Downwards movement fits the main wave count, but only movement below 18.581 would confirm it. If the main wave count is correct we may be about to see some strong downwards movement over the next week.

Click on charts to enlarge.

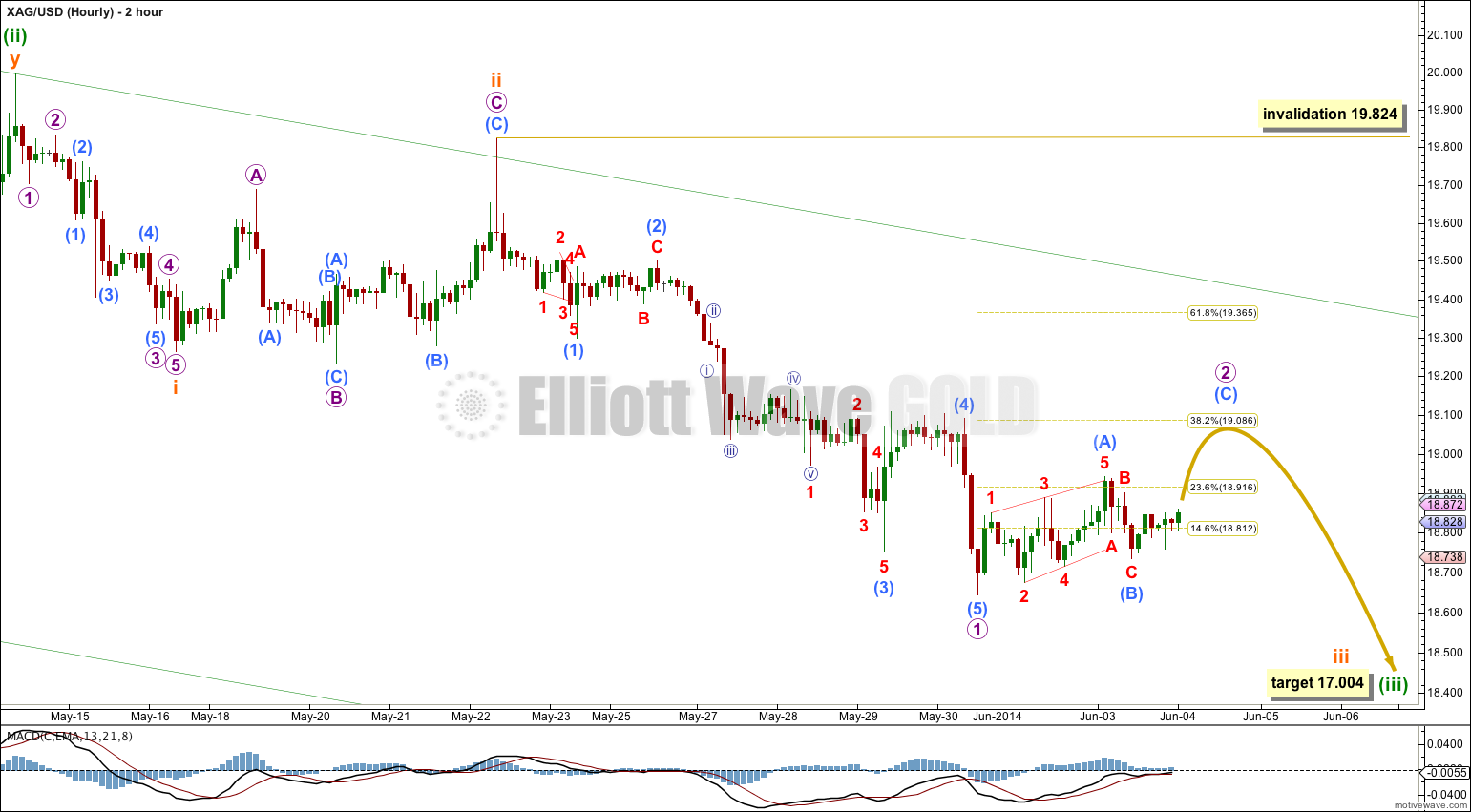

Main Wave Count.

Silver is within an intermediate degree (B) wave. Unfortunately, B waves are the most difficult of all Elliott wave structures to analyse because they have the widest variety. There are more than thirteen possible structures this B wave may take and so flexibility in analysis is essential.

Intermediate wave (B) may be an incomplete flat correction.

Within the flat minor wave A subdivides as a three wave zigzag.

Minor wave B downwards may be an incomplete zigzag.

Within the zigzag of minor wave B minute waves a and b are complete. Minute wave c would be an incomplete impulse.

The target for downwards movement to end is at 15.691 where minute wave c would reach equality in length with minute wave a. This target may be about four weeks away.

Movement below 18.581 would invalidate the alternate wave count below and confirm this main wave count.

This wave count expects to see an increase in downwards momentum as a third wave unfolds.

Downwards movement may find support and may end at the lower edge of the pink channel containing minor wave B.

Within minuette wave (iii) subminuette wave ii may not move beyond the start of subminuette wave i above 19.996.

So far within minuette wave (iii) subminuette waves i and ii are complete. Within subminuette wave iii micro wave 1 is complete and micro wave 2 is over halfway complete.

The green channel is a base channel drawn about minuette waves (i) and (ii): from the start of minuette wave (i) to the end of minuette wave (ii), with a parallel copy upon the end of minuette wave (i). Upwards movement for subsequent second wave corrections should find resistance at the upper edge of the base channel. The momentum of micro wave 3 should be strong enough to break through support at the lower edge of the channel. Once breached the lower trend line should then provide resistance.

Micro wave 2 may move a little higher to end about 19.086.

At 17.004 minuette wave (iii) would reach 1.618 the length of minuette wave (i). This target may be one to two weeks away.

Micro wave 2 may not move above the start of micro wave 1. This wave count is invalidated with movement above 19.824.

Alternate Wave Count.

A triangle may be forming at the daily chart level. The triangle fits best as a barrier triangle for intermediate wave (B). The B-D trend line is almost perfectly flat.

This wave count expects more choppy overlapping sideways movement with a decrease in volume, and momentum remaining close to zero, for about another two or three weeks.

Within the barrier triangle minor wave D may not move substantially below the end of minor wave B. As long as the B-D trend line remains flat this wave count will remain valid.

Minor wave E should subdivide as a single zigzag and may not move above the end of minor wave C at 22.224.

This alternate wave count expects price to break out to the downside once the sideways structure is complete. This breakout may yet be weeks away. Minor wave E is incomplete, and it has not taken enough time nor moved high enough at this stage to look right.

I know, and I’m sorry for the delay.

I WILL do it today. Oil too…. and maybe FTSE.

If anyone can figure out how to make a day longer than 24 hours please let me know.

Yes, just a short update would be great.

Hello Lara, Just wondering if you would consider analyzing SLV as you have GDX. I appreciate the Grand SuperCycle revisit you did on Gold June 7th. Will you be updating Silver soon? BTW, I saw sand and surf and blue waters yesterday (Monday) before lunch watching the Soccer World Cup. tee hee. Otherwise, been trudgin’ thru mud. 🙂

I will be analysing Silver later today.

Only if I can find data back to the 1800’s will I be able to do a Grand Supercycle analysis of Silver.

How about a non-grand-supercycle update for now if you can’t find the data?

ditto