A new low for Silver in the last 24 hours changes the situation. Yesterday’s alternate wave count for Silver was confirmed, and so I expect Gold should follow.

I am swapping the main and alternate wave counts for Gold over today. I am still expecting a little more upwards movement, but this should be followed by new lows within two to four days.

Click on the charts below to enlarge.

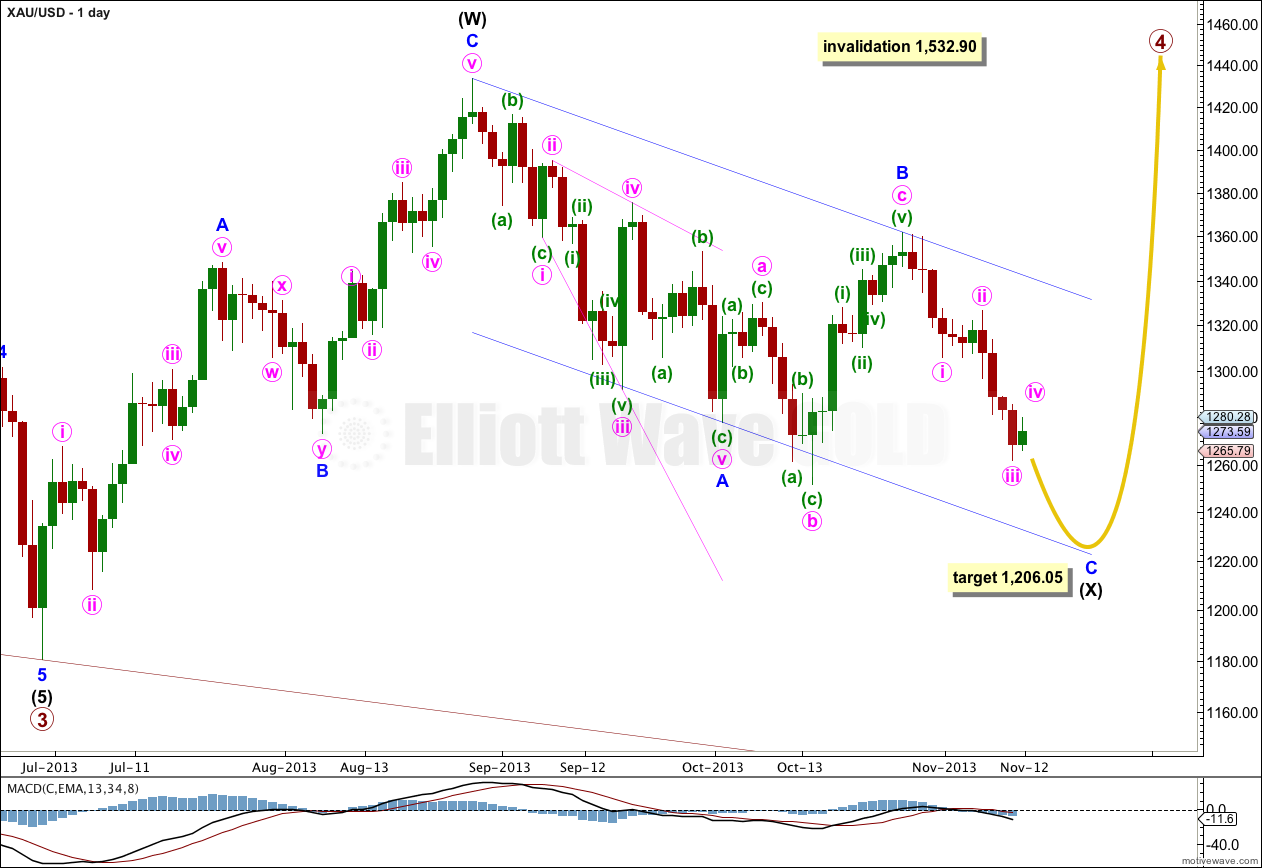

Main Wave Count.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. It is now more likely to continue as a double combination because within it intermediate wave (X) should be deep.

The purpose of double combinations is to take up time and move price sideways, so I would now expect intermediate wave (Y) to end about the same level as intermediate wave (W) at 1,433.83. Double combinations in fourth wave positions are quite common.

Within the combination intermediate wave (X) is unfolding as a zigzag. Minor wave C downwards must complete as a five wave structure. At 1,206.05 minor wave C would reach equality in length with minor wave A.

There is no lower invalidation point for intermediate wave (X); X waves may make new price extremes beyond the start of W waves, and they may behave like B waves within flat corrections. For combinations X waves often end close to the start of W waves.

I have drawn a parallel channel about the zigzag of intermediate wave (X) using Elliott’s technique for a correction. Draw the first trend line from the start of minor wave A to the end of minor wave B. Place a parallel copy upon the end of minor wave A. I will expect minor wave C to find support at the lower end of this channel, and it may end there.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within minor wave C minute waves i, ii and iii are complete. There is no Fibonacci ratio between minute waves i and iii so it will be very likely that minute wave v will exhibit a Fibonacci ratio to either of minute waves i or iii. When minute wave iv is complete, and I know where minute wave v has begun, I will add to the target calculation at minute wave degree, so the downwards target may widen to a small zone or change.

