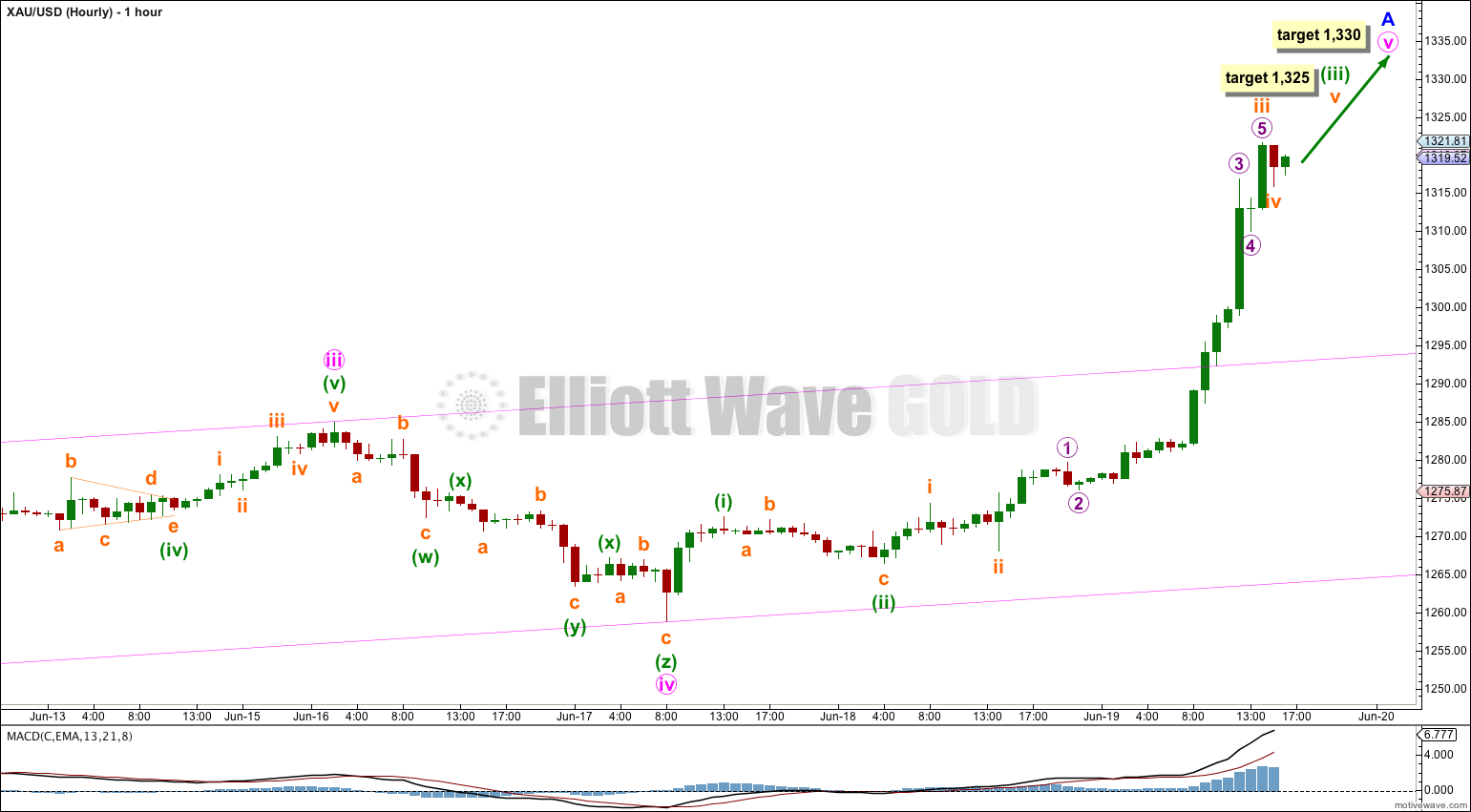

Last Elliott wave analysis of Gold expected one more downwards wave of about $27 in length before the upwards trend resumed. This is not what happened. Movement above 1,284.99 invalidated the hourly wave count.

Summary: Minor wave A may be close to completion. Upwards movement should continue to a target at 1,330.

Click on charts to enlarge.

