Last analysis expected a three wave movement upwards for an X wave which is exactly what happened. The structure of the current correction is incomplete. I would expect overall another six days minimum of choppy overlapping movement.

Click on charts to enlarge.

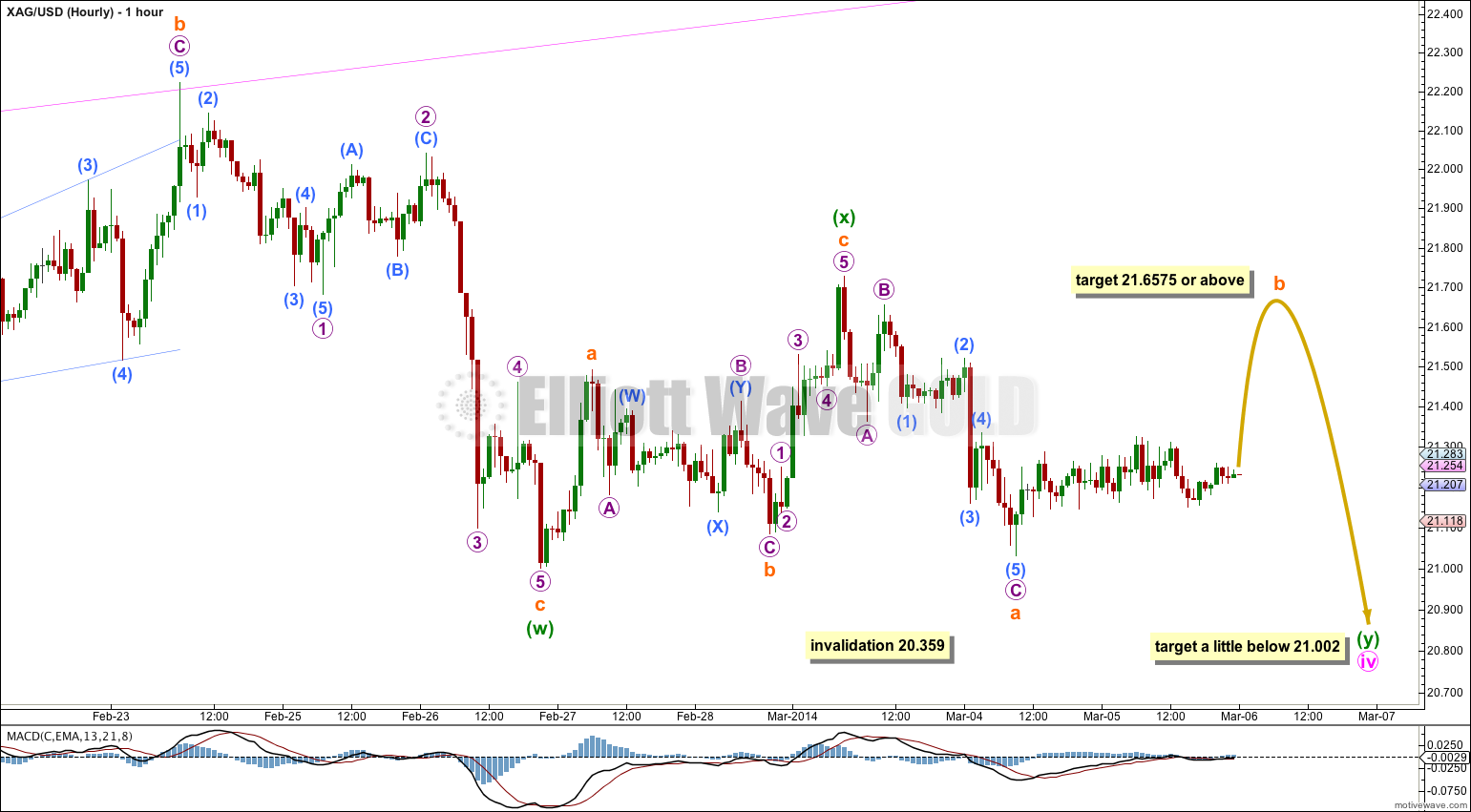

Minute wave iv may be unfolding as a double combination in order to show structural alternation with minute wave ii. So far within the combination the first structure, minuette wave (w), is an expanded flat correction.

