Yesterday’s analysis expected more downwards movement which is what we have seen. Price has moved below the first short term target which was at 1,276 to 1,274.

Movement below 1,277.97 has invalidated the first alternate wave count. There is now just the main wave count and one alternate, and both expect the same direction next.

Click on the charts below to enlarge.

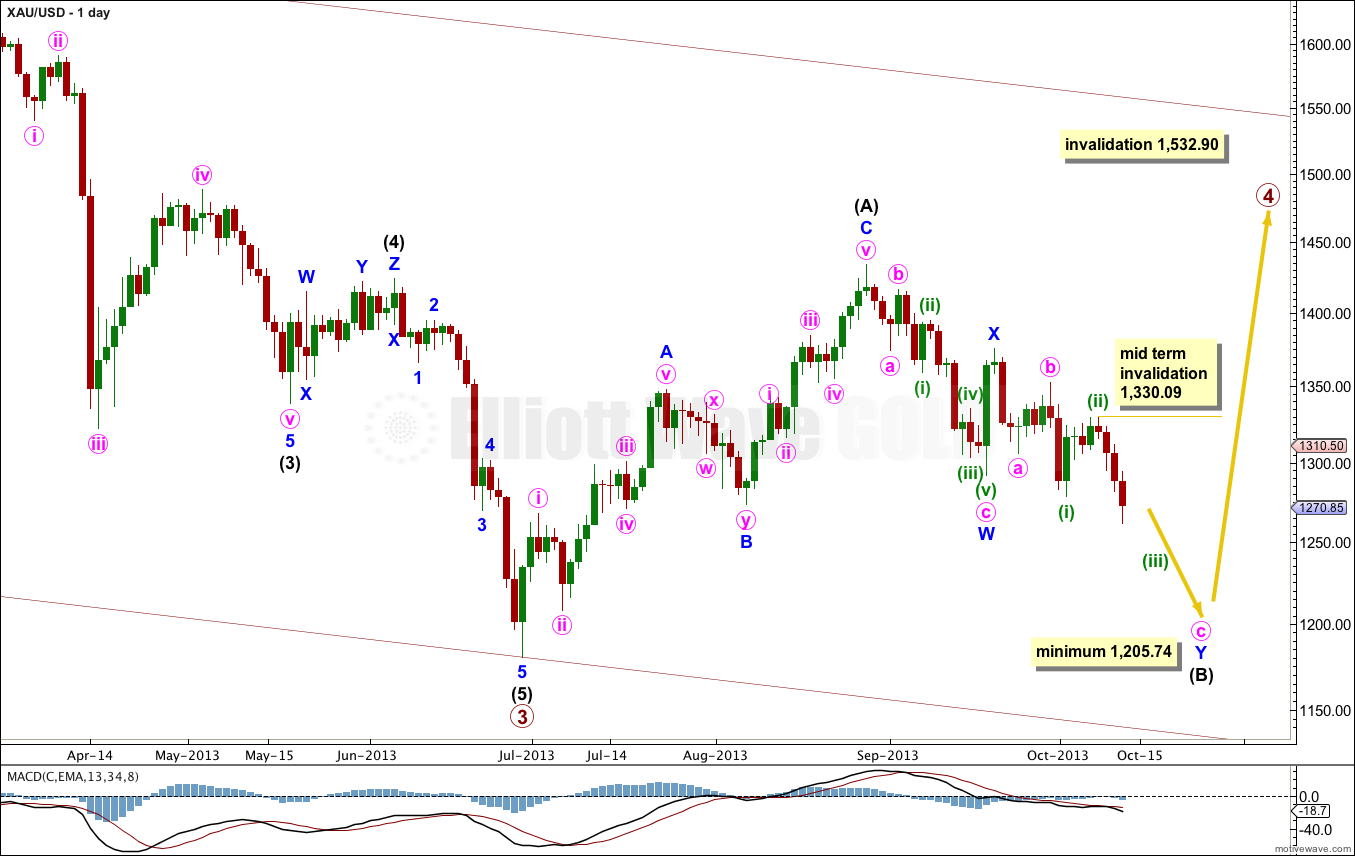

Main Wave Count.

This is the main wave count with the highest probability. Flat corrections are extremely common structures, particularly in fourth waves. Primary wave 2 was a rare running flat, and primary wave 4 may exhibit alternation if it is a more common expanded flat or a still common regular flat. Primary wave 4 may also exhibit alternation if it is shallow; primary wave 2 was very deep.

Primary wave 2 lasted 53 weeks. It would be likely that primary wave 4 will continue for longer to be better in proportion to primary wave 2.

It is most likely that primary wave 4 is not over and is unfolding as a large flat correction. Within the flat intermediate wave (B) is an incomplete double zigzag. Within the second zigzag of this double, labeled minute wave y, minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated at this stage and for some time yet with movement above 1,532.90.

Within the flat correction intermediate wave (B) must be at least 90% the length of intermediate wave (A). This wave count requires more downwards movement to this minimum at 1,205.74.

