Last analysis of silver was published on 5th May, 2013. It’s time to update this analysis. I will endeavor to update Silver for you once a week, time permitting.

Click on the charts below to enlarge.

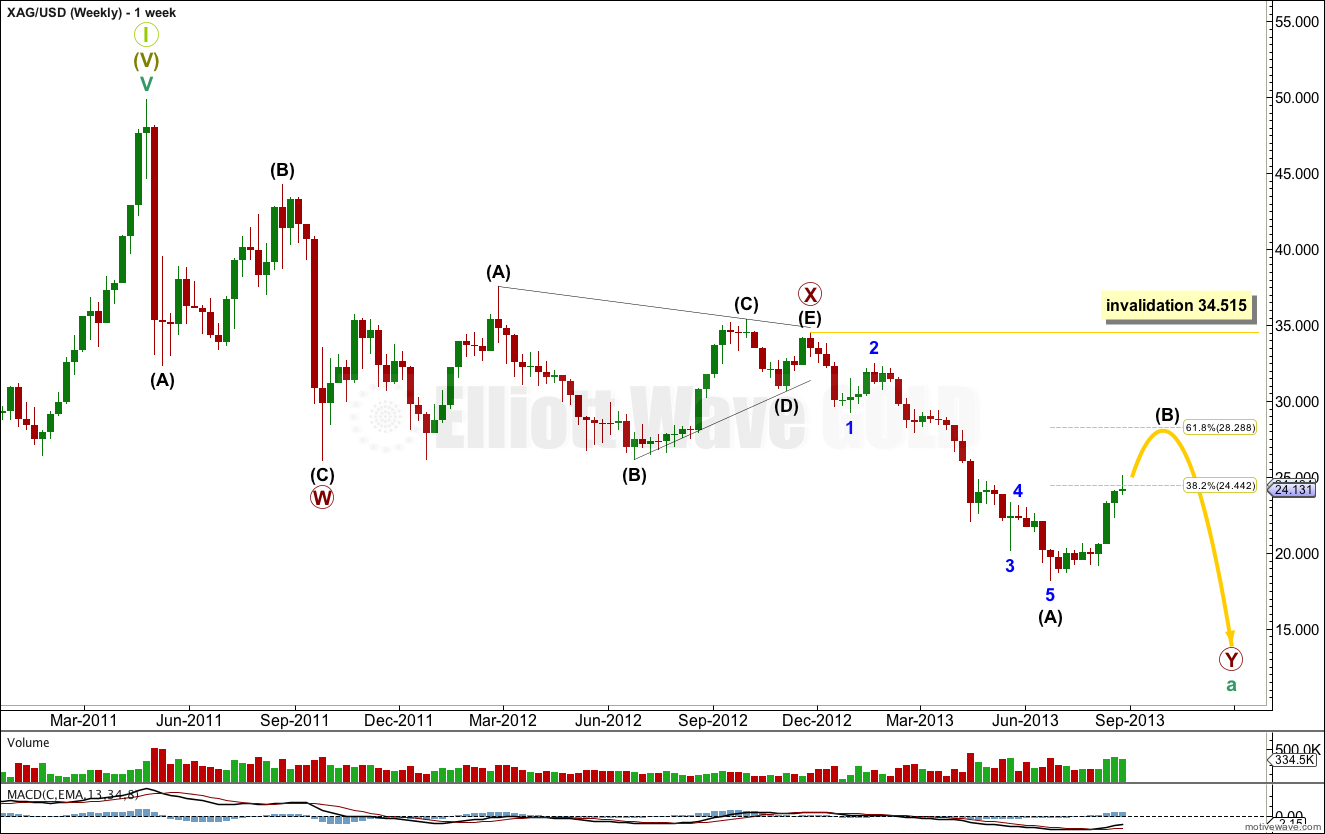

At the monthly chart level the long rise for silver to the all time high at 49.51 looks like a completed five wave impulse. Because this lasted generations it may be a grand super cycle wave.

No matter what degree downwards movement is labeled, it is a correction and it is incomplete.

The current corrective structure is unfolding as a double zigzag. Primary wave W is a zigzag, and the double is joined by a correction in the opposite direction, a triangle labeled primary wave X. The second structure in the double has begun with a completed five wave structure downwards, and it is also unfolding as a zigzag. This corrective structure at cycle degree is a double zigzag.

The second zigzag of primary wave Y is incomplete.

Within the first zigzag in the double, primary wave W, intermediate wave (C) is just 0.67 longer than intermediate wave (A).

Primary wave X is a completed regular contracting triangle.

Primary wave Y is incomplete.

Within primary wave Y downwards movement for intermediate wave (A) subdivides nicely into a five wave impulse.

