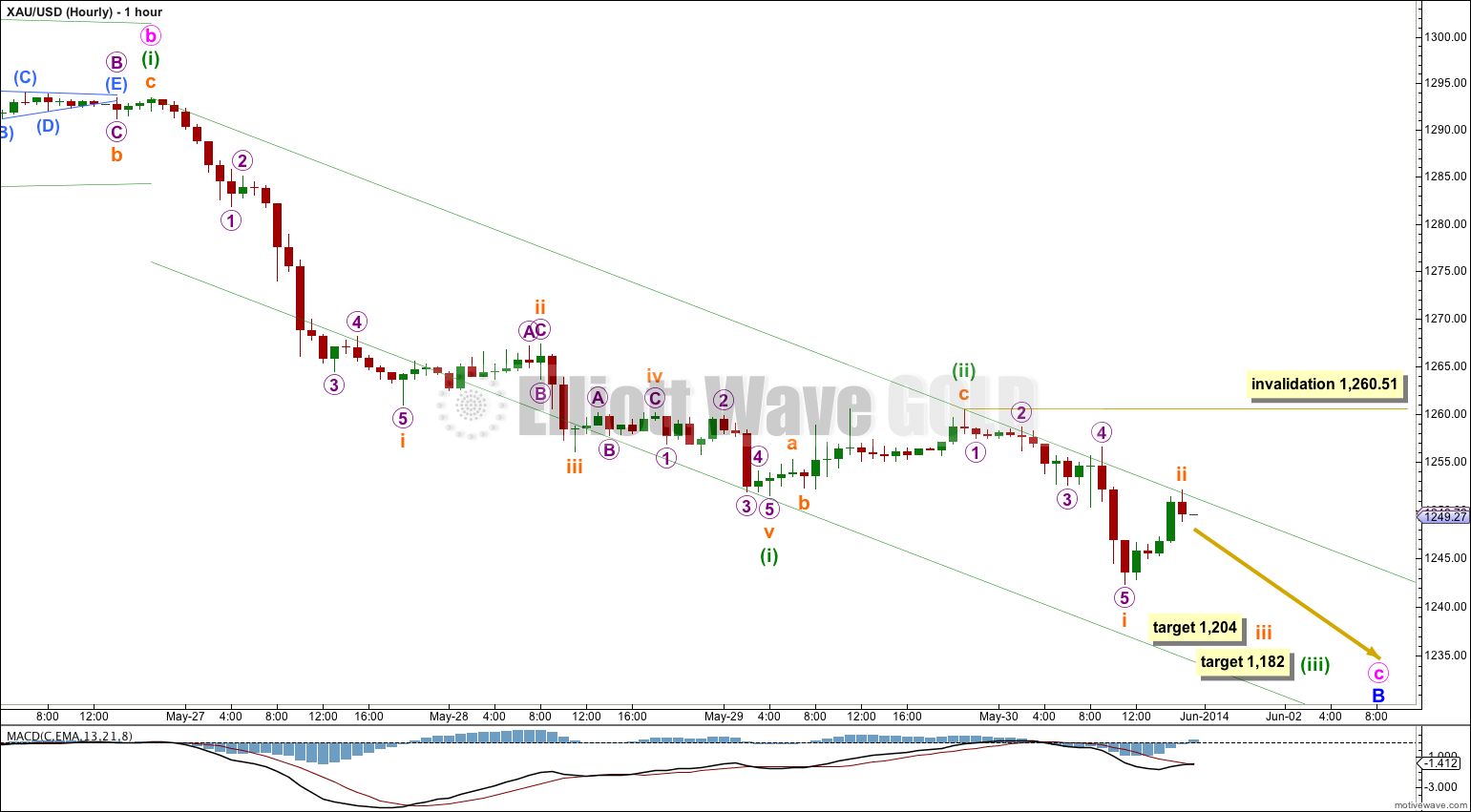

Again I had expected to see a doji or green candlestick for Friday’s session. This is not what happened. I now expect the second wave correction is over, without showing up on the daily chart clearly.

Summary: The short term target for Monday / Tuesday is 1,204. I expect to see an increase in downwards momentum from here as a third wave unfolds.

This analysis is published about 02:10 a.m. EST. Click on charts to enlarge.

