I had expected to see a little downwards movement to begin the week, to reach slightly below 1,282.60 but not below 1,277.79. So far price has reached down to 1,282.04 and turned up slightly.

Summary: I expect overall upwards movement from here to either 1,336 or above 1,380.82. Only when the channel on the hourly chart is clearly breached with upwards movement would I have any confidence in these targets.

This analysis is published about 4:45 p.m. EST. Click on charts to enlarge.

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure: either a flat correction (main hourly wave count) or a double zigzag (alternate hourly wave count). Minor wave B should continue for a few more weeks and may make a new low below 1,180, and is reasonably likely to do so in coming weeks.

This main wave count follows the idea that minor wave B may be unfolding as a flat correction. Within the flat correction minute wave a subdivides as a single zigzag. Minute wave b within the flat must reach a minimum of 90% the length of minute wave a at 1,380.82.

Minute wave b is most likely to subdivide as a single or double zigzag in order to reach 1,380.82.

Within a zigzag minuette wave (a) must subdivide as a five wave structure. It fits best as a complete impulse, with an ending contracting diagonal for its fifth wave.

Minuette wave (a) may have lasted nine days. Minuette wave (b) may have ended in a total Fibonacci five days. Within minuette wave (b) subminuette wave c has moved very slightly below the end of subminuette wave a and so a truncation has been avoided. The structure is complete.