Sideways movement continues. Minute wave iv is incomplete.

Minuette wave (x) unfolded as expected as an upwards zigzag.

Overall I expect more very choppy overlapping movement for minute wave iv for about another six days minimum, but it may last longer. It may find support at the lower end of the pink parallel channel.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 20.359.

Minuette wave (w) subdivides perfectly as an expanded flat correction.

Minuette wave (y) may be either a flat, zigzag or triangle correction (in order of probability). If it is a flat then minute wave iv would be a double flat. If it is a zigzag or triangle then minute wave iv would be a double combination. The purpose of double flats and double combinations is the same: to move price sideways and take up time.

Within minuette wave (y) so far the first downwards wave of subminuette wave a looks best as a zigzag. This indicates that minuette wave (y) may be most likely a flat correction or possibly a triangle. Either structure would be expected to move price overall sideways for a few days yet.

If minuette wave (y) is a flat correction then within it subminuette wave b must reach a minimum of 90% the length of subminuette wave a at 21.6575.

If minuette wave (y) is a triangle there is no minimum upwards point that subminuette wave b must reach.

The whole structure for minute wave iv, whether it be a double flat or a double combination, should move price sideways. This means the second structure in the double is likely to end about the same level as the first. Minuette wave (y) is likely to end about 21.002 or a little below this point, but not significantly below.

Hi Lara,

I have lots of questions for you. I re-visited the February 6th grand scale analysis you did and am looking at where we are today. [can you link this to current pages?]

Can another wave structure produce after the current minute v wave (within Minor C within the Intermediate B) and what might the price movement of that next structure look like? Is there a target calculated for the end of minute v? Also, what time frame do you now anticipate reaching the end of Minor C, as we started this wave in September?

Thanks for your input on this.

I’ll try to get Silver updated today. I moved house over the last few days and life has just now settled back down.

Minute wave v can be only one of two structures; an impulse (most likely and easiest to analyse) or an ending digonal. Impulses are easy, the trend is unmistakeable. Diagonals are choppy overlapping affairs, harder to analyse and so harder to trade.

The target will remain pretty much the same.

Minor wave C is very likely to end slightly above the end of minor wave A at 25.118 to avoid a truncation.

This means… that my analysis for Silver expects it to move a LOT higher than Gold. Which probably means I’ve got one of them wrong 🙁

No fear, Its all copper’s fault. LOL

Hi Lara

Could we still be finishing (y) and a target of 25ish still valid?

Amr

Minute wave iv is over.

The target at 25.49 remains the same. I expect now that Silver is in a fifth wave up.

Lara,

As always, congratulations on your excellent work!

And thank you! 🙂

you’re welcome!

Today was a wild day in Gold and Silver.

I believe that at this point there is more confidence in Silver moving up to the targets than Gold. Hopefully that is the case as I invested in Silver miners today.

I have a question regarding the EWP.. can a wave W be composed of w-x-y..?

No. Because the maximum number of corrective structures in a multiple is three. If W, Y ore Z were allowed to be multiples also then the maximum would be more than three.

My sentiments exactly. Subminuette c of Minuette Y is a 5-wave impulse. As at Friday’s close, the fourth wave is most likely over. On Monday, the fifth wave will complete the drop. The target is most likely between 20.70 and 20.60. Thereafter, it will be the rise to 25.49.

Saw a low of 20.62—you were spot on. Hope you are right about the second part of 25.49 or so.

Hello Lara,

Silver is at 20.85.

Can u please elaborate your above point of not significantly below 21.002

It is a bit lower than I had expected, but it’s still acceptable. Overall it is moving mostly sideways in choppy overlapping movement, and overall I expect it may actually move slightly lower on Monday. Then it should be done.

I’ll be expecting a trend change back to the upside Monday or Tuesday next week for Silver.

Thank You so much… u rock !!

i have seen silver and gold analysis, then its mean gold has no chance to go down as long as support is at 1325. and it ca touch above 1400