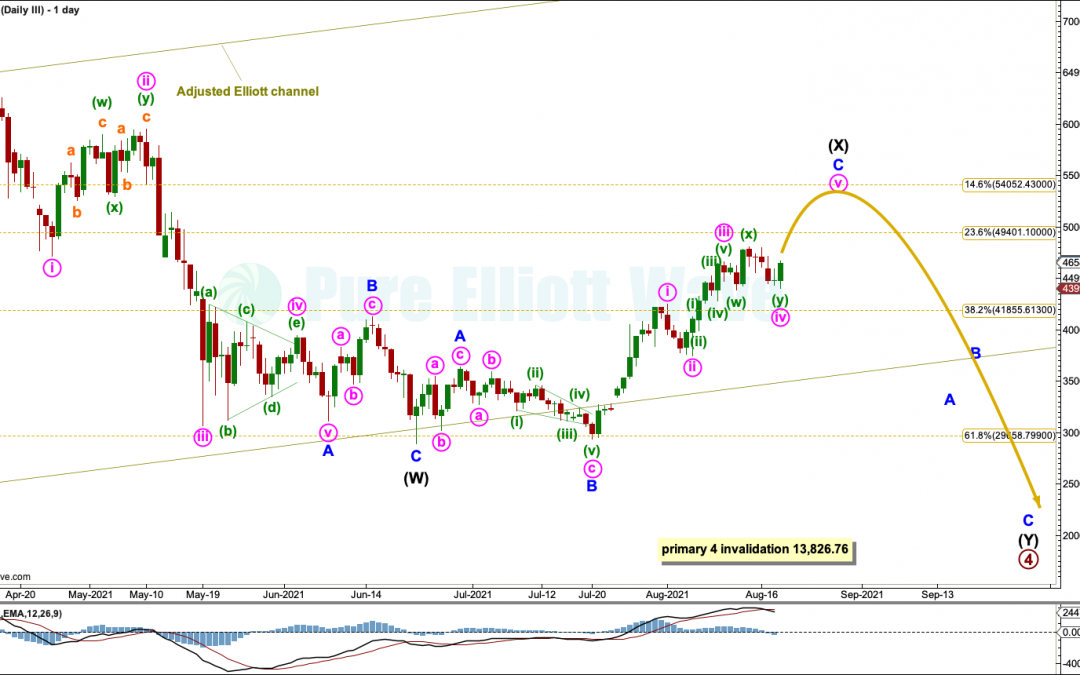

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 5, 2021 Last Bitcoin analysis, on July 29, 2021, expected a consolidation or pullback. This is a mid-term expectation and the consolidation or pullback may last a few more months. Summary: Technical...

