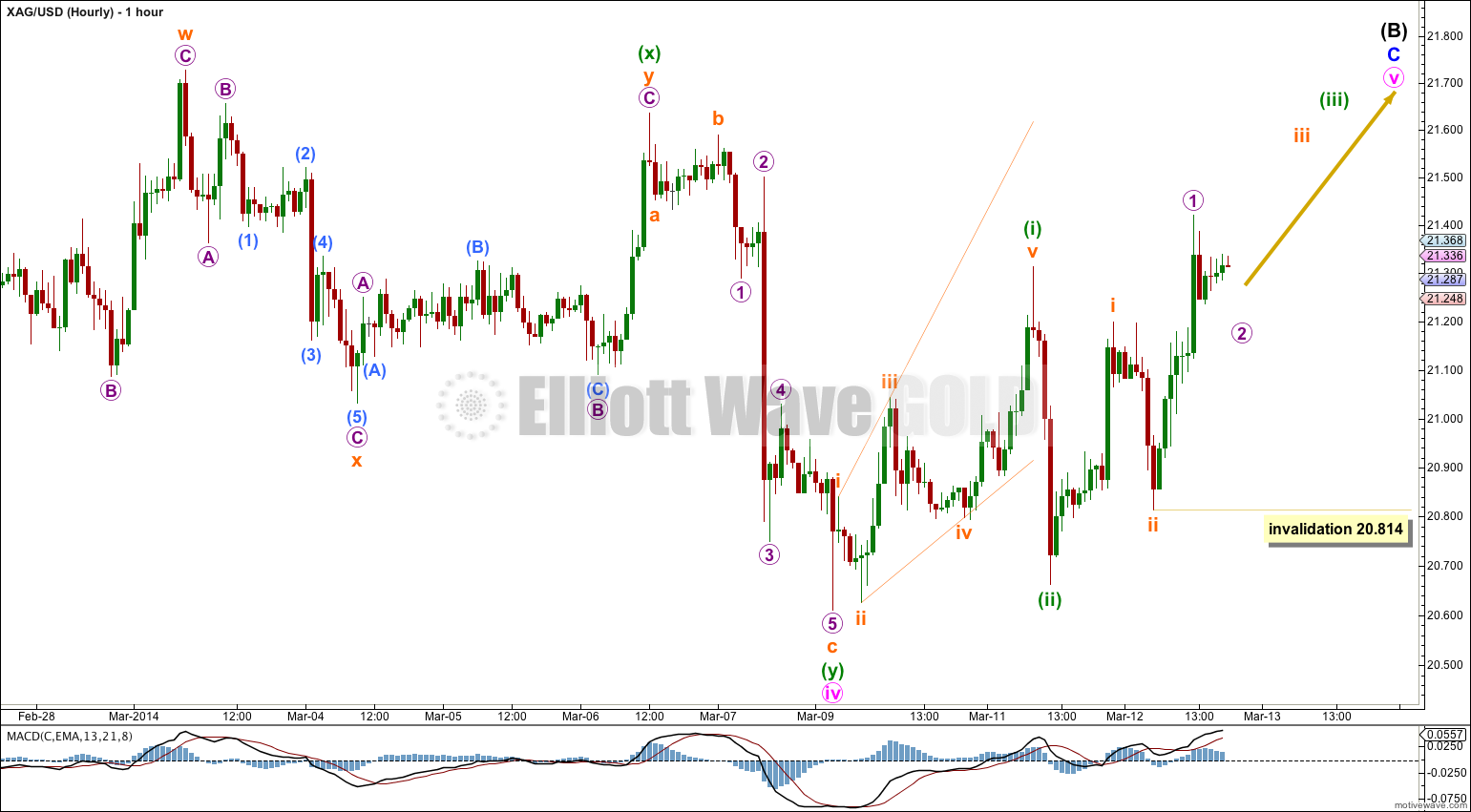

A fourth wave correction has ended as expected, slightly below the target. A final fifth wave up has begun which should unfold over the next few days.

Click on charts to enlarge.

