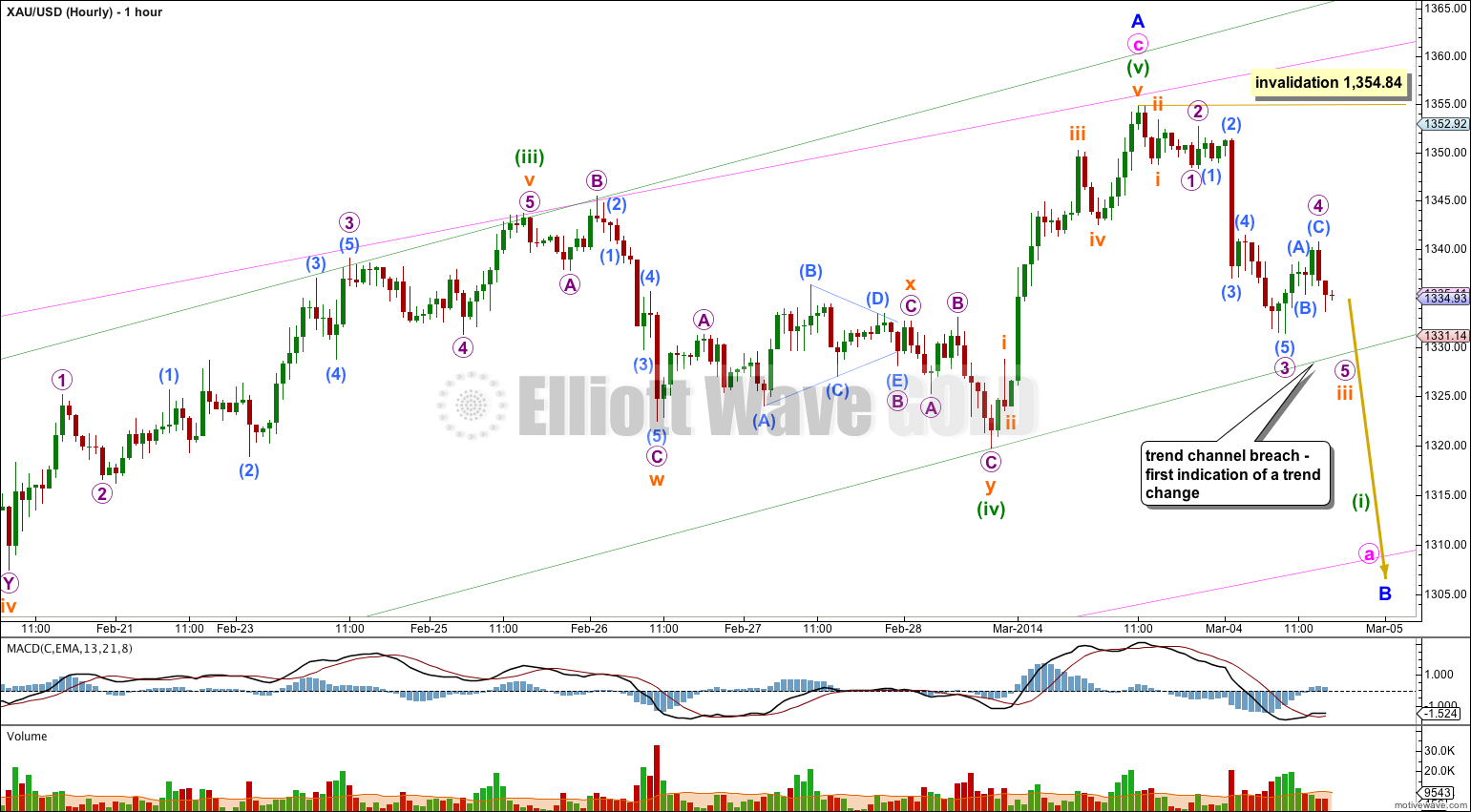

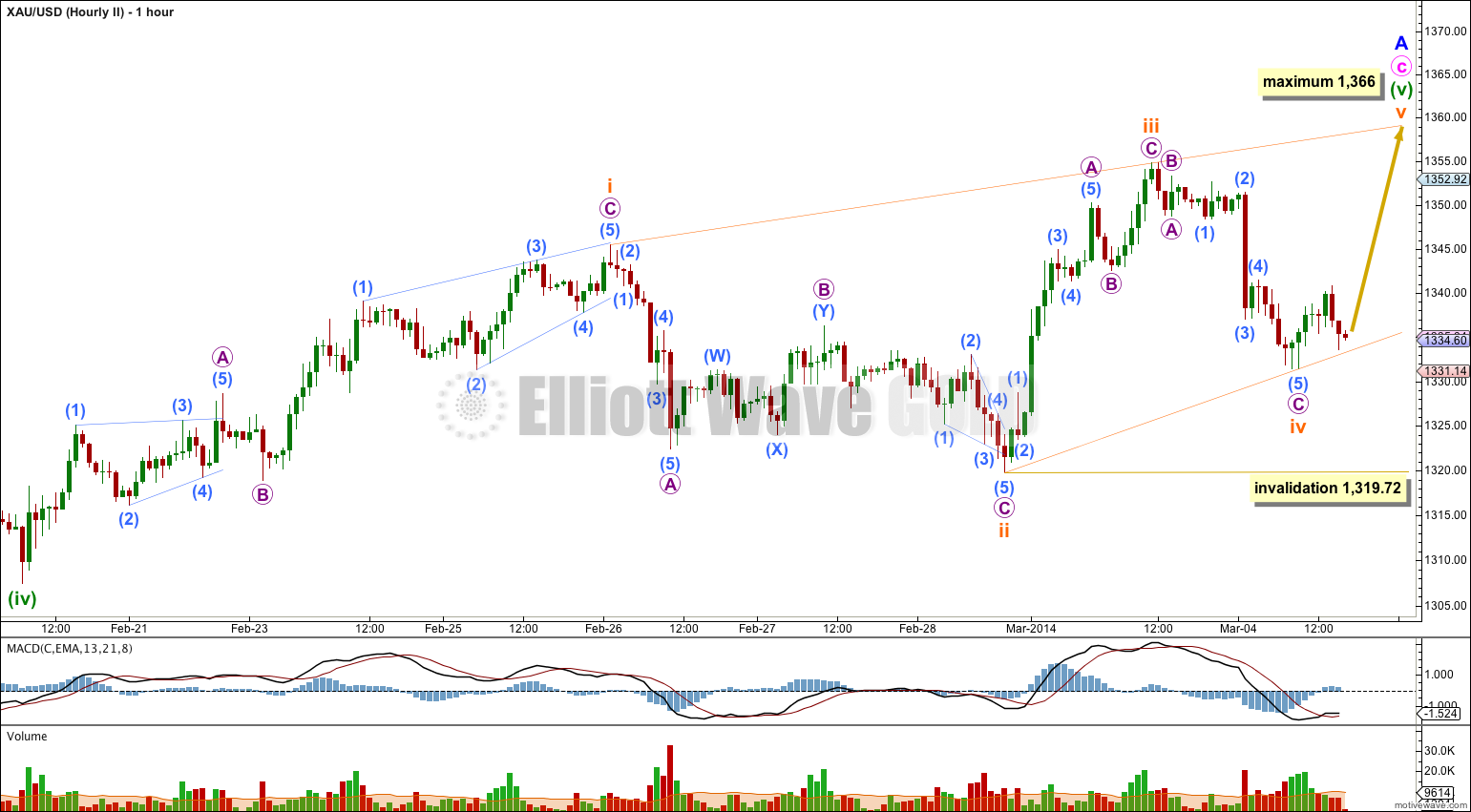

Movement below 1,342.57 invalidated the main hourly wave count and confirmed the alternate. At that stage the short term target for downwards movement was 1,335. So far price has reached down to 1,331.43.

The strong red candlestick on the daily chart must be taken into account. The wave count is changed and I have two wave counts for you today.

