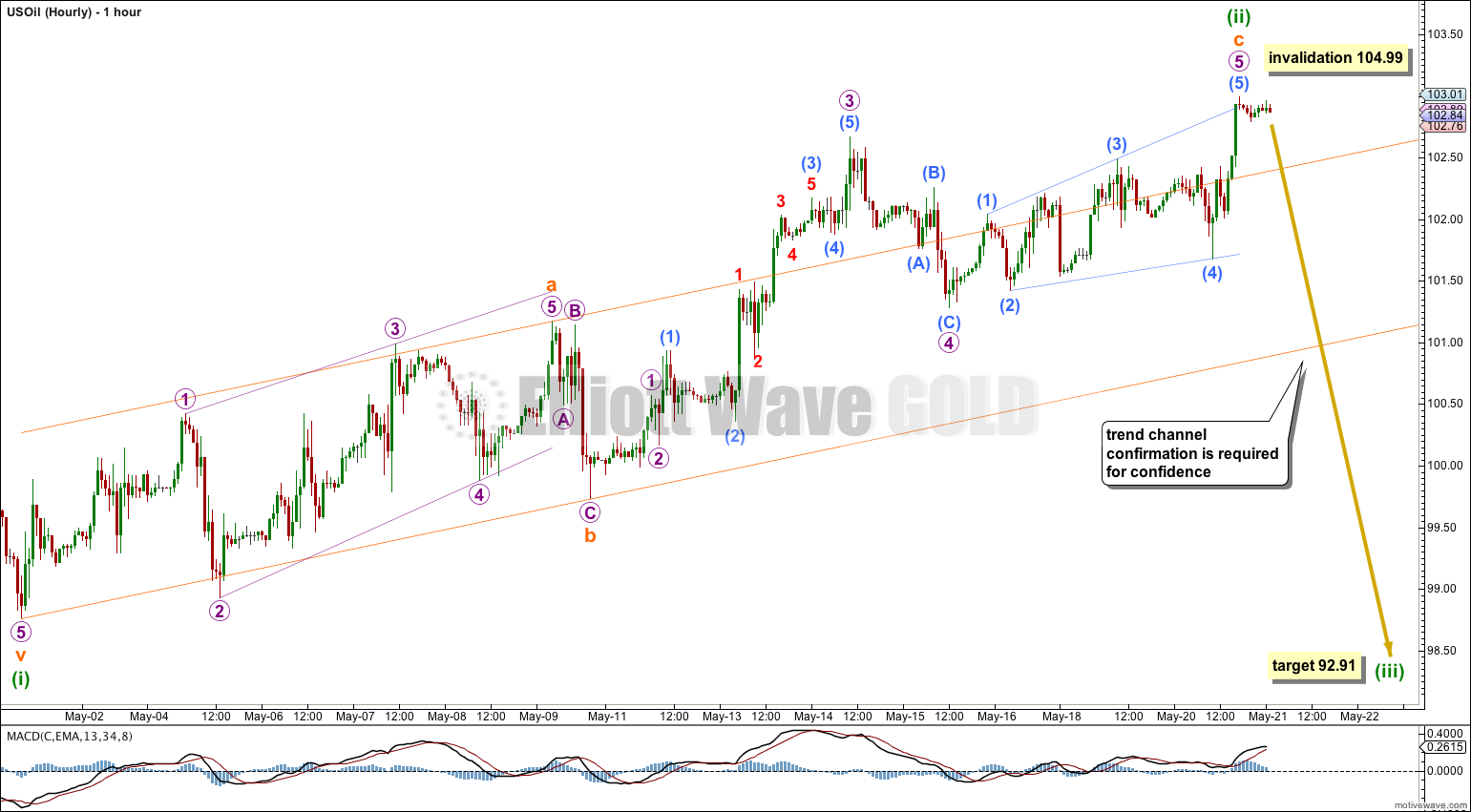

Last analysis expected a little upwards movement to the target at 102.14 to 102.61 to last about five days. So far upwards movement has reached 102.99 and has lasted six days from last analysis.

Summary: I expect that upwards movement is over for now. A clear breach of the channel on the hourly chart would provide me with confidence that the middle of a third wave down has started. The target for the next wave down is 92.91 and may be reached in two to three weeks.

Click on charts to enlarge.