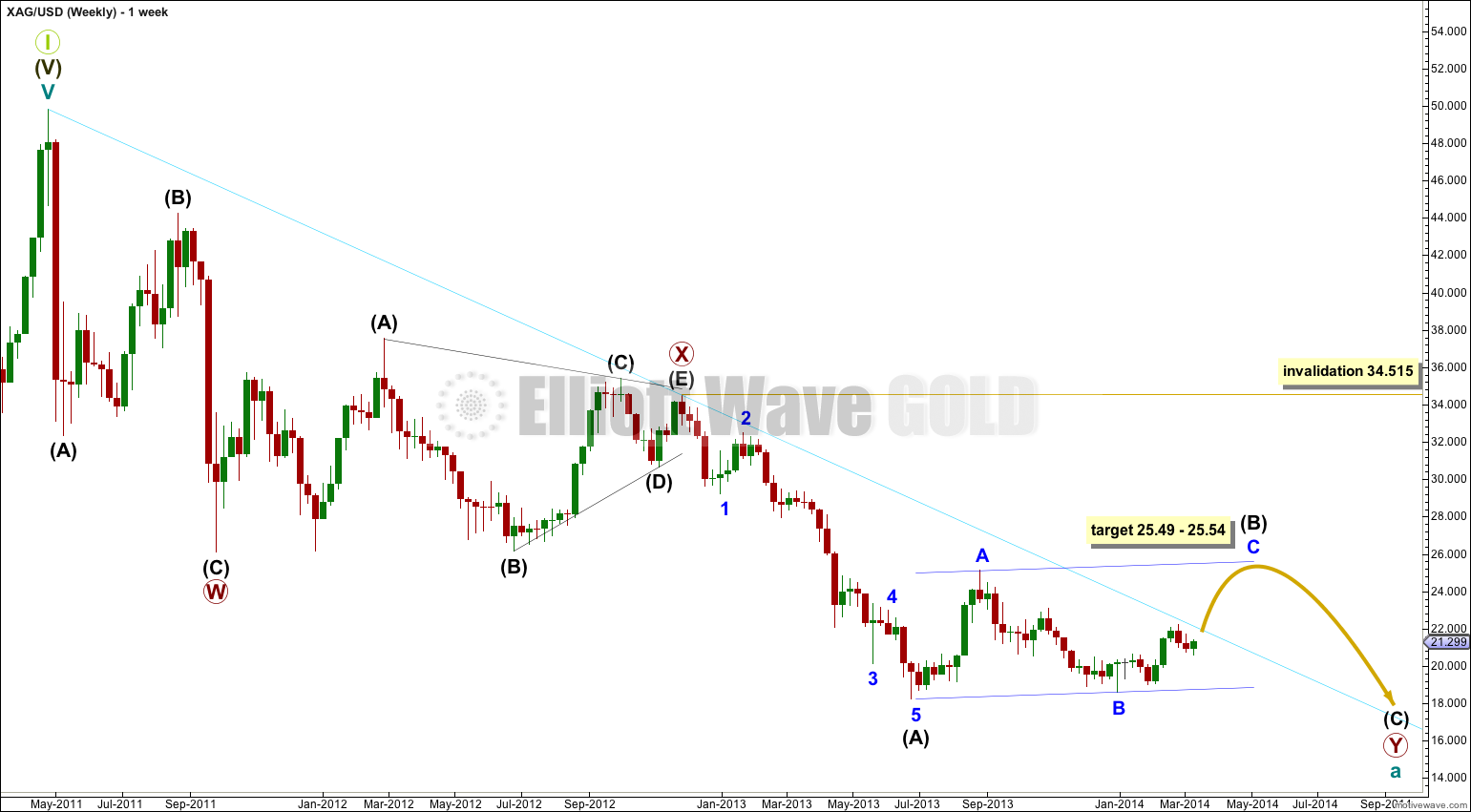

The new downwards trend from the all time high at 49.825 subdivides so far as an incomplete double zigzag.

The first wave down is a three labeled primary wave W.

The two structures are joined by a “three” in the opposite direction labeled primary wave X. Primary wave X is a contracting triangle.

The second zigzag downwards is unfolding. Within it intermediate wave (B) may not move beyond the start of intermediate wave (A). This wave count is invalidated with movement above 34.515.

Within intermediate wave (B) minor wave A subdivides as a five wave impulse. Minor wave B is an incomplete zigzag.

