Yesterday’s analysis expected to see some downwards movement, from both the main and alternate hourly wave counts. This is what has happened. With a further 24 hours price action to analyse I now have more confidence in the main hourly wave count.

Summary: I expect to see an increase in downwards momentum this week. I have a little more confidence today that a third wave has begun. The target at 1,242 is at least three days away, and may be six days away .

This analysis is published about 08:25 p.m. EST. Click on charts to enlarge.

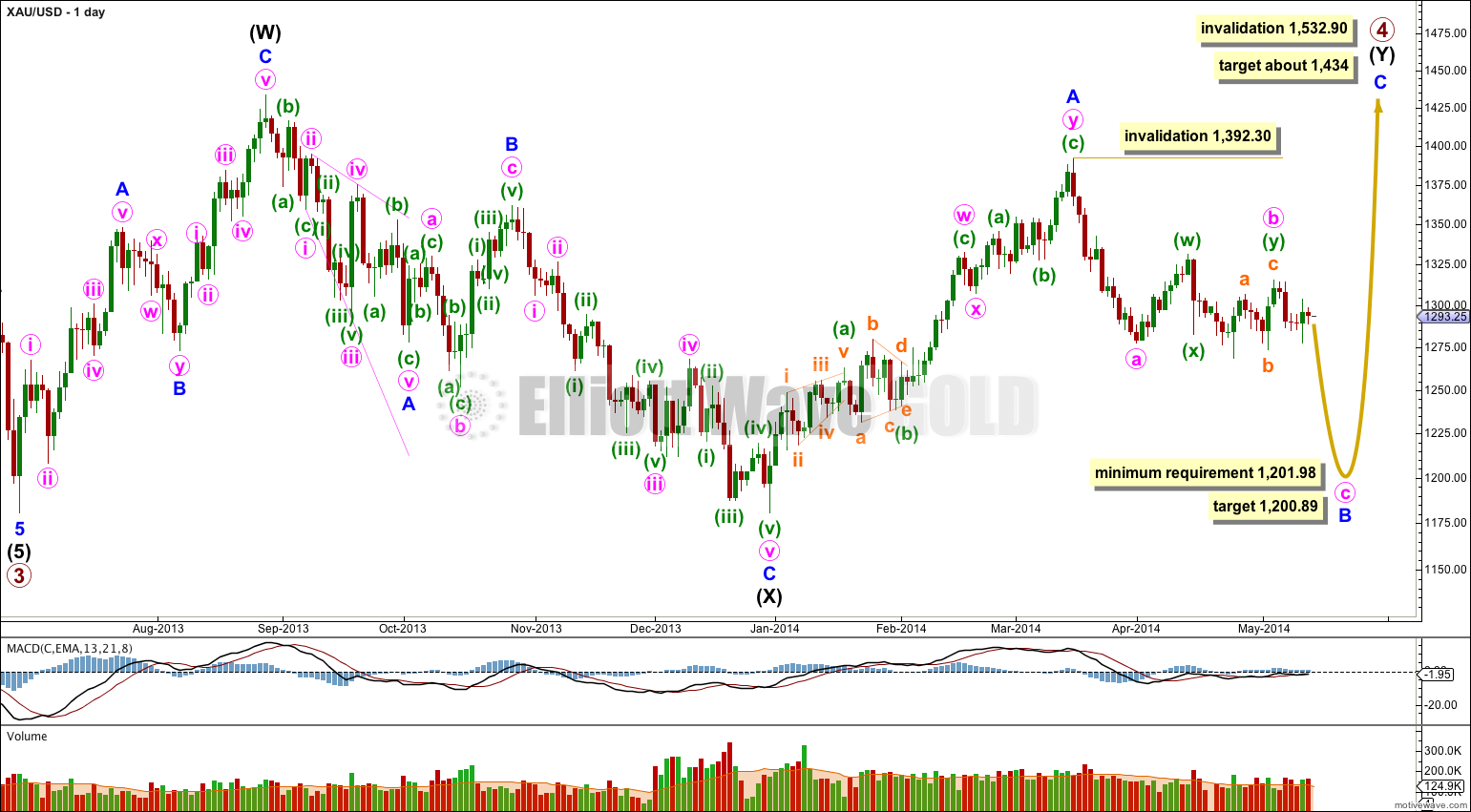

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

Overall the structure for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure may be either a single zigzag (as labeled here) or a double zigzag (relabel A-B-C to W-X-Y). While this next wave unfolds I will have to consider two structural possibilities; it may be an impulse for a C wave, or it may be a zigzag for a Y wave.

If minor wave B is a single zigzag then within it minute wave b may not move beyond the start of minute wave a above 1,392.30. Minute wave c would reach equality in length with minute wave a at 1,200.89.

If minor wave B is a double zigzag, relabeled minute w-x-y, then within it there is no invalidation point for minute wave x. But X waves within double zigzags are usually relatively brief and shallow, as they very rarely make new price extremes beyond the start of the first zigzag in the double.

Main Wave Count.

