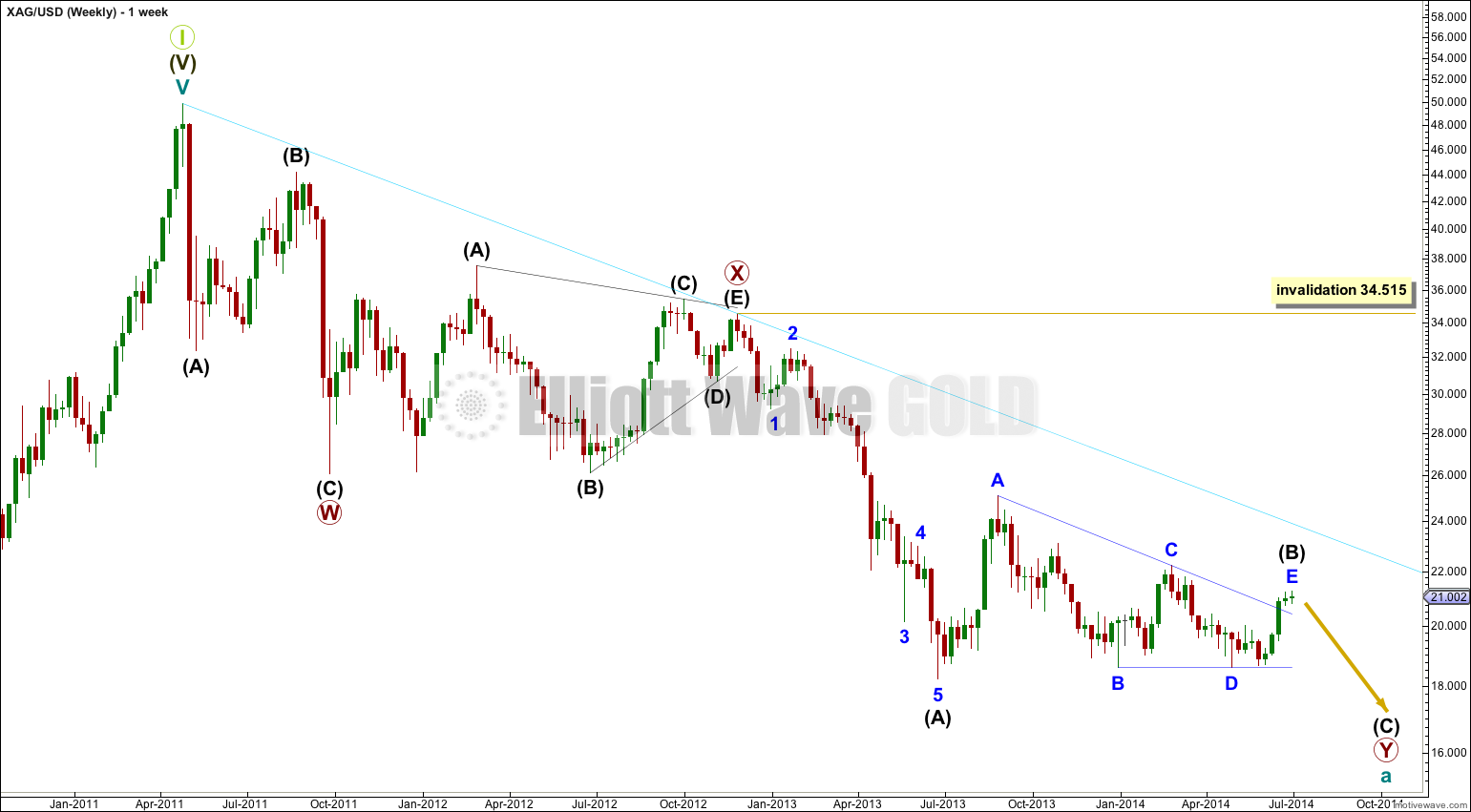

Upwards movement continues. The triangle for Silver, as it is for Gold and GDX, is incomplete.

Click on charts to enlarge.

The triangle for intermediate wave (B) is almost a complete barrier triangle.

When I am confident that the triangle for intermediate wave (B) is complete I can then calculate a downwards target for intermediate wave (C) for you. I cannot do that yet because I don’t know where it begins.

Intermediate wave (B) may not move beyond the start of intermediate wave (A) at 34.515.

The triangle structure is correct and close to completion.

Within minute wave c the final fifth wave is incomplete. At 21.74 minute wave c would reach 2.618 the length of minute wave a. At 21.71 minuette wave (v) would reach 0.382 the length of minuette wave (iii).

I will use the channel on the hourly chart as first indication of a trend change. If price continues higher to complete a five wave structure for minuette wave (v) and then turns downwards, price movement below 20.774 would confirm a trend change. At that stage I would have confidence that the triangle for intermediate wave (B) is over and intermediate wave (C) downwards has begun.

I have redrawn the channel about minute wave c using Elliott’s second technique: first draw a trend line from the ends of minuette wave (ii) to (iv) (see (ii) on the daily chart), then place a parallel copy on the end of minuette wave (iii). I would expect minuette wave (v) to remain within the lower half of this channel.

When this channel is breached by downwards movement that shall be the earliest indication of a possible trend change.

I would only have confidence in this trend change with movement below 20.774 after minuette wave (v) is complete. At that stage downwards movement could not be a second wave correction within minuette wave (v) and so minuette wave (v) would have to be over.

hi,lana.

I am a new learner of EW, I wonder whether EW could be applied to individual stock?

Yes, of course.

EW can be applied to any market as long as volume is great enough.

I’ve found some property markets do not produce EW structures, like the market for my small region, because volume is too low. But most equities will have greater volume.

Lara, thanks for silver chart. I can now compare silver and gold–see if they generally agree at the daily or weekly level. If they generally agree, confidence increases. If there is significant variance, time to reevaluate.

Hope you can find the time for a silver chart every week, maybe even gdx.