Ratios within intermediate wave (A) are: there is no Fibonacci ratio between minor waves 3 and 1, and minor wave 3 is just 0.01 short of 0.382 the length of minor wave 3.

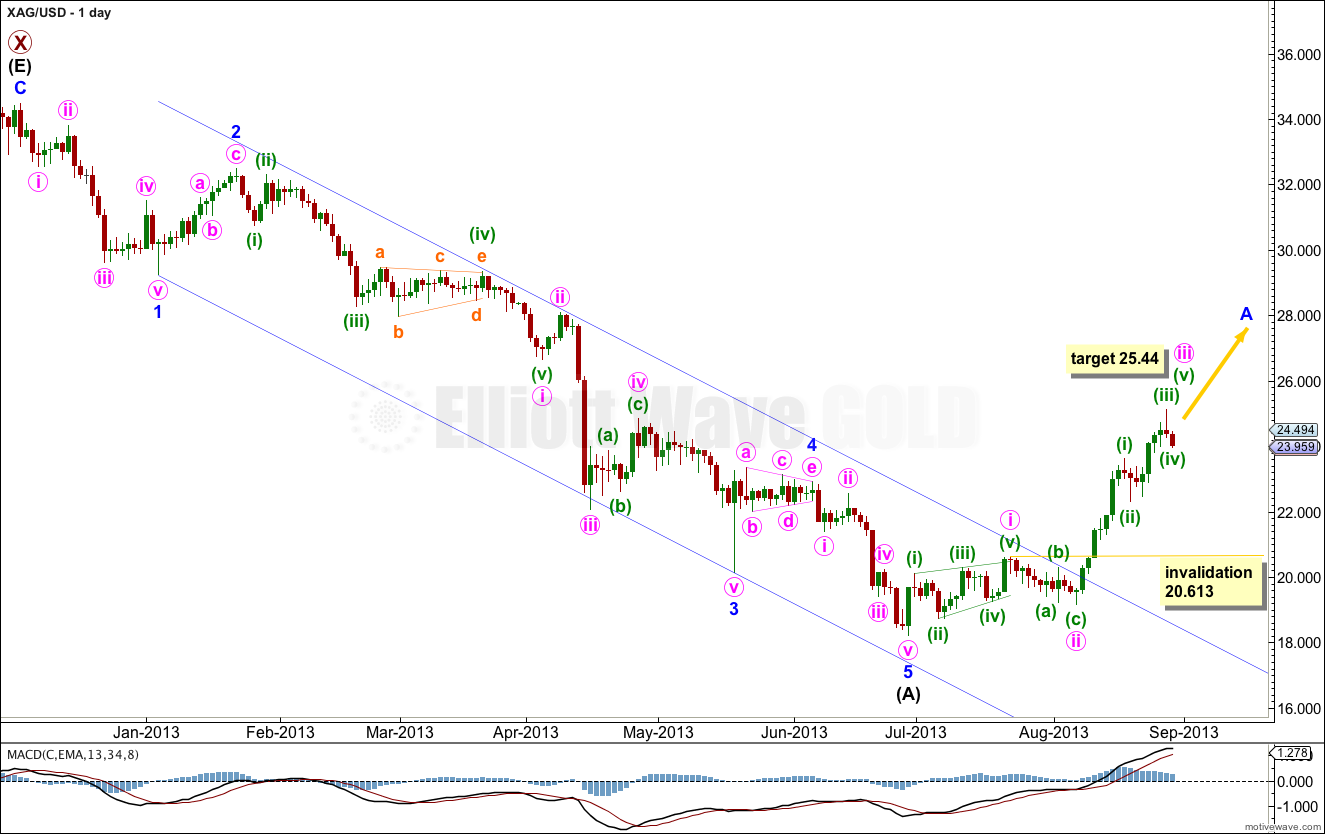

Within intermediate wave (B) so far the structure may be unfolding as a zigzag. Minor wave A is an incomplete five wave impulse.

Upwards movement for minute wave iii within minor wave A is showing a strong increase in upwards momentum, indicating a third wave which indicates an impulse for minor wave A.

At 25.44 minute wave iii would reach 2.618 the length of minute wave i.

When minute wave iii is complete then minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 20.613.

If price moves below 20.613 then minor wave A subdivided into a three wave zigzag. At that stage we should expect minor wave B to reach down to at least 90% the length of minor wave A, and to be very likely to make a new low below the start of minor wave A at 18.215. Intermediate wave (B) then may unfold as a flat or combination.

Hi Lara, I really would love, if you could do a EW Silver Analyse once a week!! Greetings Susanne

Hi Lara,

With your main count for silver showing considerable future downside potential…………..are you of the opinion that this makes your alternate gold count more likely ?

I’m thinking that silver and gold tend to lead eachother higher and lower in tandem.

Thanks,

Tyke.