by Lara | Jan 29, 2021 | Bitcoin, Public Analysis

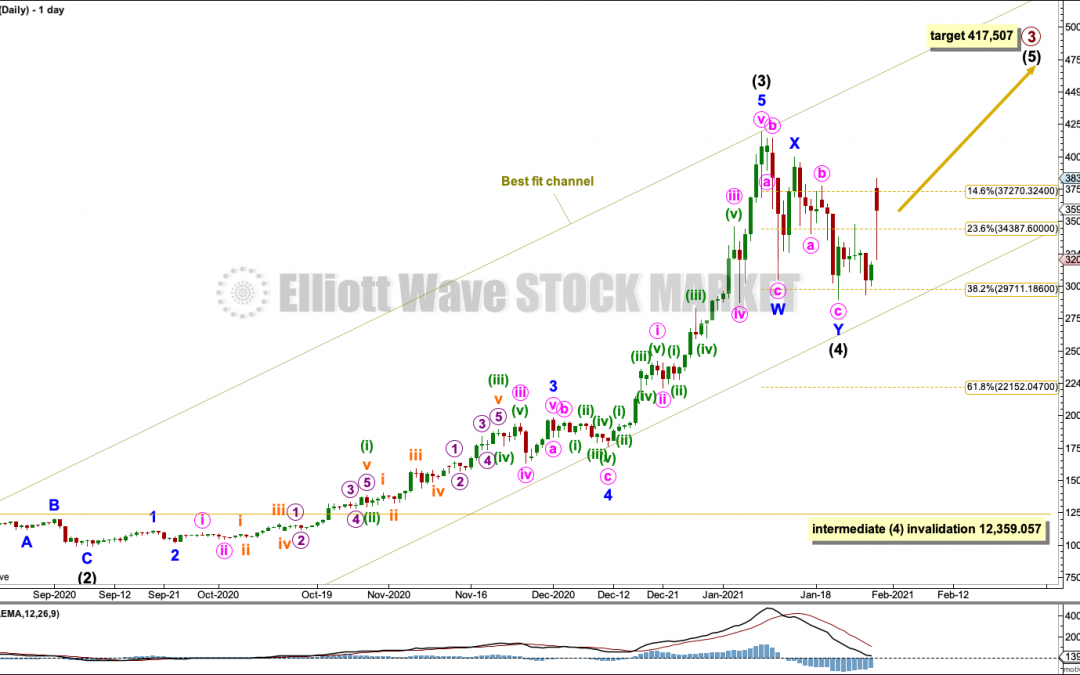

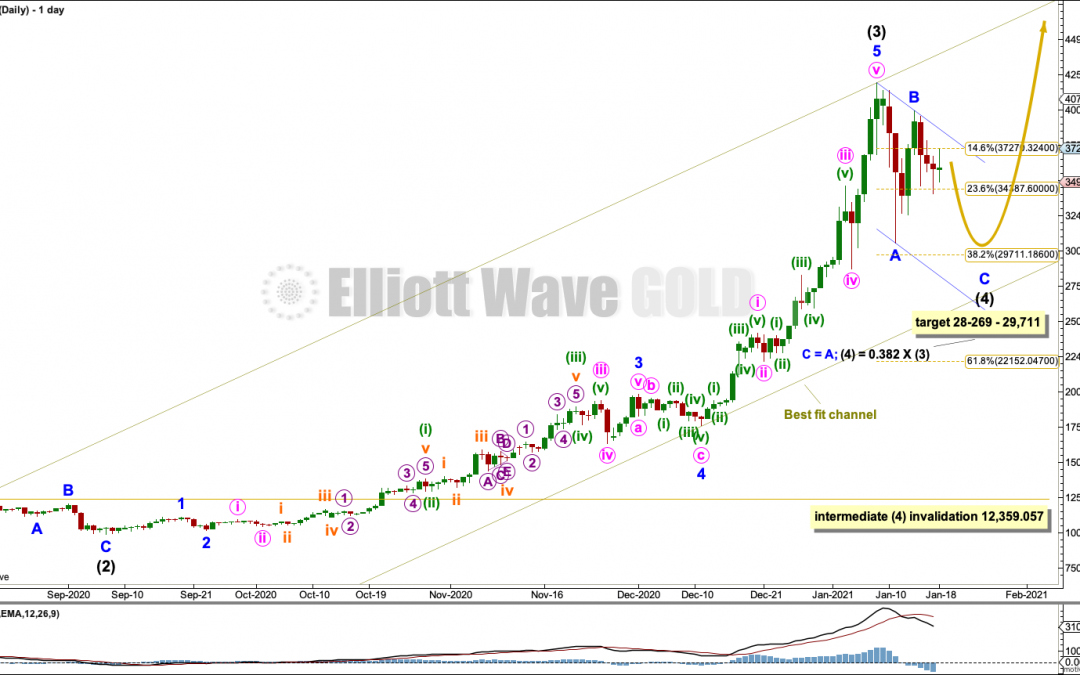

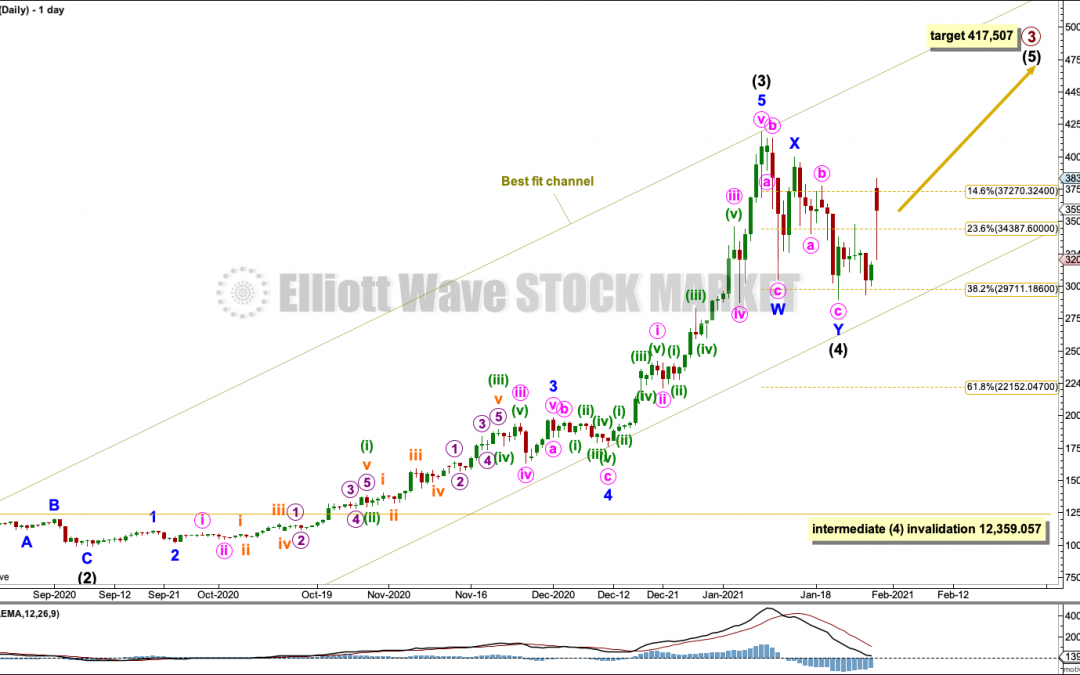

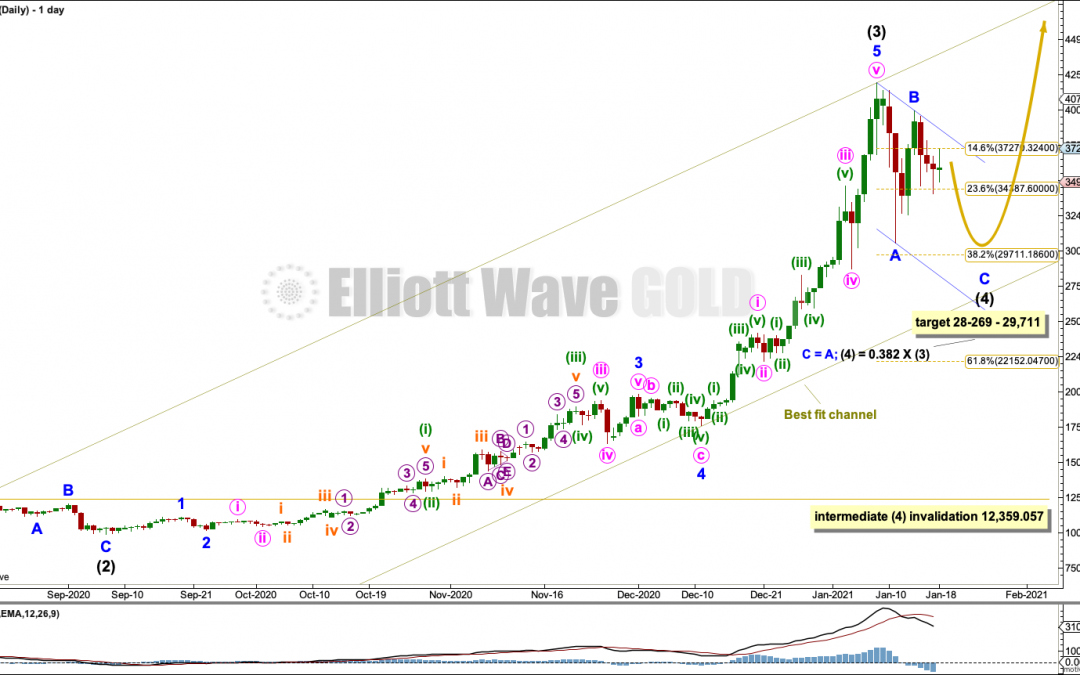

BTCUSD: Elliott Wave and Technical Analysis | Charts – January 29, 2021 Last Bitcoin analysis, on 18th January, expected a pullback to continue and end within a target zone from 29,711 to 28,269. The pullback did continue and reached 28,953.37, right in the...