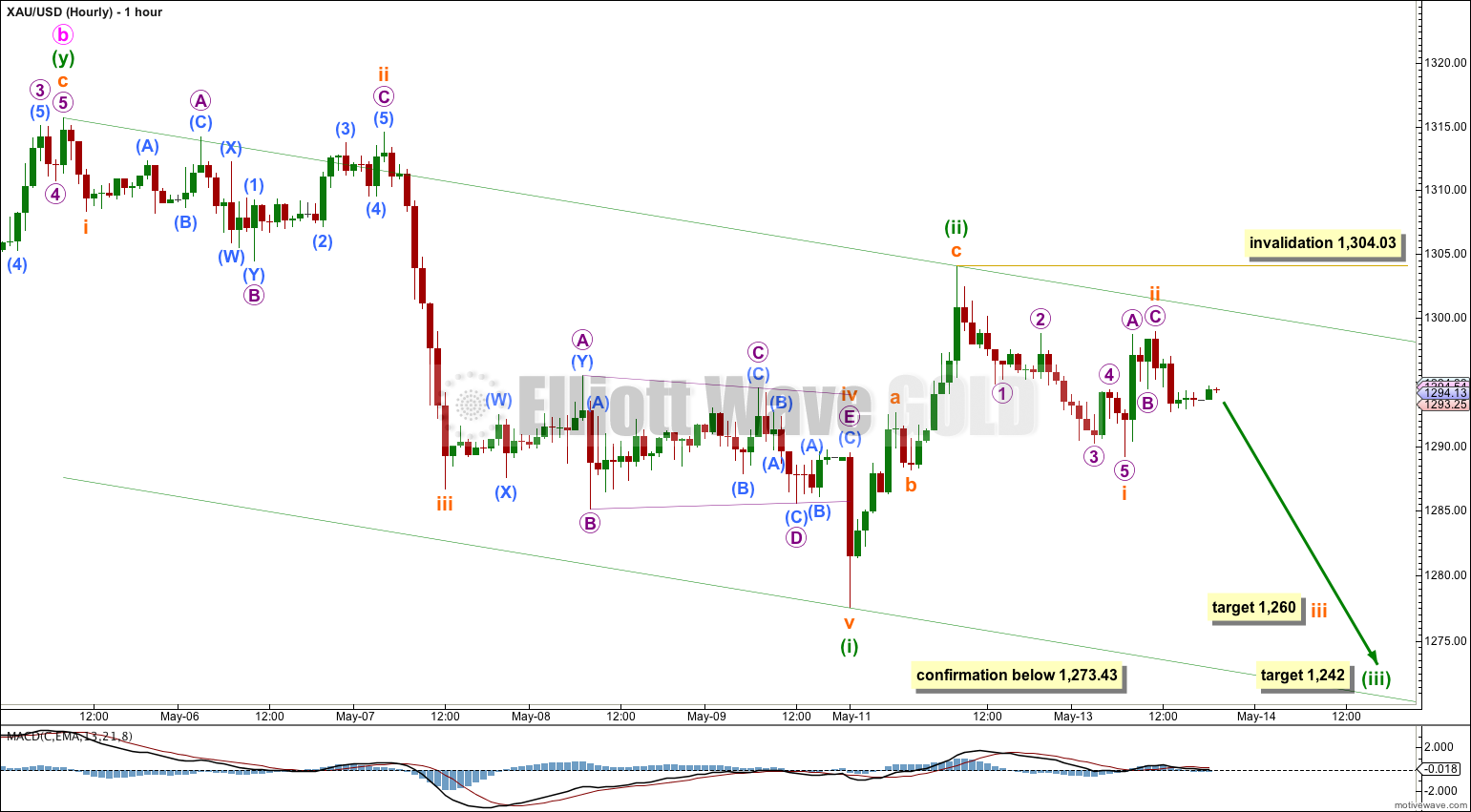

From the high at 1,304.03 there is a small five wave structure downwards now, followed by a three up. I have a little more confidence today that a third wave has begun.

At 1,260 subminuette wave iii would reach 2.618 the length of subminuette wave i. Subminuette wave iii should show strong downwards momentum. Subminuette wave i lasted one day and so I would expect subminuette wave iii to last three days in total. The target may be met in three days time.

Movement below 1,273.43 would fully confirm that Gold has broken out of the range it has been trading in for 31 days now, and is on the way down.

At 1,242 minuette wave (iii) would reach 1.618 the length of minuette wave (i). Minuette wave (i) lasted a total Fibonacci five days, so I would expect minuette wave iii to last a total of five or eight days. So far it has lasted two days. The target may be met in another three or more likely six days time.

I have drawn a base channel about minuette waves (i) and (ii). I would expect upwards corrections along the way down to find resistance at the upper trend line, and subminuette wave iii down should have enough momentum to break through support at the lower trend line.

Within minuette wave (iii) subminuette wave ii may not move beyond the start of subminuette wave i above 1,304.03.

Alternate Hourly Wave Count.

There is now another clear five down on the hourly chart and this alternate wave count is reduced in probability. If minuette wave (ii) is continuing further sideways and higher then it may become out of proportion to minuette wave (i) by the time it is complete.

This alternate wave count also expects more downwards movement at least for the short term

