I had expected one more downwards wave to complete the structure. This is not what happened. Upwards movement does remain below the invalidation point on the hourly chart, but the channel is so significantly breached now that wave count no longer looks right.

Summary: I expect minor wave C may have begun. The target for it to end is 1,350. If we see a new low below 1,298.93 then I would expect a new low to 1,280 before minor wave C begins.

Click on charts to enlarge.

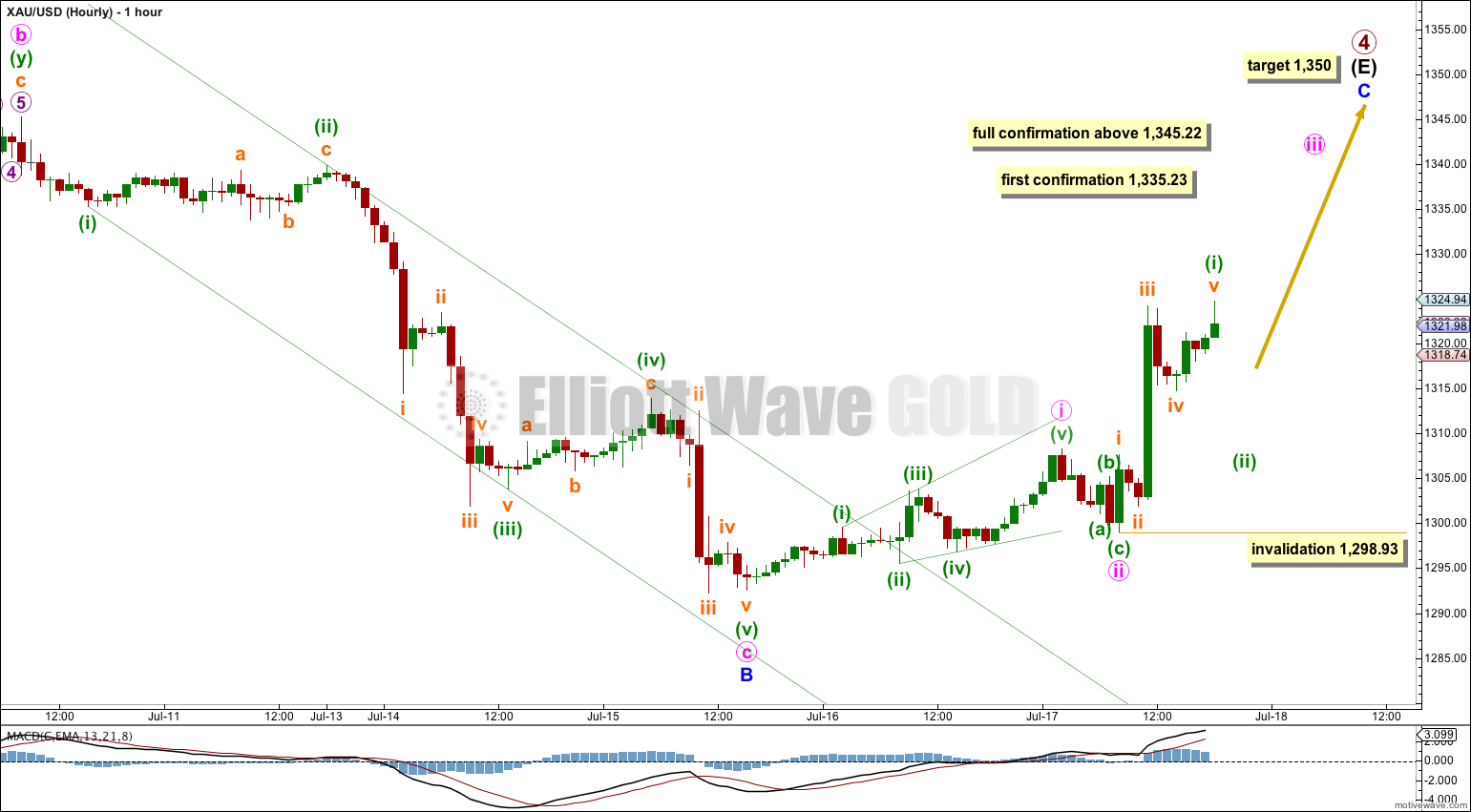

Main Wave Count.