Summary: The situation is unclear. While price remains within the green channel on the daily chart we should assume that the trend remains the same, upwards.

This analysis is published about 05:15 p.m. EST. Click on charts to enlarge.

First Wave Count.

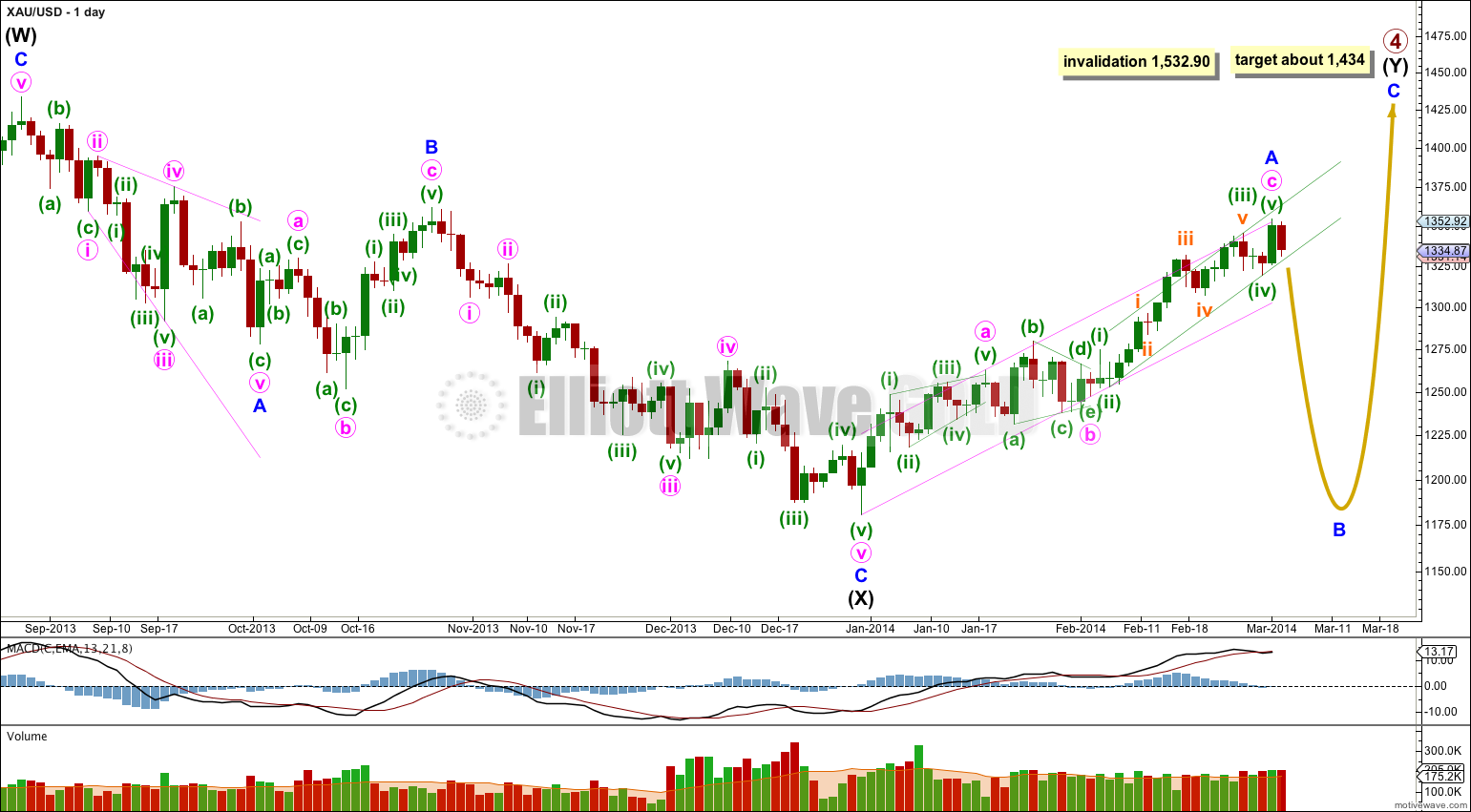

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

The first upwards wave within primary wave 4 labeled here intermediate wave (W) subdivides as a three wave zigzag. Primary wave 4 cannot be an unfolding zigzag because the first wave within a zigzag, wave A, must subdivide as a five.