If minuette wave (ii) is continuing as a flat correction then within it subminuette wave b must reach down to a minimum 90% length of subminuette wave a at 1,280.22. Thereafter, subminuette wave c should move at least slightly above the end of subminuette wave a at 1,304.03.

When subminuette wave b is complete (or subminuette wave x if minuette wave (ii) is relabeled w-x-y, a double zigzag or combination) then upwards movement above 1,289.16 would provide first confirmation that the main wave count is incorrect and this alternate is more likely. At that stage I would expect to see more upwards movement to above 1,304.03 (if minuette wave (ii) is a flat correction) or about 1,304.03 (if minuette wave (ii) is a double combination).

Minuette wave (ii) may not move beyond the start of minuette wave (i) at 1,315.72.

At this stage both wave counts expect to see some downwards movement which should subdivide as a five wave structure. Once this is done then subsequent upwards movement above 1,298.93 would confirm this alternate wave count and invalidate the main, because at that stage upwards movement could not be a small second wave correction within a third wave down.

Micro abcde is a triangle to complete orange b and a thrust up to today’s high follows to complete orange C & wave 2.

Hope this is what you have Lara…. Waiting for a drop but it seems to be stalling. Hoping to get your view before markets close.

Houston, we have a problem!

Lara,

Looks like silver tends to break through the downward channel on daily chart, silver seems resists to drop below the point 19.00 which seems to be a very key support. It seems the wave movement of gold and silver do not coherent again this time.