Last analysis expected the end of a fourth wave correction to be confirmed by a channel breach on the hourly chart. We did not get a confirmation that the correction was over. Price continued lower breaching invalidation points on both hourly wave counts.

Click on the charts below to enlarge.

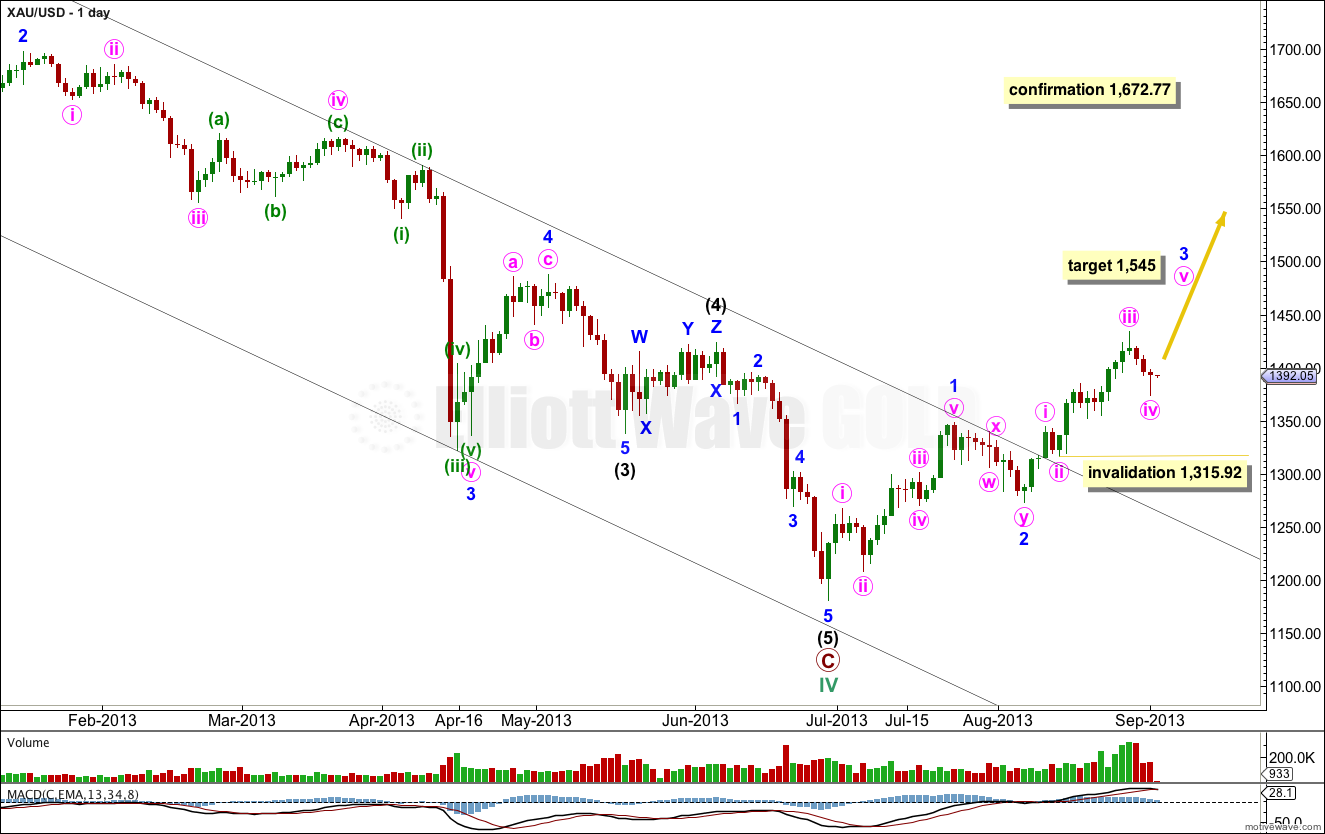

Primary wave C may be complete. Primary wave C is 28.96 short of 1.618 the length of primary wave A.

Ratios within primary wave C are: there is no Fibonacci ratio between intermediate waves (3) and (1), and intermediate wave (5) is 13.77 short of 0.618 the length of intermediate wave (3).

Within intermediate wave (1) there are no adequate Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within intermediate wave (3) are: minor wave 3 is 24.72 longer than 2.618 the length of minor wave 1 (a 6.8% variation; I consider less than 10% acceptable), and minor wave 5 is 11.74 longer than 0.382 the length of minor wave 3.

Ratios within minor wave 3 are: minute wave iii is 10.78 longer than 2.618 the length of minute wave i, and minute wave v has no Fibonacci ratio to minute wave i.

Ratios within intermediate wave (5) are: minor wave 3 has no Fibonacci ratio to minor wave 1, and minor wave 5 is just 1.61 short of equality with minor wave 3.

A best fit parallel channel is so far clearly breached by upwards movement, no matter how the channel is drawn. This indicates a probable trend change.

Within the new upwards trend of cycle wave V, within minute wave iii no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,315.92.

