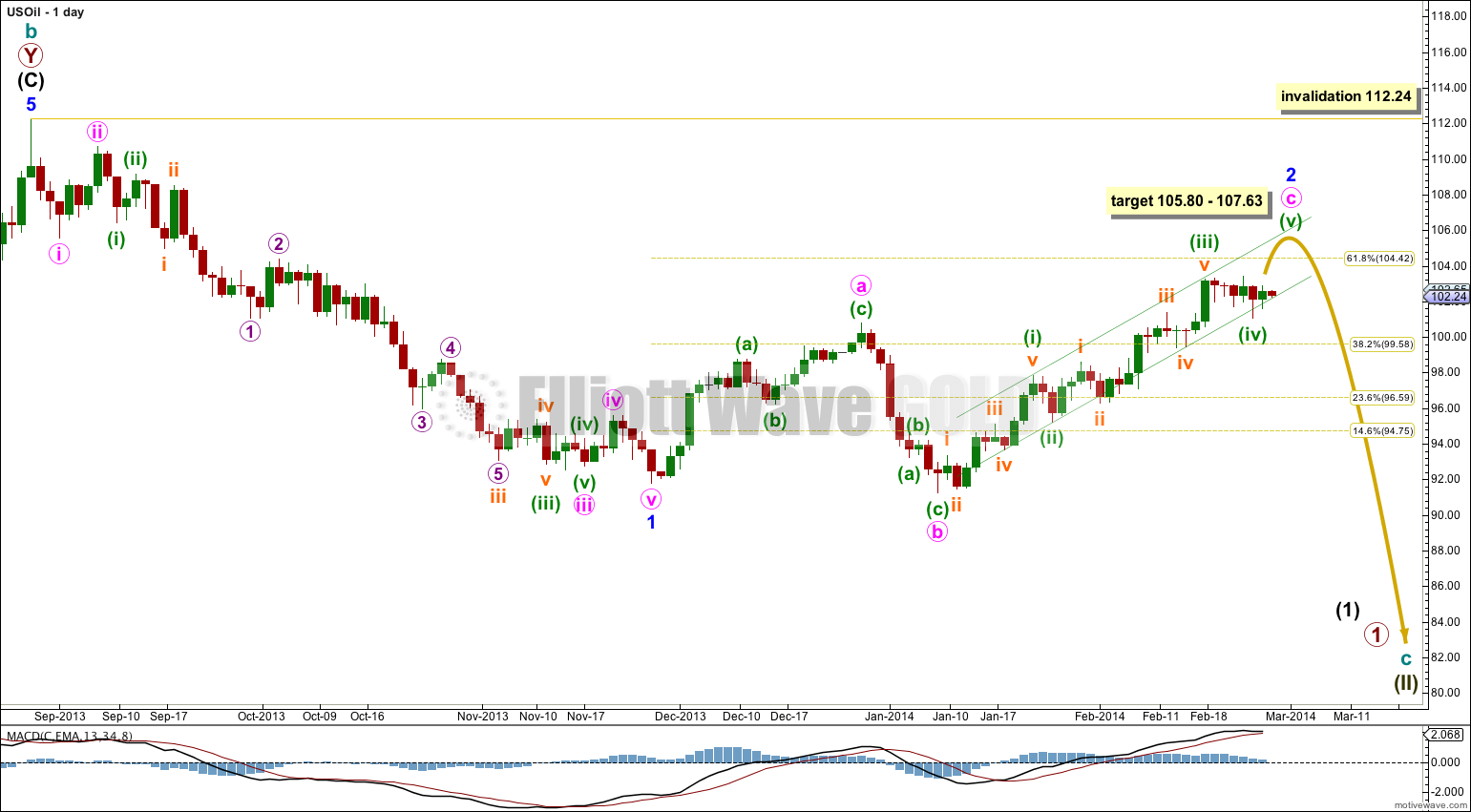

Last analysis on 11th February expected overall upwards movement towards a target at 105.80.

Price has moved higher as expected, with sideways corrections along the way. The target has not yet been reached and the structure is incomplete. I am expecting more upwards movement.

I can now calculate the target at two wave degrees so it has widened to a small zone.

Click on charts to enlarge.

