At this stage my wave counts for Gold and Silver diverge strongly. At the daily chart level both gold and silver turn together, which means one of my wave counts would have to be wrong.

But I am unable to see a wave count for Silver at the moment which requires more downwards movement. That is not because one does not exist. I just have not seen it yet, and if I do I will publish it.

At this stage it is possible that Gold has completed its downwards wave and is in the early stages of the next wave up which would last at least a month.

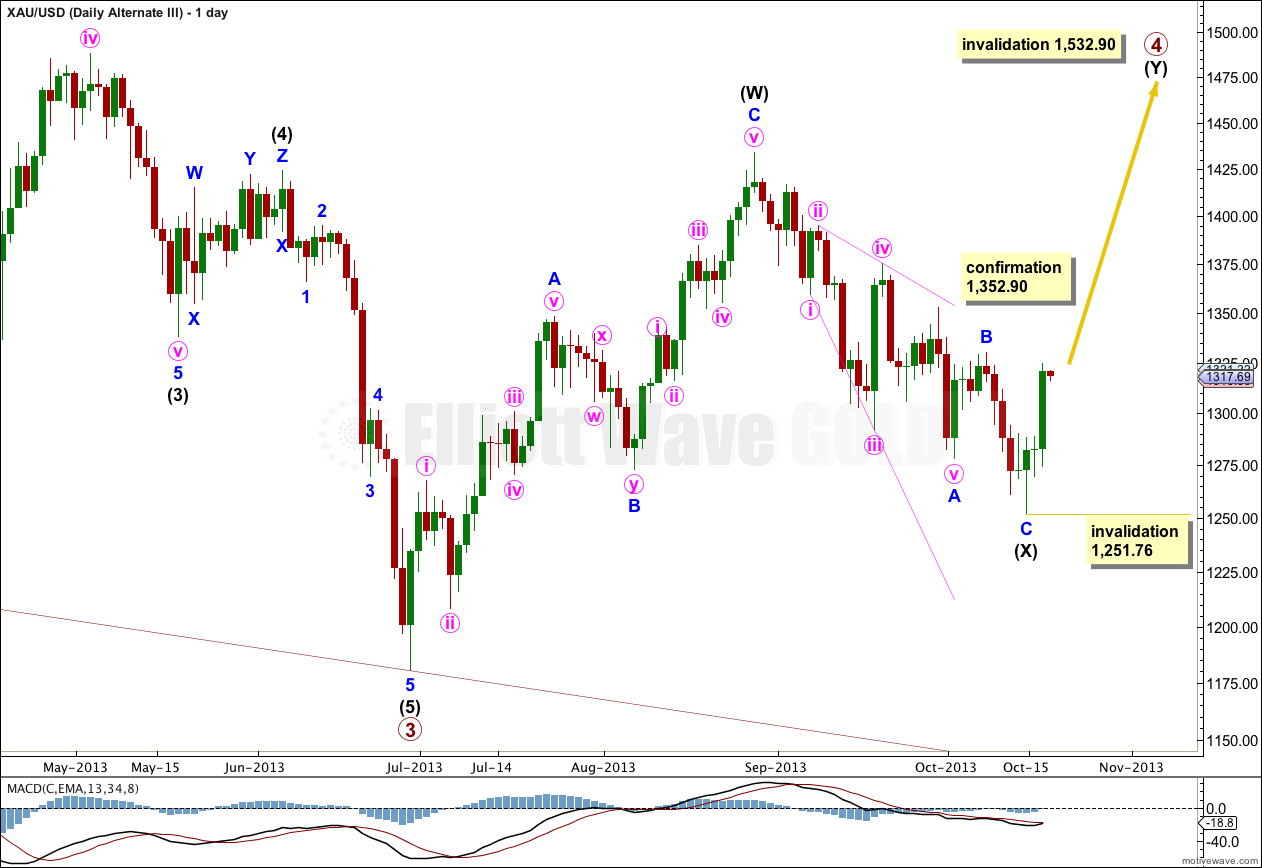

If primary wave 4 is a double zigzag, then within the double intermediate wave (X) may be complete.

Within intermediate wave (X) minor wave A may be a completed leading expanding diagonal. However, within this structure the third wave is the longest, and minute wave ii is only 0.48 of minute wave i, less than the normal range of 0.66 to 0.81. These two problems reduce the probability of this wave count.

Movement above 1,352.90 would invalidate the main wave count and confirm this alternate.

Lots of fundamental thoughts now to support the bullish view. Kick the can on the budget deal and debt ceiling may slow the Fed taper, dollar down, bullish for gold.

Let’s see if this EW pattern is the winner!