Gold moved lower in a fourth wave correction, which was expected, and we had no confirmation that the correction was over.

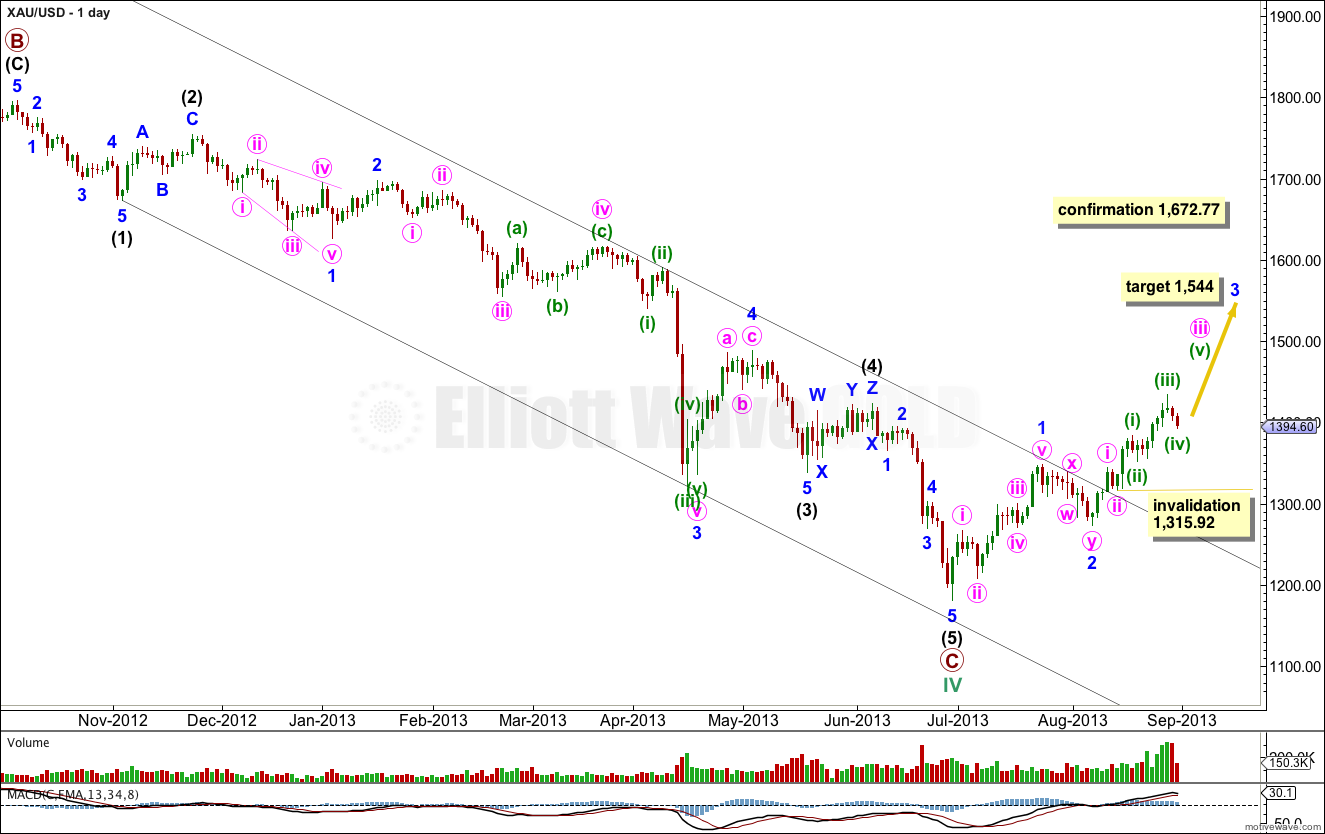

The wave count remains the same at the daily chart level, with two hourly wave counts for you today.

Click on the charts below to enlarge.

Primary wave C may be complete. Primary wave C is 28.96 short of 1.618 the length of primary wave A.

Ratios within primary wave C are: there is no Fibonacci ratio between intermediate waves (3) and (1), and intermediate wave (5) is 13.77 short of 0.618 the length of intermediate wave (3).

Within intermediate wave (1) there are no adequate Fibonacci ratios between minor waves 1, 3 and 5.

Ratios within intermediate wave (3) are: minor wave 3 is 24.72 longer than 2.618 the length of minor wave 1 (a 6.8% variation; I consider less than 10% acceptable), and minor wave 5 is 11.74 longer than 0.382 the length of minor wave 3.

Ratios within minor wave 3 are: minute wave iii is 10.78 longer than 2.618 the length of minute wave i, and minute wave v has no Fibonacci ratio to minute wave i.

Ratios within intermediate wave (5) are: minor wave 3 has no Fibonacci ratio to minor wave 1, and minor wave 5 is just 1.61 short of equality with minor wave 3.