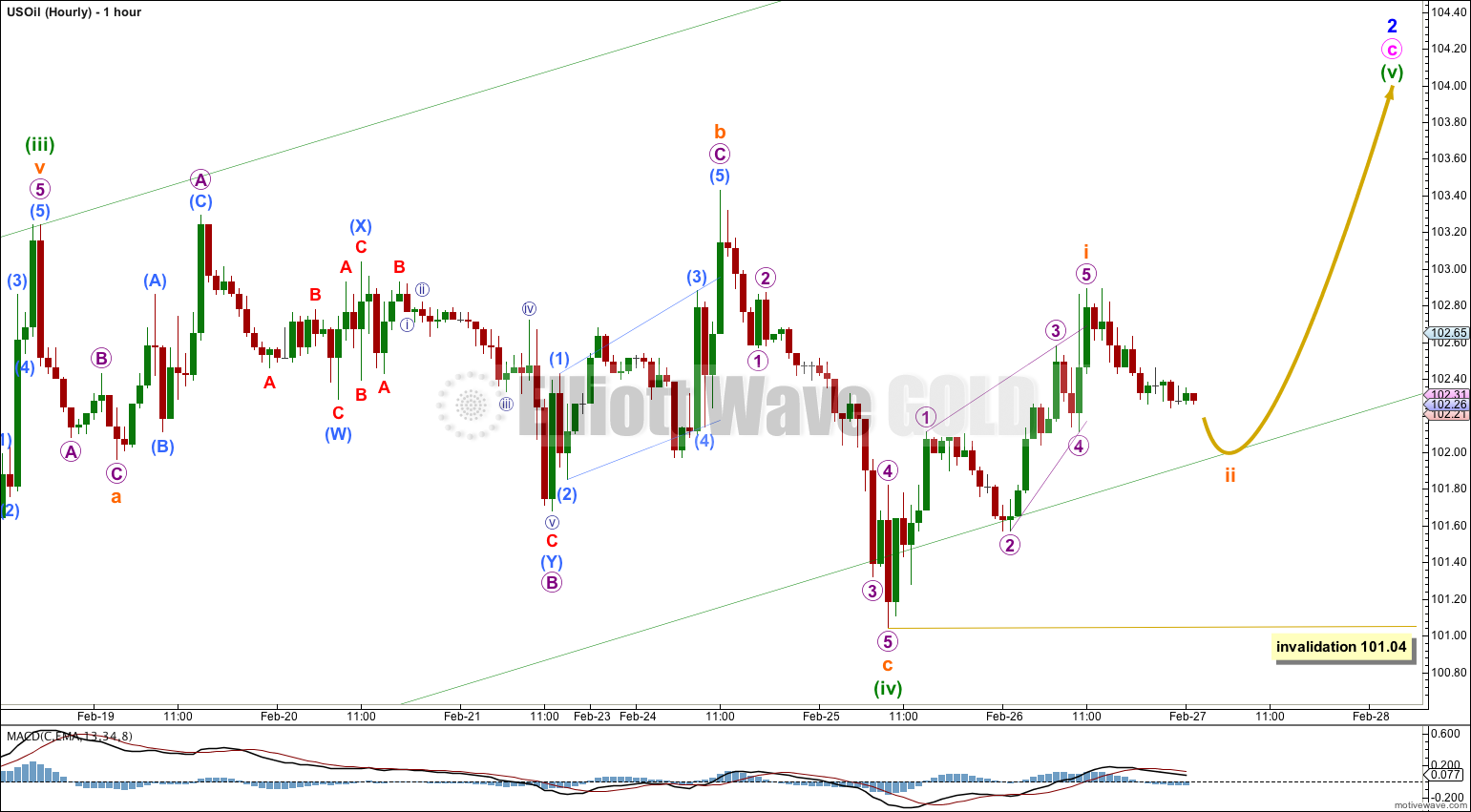

Minor wave 2 is most likely continuing as a flat correction. Minor wave 3 has not begun.

Within the expanded flat minute wave a subdivides easily as a three. Minute wave b is ambiguous. This wave count sees it as a three.

Within minor wave 2 minute wave b is a 106% correction of minute wave a so this is an expanded flat correction. Expanded flats normally have C waves which end substantially beyond the end of their A waves. At 105.80 minute wave c would reach 1.618 the length of minute wave a, and minor wave 2 would be just above the 0.618 Fibonacci ratio.

Within minute wave c there is no Fibonacci ratio between minuette waves (i) and (iii). This makes it more likely we shall see a Fibonacci ratio between minuette wave (v) and either of (i) or (iii). At 107.63 minuette wave (v) would reach equality in length with minuette wave (i).

We may now use Elliott’s technique to draw a channel about minute wave c. Draw the first trend line from the highs labeled minuette waves (i) to (iii), then place a parallel copy upon the low labeled minuette wave (ii). Minuette wave (iv) has very slightly overshot the channel, finding support about this trend line.

I expect minuette wave (v) to end either at the upper edge of this channel or with an overshoot of the upper edge.

I expect the target may be reached in about eight days.

Minuette wave (iv) subdivides perfectly as an expanded flat correction. This shows nice structural alternation with the zigzag of minuette wave (ii).

The final fifth wave of minuette wave (v) has most likely begun. Within it subminuette wave ii is most likely to move lower because second wave corrections following leading diagonals in first wave positions are commonly very deep. It may not move beyond the start of subminuette wave i below 101.04.

Lara, any chance of an update on crude? I’m thinking minor 3 is finally underway, but we need confirmation next week with a down week. Minor 2 fell just short of the 61.8% retracement so far. A fib 13 weeks down from $112-$91 and now a fib 13 week retracement to $105.22 in a perfect expanded flat scenario looks to good to be true. I thought we were heading for a nice bearish engulfing candlestick on the weekly until Friday’s rally. Intsead, we got a red doji with price closing almost flat for the week.

correction…we ended the week with a spinning top candlestick and not a doji which indicates indecision

I’ll not be updating US Oil this weekend, I’m moving house. My internet connection will be cut… any minute.

I agree, and my wave count would see minor wave 2 as over, with a clear channel breach of minute wave c to confirm it. I would expect the last two days is the typical pullback second wave correction.

How about an update now? I’m very curious on your take

I’ll do it tomorrow after Monday’s session is ending.