by Lara | Aug 14, 2021 | Gold, Lara's Weekly, S&P500, US Oil

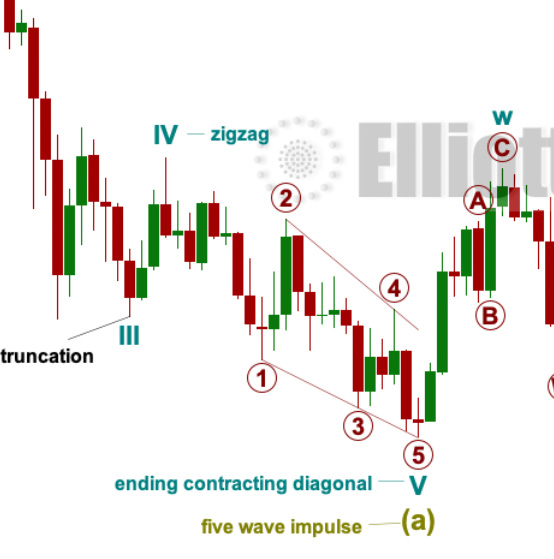

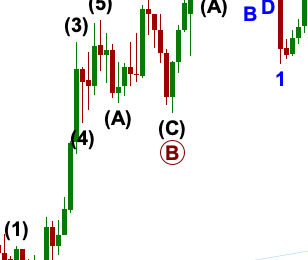

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – August 13, 2021 S&P 500 Four Elliott wave counts are considered at the end of this week. The main Elliott wave count remains the same because of technical...

by Lara | Aug 12, 2021 | Cryptocurrencies

Ethereum and Miota: Elliott Wave Analysis and Technical Analysis | Video – August 12, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 11, 2021 | Gold

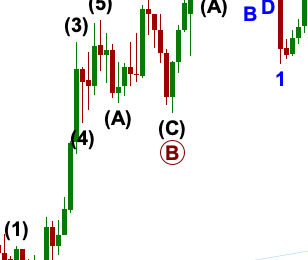

GOLD: Elliott Wave and Technical Analysis | Charts – August 11, 2021 A breach of the short-term channel on the hourly chart suggests either a bounce or a trend change has occurred. A small target zone is calculated for the preferred Elliott wave count. Summary:...

by Lara | Aug 6, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – August 6, 2021 S&P 500 For the very short term, a little upwards movement was expected to a short-term target. The short-term Elliott wave target is almost...

by Lara | Aug 6, 2021 | Gold

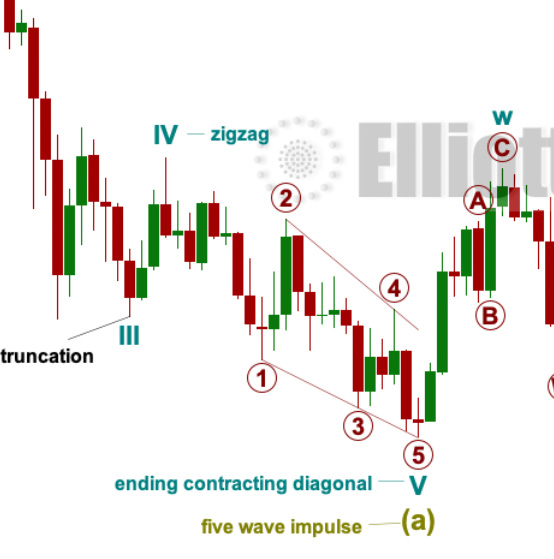

GOLD: Elliott Wave and Technical Analysis | Charts – August 6, 2021 Downwards movement again has unfolded as expected for both the first and second Elliott wave counts. The second (preferred) Elliott wave count has expected an increase in downwards momentum and...

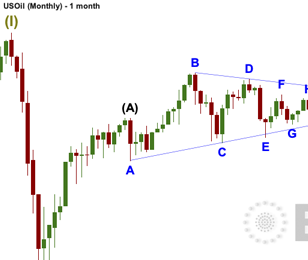

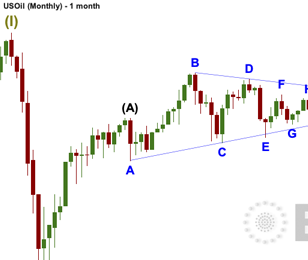

by Lara | Aug 6, 2021 | US Oil, US Oil Historical

US OIL: Elliott Wave and Technical Analysis | Charts – August 6, 2021 Downwards movement this week remains within the channel and above the invalidation point on the main Elliott wave count. The lower edge of the channel is providing support, so far. The...

by Lara | Aug 6, 2021 | Silver, Silver Historical

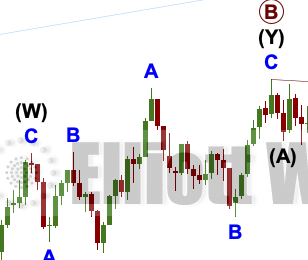

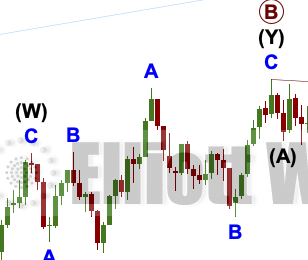

SILVER: Elliott Wave and Technical Analysis | Charts – August 6, 2021 Last week’s analysis expected a small bounce to find resistance about the upper edge of a channel on the daily charts and thereafter for price to move lower. The bounce this week has...

by Lara | Aug 5, 2021 | Bitcoin, Cryptocurrencies

Bitcoin: Elliott Wave Analysis and Technical Analysis | Video – August 5, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 5, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 5, 2021 Downwards movement was expected to continue for both Elliott wave counts, which is exactly what is happening. The short-term invalidation point may be moved lower. Summary: Both the main and...