Last analysis expected to see a green candlestick for Friday’s session which is exactly what we have got. However, upwards movement fell well short of the target of 1,252, by $7.26.

The wave count remains the same.

Click on the charts below to enlarge.

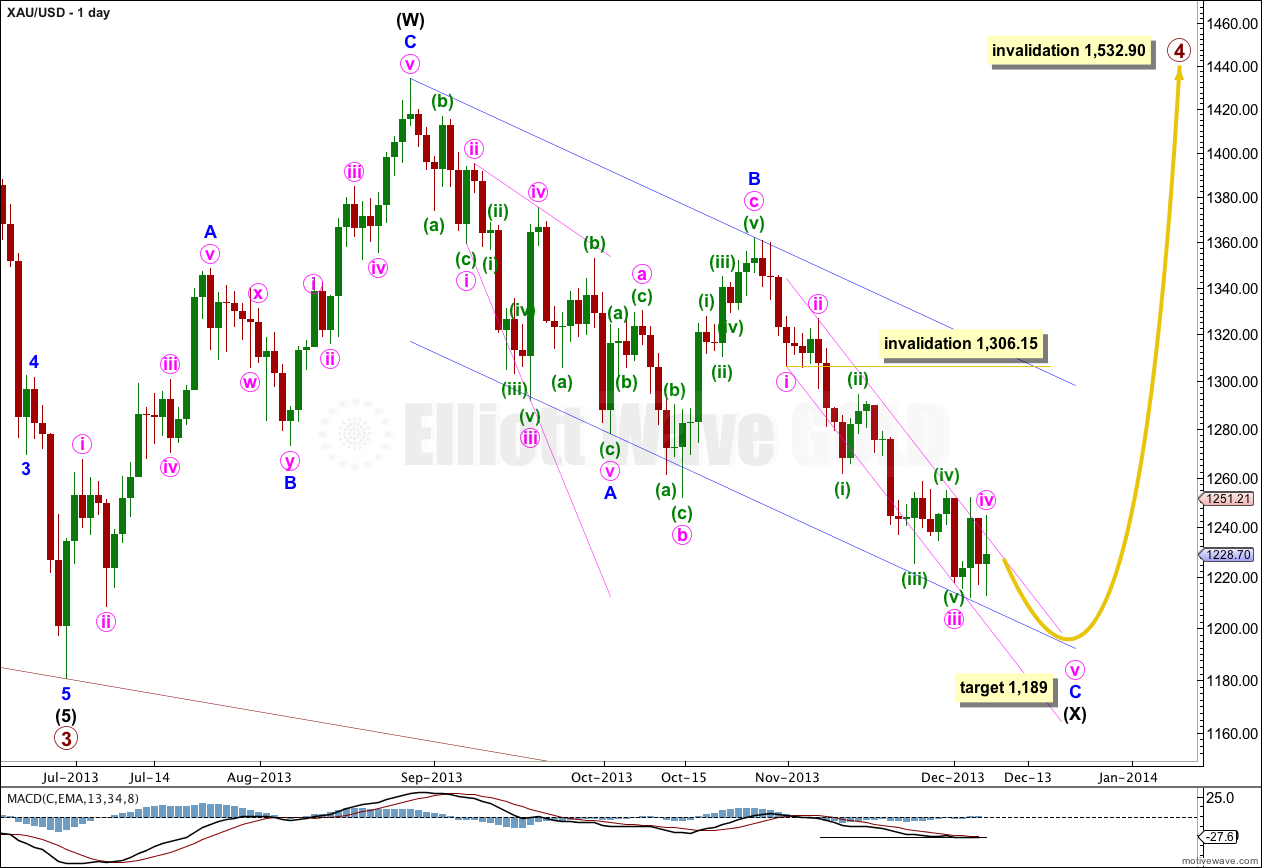

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. To see a full explanation of my reasoning for expecting that primary wave 4 is not over and is continuing see this.

Primary wave 2 was a rare running flat correction, and was a deep 68% correction of primary wave 1. In order to show alternation in structure primary wave 4 may be a zigzag, double zigzag, combination, triangle or even an expanded or regular flat. We can rule out a zigzag because the first wave subdivides as a three. This still leaves several structural possibilities.

If primary wave 4 is a combination, expanded flat or running triangle then we may see a new low below 1,180.40 within it. This is why there is no lower invalidation point for intermediate wave (X).

If price reaches 1,205.74 then downwards movement labeled intermediate wave (X) would be 90% of upwards movement labeled intermediate wave (W). I would relabel primary wave 4 as an A-B-C flat correction. If price does not reach 1,205.74 then primary wave 4 is most likely a double combination.

Within intermediate wave (X) zigzag downwards minor wave C has an extended third wave which is now complete. So far a count of minor wave C gives a count of eight, and one more downwards wave is required to complete an impulsive wave, with a count of nine.

