Yesterday’s analysis expected a third wave downwards to end about 1,234 to 1,236. The third wave has ended at 1,236.89.

The wave count remains the same.

Click on the charts below to enlarge.

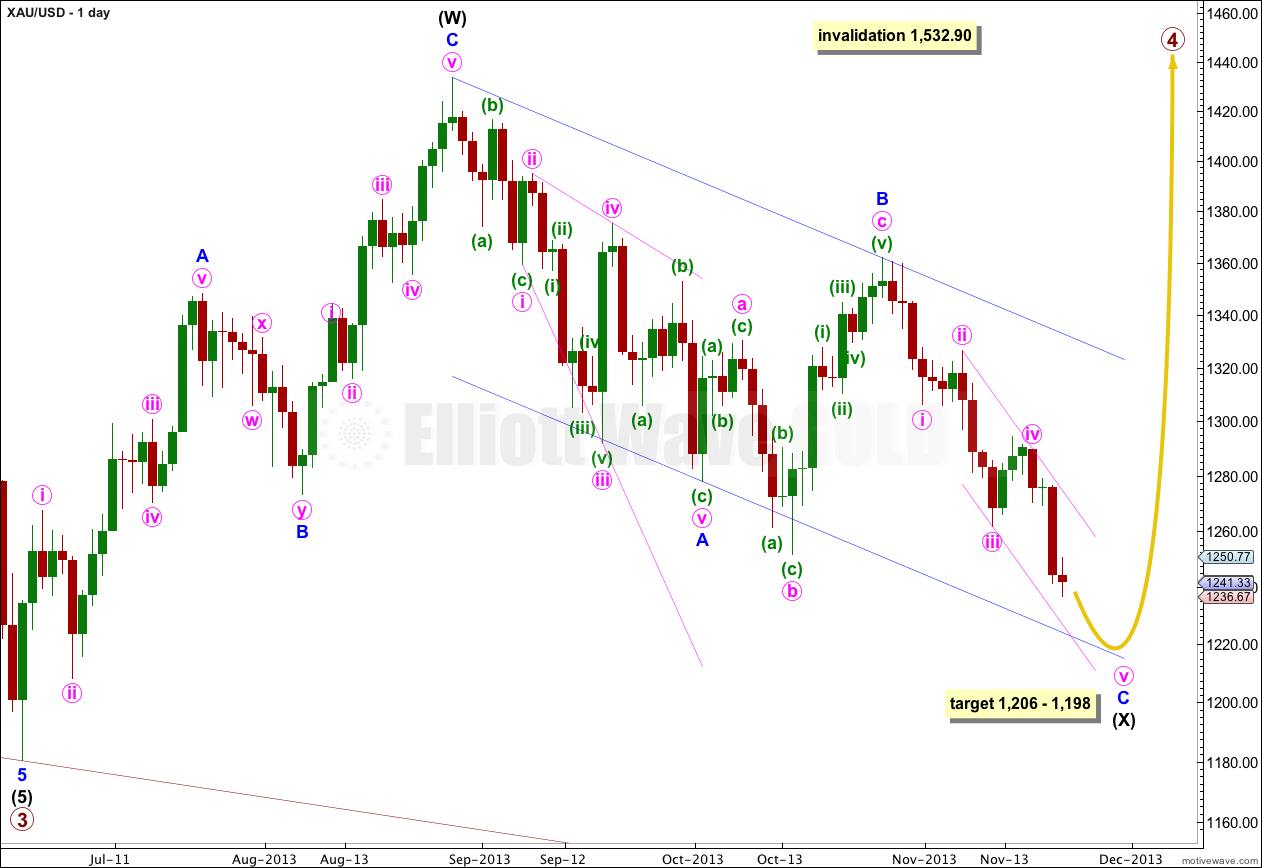

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. It is now more likely to continue as a double combination because within it intermediate wave (X) should be deep.

