Yesterday’s analysis expected more upwards movement from gold before a correction. This is not what happened as price has moved a little lower, and the correction has already arrived.

Click on the charts below to enlarge.

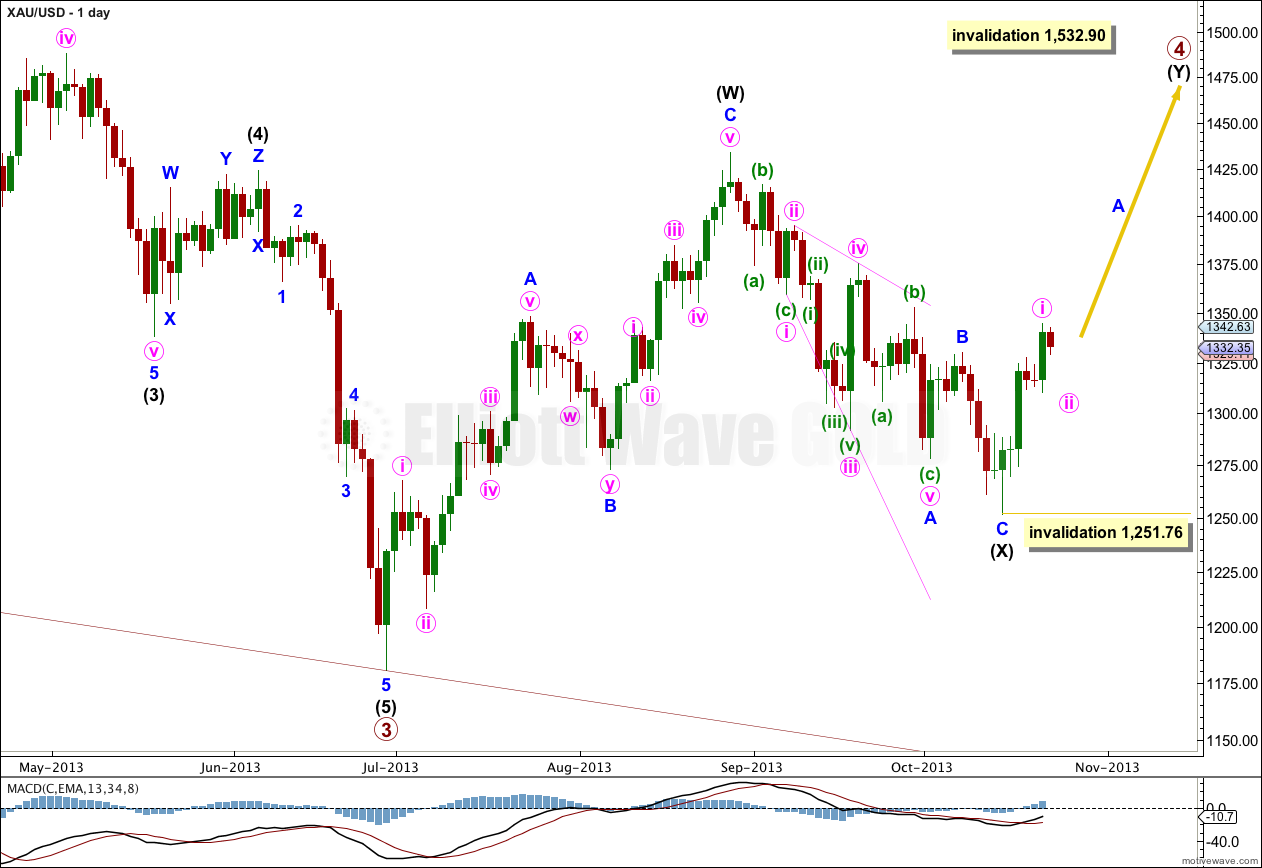

Gold has completed its downwards wave and is in the early stages of the next wave up which should last at least a month.

The structure for primary wave 4 cannot be a flat correction, because what would be the B wave is well less than 90% of what would be the A wave. That is why I have labeled it as a double.

Because intermediate wave (X) is quite shallow I would expect primary wave 4 is most likely a double zigzag rather than a double combination. Double combinations move price sideways and their X waves are usually deeper than this one is. Double zigzags trend against the main direction, and their purpose is to deepen a correction when the first zigzag did not take price deep enough. So I will be expecting intermediate wave (Y) to subdivide as a zigzag and to take price comfortably above 1,433.83. It should last about 35 to 45 days or sessions in total.

Within intermediate wave (Y) no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,251.76.