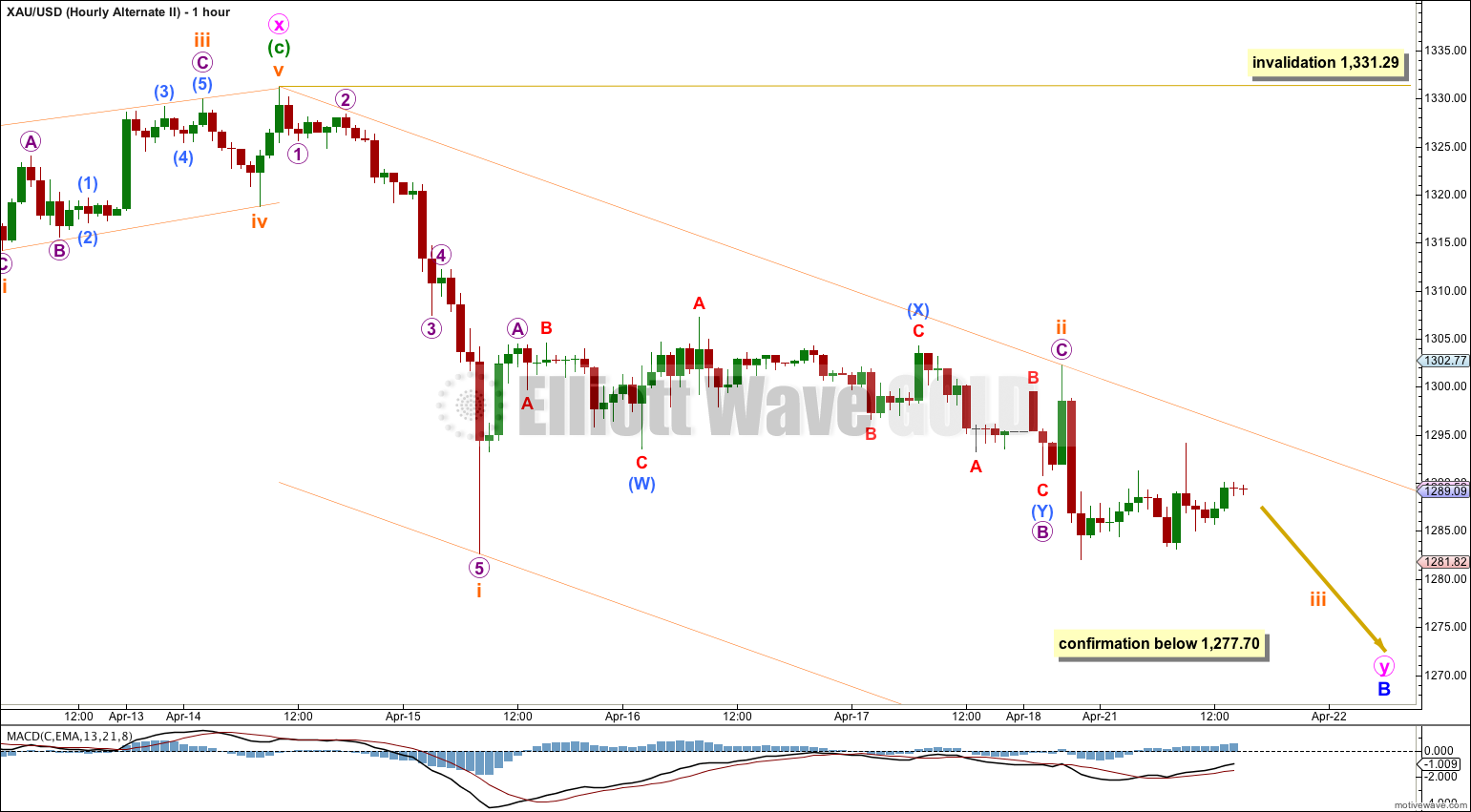

I have drawn a channel about minuette wave (b) using Elliott’s technique for a correction. Only when this orange channel is very clearly breached with upwards movement (at least one if not two full hourly candlesticks above the upper trend line and not touching it) would I have confidence that minuette wave (b) is over and minuette wave (c) has begun.

Minuette wave (c) upwards may last about eight days and must move price above 1,380.82.

If minuette wave (b) continues further then it may not move beyond the start of minuette wave (a) below 1,277.79.

First Alternate Hourly Wave Count.

This alternate wave count follows the idea that minor wave B downwards may be unfolding as a double zigzag. The first zigzag downwards is labeled minute wave w. The double should be joined by a “three” in the opposite direction which may subdivide as any corrective structure labeled minute wave x.

At this stage this alternate wave count is the same as the main wave count with the sole exception of minute wave x not requiring a minimum upwards length. At 1,336 minuette wave (c) would reach equality in length with minuette wave (a).

If minuette wave (b) continues further then it may not move beyond the start of minuette wave (a) below 1,277.79.

Second Alternate Hourly Wave Count.

This second alternate wave count sees the upwards wave labeled minute wave x as a completed three wave structure, where the first two hourly wave counts see that upwards wave as a five. It fits much better as a five, and so this second alternate wave count has the lowest probability of all three.

If minute wave x is complete as a single zigzag (or even a double or triple zigzag) then minute wave y may have begun. Minute wave y must subdivide as a zigzag to take price down to 1,201.98 or below. Within a zigzag the B wave may not move beyond the start of the A wave, and within the A wave no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,331.29.

If this alternate is correct then downwards movement should begin to show an increase in momentum as a third wave unfolds. This should take price below 1,277.70.

Because this alternate (or the variations of it that I have considered) has a low probability I would only use it if it is confirmed with movement below 1,277.70.

I’m not rearranging targets, I’m deleting invalidated wave counts.

The alternate wave count was confirmed. The target for the short / mid term will be 1,223.

I have a low of $1277.62 so far…

Are you rearranging your targets Lara?

i have an question please guide me how can you get to know 1277.79 will not break, and at 1282 trend will be end and new trend for upside will start. please i really want to know. how to read this thing

Movement below 1,277.47 invalidated the main wave count and confirmed the alternate.

How could I know that was going to happen? I can’t. I don’t have a crystal ball.

It was a low probability outcome.

That’s the problem with low probability wave counts. They have a low probability. So whenever they turn out to be correct, it is never what we expected was most likely to happen.

Another masterpiece of Elliott Wave Analysis Lara. Your written and video accuracy is truly a joy to behold. You are in my opinion the most accurate Elliotician in the world. WOW!!!