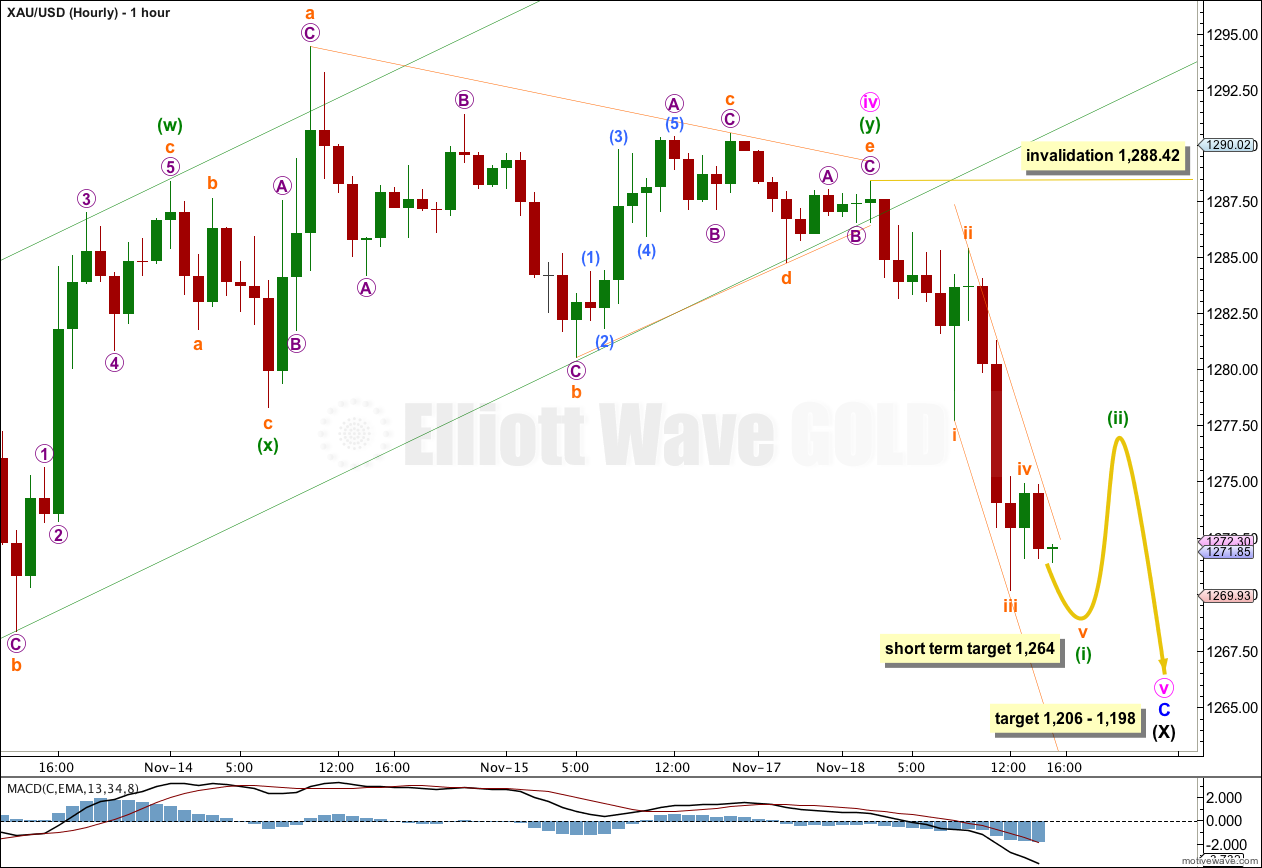

Sideways movement completed a triangle before downwards movement breached the parallel channel on the hourly chart. The channel breach was what I was looking to see on Monday as an indication of a trend change.

The wave count remains the same.

I am not going to publish the alternate wave count anymore because it no longer has a good fit on the hourly chart.

Click on the charts below to enlarge.