by Lara | Jan 18, 2021 | Bitcoin, Public Analysis

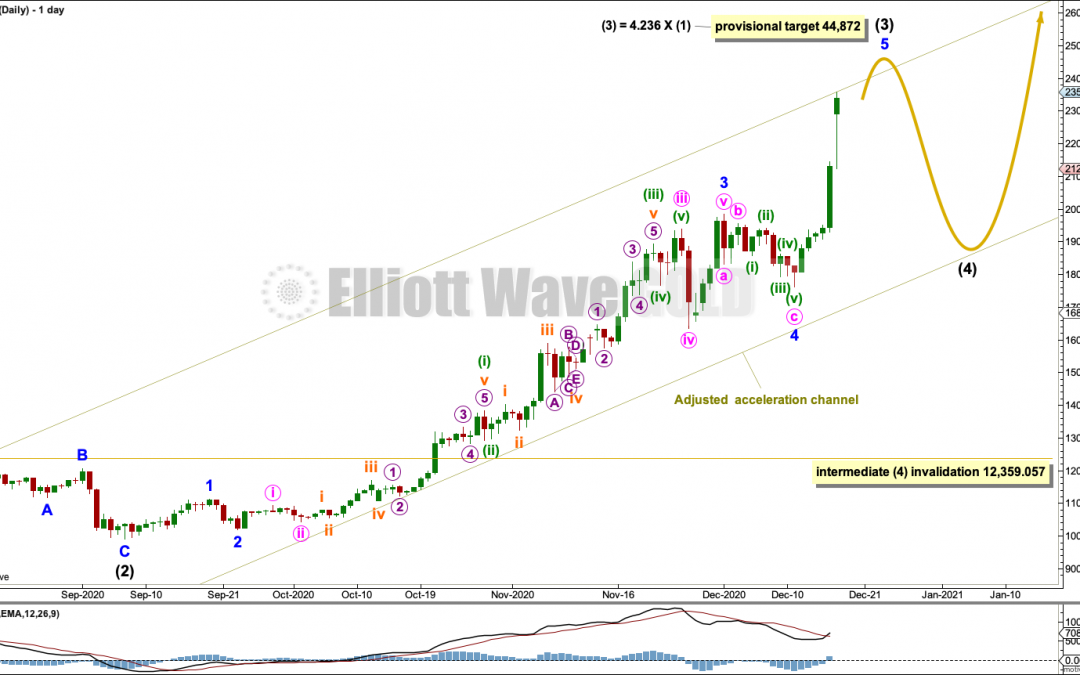

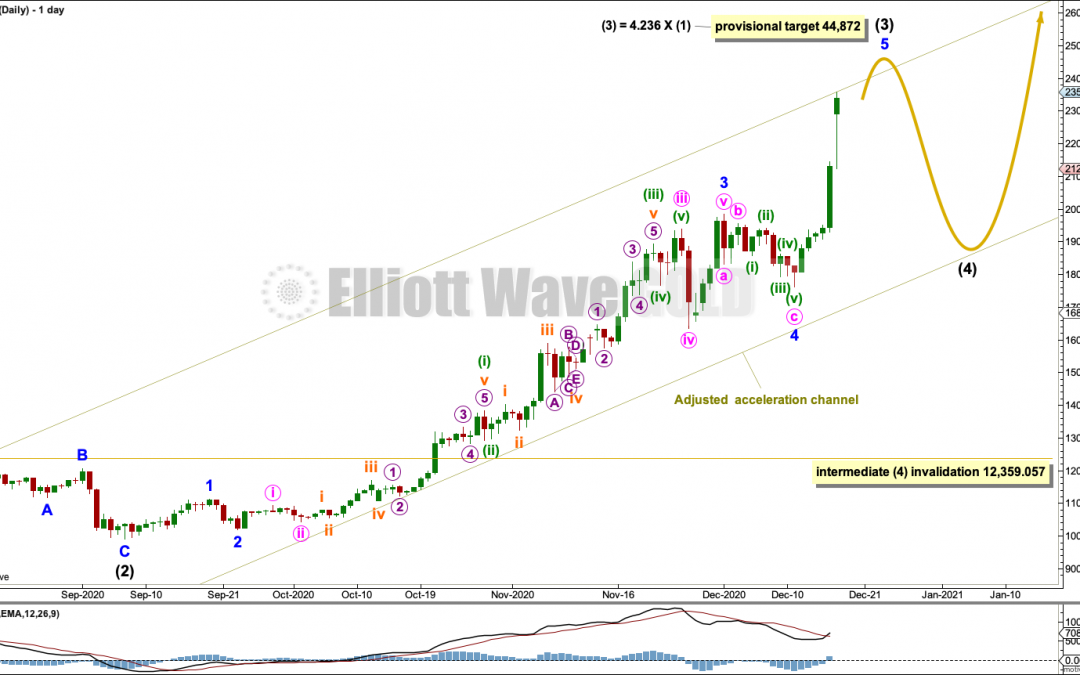

BTCUSD: Elliott Wave and Technical Analysis | Charts – January 18, 2021 The main Elliott wave count in last analysis, on December 17, 2020, expected more upwards movement to a provisional target at 44,872. Bitcoin reached 41,964.96 on January 8, 2021, which was...