The purpose of double combinations is to take up time and move price sideways, so I would now expect intermediate wave (Y) to end about the same level as intermediate wave (W) at 1,433.83. Double combinations in fourth wave positions are quite common.

If downwards movement reaches 1,205.74 or below then it would be 90% of the prior upwards movement labeled intermediate wave (W). At that stage I would relabel primary wave 4 as a flat correction, A-B-C rather than a combination W-X-Y.

Within the combination intermediate wave (X) is unfolding as a zigzag. Minor wave C downwards must complete as a five wave structure. At 1,206 minor wave C would reach equality in length with minor wave A. Within minor wave C at 1,198 minute wave v would reach 1.618 the length of minute wave i. This gives an $8 target zone for downwards movement to end. I will try to narrow this zone as the structure gets closer to the end.

There is no lower invalidation point for intermediate wave (X); X waves may make new price extremes beyond the start of W waves, and they may behave like B waves within flat corrections. For combinations X waves often end close to the start of W waves.

I have drawn a parallel channel about the zigzag of intermediate wave (X) using Elliott’s technique for a correction. Draw the first trend line from the start of minor wave A to the end of minor wave B. Place a parallel copy upon the end of minor wave A. I will expect minor wave C to find support at the lower end of this channel, and it may end there.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

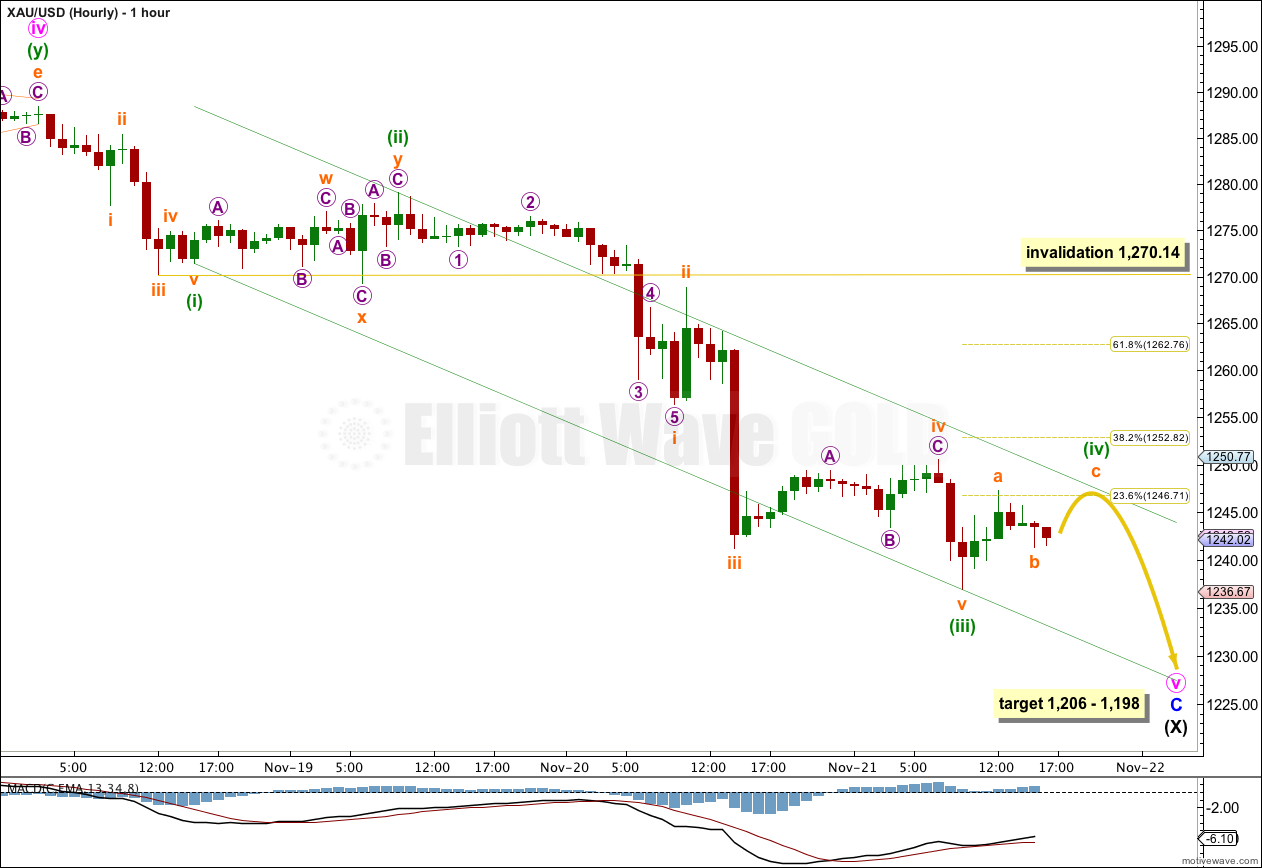

There are several ways to label this downwards wave of minute wave v so far. This labeling has the best fit.

On the daily chart it looks like minute wave v may have entered the fourth wave within it, so this fits with the look on the daily chart.

If minuette wave (iii) is over at 1,236.89 then it is 2.45 short of 2.618 the length of minuette wave (i).

Ratios within minuette wave (iii) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is just 0.34 short of 0.618 the length of subminuette wave i.

The strongest downwards movement is the middle of the third wave. This wave count fits perfectly, so far, with MACD.

Draw a parallel channel about minute wave v using Elliott’s first technique. Draw the first trend line from the lows labeled minuette waves (i) to (iii), then place a parallel copy upon the high labeled minuette wave (ii). I will expect minuette wave (iv) to find resistance at the upper edge of this channel.