Primary wave 4 is an almost complete regular contracting triangle, now in its 55th week. If it ends within the next six days it will be close enough to a Fibonacci 55 weeks to exhibit a Fibonacci duration.

The final zigzag of intermediate wave (E) may be just a few days away from completion. Within it minor wave B can be seen as a complete expanded flat. There is no Fibonacci ratio between minute waves a and c.

At 1,350 minor wave C would reach 0.618 the length of minor wave A. Minor wave C is extremely likely to at least make a new high above the end of minor wave A at 1,333.61 to avoid a truncation.

When minor wave C is a complete five wave structure then I will expect a primary degree trend change. Eventually a clear breach of the lower (B)-(D) trend line of this triangle will provide confirmation that primary wave 4 has ended and primary wave 5 has then begun.

I had thought that finally yesterday I had the labeling of this downwards movement correct. Upwards movement indicates this is most likely not the case.

Although technically this upwards movement could still be a fourth wave correction (because it remains below first wave price territory) it does not fit into a channel. It looks more likely that this upwards wave is separate.

Minor wave B may have been over. Within it minuette wave (iii) may have ended in a small truncation, and this resolves the problem of proportion and subdivisions. There is no Fibonacci ratio between minuette waves (iii) and (i), and minuette wave (v) is 1.01 short of 0.618 the length of minuette wave (iii). The third wave exhibits strongest downwards momentum.

Within the new upwards trend minute waves i and ii may be complete. Within minute wave iii only minuette wave (i) is complete. Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,298.93. When minuette wave (ii) is complete then I would expect to see a strong increase in upwards momentum as the middle of a third wave up unfolds.

When minute waves iii and iv are complete then I can add to the target of 1,350 at a second wave degree. Towards the end of this movement this target may widen to a small zone or change.

Movement above 1,335.23 would invalidate the alternate below and provide first confirmation of this wave count. Only movement to a new high above 1,345.22 would provide full confidence in the target.

At this stage I would judge this main wave count to have about a 50-60% probability. There are too many options open at this point for me to have any greater confidence.

This idea follows on directly from yesterday’s hourly chart. It is possible that this upwards movement is a fourth wave correction, but it looks unlikely. I would judge this wave count now to have a very low probability, maybe as low as 10 – 20%. Minuette waves (ii) and (iv) are too disproportionate, and minuette wave (iv) too strongly breaches a channel. This channel here looks wrong.

Only if price breaks below 1,298.93 would I consider this wave count seriously. At that point I would expect downwards movement to end about 1,280 where minute wave c would reach 2.618 the length of minute wave a.

Minuette wave (iv) may not move into minuette wave (i) price territory above 1,335.23.

The only reason why I publish this wave count today is it does have a reasonable look on the daily chart and minuette wave (iv) could be exhibiting alternation with minuette wave (ii) by being very deep.

