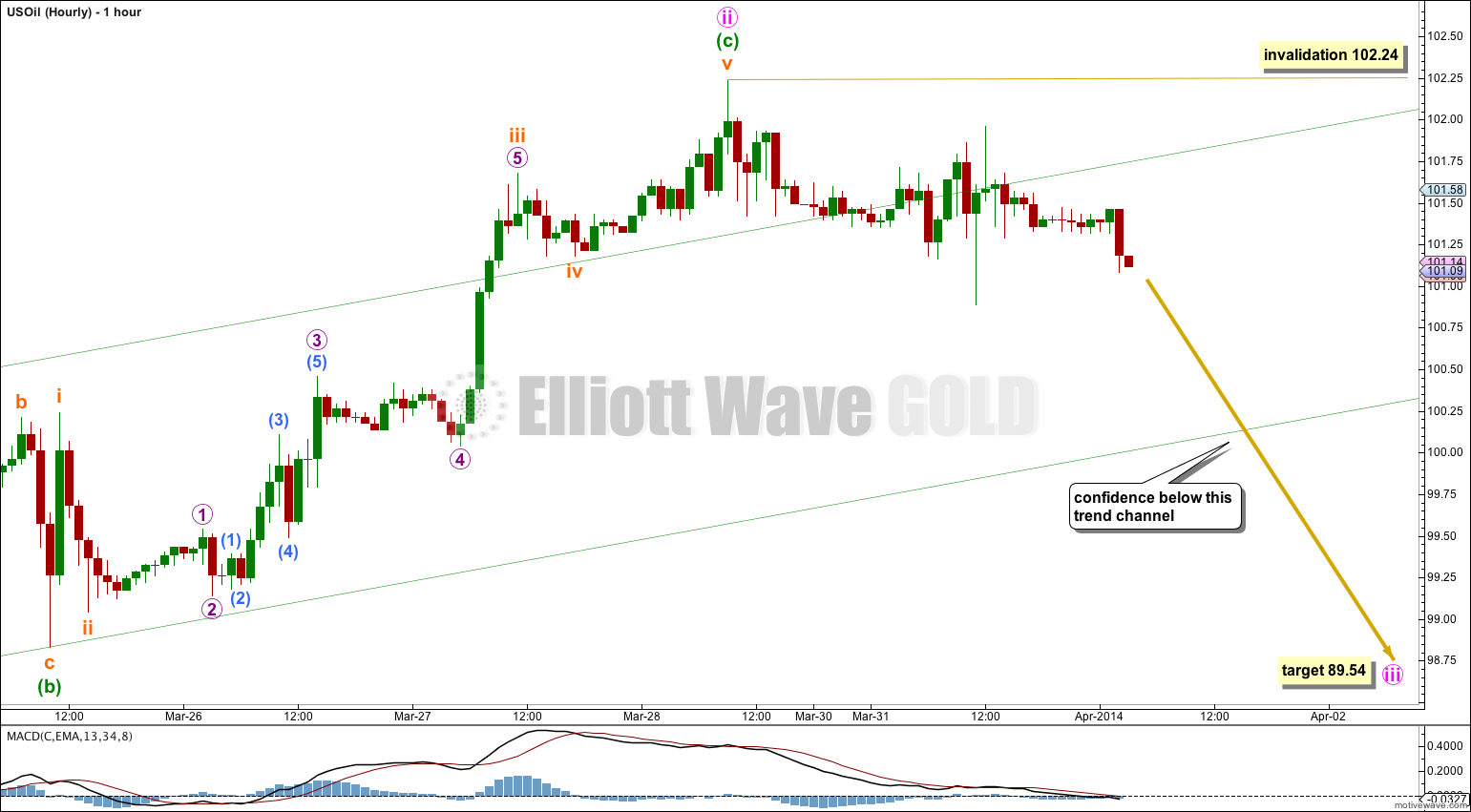

Last week’s analysis expected more upwards movement to a target at 101.76 to 102.71. So far price has reached up to 102.24. We may use a trend channel on the hourly chart to see if it has turned here. Once this channel is breached I will have confidence in the next downwards target.

Click on charts to enlarge.