Primary wave 4 is unlikely to be completing as a double zigzag because intermediate wave (X) is a deep 99% correction of intermediate wave (W). Double zigzags commonly have shallow X waves because their purpose it to deepen a correction when the first zigzag does not move price deep enough.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) may be either a flat or a triangle. For both these structures minor wave A must be a three, and is most likely to be a zigzag.

Minor wave A is either complete or close to completion. I want to see the green channel on the daily chart clearly breached before having any confidence in a trend change. While price remains within the green channel the second wave count will be possible. At this stage I do not favour either the first or second wave counts; they both have about an even probability.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

This main wave count sees minuette wave (iii) over at 1,343.35 and minor wave A may be complete.

Within minor wave A there is no Fibonacci ratio between minute waves a and c.

Ratios within minute wave c are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is just 0.60 longer than 0.382 the length of minuette wave (iii).

Ratios within minuette wave (iii) are: subminuette wave iii is just 0.09 short of 1.618 the length of subminuette wave i, and subminuette wave v is just 1.12 longer than equality with subminuette wave i. The excellent ratios within minuette wave (iii) increase the probability of this wave count.

Within this wave count the labeling of the structure within minuette wave (iv) as a double combination has a better fit than the second wave count below. This slightly increases the probability of this first wave count.

The green channel is drawn from the lows of minuette waves (ii) to (iv), then a parallel copy is placed upon the high of minuette wave (iii). I want to see this channel clearly breached on the DAILY chart with a full candlestick below the lower edge and not touching the trend line. Only at that stage will I have confidence that minor wave A is finally over. A breach on the hourly chart would be a first indication of a trend change, but it is not enough.

Within minor wave B no second wave correction may move beyond the start of the first wave. This wave count would be invalidated with movement above 1,354.84 at this stage.

