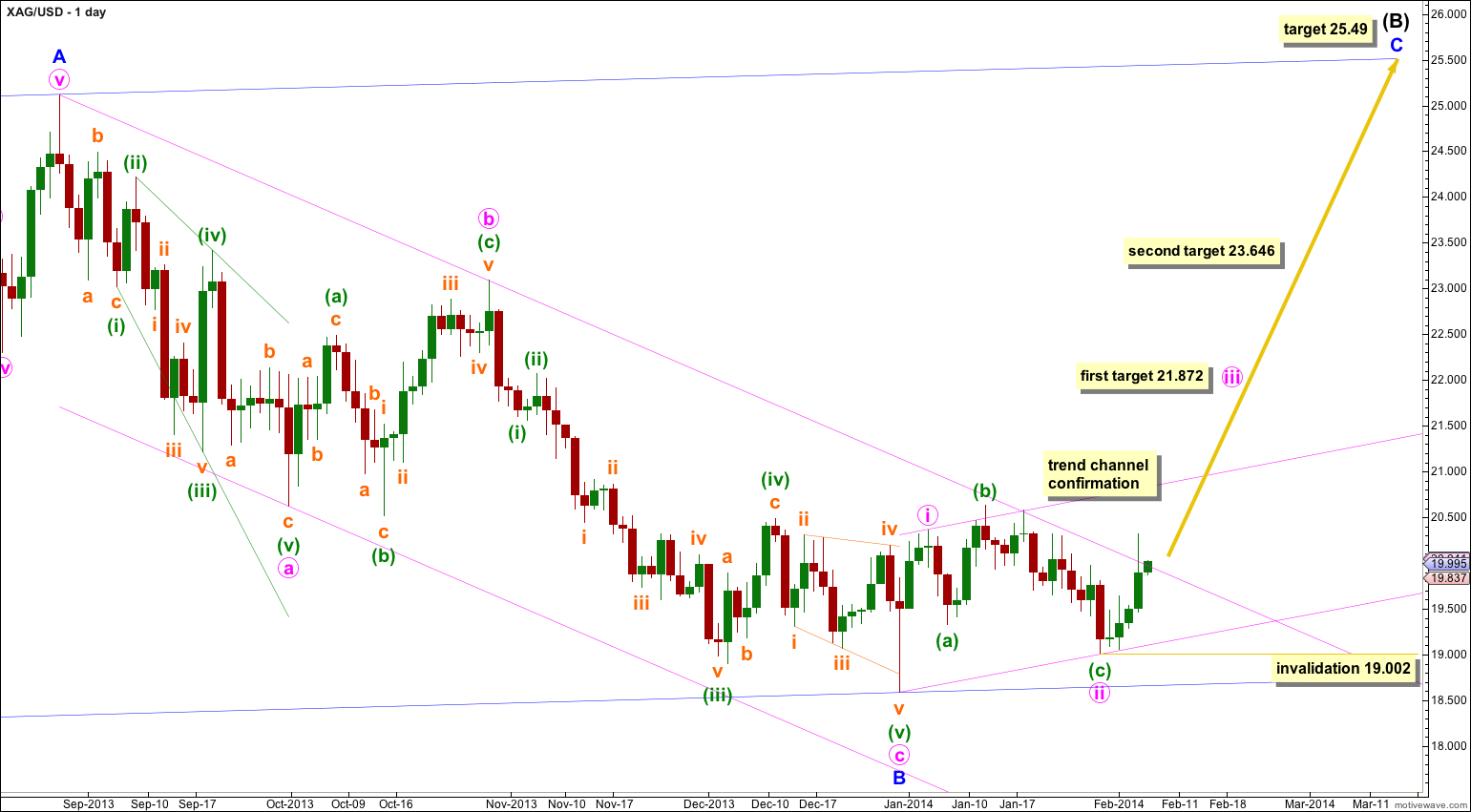

Last analysis expected a little more downwards movement to a target just below 19.327 before a trend change and a third wave up.

Price did move lower to reach 19.002 and has turned up. However, I still would like to see the channel on the daily chart clearly breached before I have confidence in this trend change and the targets calculated.

Click on the charts below to enlarge.