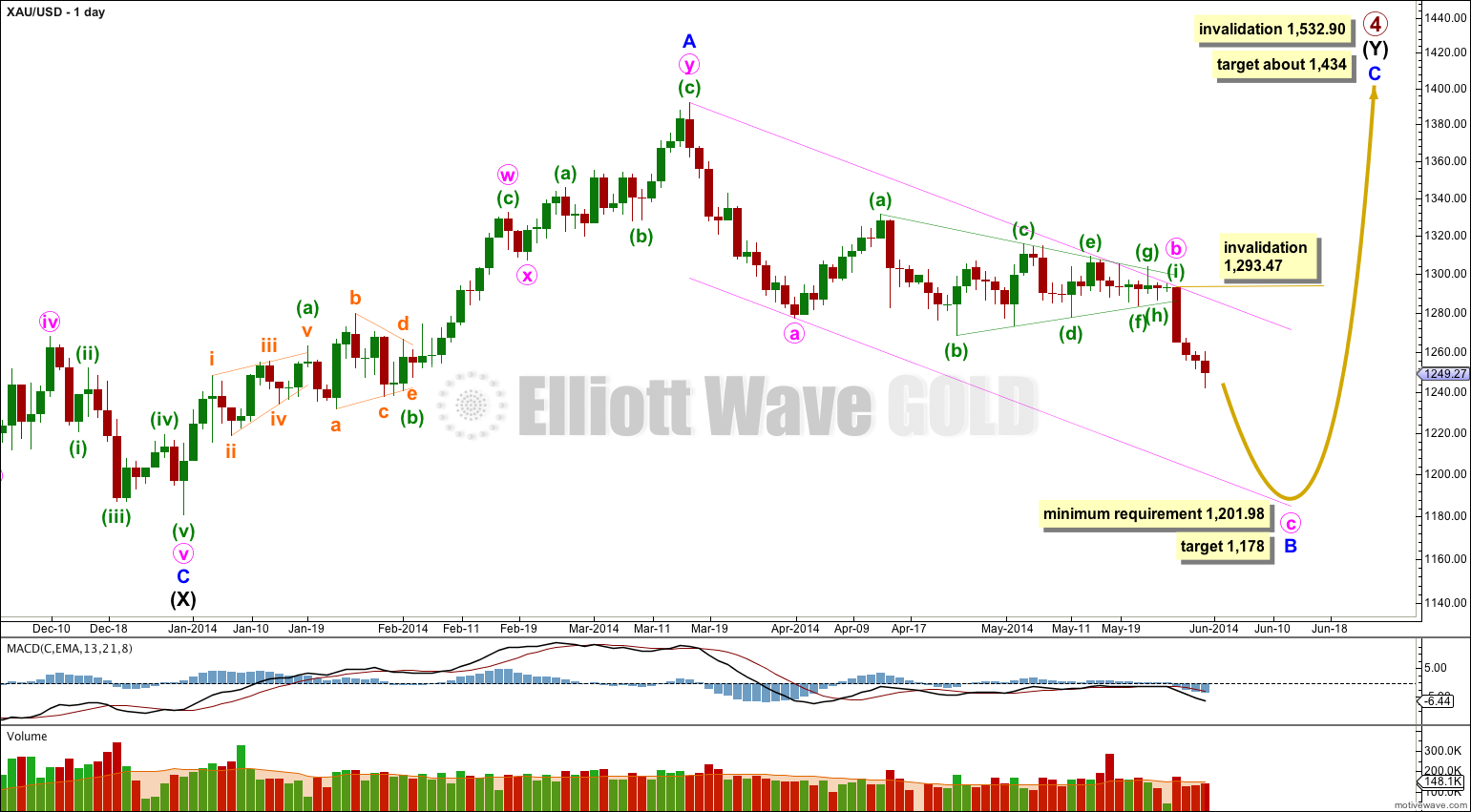

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

Primary wave 4 is most likely to be completing as a double combination: zigzag – X – second structure. The second structure labeled intermediate wave (Y) is most likely to be a flat correction. Within the flat correction minor wave B must reach a minimum 90% the length of minor wave A at 1,201.98.

