Last analysis for US Oil on 1st November expected more downwards movement towards a target at 91.74 to 91.33 before a small fourth wave correction. Price reached down to 93.07, $1.33 short of the target, before turning up for a small correction.

The wave count remains the same.

Click on the charts below to enlarge.

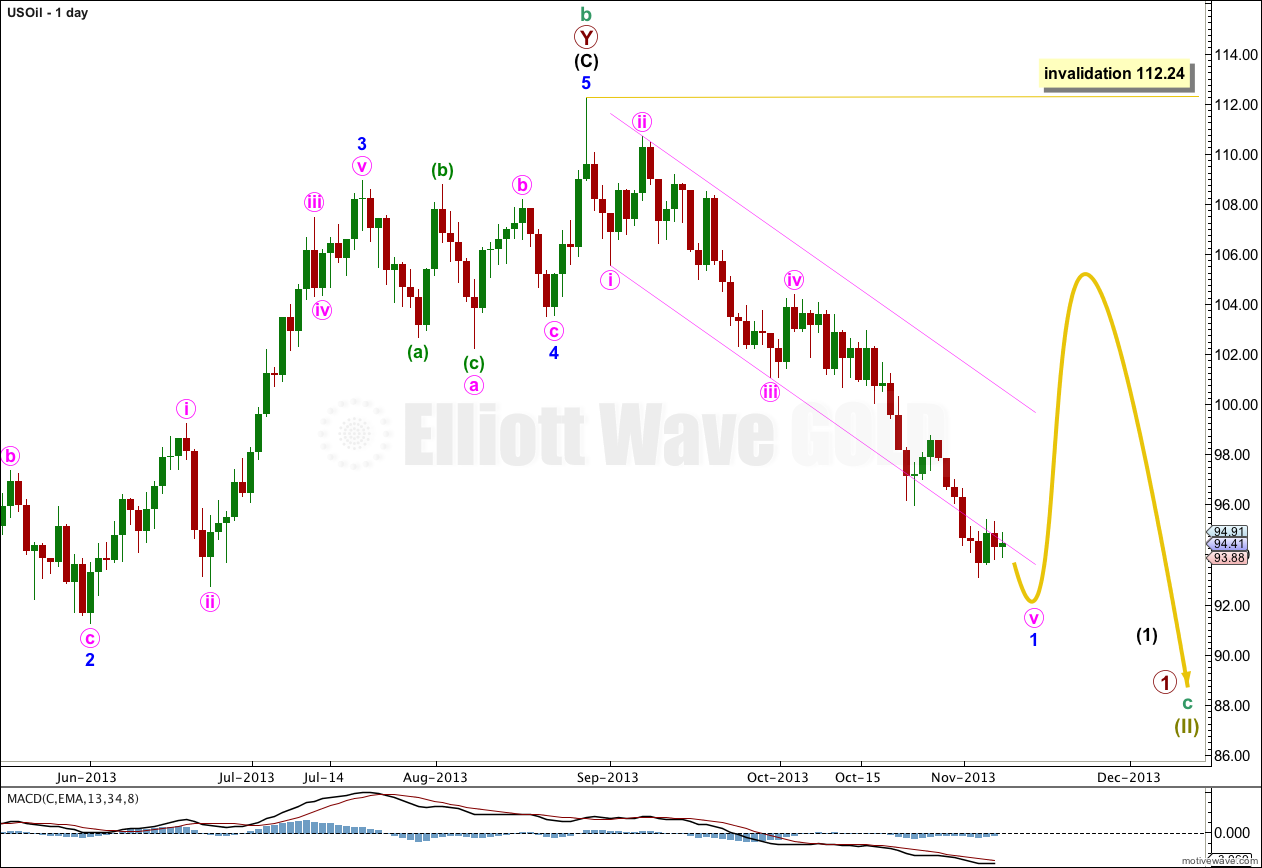

The bigger picture sees US Oil in a new downwards trend to last from one to several years. When I can see a clear five wave structure downwards on the daily chart I will have confidence in a trend change at cycle degree. So far the downwards structure for the first wave at minor degree is incomplete, and I cannot say that there is yet a clear five down.

Typical of commodities, the fifth wave is showing an overshoot of the parallel channel. When minute wave v completes minor wave 1 then I would expect upwards movement for a several days to a couple of weeks or so for minor wave 2.

The parallel channel drawn here about minor wave 1 is drawn first with a trend line from the lows of minute waves i to iii, then a parallel copy is placed upon the high of minute wave ii. When this channel is clearly breached by upwards movement then I would have confidence that minor wave 1 is completed and minor wave 2 is underway.

Minor wave 2 may not move beyond the start of minor wave 1. This wave count is invalidated with movement above 112.24.