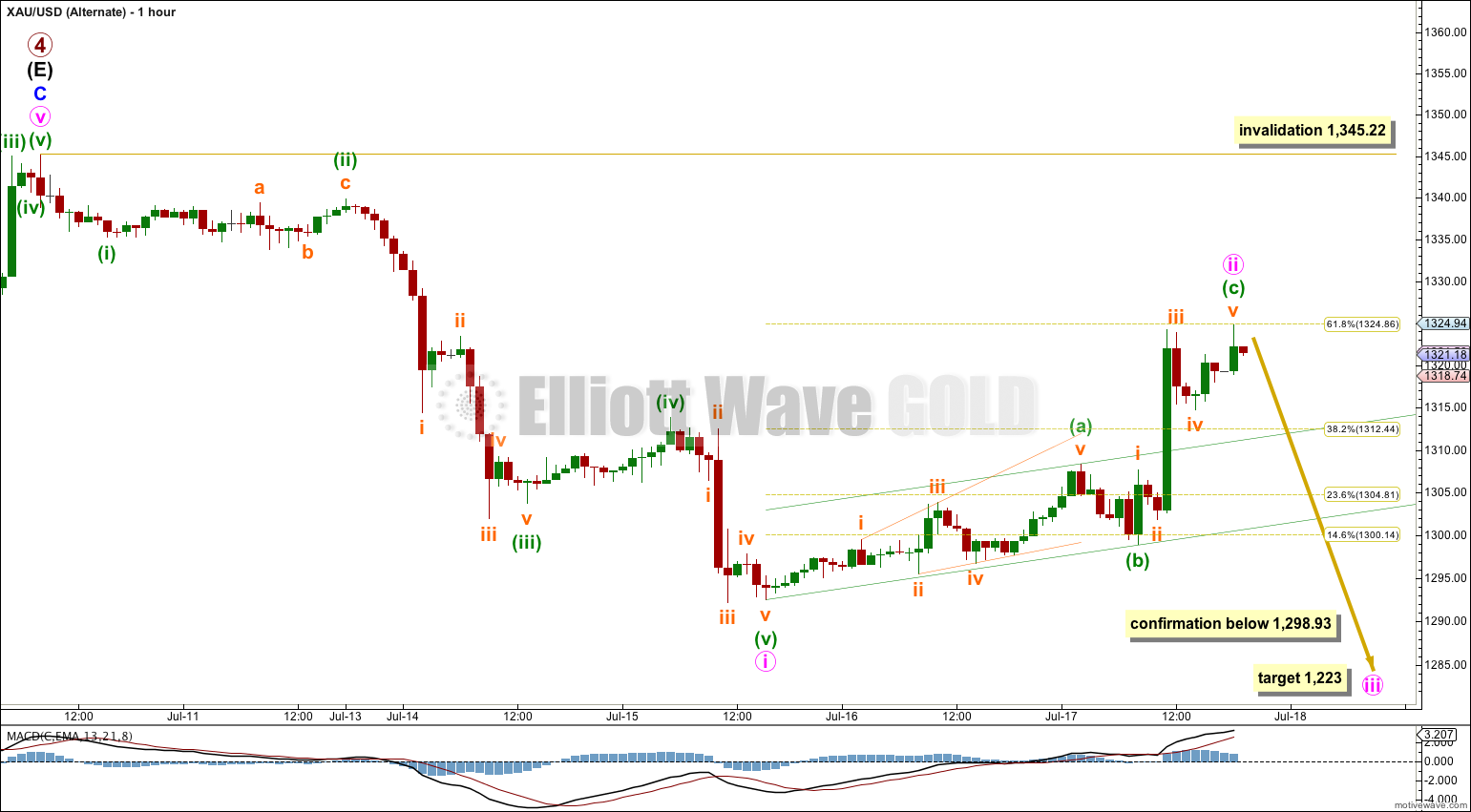

Alternate Wave Count.

It is possible that primary wave 4 is complete in a total 54 weeks, just one short of a Fibonacci 55 and just one week longer than primary wave 2 which was 53 weeks in duration.

The subdivisions for this alternate do not have as neat a fit as the main wave count:

– The triangle for minor wave B has an overshoot of the b-d trend line within minute wave c which looks significant on the hourly chart.

– At the end of minor wave A minute wave v does not subdivide well as a five wave structure on the hourly chart. This movement fits better as a three.

– Minor wave C subdivides here as a five wave structure, but it has a much better fit as a zigzag (which is how the main wave count sees it).

For the three reasons above this alternate has a lower probability. I would judge it at this stage to have a 20 – 30% probability.

The differentiating point is the lower (B)-(D) trend line here on the daily chart. If this trend line is breached by a full daily candlestick below it and not touching it then I would discard the main wave count and this alternate would be my only wave count.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 1 was a remarkably brief three weeks in duration. Primary wave 5 could also be as brief, but it is more likely to show a little alternation and be longer lasting.

Upwards movement may be a deep second wave correction which has just reached the 0.618 Fibonacci ratio of minute wave i.

Movement below 1,298.93 from here could indicate that this alternate is correct. At 1,223 minute wave iii would reach 1.618 the length of minute wave i.

Only movement below the (B)-(D) trend line on the daily chart would provide enough confidence in this wave count for it to increase in probability. At this stage I still consider it to have a low probability, maybe as low as 20%, due to the problems outlined in my text below the daily chart.

Minute wave ii may not move beyond the start of minute wave i above 1,345.22. Invalidation of this alternate would provide full confidence in the main wave count.

This analysis is published about 07:40 p.m. EST.

Hi,

About the changes between main and alternate

Wave iv (zigzag) is 61.8% retracement alternating the shallow wave ii. The invalidated point has not been reached. The yesterday channel yes.

The main is now the alternate with a low probability, I think that the channel technique in your analysis is the dominante factor to switch between main and alternate. I am right ?