If downwards movement does not reach 1,201.98 or below then intermediate wave (Y) may not be a flat correction and may be a contracting triangle. I will keep this alternate possibility in mind as this next wave down unfolds. If it looks like a triangle may be forming I will again chart that possibility for you.

It remains possible that primary wave 4 in its entirety is a huge contracting triangle. I will again publish this idea daily for you.

Overall a double combination for primary wave 4 should take up time and move price sideways, and the second structure should end about the same level as the first at 1,434. Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Within intermediate wave (Y) minor wave B downwards is an incomplete corrective structure, and at this stage the structure is most likely to be a single zigzag with a nine wave triangle for minute wave b. At 1,178 minute wave c would reach equality in length with minute wave a. This would see minor wave B 101% the length of minor wave A and so intermediate wave (Y) would be a regular flat correction. If minute wave c also shows equality with minute wave a in duration they both may last 11 days. So far minute wave c has lasted only four days.

I have drawn a channel about minor wave B downwards: draw the first trend line from the start of minute wave a to the end of minute wave b, then place a parallel copy upon the end of minute wave a. I will expect downward movement to find support at the lower end of this channel due to this being the most common place for minute wave c to end.

Within minute wave c no second wave correction may move beyond the start of its first wave above 1,293.47.

Minuette wave (ii) must already be over and was only 21% of minuette wave (i). Although this is a very brief shallow correction the subdivisions fit and the overall look is okay.

A small increase in downwards momentum for Friday indicates that minuette wave (iii) has probably begun.

Within minuette wave (iii) subminuette wave iii would reach 1.618 the length of subminuette wave i at 1,204. This target may be met in one to three days time.

At 1,182 minuette wave (iii) would reach 1.618 the length of minuette wave (i). This target may be about four or five days away.

Within minuette wave (iii) subminuette wave ii may not move beyond the start of subminuette wave i at 1,260.51.

I have drawn a base channel about minuette waves (i) and (ii); draw the first trend line from the start of minuette wave (i) to the end of minuette wave (ii), then place a parallel copy upon the end of minuette wave (i). I would expect upwards corrections within minuette wave (iii) to find resistance at the upper edge of the base channel. Minuette wave (iii) should breach the lower edge of the base channel and should then remain below it.