Minute wave ii was a shallow 36.5% regular flat correction of minute wave i. Given the guideline of alternation I would expect minute wave iv to most likely be a zigzag and to most likely end about the 0.618 Fibonacci ratio of minute wave iii at 1,301.30.

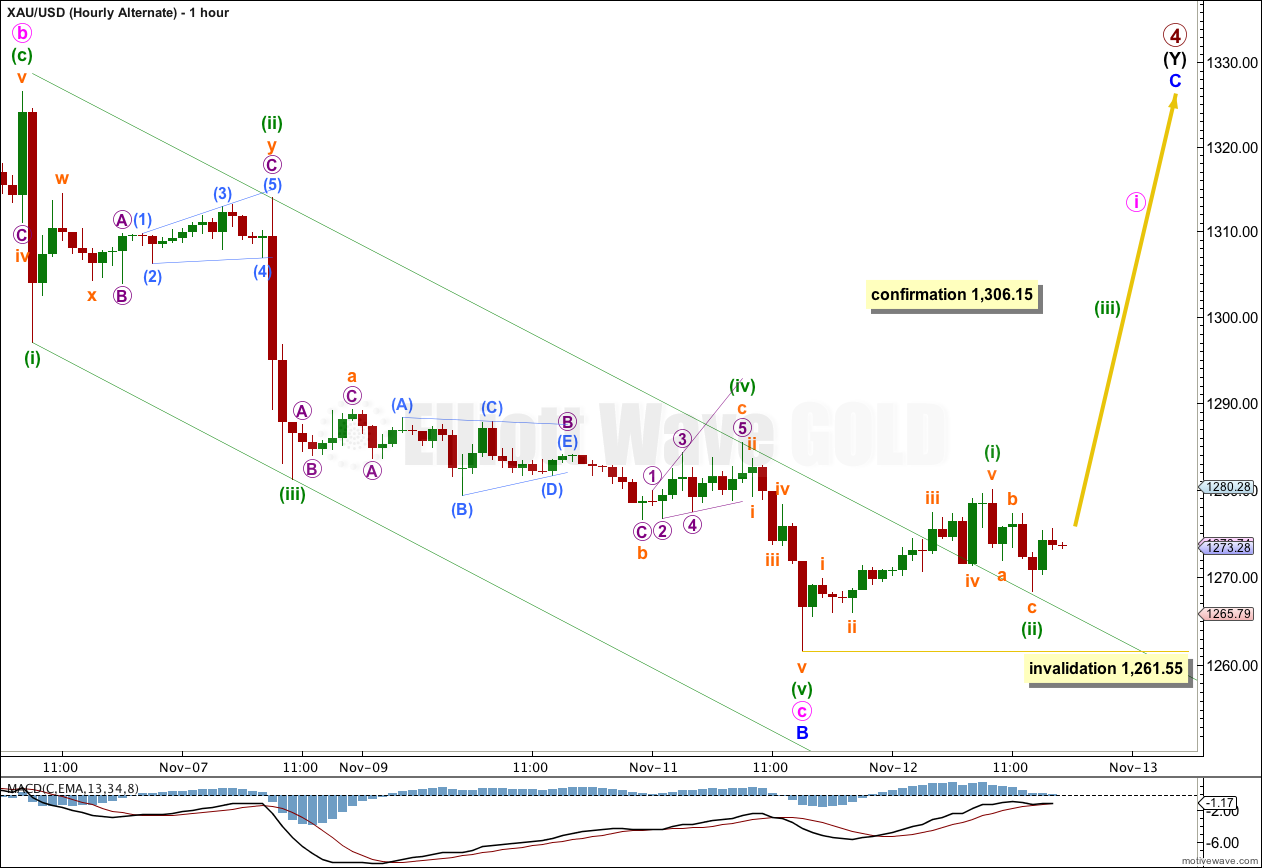

So far within minute wave iv it looks like minuette waves (a) and (b) may be complete. Minuette wave (a) subdivides nicely as a five wave impulse, and minuette wave (b) as a zigzag. Because minuette wave (a) is a five it is likely that minute wave iv is unfolding as a zigzag. At 1,298 minuette wave (c) would reach 1.618 the length of minuette wave (a).

Draw a parallel channel about minor wave C. Draw the first trend line from the lows of minute waves i to iii, then place a parallel copy upon the high of minute wave ii. I will expect minute wave iv to find resistance at the upper edge of this channel.

So far minute wave iv shows up on the daily chart as a green candlestick. Minute wave ii lasted four days, and I will expect minute wave iv to last at least another one to two days.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement above 1,306.15.