by Lara | Jan 18, 2021 | Bitcoin, Public Analysis

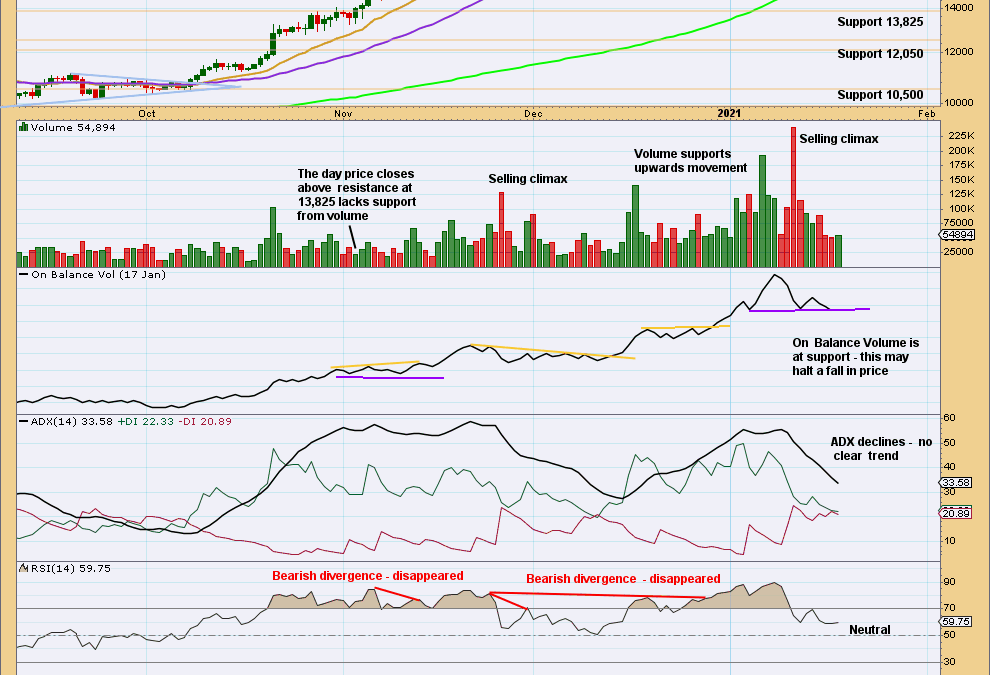

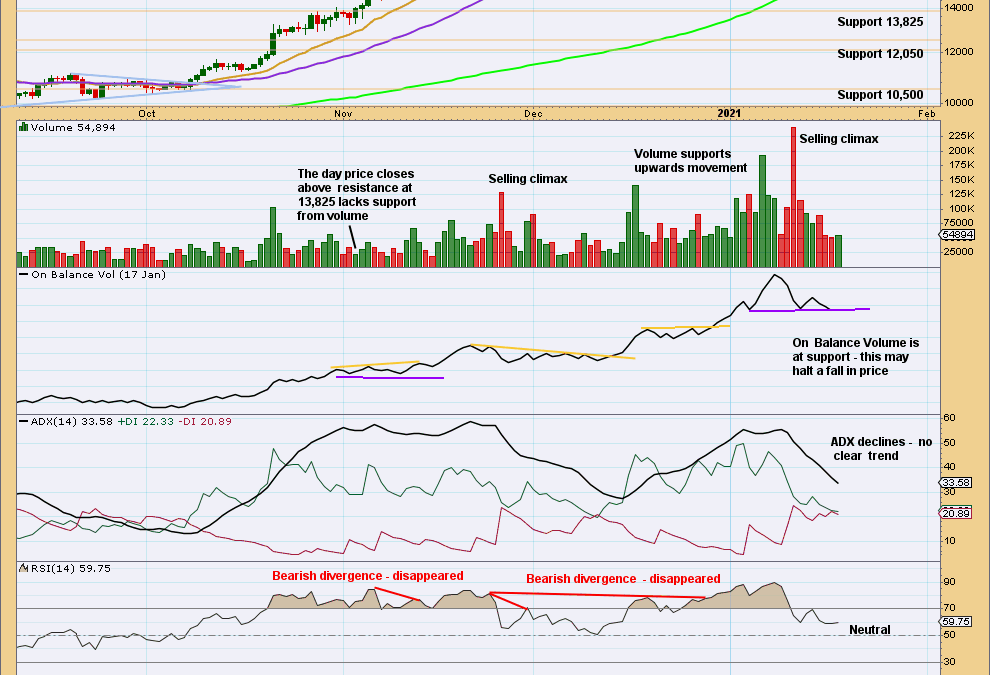

BTCUSD: Identifying Bitcoin Highs and Lows | Charts – January 18, 2021 This article analyses technical indicators at highs and lows for Bitcoin. TECHNICAL ANALYSIS WEEKLY Click chart to enlarge. The following characteristics can be noted at the end of prior major...