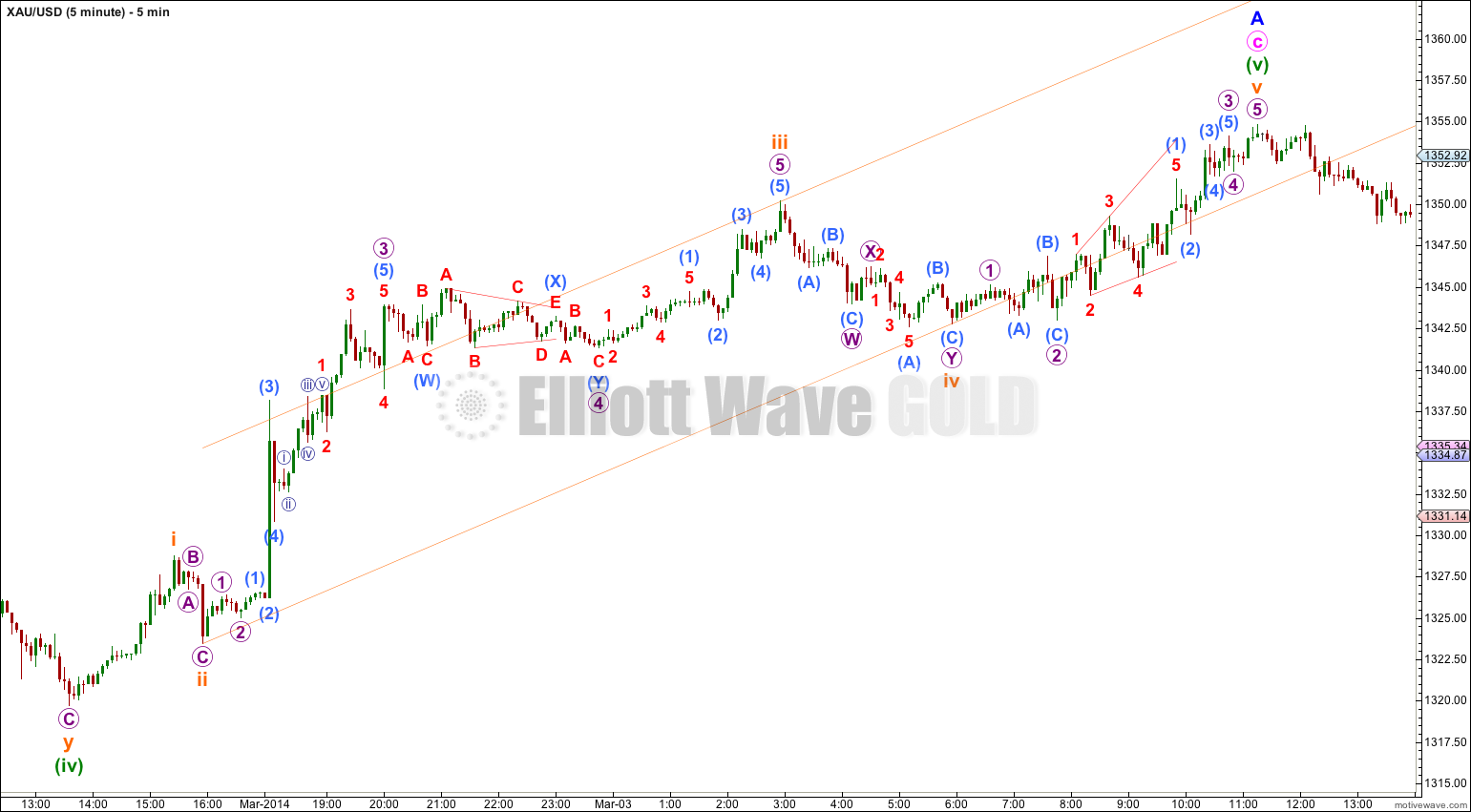

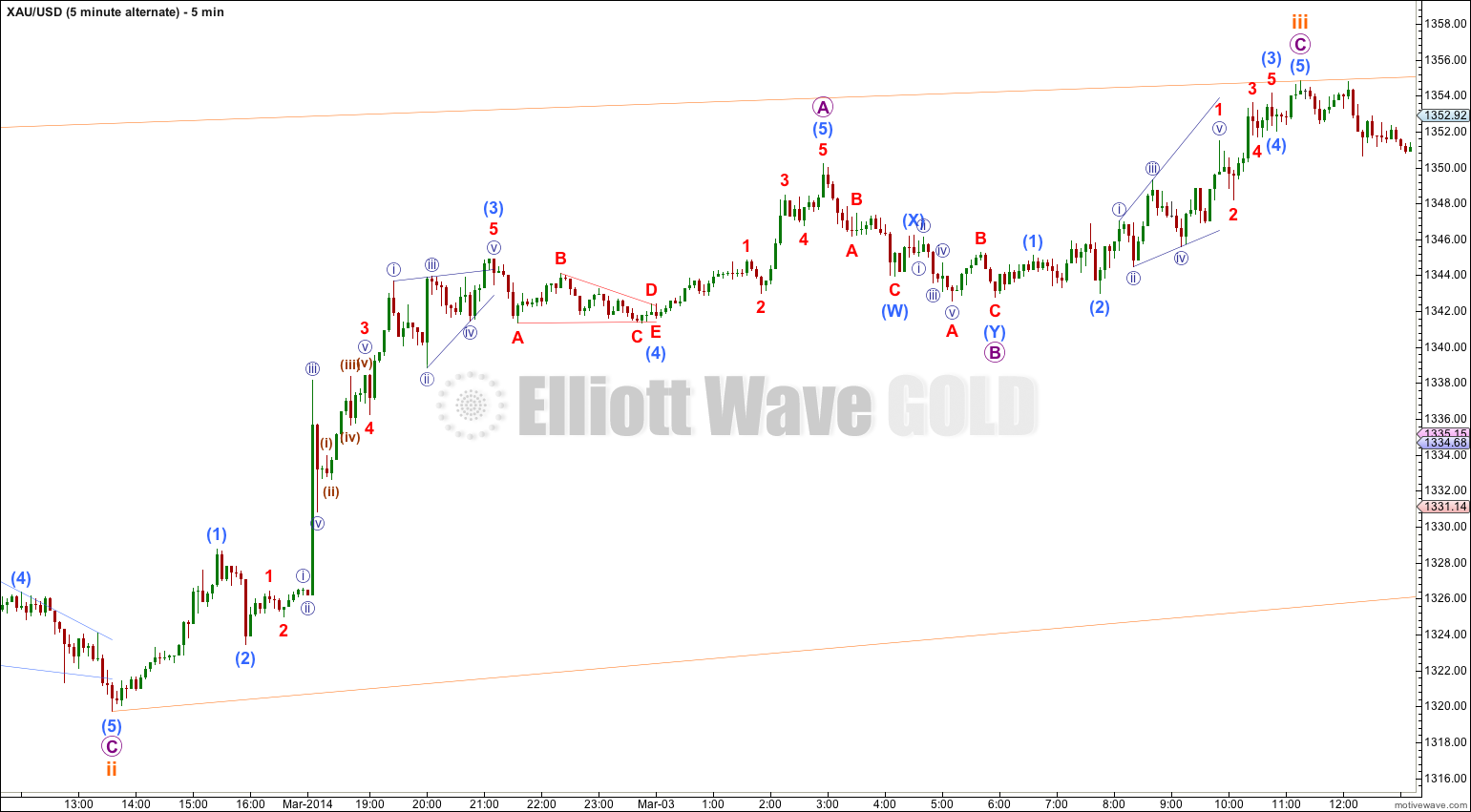

This wave count requires that the upwards movement labeled minuette wave (v) is seen as a five wave impulse. On the hourly chart this has an odd look which reduces the probability of this wave count. I have checked the subdivisions carefully on the five minute chart and it fits nicely as a five. Unfortunately, this movement is ambiguous. I publish my analysis of the five minute chart today of this movement so that members may judge for themselves.