Draw the parallel channel about minor wave C downwards with the first trend line from the lows labeled minute waves i to iii, then place a parallel copy upon the high labeled minute wave ii. Minute wave iv has slightly overshot this channel so far. I have decided to leave the channel as it is. The overshoot is small and would be contained by a third parallel line slightly higher. The lower edge of this channel may be useful to show were minute wave v finds support.

I would expect downwards movement to find support at the lower edge of the parallel channel drawn here about intermediate wave (X).

Draw a parallel channel about the zigzag of intermediate wave (X): draw the first trend line from the start of minor wave A to the end of minor wave B, then place a parallel copy upon the end of minor wave A. When this channel is finally breached by upwards movement then I would consider that final confirmation that intermediate wave (Y) is underway.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

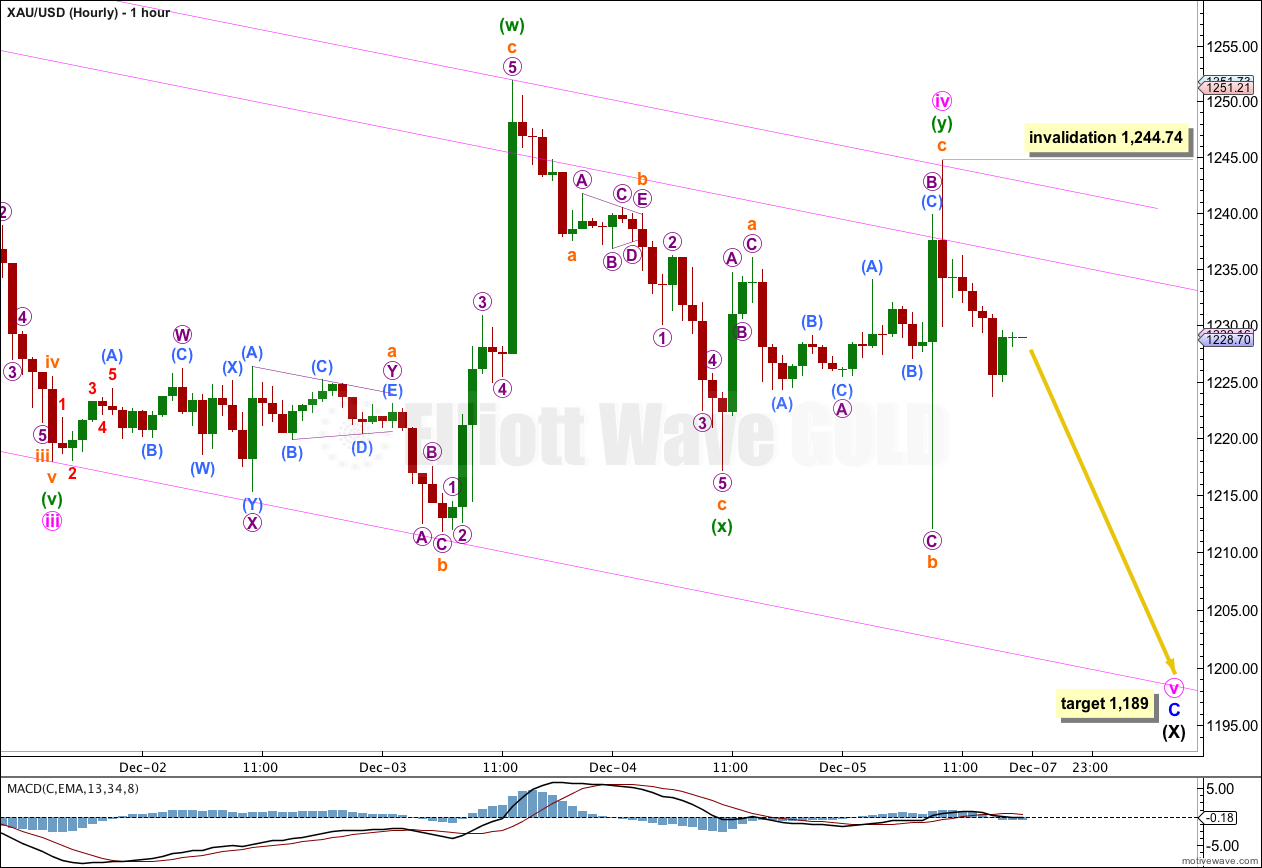

Minute wave iv is now most likely over as a double flat correction lasting four days, exactly the same duration as its counterpart minute wave ii.

Minute wave ii was a 36.5% regular flat correction. Minute wave iv was a more shallow 25% double flat correction. There is alternation in both depth and structure.

The channel drawn about minor wave C on the daily chart is copied over here to the hourly chart. The lower edge is providing good support and may continue to do so. This may be where minute wave v ends.

The upper edge of the channel is close to where upwards movement during minute wave iv found resistance. A third parallel copy pushed higher shows exactly where minute wave iv found resistance.