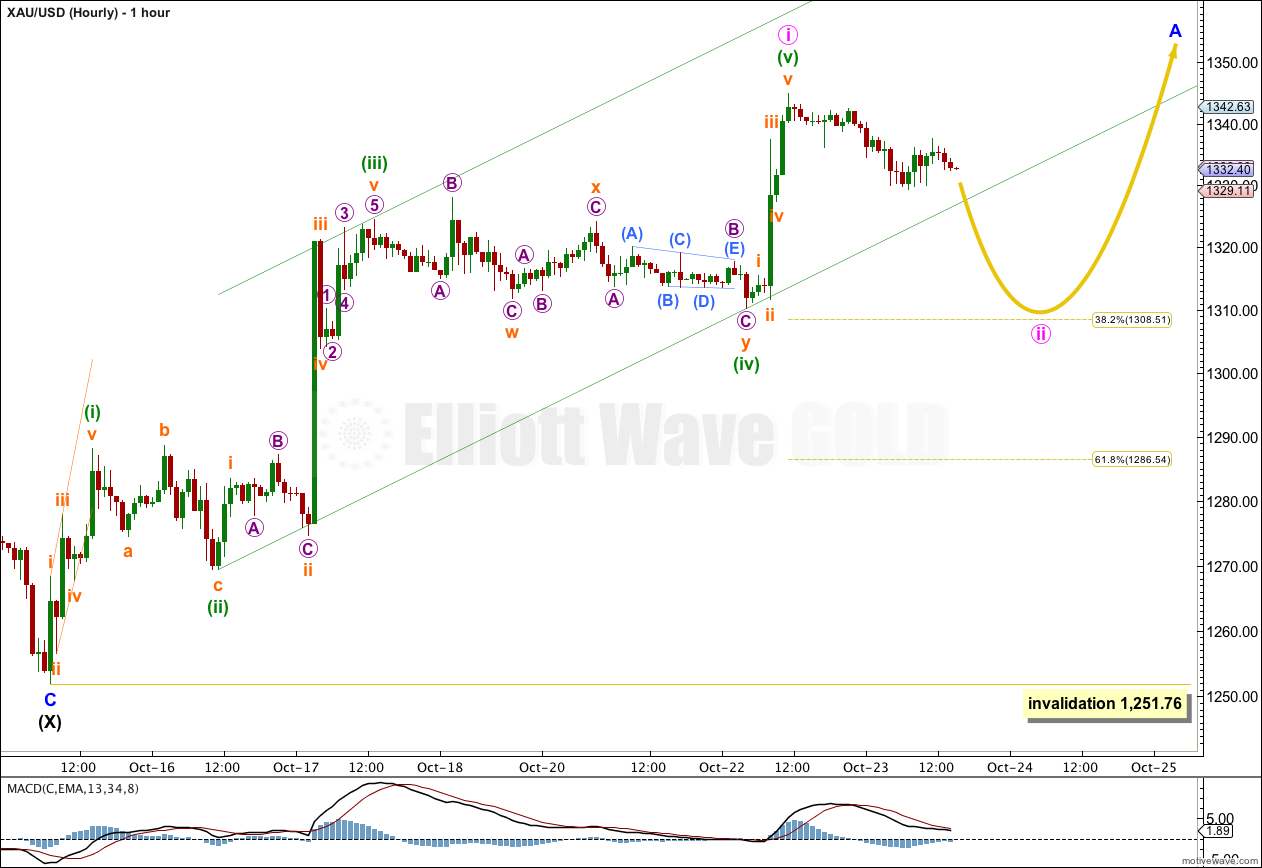

With the sideways and lower movement of the last several hours it is most likely that minute wave ii is underway.

There is a clear five wave structure upwards, and within minute wave i there is alternation between minuette waves (ii) and (iv): minuette wave (ii) is a relatively deep 52% expanded flat and minuette wave (iv) is a shallow 26% double combination.

Ratios within minute wave i are: minuette wave (iii) is 3.74 short of 1.618 the length of minuette wave (i), and minuette wave (v) is 1.83 short of equality with minuette wave (i).

Minute wave ii may end either about the 0.382 or 0.618 Fibonacci ratio of minute wave i, with the 0.382 being the first target. If price drops through this first target then the 0.618 Fibonacci ratio would be the next likely target.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,251.76.

http://therefinedinvestor.com/wp-content/uploads/2013/10/Oct-22nd-Gold-Bullish-Scenario.png

Here is another version I would like your opinion on. It is a bullish scenario similar to PUG’s.

Nope. I don’t like that at all.

There are so many errors in that wave count I don’t know where to start. It could fit with some changes, but the way it is labeled, the subdivisions don’t fit.

The biggest problem with that wave count is it is labeling the fourth wave as a double combination, but the correction trends sharply against the main direction. This is not what combinations do, and most certainly not like that.

Hi Lara,

I see that PUG is a “friend”. I don’t subscribe to him, but I noticed that he has a weekly GLD chart on stock charts.com. His LT view appears to differ from yours regarding the 2011 high. If I’m stating this correct, he shows it as a P3 and you show it as a P5. As detailed as you are, I’m sure yours is based on being the higher probability. I’m thinking that his count would only prove to be correct if we break 1532 on the upside. Can you comment? Thanks! Bob

If you could leave a link to his chart I can make an accurate reply.

I think you may be saying that the low about 1,175 is the end of P5 on Pug’s chart? then that would be a rather strange looking impulse ending there. I would be very interested to see how he sees the subdivisions.

You are absolutely correct. That idea may be proven correct if price breaks above 1,532. Or rather, I would still see the downwards wave as a three, and the upwards wave as a three, so a huge flat could be unfolding. I would rather see that than the downwards wave as a five.

http://stockcharts.com/public/1696337

Thanks. That’s certainly a valid wave count. He’s labeling this downwards move as a double zigzag which is completed.

It looks a little unusual in form for a double zigzag. But the subdivisions certainly do fit.

It’s kind of in line with my monthly alternate. Both would be confirmed above 1,532.90.