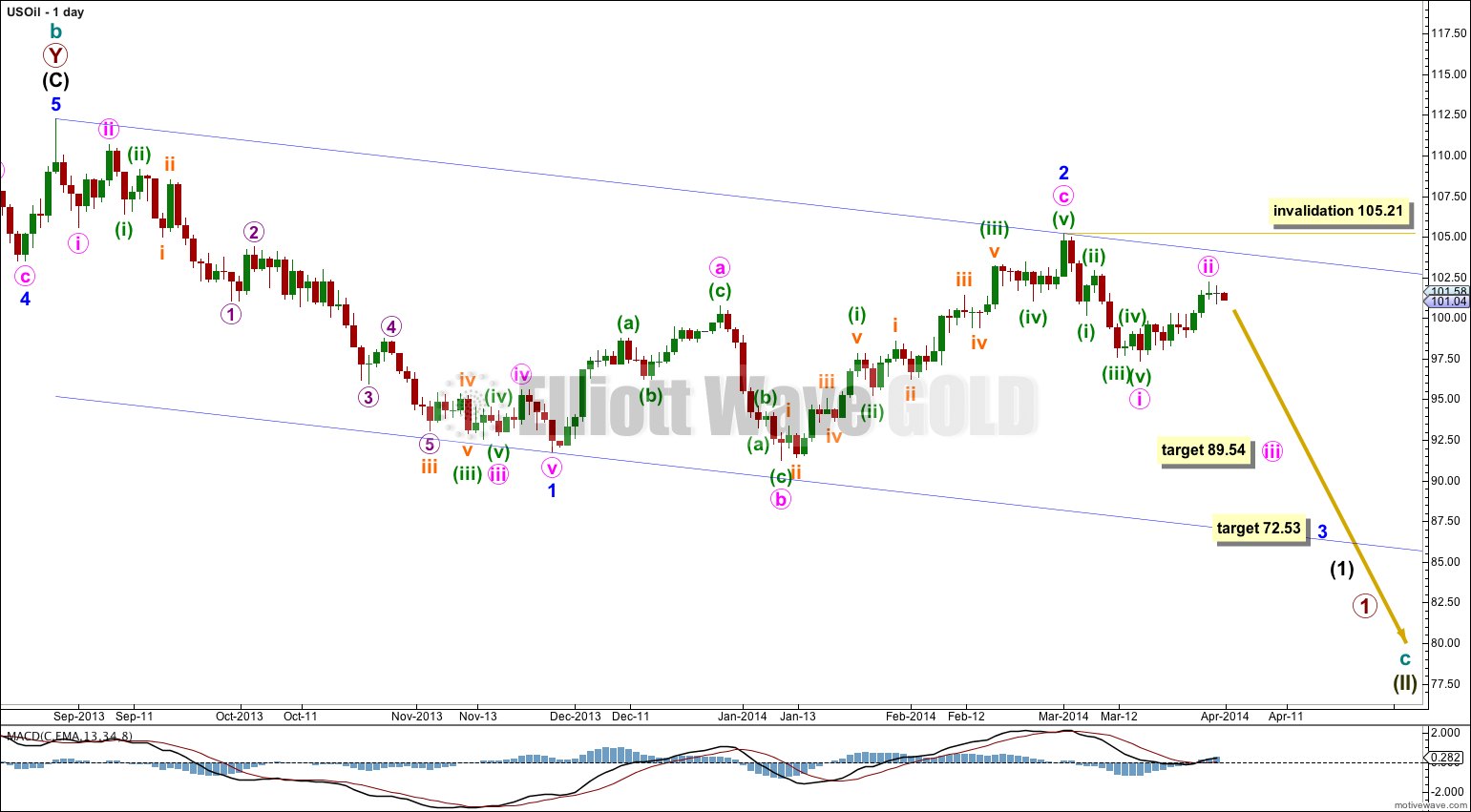

The daily chart shows all of the start of cycle wave c downwards.

Minor wave 1 subdivides perfectly as an impulse. Minor wave 2 is now complete as an expanded flat correction which is a 66% correction of minor wave 1.

At 72.53 minor wave 3 would reach 1.618 the length of minor wave 1.