A best fit parallel channel is so far clearly breached by upwards movement, no matter how the channel is drawn. This indicates a probable trend change.

Within the new upwards trend of cycle wave V, within minute wave iii no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,315.92.

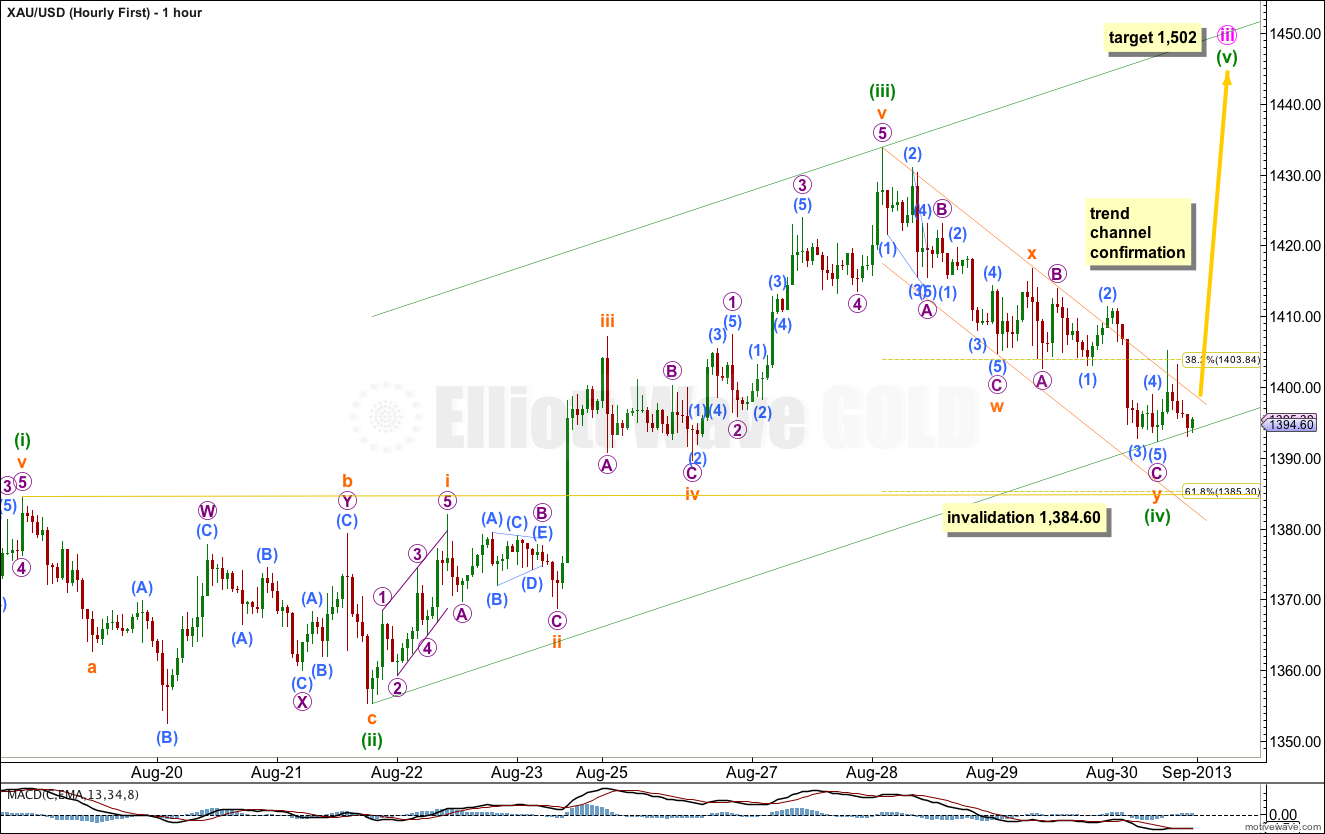

First Hourly Wave Count.

This wave count follows on directly from last analysis. The downwards movement for the last two days may be minuette wave (iv) within an extending third wave of minute wave iii.

At this stage minuette wave (iv) subdivides best as a double zigzag. The second zigzag structure is completed. There is nice alternation between minuette waves (ii) and (iv) so far; minuette wave (ii) is a relatively shallow 43% single zigzag, minuette wave (iv) is a relatively deep 53% double zigzag.

When the best fit parallel channel drawn about minuette wave (iv) is clearly breached by upwards movement we shall have an indication that minuette wave (v) has begun.

Ratios within minuette wave (iii) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 1.11 longer than 1.618 the length of subminuette wave i.

At 1,431 minute wave iii would reach 1.618 the length of minute wave i. This target is probably too low, and it would expect a very short fifth wave. At 1,502 minute wave iii would reach 2.618 the length of minute wave i.

When minuette wave (iv) has ended then the target for minute wave iii can be calculated at a second wave degree, so it may widen to a zone or it may change.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement below 1,384.60.