Within an expanded flat the B wave is 105% the length of the A wave, so this wave count allows for a new low as quite likely, because expanded flats are the most common type of flat.

Intermediate wave (B) would be about three or so weeks away from ending.

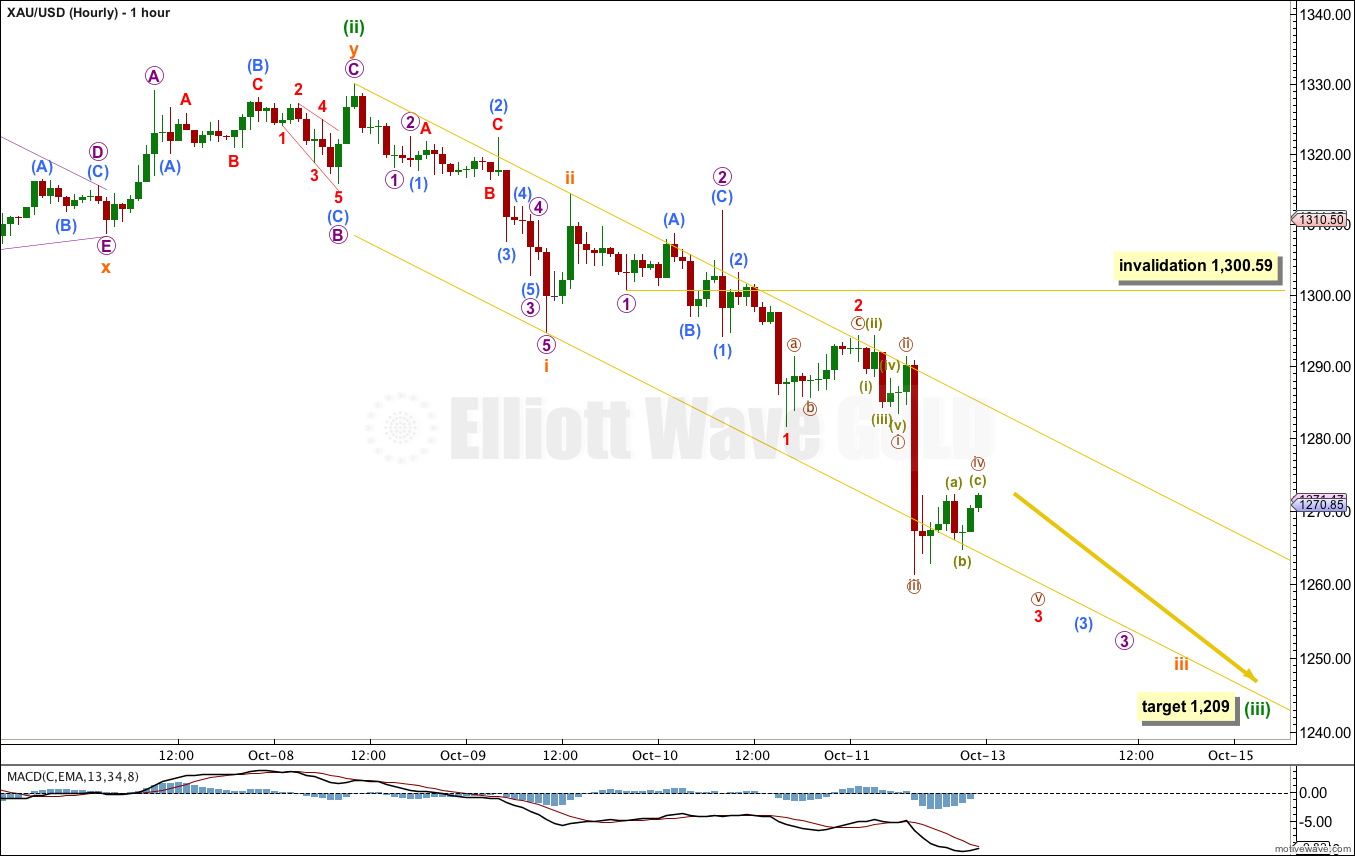

The increase in downwards momentum for Friday’s session looks like the middle of a third wave. The channel drawn here is an acceleration channel which should be breached by a third wave. Friday’s downwards movement has breached the lower edge of this channel giving this wave count a typical look.

Within the middle of this third wave minuscule wave 3 has already passed 1.618 the length of minuscule wave 1. The next target for it to end would be at 1,238 where it would reach 2.618 the length of minuscule wave 1.

Within minuscule wave 3 nano wave iii is 1.58 longer than 2.618 the length of nano wave i.

Overall this wave count expects more downwards movement with strong but decreasing momentum, and a series of small fourth wave corrections along the way down. I would expect this trend channel to continue to be breached with downwards movement.

The next fourth wave correction would be minuscule wave 4 (red) which may not move back into minuscule wave 1 price territory above 1,281.69.