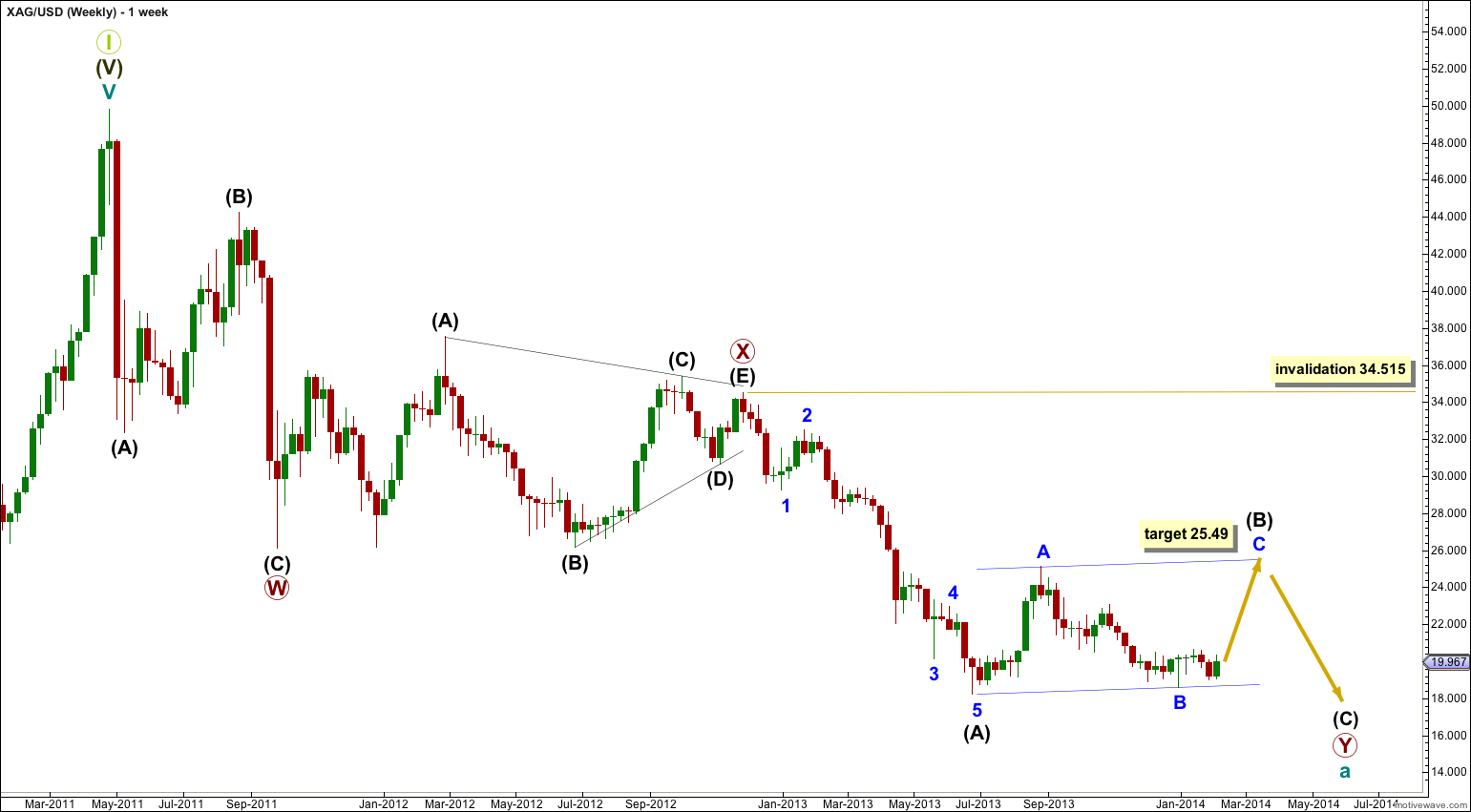

The bigger picture for Silver expects a large grand super cycle second wave correction may be unfolding downwards.

The correction may be at grand super cycle degree, or it may be a fourth wave correction at super cycle degree.

Both of these possibilities require more downwards movement for the structure to complete.

The structure unfolding downwards is a double zigzag. The first zigzag in the double is labeled primary wave W. The double is joined by a “three” in the opposite direction which is a contracting triangle labeled primary wave X.

The second zigzag is incomplete and labeled primary wave Y. Within the second zigzag intermediate wave (B) is a zigzag and is incomplete.

Within intermediate wave (B) the final wave for minor wave C upwards is incomplete. At 25.49 minor wave C would reach equality with minor wave A. It should end about the upper trend line.

Intermediate wave (B) may not move beyond the start of intermediate wave (A). This wave count is invalidated with movement above 34.515.

Within minor wave C minute waves i and now ii are complete. However, a clear channel breach of the blue parallel channel containing the zigzag of minor wave B is required to provide trend channel confirmation that minor wave B is over and minor wave C is underway. When there is a full daily candlestick above the channel and not touching the upper trend line then I would have confidence in this trend change.

Within minor wave C minute wave iii would reach 1.618 the length of minute wave i at 21.872. If price keeps rising through this first target, or if when it gets there the structure for minute wave iii is incomplete, then I would use the second target. At 23.646 minute wave iii would reach 2.618 the length of minute wave i.

I have drawn an acceleration channel about minute waves i and ii (pink upwards sloping channel). Minute wave iii should breach the upper edge of this channel and should show an increase in upwards momentum. Along the way up any corrections should find support at the lower edge of the channel.

Within minute wave iii no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 19.002.

Hi Lara. That was fantastic work in the big picture. In your next update, could you focus more on the near term like you do for gold. Silver is highly correlated with gold in that the movements of silver mimic gold’s turn by turn. So far, silver’s movement is extremely lethargic. I don’t see how it could rise to 21.872 in the short term and 25.49 in the longer term. If we are currently in Minute 3, the rise does not seem to agree with the price surges we usually see in Wave 3. Perhaps the fifth wave is extended to yield the 25.49 target. Comments please. Thank you.

I will be updating Silver today but I will only have a daily chart for you. I keep my hourly chart updated but at this stage I am not confident of my labeling there. My conclusion is this structure is incomplete and I am confident that Silver will keep moving higher.

When I am happy with how I am labeling the hourly chart then I will publish it.

I do not have the time today to go down to the one minute chart level to see all the subdivisions to get the labeling right, and that is what is required.

hi Lara,

Did we get channel breach of the blue parallel channel containing the zigzag of minor wave B today and do you think trend is now confirmed?

As usual , thanks for your superb work.

Rahmat.

No. The candlestick needs to be above the channel and not touching the upper trend line. This is an overshoot, not a proper breach.