by Lara | Dec 17, 2020 | Bitcoin, Public Analysis

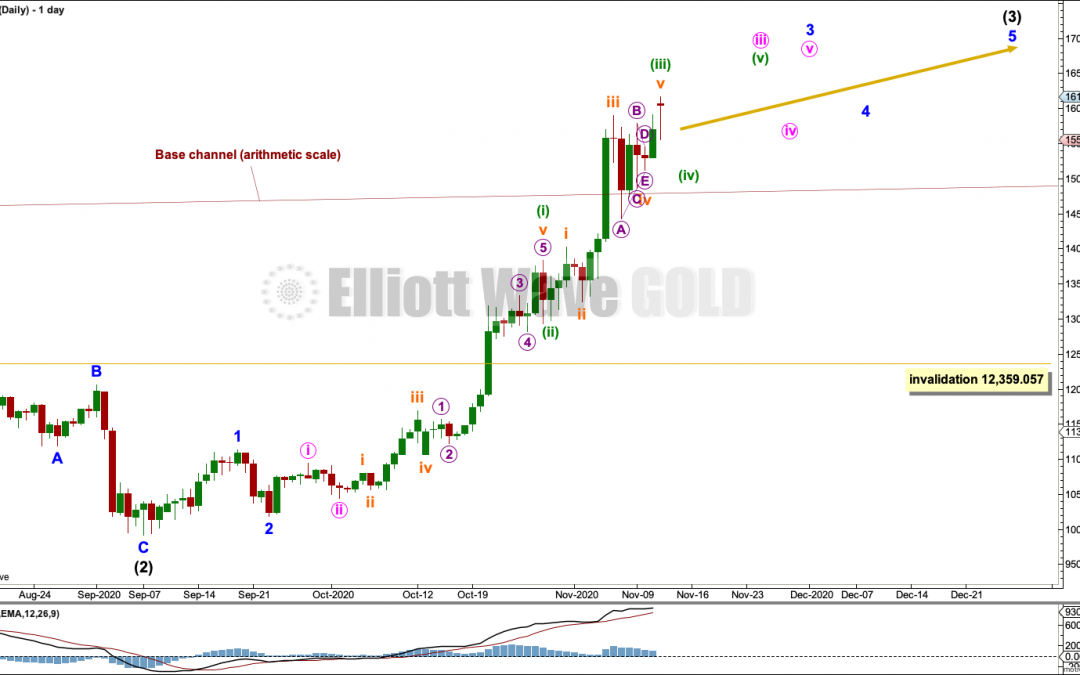

BTCUSD: Elliott Wave and Technical Analysis | Charts – December 17, 2020 The main Elliott wave count in last analysis, on 12th November, expected more upwards movement and a further increase in strength. This is exactly what is happening. Today’s analysis...