If this first wave count is invalidated with downwards movement then we should use the second wave count below.

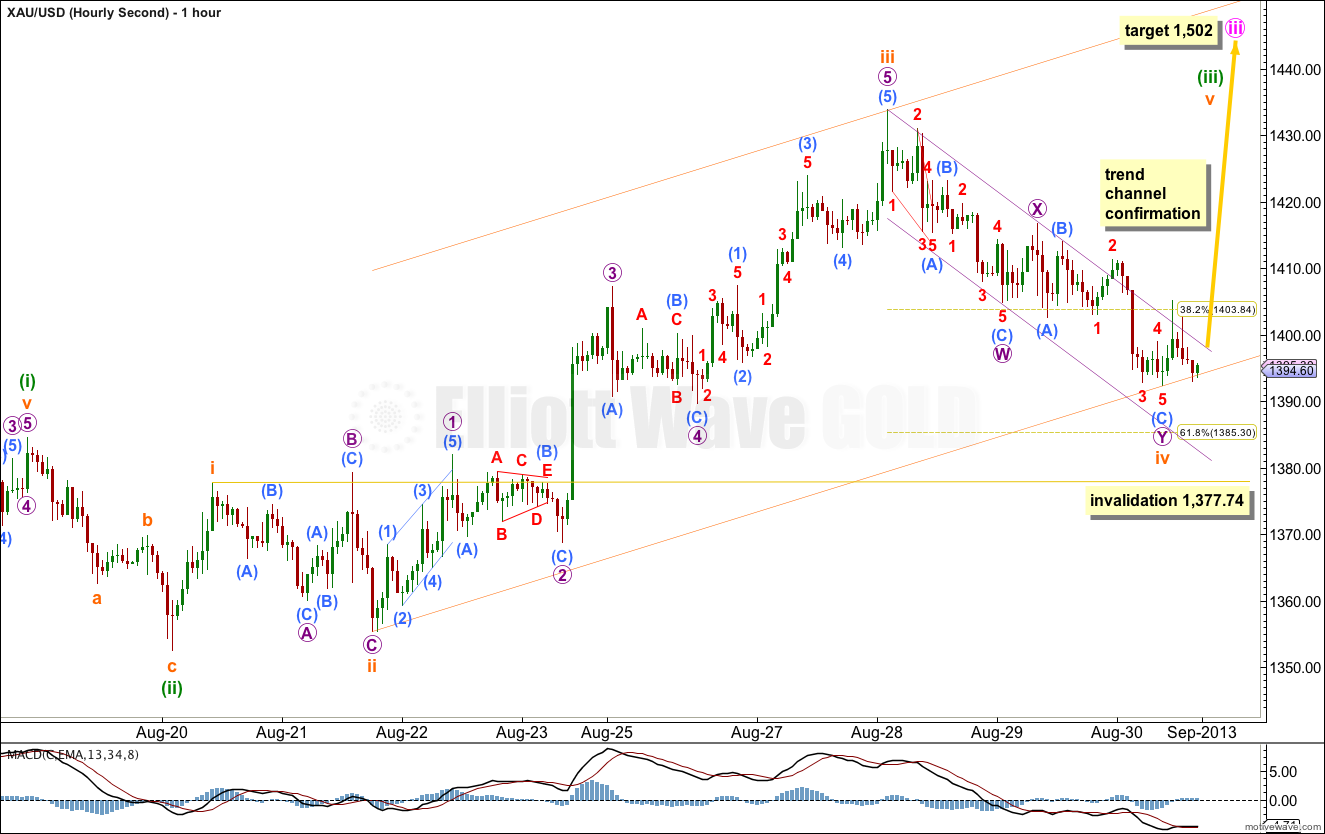

Second Hourly Wave Count.

If we see the movement within minuette wave (ii) differently, it may have been over sooner. This second wave count avoids the problem of a truncated C wave within minuette wave (ii). Downwards movement for the last two days is still a fourth wave correction, but one degree lower.

There is no Fibonacci ratio between subminuette waves iii and i.

All subdivisions from the start of subminuette wave iii are seen in the same way for both wave counts, but here only the degree of labeling differs. The key difference within minuette wave (ii) is the downwards piece of movement labeled here submiuette wave c. This second wave count sees it as a five wave structure, and the first wave count sees it as a three. On the five minute chart it fits a little better as a three.

If price moves below 1,384.60 the first wave count would be invalidated. This wave count would remain valid and would be the best explanation I can see.

Subminuette wave iv may not move into subminuette wave i price territory. This wave count is invalidated with movement below 1,377.74.

Lara, is there anyway that i dont have to be notifyed on comments follow-up please? Please do not notify me of follow-up comments by email.

Only notify me if it is posible only when you post new charts and video for gold and silver.

I’m looking into it. I haven’t found the solution yet. When you make comments there is not option to check to request follow up that you can leave out?