Following minuscule waves 4 up and 5 down, submicro wave (4) up may not move into submicro wave (1) price territory above 1,304.14.

Following submicro wave (4) up and submicro wave (5) down the following upwards correction for micro wave 4 may not move into micro wave 1 price territory above 1,300.59. This wave count is invalidated at that stage with movement above 1,300.59.

When micro wave 3 is complete I will redraw the channel using Elliott’s first technique.

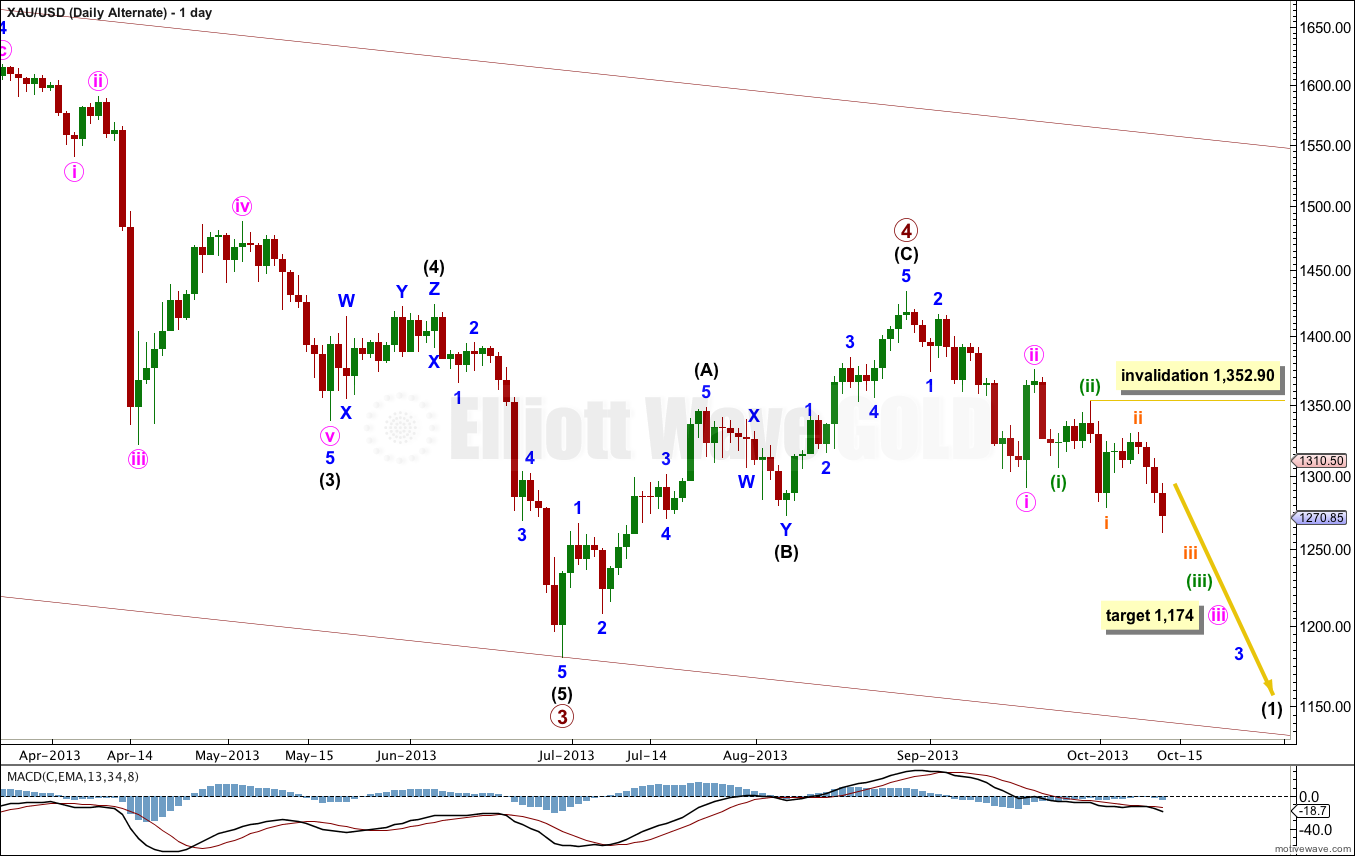

Alternate Wave Count.

This wave count has the lowest probability because it would see primary wave 4 as having lasted only 9 weeks. Compared to primary wave 2 having lasted 53 weeks, this lack of proportion gives this alternate wave count the wrong look at the weekly chart level. This significantly reduces the probability of this wave count.

This alternate expects very strong downwards movement as the middle of a third wave unfolds. If the next wave down shows a very strong increase in momentum then I would more seriously consider this alternate.

At 1,174 minor wave 3 would reach 1.618 the length of minor wave 1.

Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is invalidated with movement above 1,352.90.

hi Lara..

if gold is likely to exceed its previous low, how likely is silver to remain above its previous lows?

.. or… is silver now in a correction back up to $26, without having met your $20.36 target?

thx