At 1,189 minute wave v would reach equality in length with minute wave iii, and minor wave C would be less than 10% off equality with minor wave A.

Within minor wave C there is no Fibonacci ratio between minute waves iii and i, and a ratio for minute wave v to either of minute waves iii or i would be highly likely. Equality with the first wave is the most common ratio for a fifth wave, so this target has a good probability.

Within minute wave v no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 1,244.74.

When there is a clear five down on the hourly chart then I would have increased confidence in this trend change.

Minor wave i lasted four days, and I would expect minor wave v to also last four days, ending on Thursday 12th December.

I will add to the target calculation at more wave degrees as minute wave v gets closer to its end, which may widen the target to a small zone or it may change. At this stage I would not expect it to change by much.

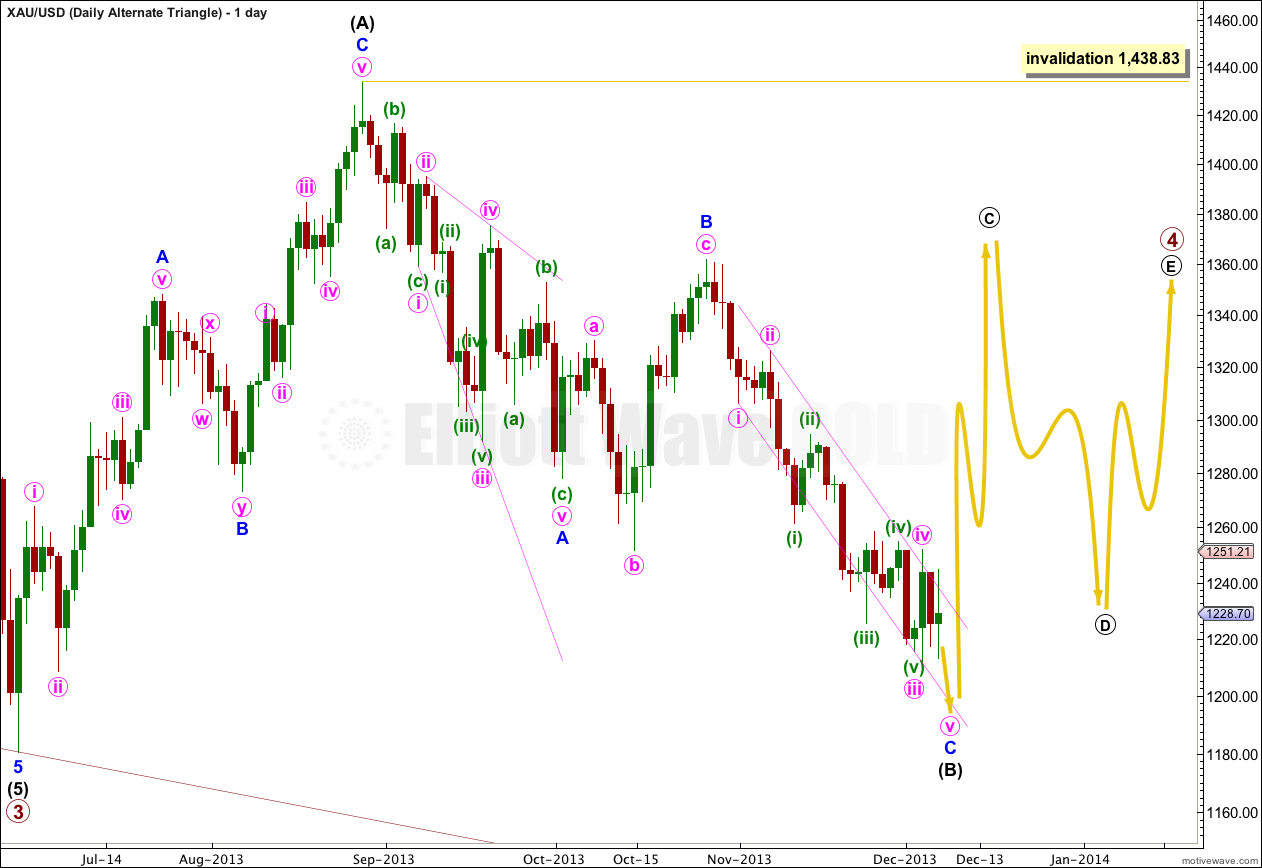

Daily Alternate Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

The expected direction and structure of this next upwards wave is the same, but for this alternate intermediate wave (C) of the triangle may not move beyond the end of intermediate wave (A). The triangle is invalidated with movement above 1,438.83.

The final intermediate wave (E) upwards may not move above the end of intermediate wave (C) for both a contracting and barrier triangle. E waves most commonly end short of the A-C trend line.

All five subwaves of a triangle must divide into corrective structures. If this next upwards movement subdivides as a zigzag which does not make a new high above 1,438.83 then this alternate would be correct.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.