by Lara | Aug 21, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Video – August 20, 2021 S&P500 first Gold at 16:01 US Oil at...

by Lara | Aug 20, 2021 | Gold, Lara's Weekly, S&P500, US Oil

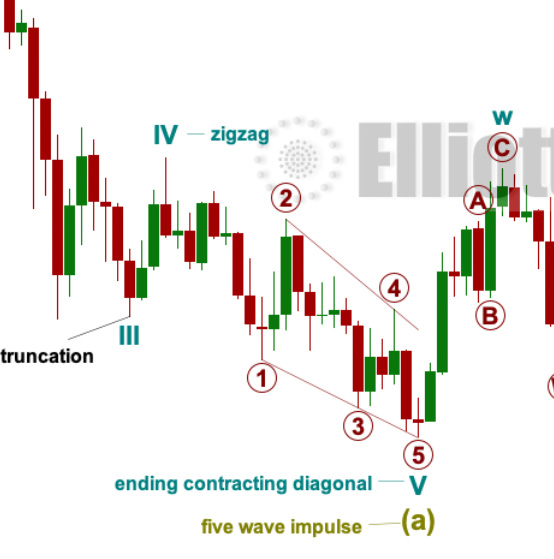

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – August 20, 2021 S&P 500 A bounce on Friday remains below the short-term invalidation point but does not fit expectations for the short term picture. The...

by Lara | Aug 20, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Video – August 20,...

by Lara | Aug 20, 2021 | Gold

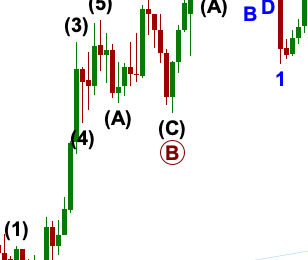

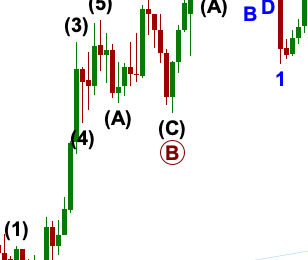

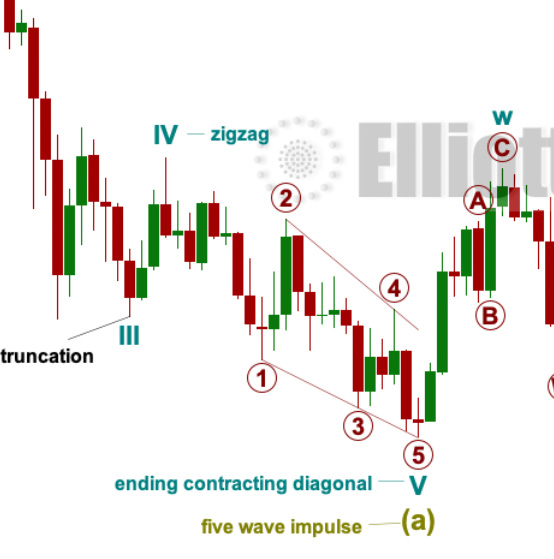

GOLD: Elliott Wave and Technical Analysis | Charts – August 20, 2021 Another small range day to end the week closes as a Gravestone Doji candlestick. This pattern supports the bearish Elliott wave count, slightly. Summary: Both Elliott wave counts remain valid,...

by Lara | Aug 19, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 19, 2021 Another small range day moves price slowly lower. Both Elliott wave counts remain valid. Today a new alternate bullish Elliott wave count is considered. Summary: Both Elliott wave counts remain...

by Lara | Aug 18, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 18, 2021 A small range day fits expectations for the preferred Elliott wave count, but a lack of range suggests a short-term alternate Elliott wave count should be considered. Summary: Both Elliott wave...

by Lara | Aug 17, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 17, 2021 Upwards movement today found resistance at the next identified resistance area and has then breached the short-term channel for the preferred Elliott wave count. Summary: Both Elliott wave...

by Lara | Aug 16, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 16, 2021 Price remains within the channel on the hourly charts and below the invalidation point for the bearish Elliott wave count. Both Elliott wave counts remain valid. Summary: Both Elliott wave...

by Lara | Aug 14, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – August 13, 2021 S&P 500 Four Elliott wave counts are considered at the end of this week. The main Elliott wave count remains the same because of technical...