Minor wave 1 lasted 65 days and minor wave 2 lasted 67 days. If minor wave 3 is of about the same duration it may end in another 48 days or thereabouts.

The channel drawn about minor waves 1 and 2 is a base channel. Minor wave 3 downwards should clearly and strongly breach the lower edge of the channel. Along the way down upwards corrections should find resistance about the upper edge of the channel.

Within minor wave 3 minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement above 105.21.

When downwards movement breaches the channel on the hourly chart I would have confidence that minute wave ii is over and minute wave iii is underway. At that stage I would move the invalidation point down to the start of minute wave iii at 102.24.

Within minute wave ii there is no Fibonacci ratio between minuette waves (a) and (c).

Ratios within minuette wave (c) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is just 0.05 longer than 0.382 the length of subminuette wave iii.

Ratios within subminuette wave iii are: micro wave 3 is just 0.01 longer than 2.618 the length of micro wave 1, and micro wave 5 has no Fibonacci ratio to either of micro waves 3 or 1.

If minuette wave ii is over then downwards movement should clearly breach the green channel which contains it. Only when this channel is breached will I have confidence in the targets.

Within minute wave iii no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 102.24.

The wave count remain the same.

The trend line is overshot, but not properly breached. There is no daily candlestick fully above it and not touching it. They all moved back in.

It’s right there as of yesterday.

We should see over the next couple of days… if the wave count is correct then the second wave should be over now and price should start accelerating downwards for the start of a third wave.

Hi Lara, looks like price breached the trend line joining wave 1 and 2. what is the alternative count now? because the rise from the low of $97.37 looks corrective in nature?

Lara, any new thoughts on the oil chart? Is the market trying to fool the bears and getting ready for a huge drop? I’m getting better at seeing the waves but cannot make out anything. Do you see anything still bearish? I need help!

I would request Lara to please share the oil analysis on daily basis like gold. This would help us to follow the trend. So we would be able to change positions accordinlgy. Thanks

I hope you would not mind it and will help us.

The FAQ answers your question.

Elliott wave analysis is very time consuming, it takes hours sometimes to analyse just one market and prepare and publish charts, text and video.

I do not have time to do two more markets each day.

I still expect this is a second wave correction.

Draw a trend line from the start of minor wave 1 at 112.24 to the end of minor wave 2 at 105.21. Only if this trend line is broken would I be concerned for this wave count.

I will be updating US Oil this week, but I need to look at AAPL and FTSE for Elliott Wave Stock Market first.

I had a feeling that’s what you would say. However, I’m really curious on the subdivisons for Minute 2. Somehow we must see the rise from $97-102.22. I can’t see it but maybe you can.

looks like in order for the trend line to be broken, it has to get up above 103.25/50 area. tomorrow the inventory report is due for last week, and the reaction to this report will let us know if there is more upward momentum, or reverse and go down like lara has been predicting. i’m on lara’s side. we’ll see…

Oil had a perfect opportunity to head down with stock selloff. Makes you wonder.

Amr

That’s what the wave count expects, yes.

How you see the oil now Lara ? As the price has came again into the channel and seems very bullish.

Lara, I’ll add to this question as I realize the main wave count has not been invalidated. How do you normally view patterns when the channel is decisively broken and then it reenters the channel rather quickly? Is this bullish or still can be viewed as bearish or has no significance? Have you seen second waves do this before?

The wave count is the same.

I’m still expecting it to move lower. The wave count is exactly the same.

Draw a trend line from the start of minute wave i to the end of minute wave ii (the last high). Price has come up to ever so slightly overshoot that trend line. It may find enough resistance there to bounce down.

If that trend line is breached I would be concerned; the wave count could be wrong.

This count looked great with the channel break on the hourly chart and trade down to $98.90. However if it’s a third wave within a third wave, I’m very surprised to see oil back over $100. I’m assuming this is a 2nd wave correction within minute iii. Am I analyzing this correctly?

Yes, it looks like a second wave correction. It may find resistance at the lower edge of the channel which previously provided support.

The downwards wave looks like a five, and this upwards wave so far looks like a three.

It looks fine to me.

I hope you’re right! It’s looking awfully bullish now and nothing like a third of a third down yet

Davey,

Thanks for your questions. I have learned a great deal in the time I have been a subscriber to Lara’s services, a great deal indeed. Good questions like yours help with that learning process.