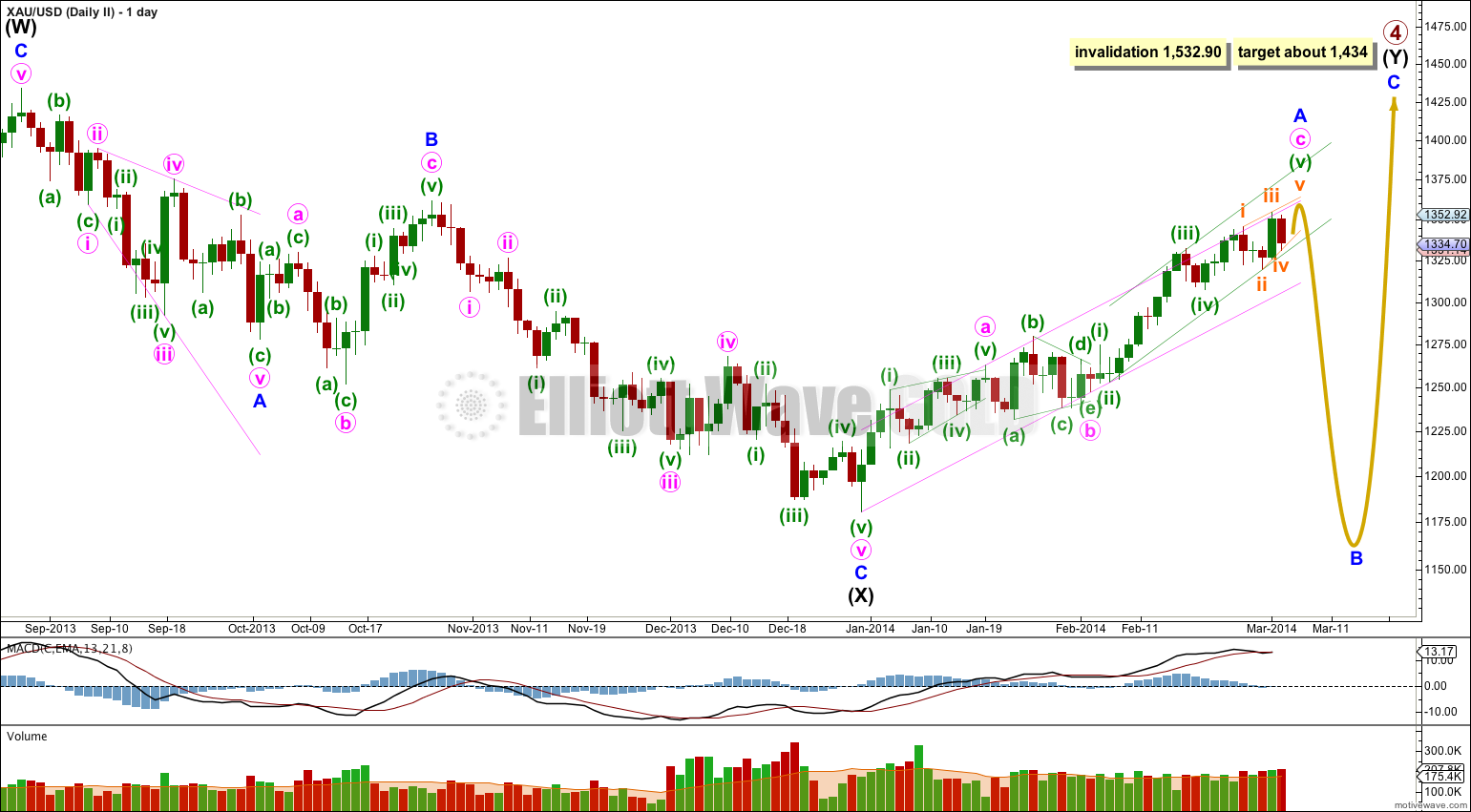

Second Wave Count.

I am considering this possibility mostly because of the overall look of minute wave c on the daily chart. I want to see minuette wave (iii) over at 1,332.28 because there it has the best look on the daily chart. The following overlapping movement may be an ending diagonal for minuette wave (v).

With this wave count the green channel does not have a good fit when it is drawn using either of Elliott’s techniques, so I have drawn it as a best fit here. The lower green trend line is the same for both daily wave counts.

This second wave count allows for one final upwards thrust to complete the structure for minor wave A.

This wave count sees minuette wave (iii) over earlier. Minuette wave (iii) has no Fibonacci ratio to minuette wave (i).

Ratios within minuette wave (iii) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 3.95 longer than equality with subminuette wave i. The ratios here are not as good as the first wave count which reduces the probability of this second wave count.

This hourly wave count shows all of this possible ending diagonal. Within an ending diagonal all the subwaves must subdivide as single zigzags with no other structures allowed. This is why subminuette wave iii is labeled as a zigzag.

Within this possible ending diagonal the structure within subminuette wave ii does not have as good a fit as for the first wave count.

Within this possible ending diagonal the structure within subminuette wave iii has a better fit than the first wave count. On the five minute chart this upwards movement subdivides neatly as a zigzag, and on the hourly chart it looks best as a zigzag.

The diagonal would be contracting: subminuette wave iii is shorter than subminuette wave ii, and subminuette wave iv is shorter than subminuette wave ii. This limits the length of subminuette wave v to no longer than equality with subiminuette wave iii at 1,366.

Within the diagonal subminuette wave iv may not move beyond the end of subminuette wave ii. This wave count is invalidated with movement below 1,319.72.

I publish my five minute chart analysis of the upwards movement for subminuette wave iii below so that members may judge this movement for themselves.

