Click on charts to enlarge.

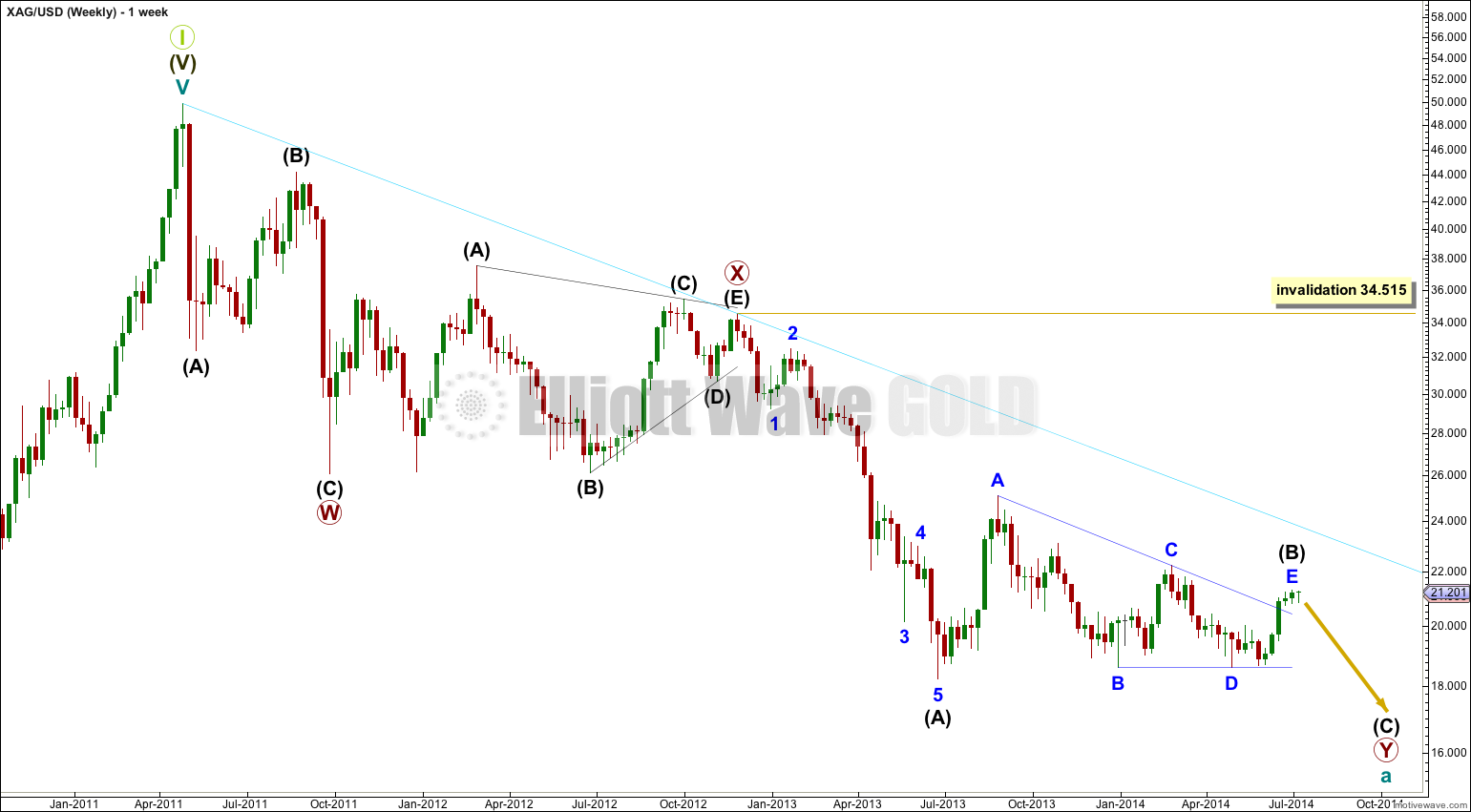

Main Wave Count.