Thanks,

Rodney

Lara,

Thank you for your forthright answers and taking the time to answer your subscribers. To me, it is a very valuable part of this service.

Thanks,

Rodney

You’re welcome 🙂

“If minor wave 3 is of about the same duration it may end in another 48 days or thereabouts.”

Lara

(1) Does 48 days mean 48 trading days?

(2) In the past I asked and you answered that of spx and gold, EW seems more accurate with gold. I am wondering about oil–do you see EW analysis of oil as more or less accurate than gold?

I mean trading days. I count the days candlesticks and weekends don’t show up.

Gold is the easiest market for me to analyse. The S&P is (usually) relatively easy (but I’ve had major difficulties with it over the last four weeks).

US Oil is not as easy as Gold nor often the S&P.

Lara,

That’s interesting–spx, gold, oil are all waves of energy, all closely followed with (I assume) good data. Why would one market be more or less clear under EW?

What about long-term vs short term EW analysis? Let’s say daily vs hourly. Is there any significant difference in probability of success in daily or hourly analysis?

Using oil as example: daily chart showing from aprox 100 down to aprox 70. I am asking myself (not asking for investment advice just your experience with EW probabilities) If probability of success is as good or better using daily chart why spend time and effort attempting to trade in and out on hourly chart?

That’s a question I asked myself years ago and answered with “don’t bother”. When we trade we hold positions for days or weeks.

The difference is in temperament. What we do is I think commonly referred to as “swing trading” rather than day trading. I find watching hourly charts and worrying each day too stressful. I have better things to do. But some people love it, it makes them happy.

For a market like Gold I must say I do find the daily chart clearer. I only analyse the hourly chart in such detail because that’s what members want me to do.

My favourite to trade is NZDUSD, which is silly really because it’s such a pig to analyse. I don’t bother too much with the hourly chart analysis for myself because I’m trading on the daily chart. I rarely look at 5 minute charts of NZDUSD which may surprise members.

I think the difference in EW structures between the different markets is due to volume. Gold is probably one of if not the highest volume market in the world. It’s truly global if my membership is a representation of who is trading it. With extremely high volume comes clearer EW structures, and the analysis is easier.

The S&P 500 is more US focussed. The EW structures are not as clear. I expect it’s total volume traded is lower than Gold.

As for US Oil, I had some difficulty with it back in August last year around that trend change. But since then it seems to be getting a bit easier. I’m also getting a better… “feel” for this market.

Lara,

Thanks. I learn from your comments.

You have great skill using EW system to “see” market energy waves so would be fascinating to hear your opinion on topics like astrology, numerology etc as systems to “see” market energy waves.

One question on EW probabilities– which wave structures do successful EW investors look for? Many different wave structures but I will guess that over time you see successful EW investors gravitating to only a few wave structures? Yes, I could read books for the author’s opinion but I appreciate your insight.

Impulses. Particularly third waves within impulses. They’re the “holy grail” because price moves fast in an unmistakeable direction.

Conversely B waves are usually the worst trading opportunities. They have the most variation and they’re the most difficult to analyse.

Lara,

So B wave internal sub-waves are highly variable, difficult to analyze and a poor trade opportunity.

What about the overall B wave structure–identifying the beginning and ending of a B wave? Is it reasonable to trade the begin to end-point of a B wave with reasonable certainty (just ignore internal sub-waves) meaning EW can analyze with reasonable certainty B wave begin and end-points. Or is a B wave end-point highly variable and so risky to trade just like the internal B sub-waves?

A B wave at minor degree can be a good trading opportunity, yes. It’s difficult, but because it lasts weeks it’s entirely possible. You just have to beware that it can be choppy and overlapping, and would have an upwards minute degree b wave within it.

A smaller B wave within a larger B wave though…. horrible. The variation is so great, and the duration is not really long enough for me to get a good handle on what’s happening… and I may not have the right wave count for you until right at the end.

Lara,

As you said, Impulses. Particularly third waves within impulses. They’re the “holy grail” because price moves fast in an unmistakeable direction.

Are we in third wave within impulses now?

Thanks a lot.

Rahmat