The light aqua blue trend line may provide some resistance to upwards movement.

Minute wave iv is a complete double combination: flat – X – zigzag. It lasted 14 days and is in proportion to minute wave ii.

At 25.54 minute wave v would reach 1.618 the length of minute wave i. At 25.49 minor wave C would reach equality in length with minor wave A. This gives a 5 cent target zone for upwards movement to end.

The upwards sloping pink channel is drawn using Elliott’s first technique. For this wave count I would expect Silver to breach the upper edge. I am expecting a fast moving and strong fifth wave up.

Minor wave C is very likely to at least move above the end of minor wave A at 25.118 to avoid a truncation.

So far to the upside it looks like there is a series of three overlapping first and second waves. This indicates we may see an increase in upwards momentum over the next few days.

Micro wave 2 may not move beyond the start of micro wave 1. This wave count is invalidated with movement below 20.814.

No. I need to update my wave count for Silver. Probably I will do that tomorrow.

I expect Silver to move sideways and lower now. It should move in line with Gold.

And you are absolutely right; upwards movement on the hourly chart from 20.611 looks typically corrective. However, a small word of caution there; often the beginning of impulses can look like that when the third wave within an impulse is extended. They necessarily begin with a series of overlapping first and second waves which makes us think the movement is corrective, right before a strong third wave takes off. That’s happened to me often enough to be aware of that possibility.

Hi Lara, the entire up move from the low of 20.611 is an overlapping structure and looks corrective in nature. Do you still think that it could rise significantly?

Hi Lara.

Given the current situation in which silver movement is so slow, it appears to be the end of a wave rather than nearer the beginning of one (in this case, Minute 5). The most probable scenario is as you surmised, that this is actually the end of Minute 1. What it takes is to simply move the labeling down one degree.

To continue with the current description would require silver to diverge significantly with gold. Silver would need to make an extended 5th wave to breach the gap between the current price and the target of 25.49. And this will be a very huge extension, requiring a Fibonacci ratio of 6.854 or a series of smaller ones (that are larger than 1.618). Timewise, this is highly improbable. Unless, of course, there is a sudden spike in price. But if silver spikes, it is inconceivable that gold would be rising slowly.

Yes I am aware of the problem.

Either one of my wave counts is wrong or Silver will move up very strongly, while Gold will be more sluggish.

I’m more confident at this stage of my Gold wave count. I’m waiting to see what Silver does over the next week.

Either my wave count for one of these markets is wrong, or Silver will have a turbo charged fifth wave.

Today’s sluggish movement looks more like turbo snail though.

I’m considering my degree of labeling for Silver may be wrong, we may be only at the end of minute wave i and soon to have minute wave ii down.

I think I misinterpreted ” A few days” as meaning it would get to $25.49.

I guess a few days is just to get Silver to Wake up and rise to the occasion to make us some money. If Gold’s rally is over in 2 more days how far along would Silver be then and can it continue up to $25.49 without Gold?

If Gold ends this trend in two days then I don’t think Silver will make it. It’s fast asleep today.

“I am expecting a fast moving and strong fifth wave up.”

Lara, do you expect any significant correction down during this silver fifth wave?

I look at both gold and silver analysis on day charts–gold expects small (maybe 1-2%) up then significant move down while silver expects significant move up (21.3 to 25.5 maybe 20%). How can this be? Gold and silver normally are roughly concurrent. Analysis on daily charts show gold and silver making significant moves in the opposite direction?

Hello Lara,

Your updates today show Gold target in 3 days is $1,390 which is an increase of only 2% yet Silver target in a few days is $25.49-25.54 which is an increase of 20%. How is it possible for Silver to go up ten times more than Gold in just 3 or a few days? I am curious, does Silver has a Fast and Furious TURBO drive in wave V ? It looks like it did in wave V the end of August 2013 so we are getting that again?

Also your Silver chart looks like (c) Y a wave down is equivalent to wave 5 (circle) down for Gold whereas Gold still has another wave up and down after this week before it would start it’s final wave 5 down to ultimate bottom. That is a big divergence. Thanks for any clarification you can provide. Your charting is great this week and I am betting on it, thanks.