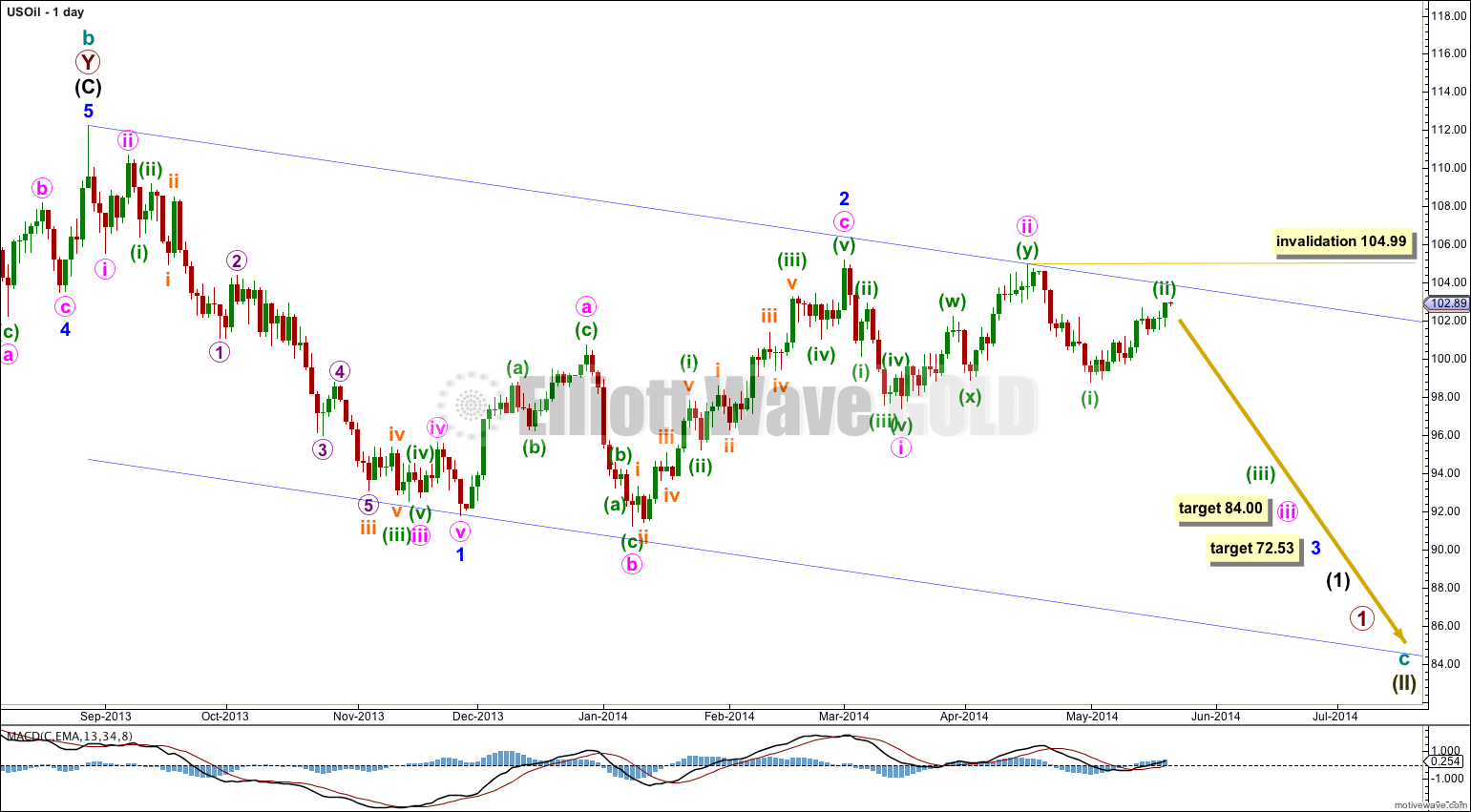

The daily chart shows all of the start of cycle wave c downwards.

Minor wave 1 subdivides perfectly as an impulse. Minor wave 2 an expanded flat correction which is a 66% correction of minor wave 1.

At 72.53 minor wave 3 would reach 1.618 the length of minor wave 1. Minor wave 1 lasted 65 days, and I would expect minor wave 3 to be extended so longer in duration. It may last a total Fibonacci 89 days.

Minor wave 1 lasted 65 days and minor wave 2 lasted 67 days. Minor wave 3 is likely to be extended and so should last longer than 65 days. It may complete in a total Fibonacci 89 days.

I have slightly adjusted the base channel about minor waves 1 and 2 to a “best fit” channel. I would expect upwards corrections to find resistance at the upper edge of this channel, and the third wave down should have enough momentum to break through support at the lower edge of the channel.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 104.99.

At this stage it looks likely that minuette wave (ii) is now over; the structure is complete. However, I would use the channel drawn about it to confirm the resumption of the downwards trend. When this channel is clearly breached by at least one or two hourly candlesticks below the lower edge and not touching the lower trend line then I would have confidence that the middle of a third wave down is underway.

If minuette wave (iii) begins at 102.99 then at 92.91 it would reach 1.618 the length of minuette wave (i). If minuette wave (ii) moves higher then this target would need to be recalculated.

Once the channel is breached I would expect downwards movement to continue and downwards momentum to increase strongly.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 104.99.

There are a few problems with that idea.

It’s a second wave, and they can’t be triangles.

Your triangle would be in wave C, needing D down and finally E up.

I can see a possible triangle for an X wave if minor wave 2 is continuing. But that has a REALLY low probability. X waves are most commonly zigzags, and if minor wave 2 continued it would be huge in duration compared to minor wave 1.

thanks Lara..

what if breaks the invalidation point?

then all the wave count from start changes..right?

The invalidation point remains intact. I will only change the wave count if 104.99 is breached.

Hi Lara,

on my trading platform yesterday Minuette wave (ii) moved a tiny bit beyond the start of minuette wave (i).

What would be the alternate wave count?

Thanks a lot,

Heiko

Not on mine. Minuette wave (i) begins at 104.99. Minuette wave (ii) has so far reached up to 104.29.

Oh ok. I am using FXDD and the instrument there is called OIL/USD (http://www.fxdd.com/mt/en/products/oil/). After checking stockcharts.com I believe what you are analyzing here is Light Crude or $WTIC. Maybe my platform shows olive oil — LOL.

Thanks Lara.

It appears you are analyzing Light Crude $WTIC. What I can trade with FXDD is OIL/USD, bit different.

thx,

Heiko

photo

Dear Lara

Please update oil wave count as the scenario seems to be different than your suggestion . oil broke upwards the pattern above 104 . please let us know what would be possible scenario .

thanks

mohammad

I think its forming a converging triangle on day chart with wave a starting from March 17 low of 97.01 and is currently completing its wave d which it has almost completed. It will go for wave e downward with target around 99-99.5 and then go for larger wave 3…in short its going up in the long term scenario. what do you think Lara?