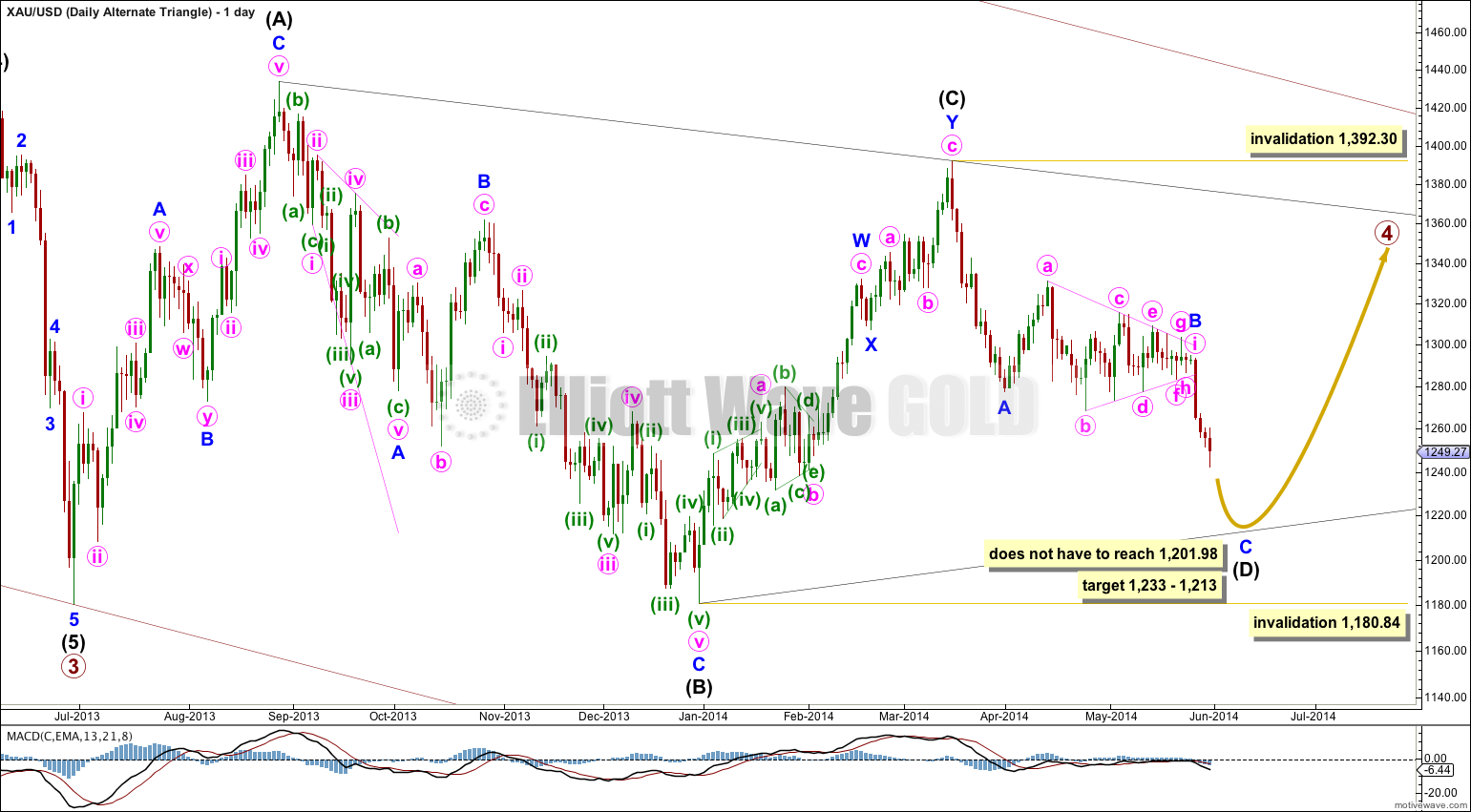

Daily – Triangle.

It remains possible that primary wave 4 in its entirety is a huge regular contracting triangle.

So far one of the five subwaves of the triangle subdivides into a double zigzag. All the other four subwaves must then be simple corrections, and three of them must be single zigzags. The fourth may be another type of simple A-B-C correction, and most commonly it would also be a zigzag.

Intermediate wave (D) would most likely be incomplete for the triangle to have a typical look. Intermediate wave (D) may end between 1,233 and 1,213, 75% to 85% the length of intermediate wave (C), which in my experience is a typical wave length for a triangle subwave.

Intermediate wave (D) may not move beyond the end of intermediate wave (B) for a contracting triangle. For a barrier triangle intermediate wave (D) may end about the same level as intermediate wave (B) as long as the B-D trend line remains essentially flat. In practice this means that intermediate wave (D) may end very slightly below the end of intermediate wave (B). This lower invalidation point is not black and white. This is the only Elliott wave rule which is not black and white.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) for either a contracting or barrier triangle.

Hi, Lara,

What do you think if I interpret the minuette wave (i) of Minute C has just completed (shown on the graph) ? If this wave count is possible, I expect minuette wave (ii) may return to 1267 which is micro 4 of subminuette (iii).

I was thinking the exact same thing because I want to see minuette i down over at strong support of 1243 and the middle of the third wave with the strongest downwards momentum. It also makes the 21% correction more typical of a fourth wave. It seems to take care of all the issues. Target for minuette ii would be = $1268-$1277.

Lara, I think he’s onto something!

Yes that’s all possible.

It would not require a reanalysation of the triangle though, it still ends in the same place at (i)?

And yes, it could be that minor wave B is a double zigzag. But I think at this stage it’s more likely to be a single; that triangle looks more like a long B wave rather than an X wave which are more commonly zigzags.

Good point, it still ends in the same place at (i), very brief to explain the reason and precise 🙂 .

Yes, that fits.

The proportion between subminuette ii and iv give it an odd look though.

It fits nicely with MACD though.

Edit to add: I don’t have that spike up to about 1,300 which you have labeled (i) though. That makes a difference. Our data must be different.

Lara

I also have a spike and numbers as follow..

1302.06 as i of triangle and origin of impulse down

1290.4 as 1 down

1294.87 as 2 up

This gives wave 2-up a remarkable 38.2% ratio