by Lara | Nov 12, 2020 | Bitcoin, Public Analysis

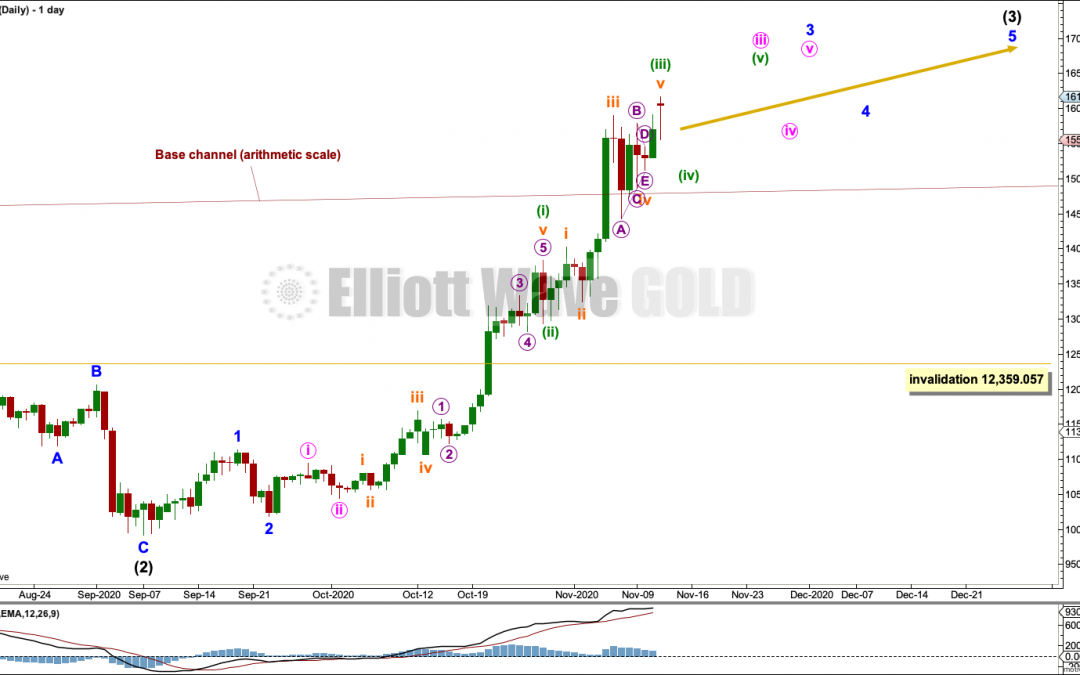

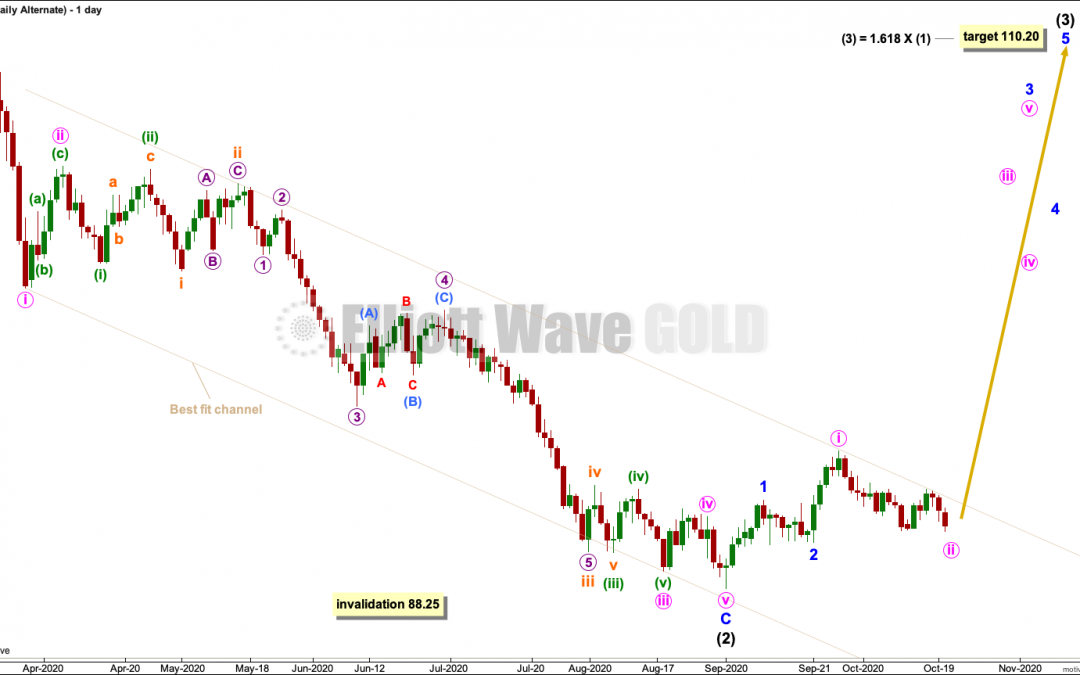

BTCUSD: Elliott Wave and Technical Analysis | Charts – November 12, 2020 In last analysis on October 13th, the main Elliott wave count expected a pullback to continue. This was discarded above 12,359.057 in favour of a bullish alternate wave count, which...