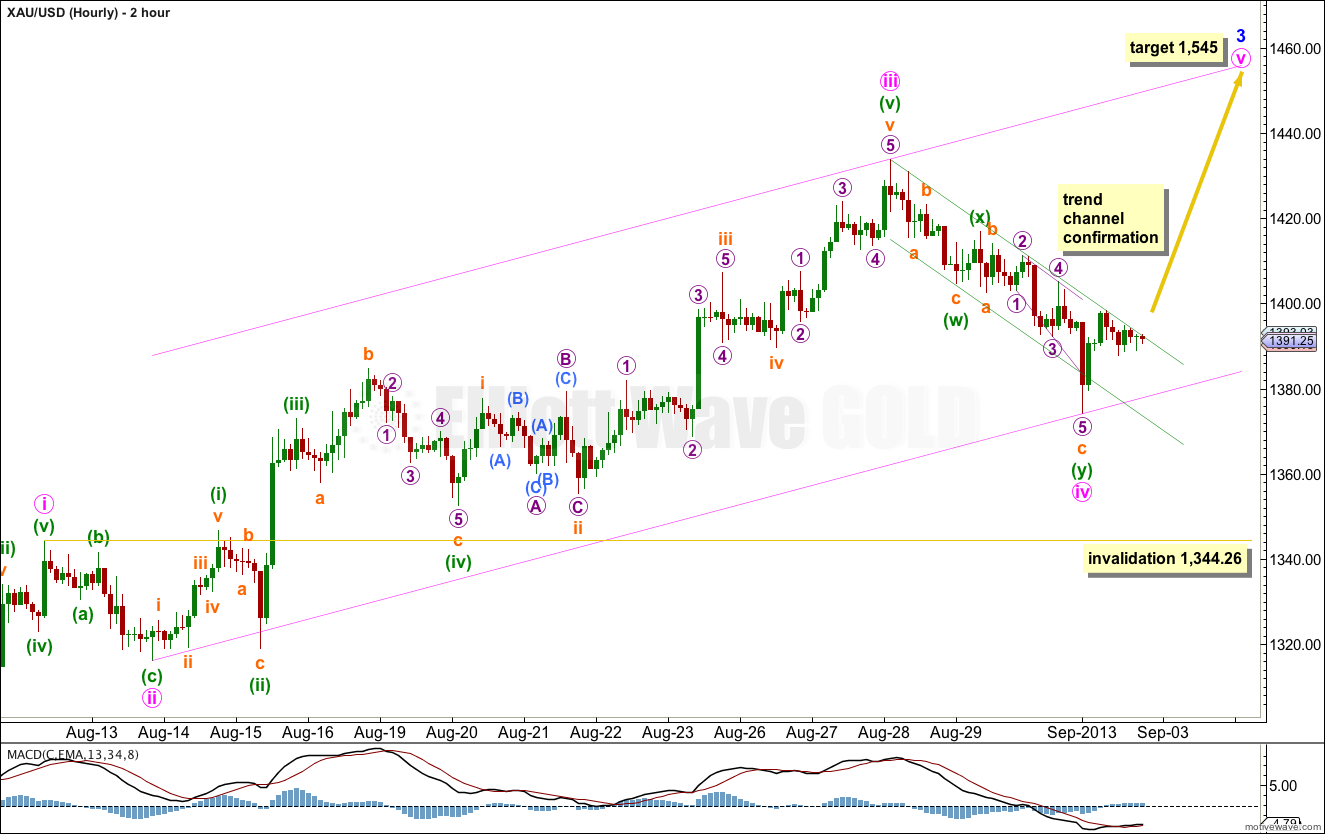

This downwards movement cannot be minuette wave (iv) within minute wave iii, nor can it be subminuette wave iv within minuette wave (iii). Both of those wave counts were invalidated in last analysis.

The structure for this third wave, minor wave 3, is most likely incomplete. I have tried to see a five wave impulse completed within this upwards wave, but within it the third wave would be slightly the shortest. This core Elliott wave rule cannot be broken.

Within minor wave 3 incomplete this downwards movement is likely to be a fourth wave correction. It may be minute wave iv.

Minute wave iii is just 2.58 longer than 1.618 the length of minute wave i.

Ratios within minute wave iii are: minuette wave (iii) is 4.37 longer than 1.618 the length of minuette wave (i), and minuette wave (v) is 1.27 short of 2.618 the length of minuette wave (i).

Minuette wave (v) is extended. Ratios within minuette wave (v) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is 3.28 longer than 1.618 the length of subminuette wave i.

There is nice alternation between minute wave ii, a shallow 40% single zigzag, and minute wave iv, a slightly deeper 51% double zigzag.

A clear trend channel breach of the downwards sloping smaller channel about minute wave iv would provide confirmation that the correction is over and the next wave is underway. We still do not have this confirmation.

Movement above 1,413.97 would be strong indication that minute wave iv is completed as at that stage it could not be a second wave correction within subminuette wave c of minuette wave (y), and so minuette wave (y) would have to be over.

Good work, keep it up.

Thanks. It was all good… until today’s invalidation.

There is just no way I can always be right.

Yes…………and it looks like you may well be correct with today’s movement higher.

Thanks Lara

Hi Lara,

Do you think it possible that minute wave (iv) has lower to travel yet because it seems fairly typical for a corrective wave to reach the price territory of the second wave of a previous extended fifth wave…….in this case the extended fifth wave of minute wave (iii).

Regards,

Tyke

Possibly. And yes, that’s a common place for fourth waves to end after a fifth wave extension.

Except… it looks nicely in proportion now to minute wave ii, in fact it’s longer in duration. So a continuation would start to be out of proportion giving the wave count an odd look.