Minuette wave iv should show alternation with minuette wave (ii). Minuette wave (ii) was a relatively shallow 45% double combination correction. Minuette wave (iv) may show alternation in depth and / or structure. So far it looks like it may be unfolding as a zigzag which would provide alternation in structure. If it finds resistance at the upper edge of the channel it may end about the 0.236 Fibonacci ratio of minuette wave (iii) at 1,246.71, and show some alternation in depth also.

Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 1,270.14.

Thanks for also posting at Safehaven.com . Really love your stuff* I must say. Not many gals can do this kind of thing. Not many guys or anybody really … Way technical with all the fibs and all that … Well just say’in this girl is ~good. But this really huge pop in the price coming early December, market down gold price up that used to be the way years ago but not any more{?} Gotta go before I write a book, but luv

ya dar’lin & luv your e-wave stuff* big-time …

I start to look now and see how ya do. Seemed to nail that recent drop – beautifully done.

Thanks. We’ll see what happens over the next couple of weeks… the technical situation gets trickier from this point on. The number of alternate wave counts I’ll have to have will be a few.

Hi Lara – Very nice analysis, have placed few thoughts on the overall count looking at weekly and monthly charts as well. From a weekly chart perspective, the 5th and final wave may take it to 1150 and here is my take on it

wave 1 – 1549.3

wave 2 – 1797.6

wave 3 – 1186.8

wave 4 – 1433.3

wave 5 – 1150

By the way I trade at DGCX there may be a slight difference price due to exchanges being different

Hi, thanks for the comment but a link to a chart would be so much easier.

Hello Lara

I’m new. I’ve seen several EW services and yours seems to be the best.

It appears that wave iv will complete v. soon. Tomorrow is friday and Dec. options expire Monday Dec 25. My limited experience tells me that the option writers/big players like to hold up movement near expiration. If this happens they will try to stymie wave v down for the next two days.

But your analysis seems to point down real soon.

I guess we’ll find out soon.

That little fourth wave (if you’re referring to minuette, or green labels) was a bit more time consuming. It is continued on for another two days the wave count would not have the “right look” so from an EW perspective I’m not expecting that to happen.