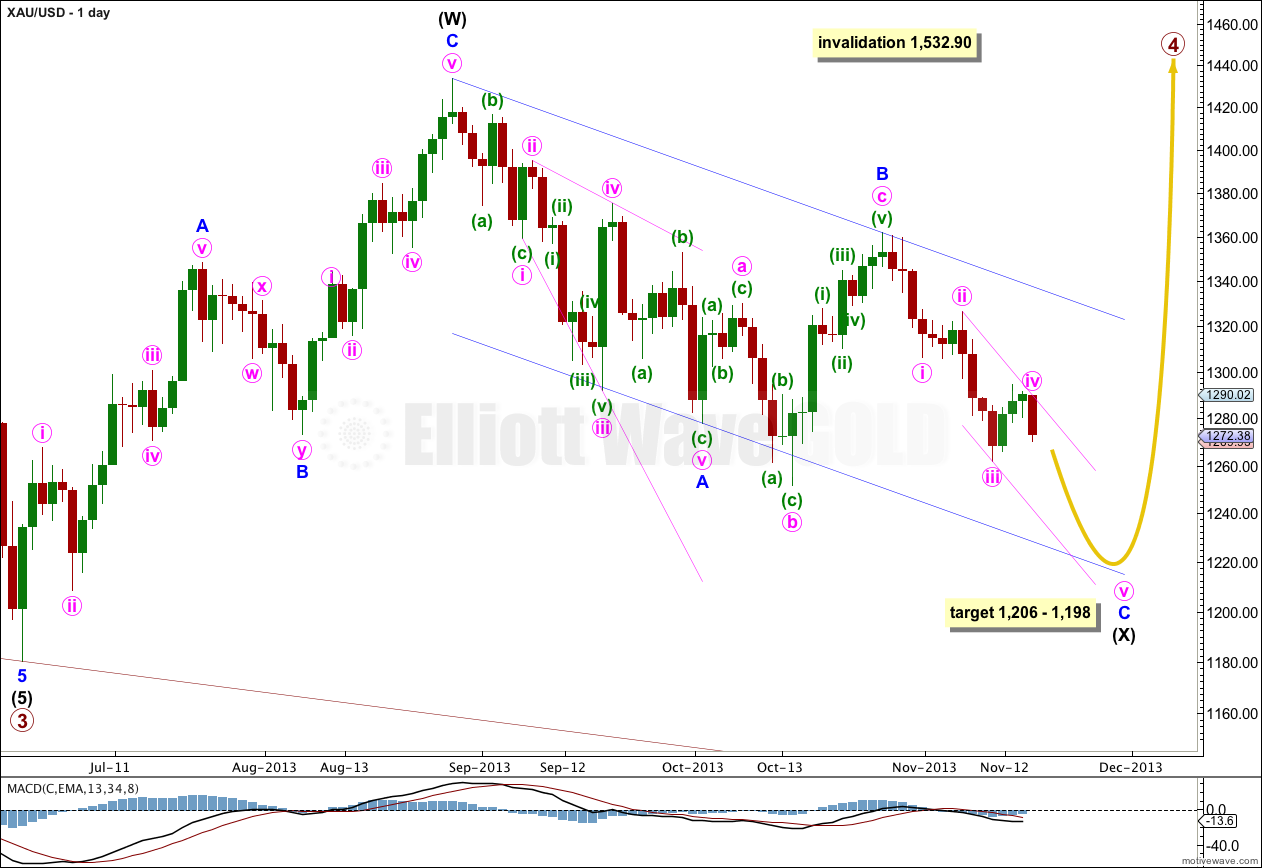

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. It is now more likely to continue as a double combination because within it intermediate wave (X) should be deep.

The purpose of double combinations is to take up time and move price sideways, so I would now expect intermediate wave (Y) to end about the same level as intermediate wave (W) at 1,433.83. Double combinations in fourth wave positions are quite common.

If downwards movement reaches 1,205.74 or below then it would be 90% of the prior upwards movement labeled intermediate wave (W). At that stage I would relabel primary wave 4 as a flat correction, A-B-C rather than a combination W-X-Y.

Within the combination intermediate wave (X) is unfolding as a zigzag. Minor wave C downwards must complete as a five wave structure. At 1,206 minor wave C would reach equality in length with minor wave A. Within minor wave C at 1,198 minute wave v would reach 1.618 the length of minute wave i. This gives an $8 target zone for downwards movement to end. I will try to narrow this zone as the structure gets closer to the end.

There is no lower invalidation point for intermediate wave (X); X waves may make new price extremes beyond the start of W waves, and they may behave like B waves within flat corrections. For combinations X waves often end close to the start of W waves.

I have drawn a parallel channel about the zigzag of intermediate wave (X) using Elliott’s technique for a correction. Draw the first trend line from the start of minor wave A to the end of minor wave B. Place a parallel copy upon the end of minor wave A. I will expect minor wave C to find support at the lower end of this channel, and it may end there.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Minute wave iv completed not as a double zigzag but as a double combination. The second structure in the double is a triangle which moved price sideways. Minute wave iv ended in four days, exactly equal in duration to minute wave ii which lasted four days. This gives the structure for minor wave C a very typical look.

There is an extremely clear channel breach of the best fit channel about minute wave iv. This gives me confidence that the correction for minute wave iv is now over and the next wave downwards is underway.

Minute wave v may be extended; it would have to be to reach the target zone. Minute wave i lasted four days, minute wave iii lasted three days. If minute wave v is extended it may last a Fibonacci five days and so take all week.

Within the first piece of downwards movement there is no Fibonacci ratio between subminuette waves i and iii. This makes it more likely that subminuette wave v should exhibit a Fibonacci ratio. At 1,264 subminuette wave v would reach equality in length with subminuette wave i. This target may be met within about six hours.

When minuette wave (i) downwards is complete I would expect a deep second wave correction. I would draw a Fibonacci retracement along the length of minuette wave (i) down and use the 0.382 and 0.618 Fibonacci ratios as targets for minuette wave (ii), favouring the 0.618 Fibonacci ratio.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 1,288.42.

Hi Lara.

Good tracking for Gold…!

But why did you think “Minute wave v may be extended”…?

Thanks

Antoine