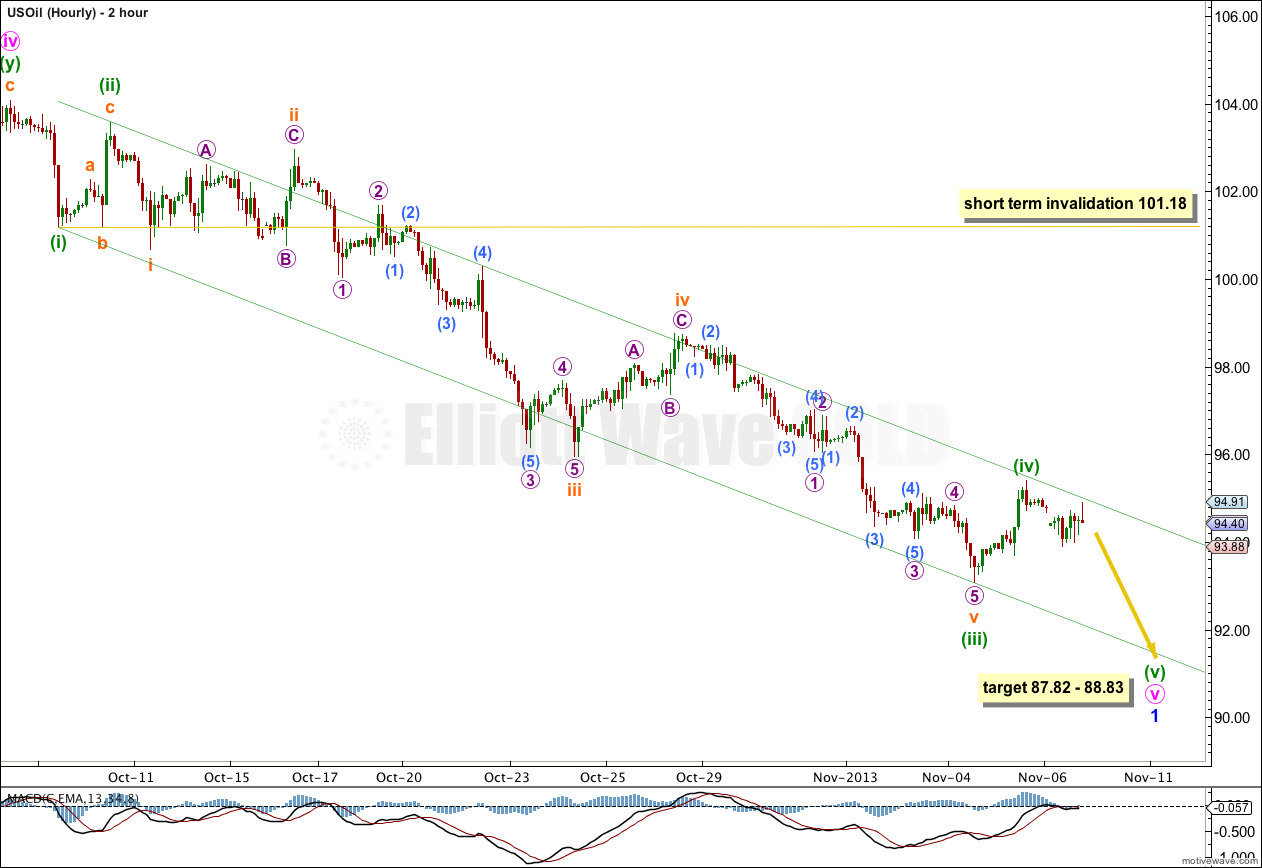

This two hourly chart shows all of the extended fifth wave of minute wave v.

There is no Fibonacci ratio between minuette waves (iii) and (i). I would expect to see a Fibonacci ratio between minuette wave (v) and either of (iii) or (i). At 87.82 minuette wave (v) would reach 2.618 the length of minuette wave (i).

At 88.83 minute wave v would reach 1.618 the length of minute wave iii.

A channel drawn about this extended fifth wave shows perfectly where minuette wave (v) has ended. The channel is drawn first from the lows of minuette waves (i) to (iii), then a parallel copy is placed upon the high of minuette wave (ii). When minuette wave (v) downwards has completed then a subsequent breach of this channel to the upside would be the first indication that minor wave 1 would be over and minor wave 2 would be underway.

I would expect minor wave 2 to be very deep; it may reach up to about 110.68.

Minuette wave iv may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 101.18.

When minuette wave (v) downwards may be considered to be complete then the invalidation point must move up to 112.24, and I would expect a trend change for a deep second wave correction.

oil to go to $55 in two years per cycles and multiple correlation analysis imho.