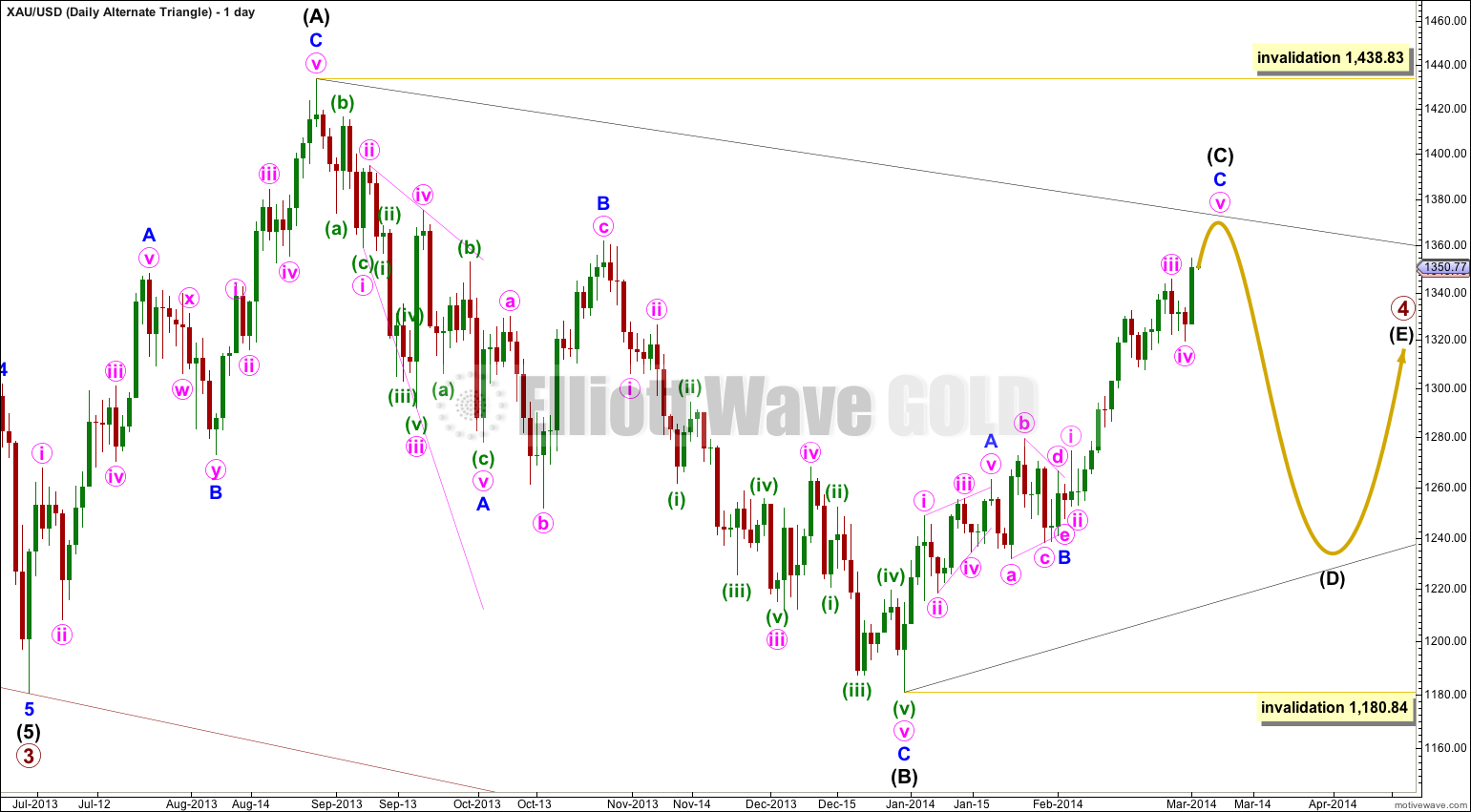

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

This wave count has a good probability. It does not diverge from the main wave count and it will not diverge for several weeks yet.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

The alternate does tend to be the one that actually happens next!

In this case I’m naming them “first” and “second”. After Thursday’s strong green candlestick I’m again going to sit on that (uncomfortable) fence. They have about an even probability.