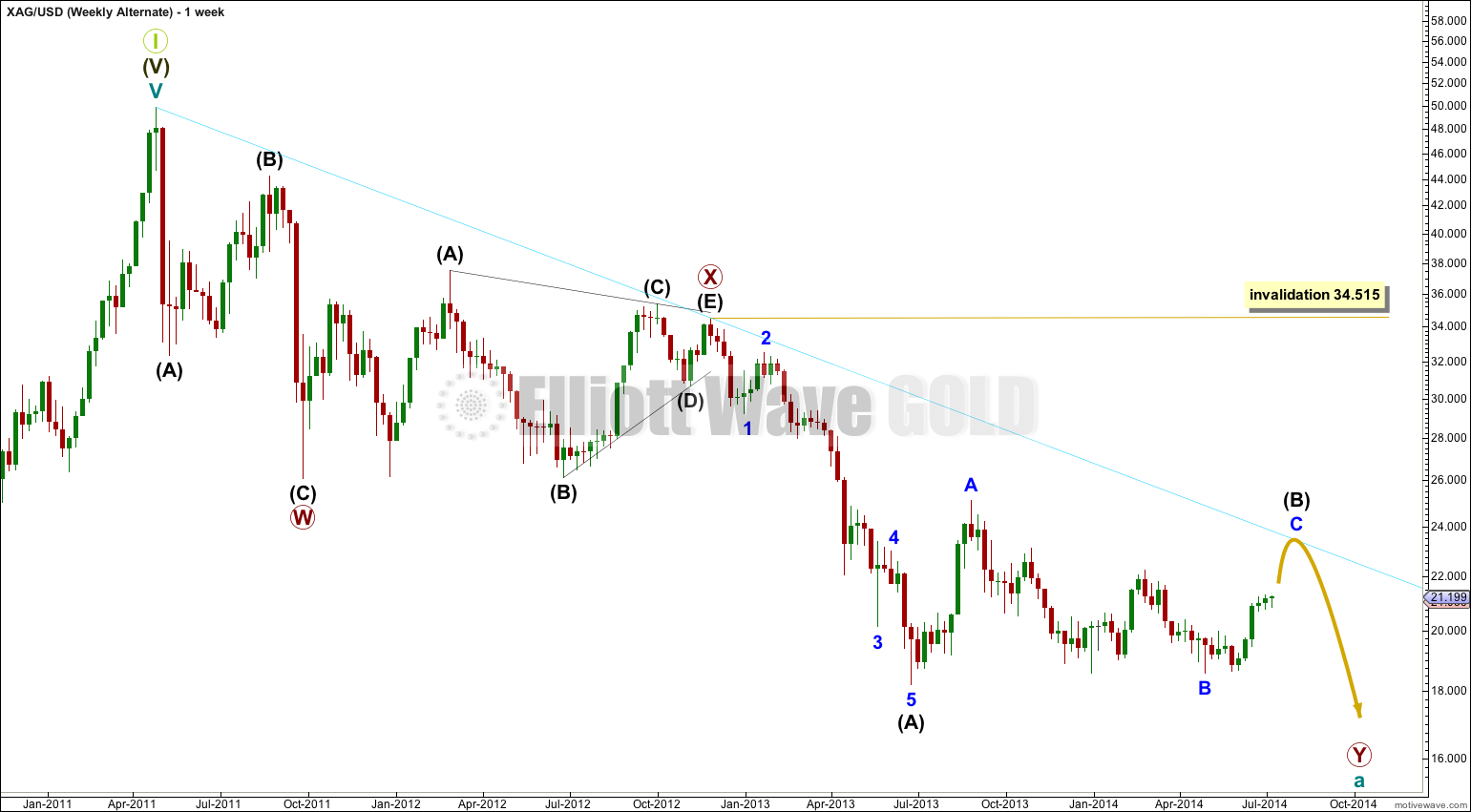

Alternate Wave Count.

The triangle is starting to look strange because the overshoot of the A-C trend line for minor wave E looks too big. Therefore, I have the alternate idea below.

The end of minor wave B, the ending diagonal of minuette wave (v), does not have a good fit. This reduces the probability of this wave count. The main wave count has a better fit for this piece of movement.

