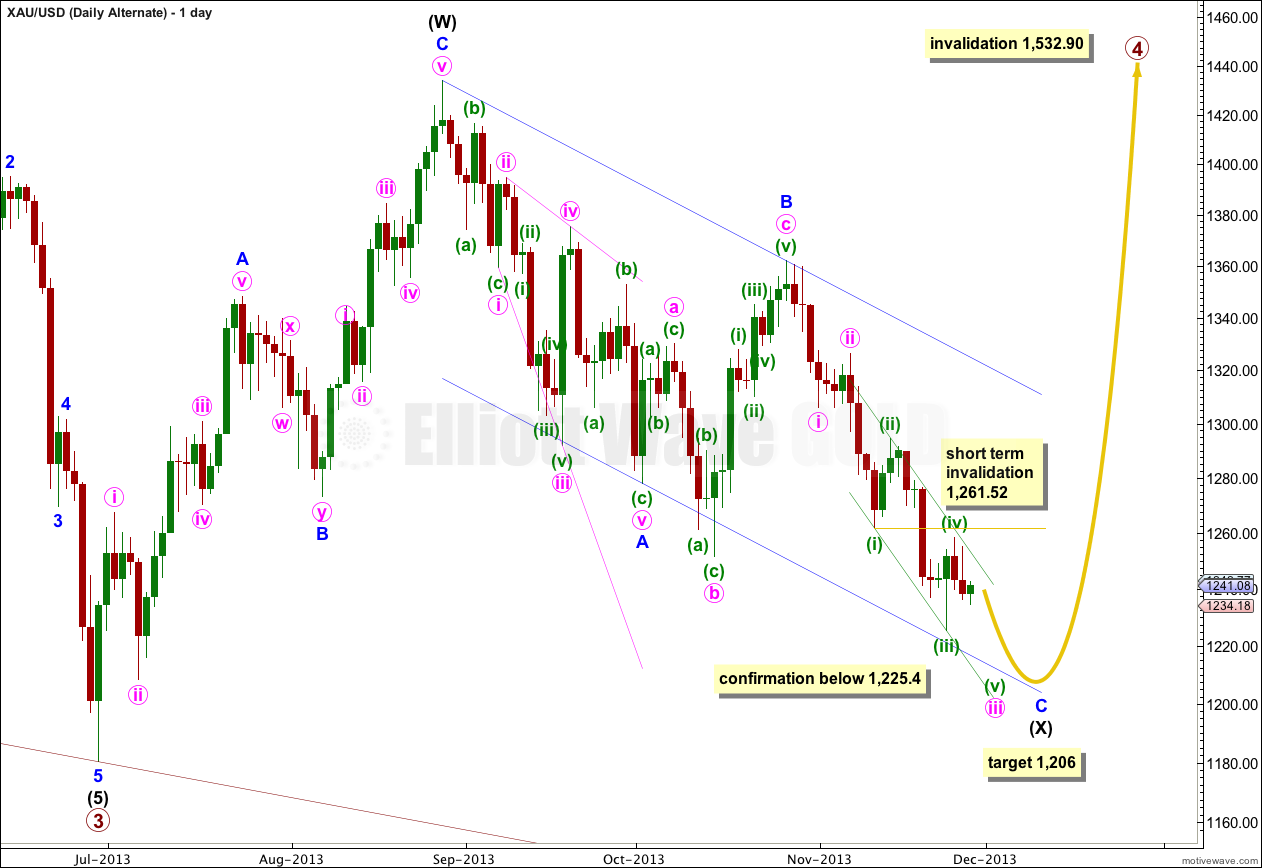

I have been trying to see a valid wave count which would allow for more movement below 1,225.40 (and an equivalent for Silver).

I have found a wave count which has a very nice fit and is entirely viable. Not only will it provide an explanation of what should happen next if price moves below 1,225.40 and invalidates the main wave count, but it nicely provides a confirmation point above which this new alternate is invalid and so the main wave count would be further confirmed.

While price remains within the pink parallel channel on the daily chart for the main wave count I would seriously consider this alternate.

Click on the charts below to enlarge.

Alternate Daily Wave Count.

This alternate is mostly the same as the main wave count except it sees minute wave iii within minor wave C extending. At 1,206 minor wave C would reach equality in length with minor wave A.

Within the extending third wave of minute wave iii, minuette wave (iv) may not move into minuette wave (i) price territory. This alternate would be invalidated above 1,261.52.

This wave count agrees with MACD; it sees the strongest downwards momentum as within the middle of the third wave. Only because it agrees with MACD will I consider it as a viable alternate.

If price moves above 1,261.52 then I would have full confidence in the main wave count and I would expect that gold is in a new upwards trend to last for weeks.

Main Wave Count – Updated Hourly Chart.

This is an updated hourly chart for the main wave count.

Minuette wave (ii) should now be over. At 1,281 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

My intention for you in providing confidence and confirmation points is to allow you to judge for yourselves your level of risk; as each confidence point and confirmation point is passed the number of alternate possibilities which allow for more downwards movement reduces. The probability of a trend change at 1,225.40 increases.

Initially movement above 1,255.01 would give me confidence in this wave count and a trend change at the low of 1,225.40. At that stage upwards movement could not be a second wave correction within a continuing downwards trend.

Movement above 1,261.52 would add significant confidence to this wave count. Movement above the pink parallel channel (copied over here from the daily chart) would also add confidence to this wave count.

Lara

If the Alt Daily you described were confirmed, does it allow movement below the 1206 target towards 1150, 1100 etc ?

Yes. For Gold there is no lower invalidation point.

If it moves below 1,205 then it would most likely be a flat unfolding, and the most common type of flat is an expanded flat where B = 105% X A. This would mean a new low below 1,180.40 would be quite likely.

However, for Silver there is an invalidation point, Silver should not make a new low (if my analysis of the prior upwards wave as a five is correct).

Lara. Your dedication is admirable. The scenario described differs slightly from the one I suggested in your silver posting. But, in both scenarios, Minor C would reach equality with Minor A. I would defer to your count as I did not work down to the lower degrees like you have done. That would have yielded a more accurate count.

As you said, we will await the confirmation or negation of the main wave count to see which scenario is correct, the main or the alternate.

I agree that to see C=A is quite likely.

The problem with a flat correction for Silver is the bit upwards move from 18.215 to 25.120 on 28th August does not subdivide as a three, it looks best as a five. That suggests Silver is either in a new big upwards trend, or it is a zigzag. Which does not allow for B to move beyond the start of A.

I am struggling to see a valid wave count where Silver can move below 18.215.

I’m glad members understand that sometimes we have to wait for confirmation. It’s a reasonably big trend change. Sometimes it is the trades you don’t take which make the difference between profit and loss. But also, the invalidation point is very close by so the risk is reasonably low.

Lara,

Thank you for your effort and commitment to your work. We are definitely at the crossroads and the Bears are roaring but I did go long 2 days ago but have not been happy with the chop since. I would have thought we would have taken off by now with the weakness in the US Dollar so a bearish alternative is welcomed to watch out for.

Frank.

Thanks Frank. I’m not happy with this chop either. It is unconvincing.

However, the US is quiet this week with Thanksgiving, maybe that’s the reason.

Careful attention to subdivisions will tell, and now we have a nice series of confirmation points.