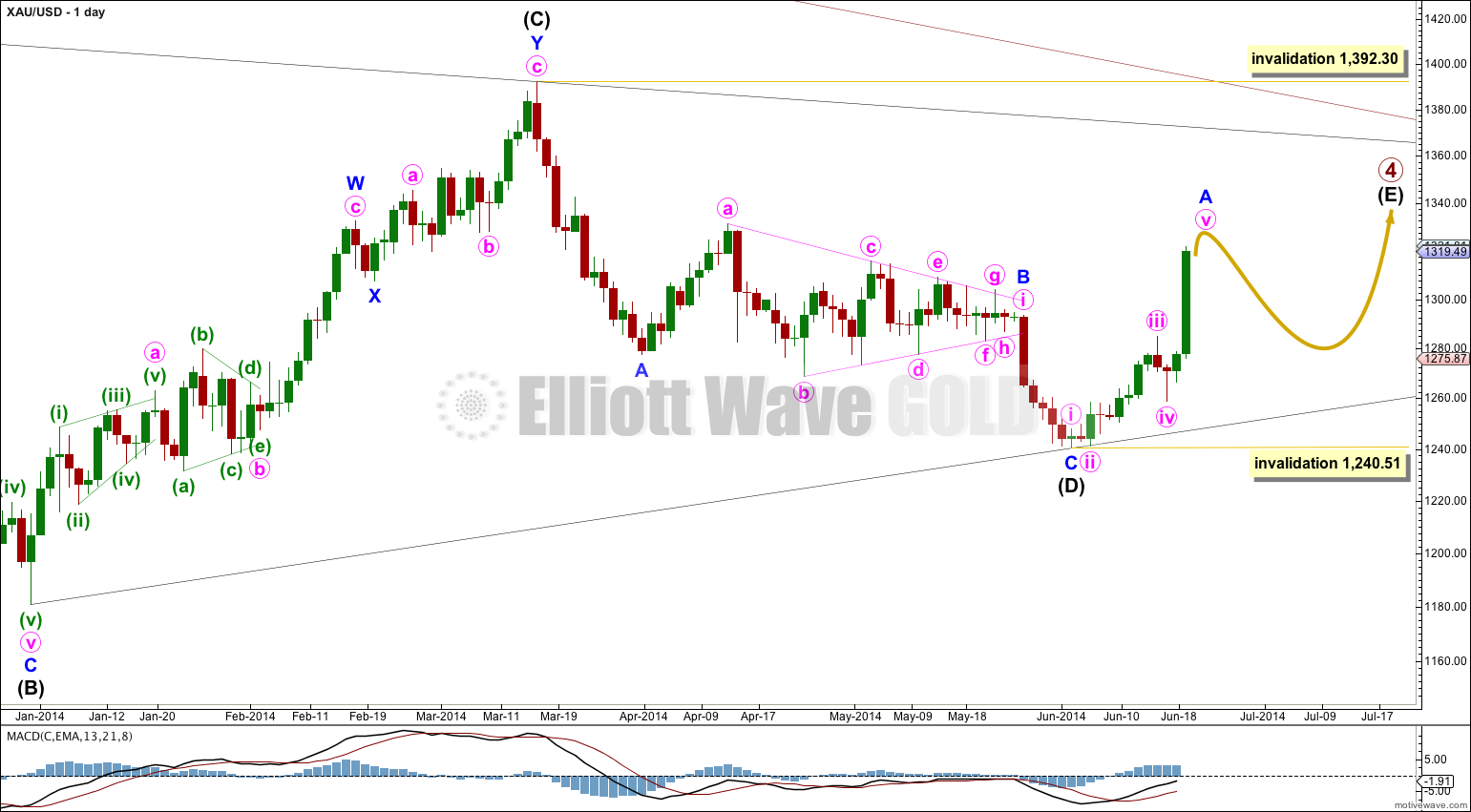

Gold is still within a large fourth wave correction at primary wave degree which is incomplete.

Primary wave 2 was a rare running flat. Primary wave 4 is unlikely to be a flat correction because it is likely to show structural alternation with primary wave 2.

This wave count expects primary wave 4 is a huge triangle. The triangle is now within the final wave of intermediate wave (E) which should subdivide as a zigzag.

Intermediate wave (E) is most likely to fall short of the (A) – (C) trend line. It may also overshoot this trend line, but that is less common.

Within the zigzag of intermediate wave (E) minor wave B may not move beyond the start of minor wave A at 1,240.51.

So far within primary wave 4 intermediate wave (A) lasted 43 days, intermediate wave (B) lasted 88 days, intermediate wave (C) lasted 53 days and intermediate wave (D) lasted 56 days. Intermediate wave (E) may last a total of about 43 to 56 days. So far it has only lasted 12 days.

Minute wave iv was complete. I had labeled this downwards movement as a five wave impulse because that is what it looks like, and impulses are the most common Elliott wave structures. The only complete corrective structure which fits for that wave is a very rare triple zigzag. The rarity of triples means I did not consider that possibility, and that is the problem with rare structures. You never expect to see them based on probability, and only label them so once all other options are eliminated.

Invalidation of yesterday’s hourly wave count with movement above 1,284.99 indicated minute wave iv had to be over and the upwards trend for minor wave A had resumed.

With minute wave iv complete minute wave v upwards is showing strong momentum, typical of fifth waves in commodity markets.

Minute wave v would reach 1.618 the length of minute wave iii at 1,330.

Within minute wave v minuette wave (iii) would reach 4.236 the length of minuette wave (i) at 1,325.

Within minuette wave (iii) subminuette wave iii is just 0.77 short of 6.854 the length of subminuette wave i.

When minor wave A is complete then I would expect a few days to a couple of weeks of very choppy overlapping downwards movement for minor wave B. Minor wave A may end within one or two more days.

This analysis is published about 05:13 p.m. EST.

Hi Lara

Im registered in your website through my wife Maria

I would like to ask;beside the temporay correction,which target do you expect the final gold wave will reach ?

1430?

Thanks

Maurizio & Maria

You don’t state which degree of correction you’re referring to, nor which timeframe. I’ll have to make some assumptions to answer your question.

I expect intermediate wave (E) to end below 1,392.30, and to fall short of the black trend line on the daily chart.

After that I expect another primary degree wave to new lows for primary wave 5. That may be as brief as three weeks, if it is equal in duration with primary wave 1, and would be 388.25 in length if it is equal with primary wave 1.

When that is over then I expect cycle wave b to take gold higher and last about three years.

A new high above 1,532.90.

Thank’s a lot Lara. Thank you also for the Grand cycle analysis that you published a few days a go. Although the correction might not be over, gold investors should be happy to know that a huge 5th wave is on the way.

I have answered this in today’s Gold and Silver analysis.

Both were updated today.

Hi Lara,

Thanks for the analysis, will you be expecting silver to follow the same movement as that of gold or will silver break this correlation and surge higher to meet the 15:1 historical price ratio between Gold and Silver.

Also when will you be publishing the Silver analysis? The last one was very informative

Thanks

Aviraj

Hello Lara. Can you please explain what price action would make you reconsider your main wave count and could suggest that gold made a final low in December 2013? Thank you in advance.