by Lara | Oct 20, 2020 | Public Analysis, USD Index

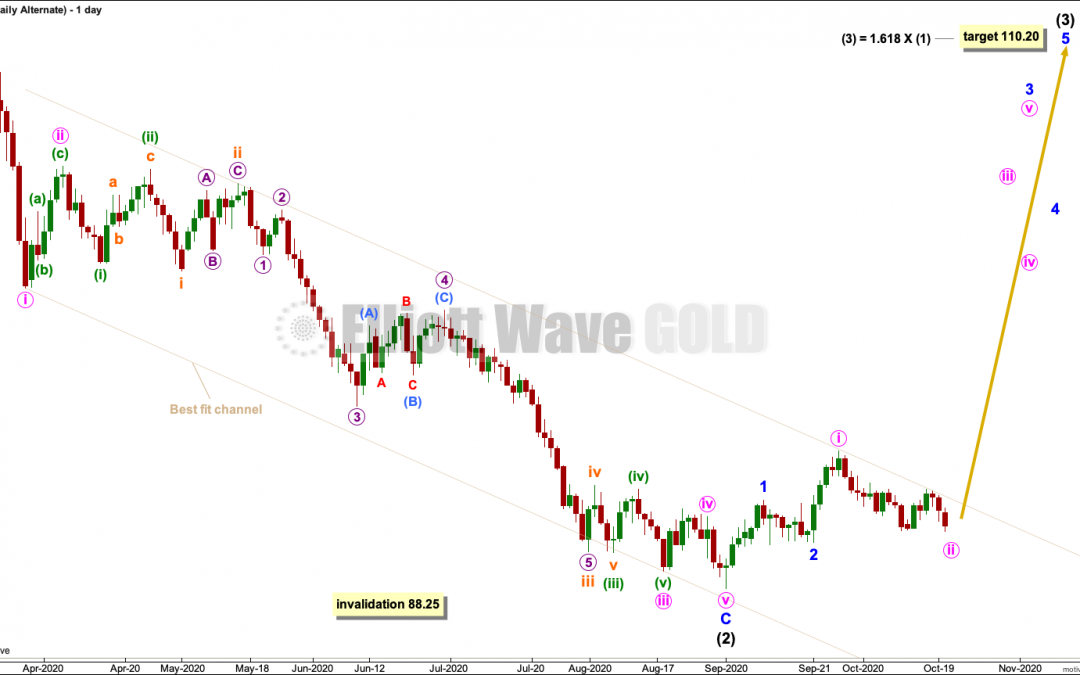

USD Index: Elliott Wave and Technical Analysis | Charts – October 20, 2020 Both a bull and bear wave counts at the quarterly chart level may remain valid. Summary: The bearish Elliott wave count expects a downwards trend has begun. The long-term target is...