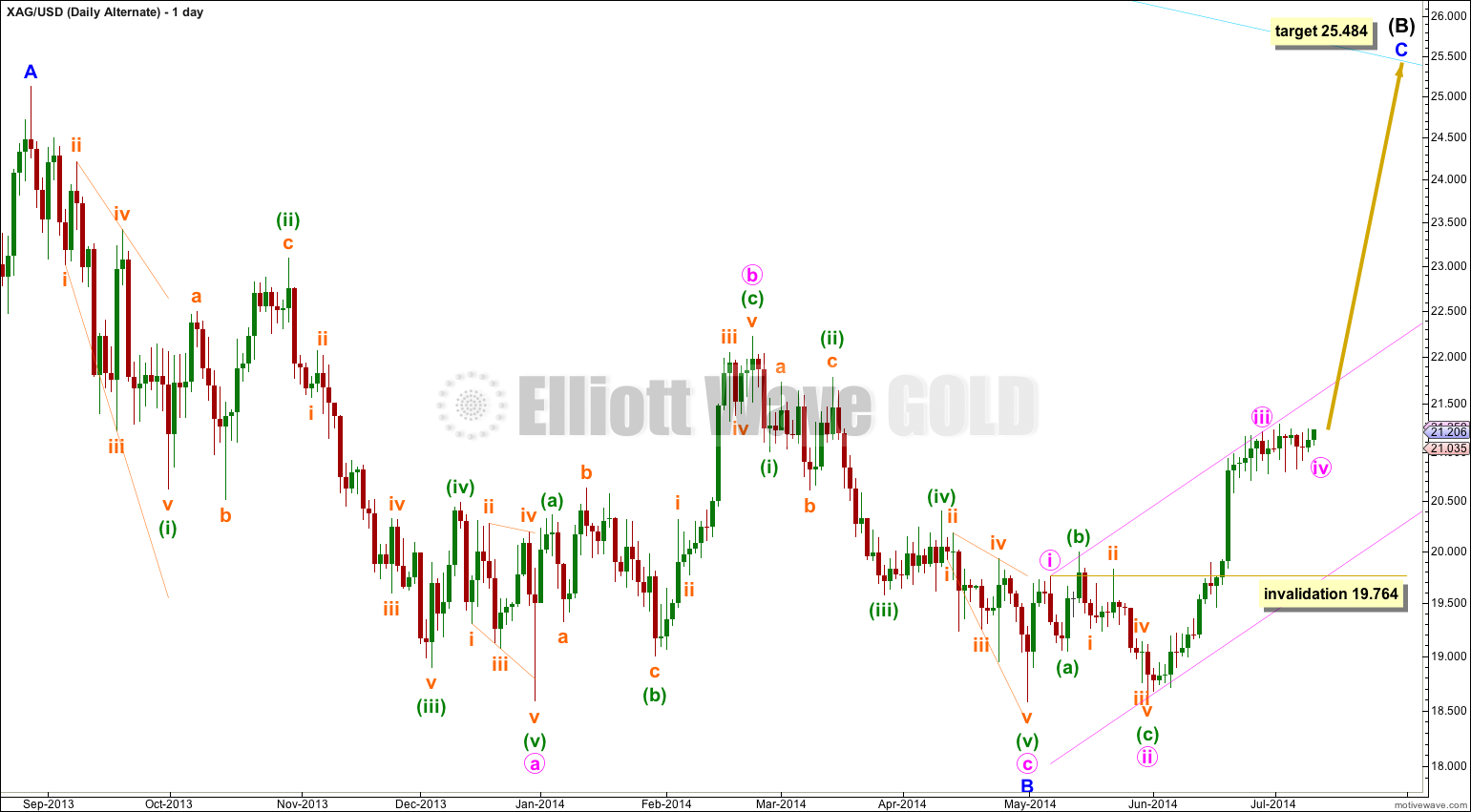

Hi Lara. Your alternative wave count is the equivalent of the bullish scenario that is being advocated by some posts in the Web.

I agree with you about the end target being around 25.48. Looking at the chart, the leap from Minute iii at around 21.25 to Minute v at 25.48 from a base of 18.62 Minor B seems a bit stretched. May I suggest that your labeling from Minor B onwards be moved one degree lower. So, the minute waves become minuette waves. We are now at minuette iv (your Minute iv). The minute waves form a 5-wave impulse. They appear to follow standard Fibonacci ratios rather well. My estimation gives 18.62 – 21.58 – 19.75 – 24.54 – 22.71 – 25.67, assuming standard ratios. If silver does move to 21.71/21.74 as you estimated, then this would require a slight adjustment. Of course, nothing is cast in stone. It is just that this is a likely scenario if standard ratios are applied.

Please feel free to comment. Thank you.

Yes, I agree. That should be moved down one degree for the alternate. The way I have it labeled would be expecting a very long extended fifth wave!

The target 25.48 is where minor wave C would reach equality with minor wave A, so its a pretty typical ratio and has a good probability.

I labeled it at that degree initially because the last correction looks so strongly like a contracting triangle, so I wanted to have a fourth wave there.

Do you have any odds for main wave count vs. alternate?

Not really… and I know that answer is not helpful.

I expect the main wave count is only slightly more likely than the alternate.

The price point which differentiates them is close, 22.224.