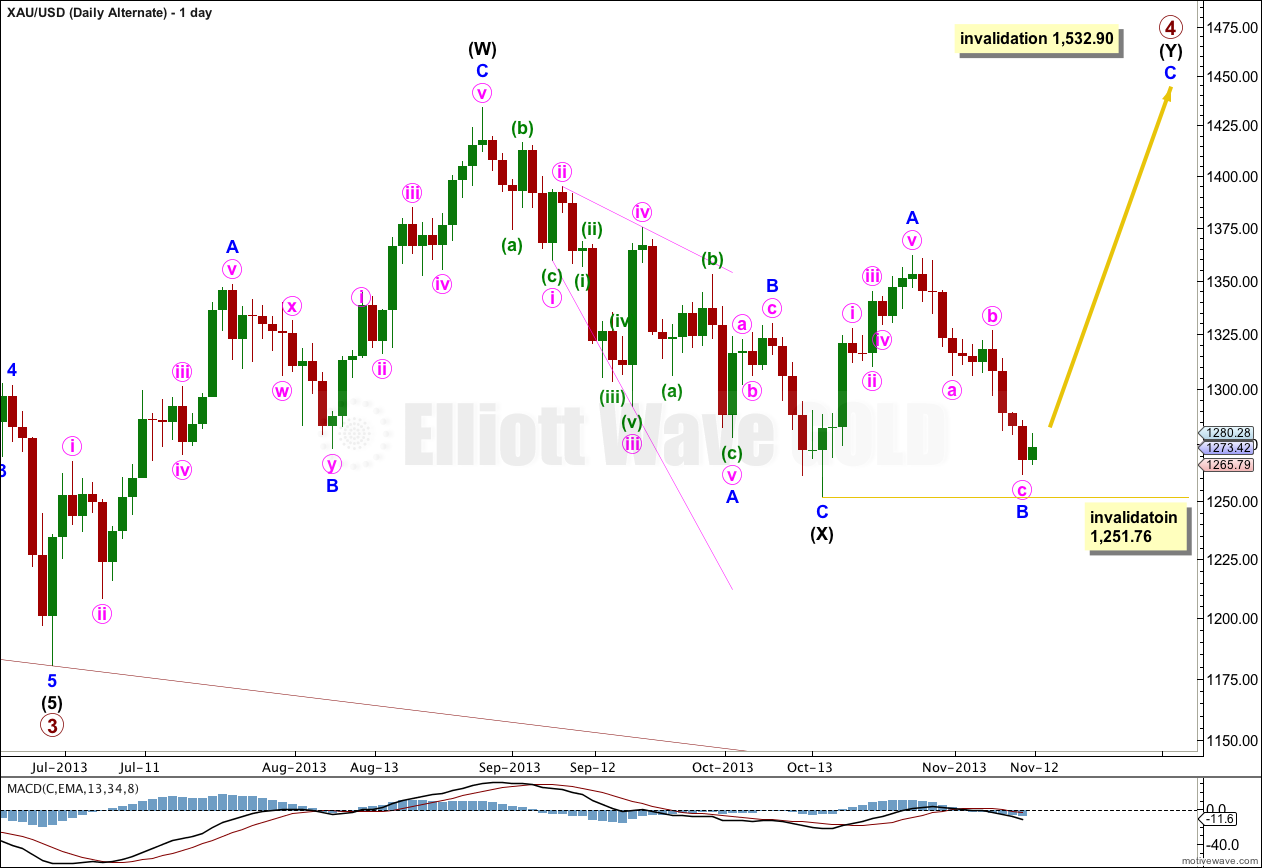

Alternate Wave Count.

Up to now this has been the main wave count. Its counterpart for Silver was invalidated and so I would expect Gold to follow with an invalidation of this wave count within a few days.

This alternate looks at the possibility that primary wave 4 is a double zigzag, and that the second zigzag is underway.

Minor wave B may not move beyond the start of minor wave A. This wave count is invalidated with movement below 1,251.76.

For this alternate minor wave B should now most likely be over. Within minor wave C no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,261.15.

Only if price moves above 1,306.15 in the next few days would I again use this wave count. Otherwise I am expecting now for it to be invalidated.

Hi Lara

Great prediction truly impressive wave counts…

Keep up the good work…thank you

Thank you very much! Positive comments like yours provide fuel to keep me going.

rabbit,

You’re only going to get possibilities from Elliott Wave, not certainties. As a trader, I can tell you that (if you are a trader), you must predict the outcome yourself, with your money on the line. That’s what trading is all about. Elliott Wave can still be useful though, to get an estimate of price targets for support and resistance. Lara is one of the best at providing these targets. She has to consider several possible directional outcomes to give you price targets for several outcomes. You can’t expect more from her (or any other technical analyst for that matter) than that.

Lara, I am bewildered. You show gold moving to 1292 on one chart ,then not on the other,; then moving to 1222 or so; but you show a Target of 1206, before then moving to 1443 0r so. Please spell this out for me !!!,

Do not take the levels I have sat the labels at as where I expect the wave to go.

Use the targets, the price points I have on the notes on the chart.

It needs to go up first to complete a fourth wave correction. The target for this is 1,298.

When that is done it needs to go down. The target for that is 1,206.05. This target will be calculated at another wave degree when I can, so it may change or widen to a small zone.