Sideways movement has continued. The alternate hourly Elliott wave count was confirmed when the main hourly wave count was invalidated with a slight new low below 1,305.78. The alternate expected only more sideways movement. The bigger picture remains exactly the same.

Summary: When this sideways trend is finished the breakout should be upwards. It is extremely likely Gold will make a new high above 1,345.22 and the target remains the same at 1,346. The target may be met now in four days time.

Click on charts to enlarge.

Primary wave 4 is an incomplete regular contracting triangle. Primary wave 2 was a deep 68% running flat correction. Primary wave 4 is showing alternation in depth and some alternation in structure.

Within the triangle of primary wave 4 intermediate wave (E) is unfolding as a zigzag: minor wave A is a five wave impulse and minor wave B downwards is a zigzag. Minor wave C must subdivide as a five wave structure.

At 1,346 minor wave C would move slightly above the end of minor wave A at 1,345.22 and avoid a truncation, and intermediate wave (E) would fall short of the (A)-(C) trend line.

There are four nice examples of triangles on this daily chart: within intermediate wave (C), within intermediate wave (D), within minor wave A of intermediate wave (E), and within minor wave B of intermediate wave (E). In all four examples the final subwave of the triangle ends comfortably short of the A-C trend line. This is the most common place for the final wave of a triangle to end and so that is what I will expect is most likely to happen for this primary degree triangle of primary wave 4.

Within minor wave C no second wave correction may move beyond its start below 1,280.35.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) above 1,392.30.

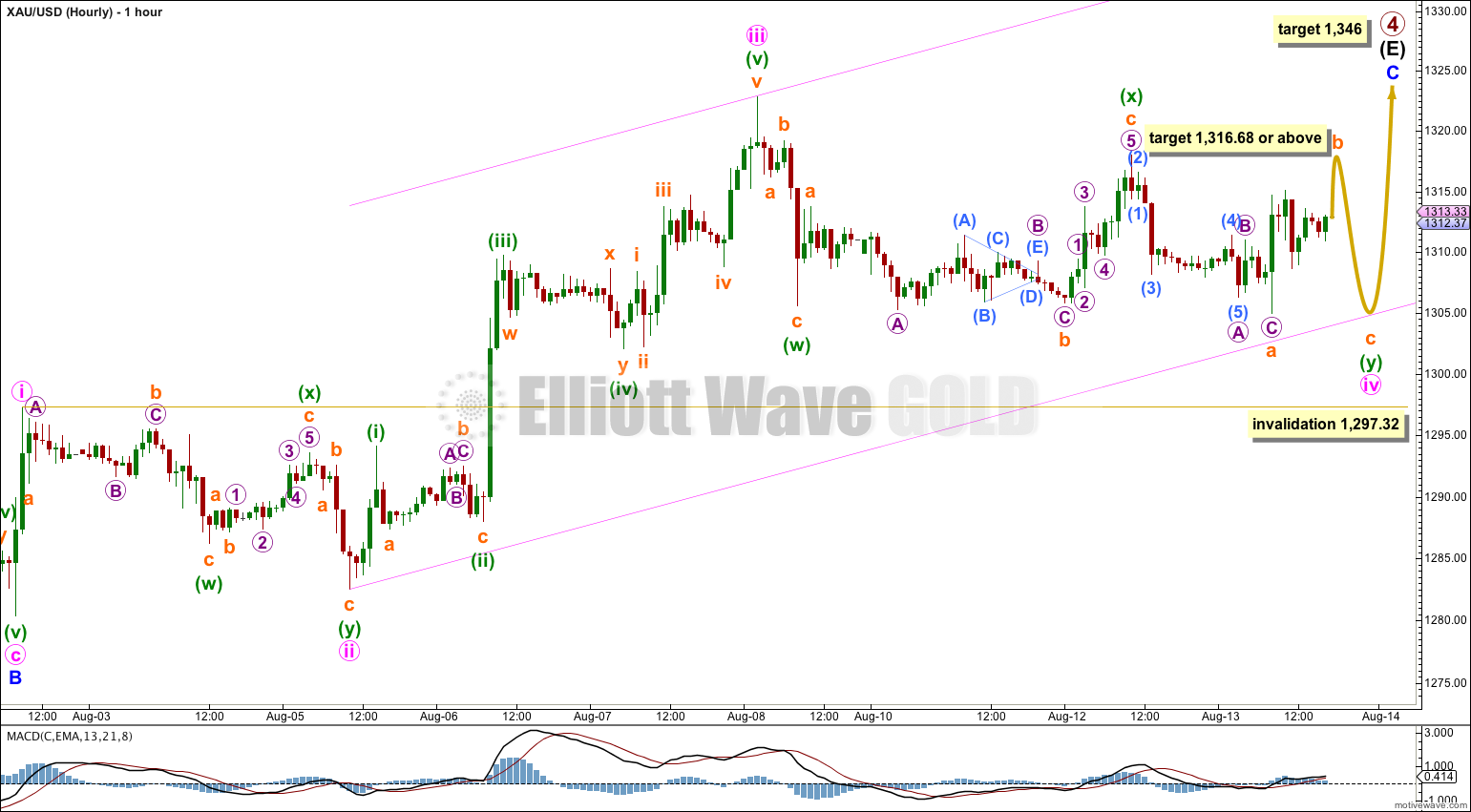

Main Hourly Wave Count.

Sideways movement has continued and this can only be a continuation of this fourth wave correction. I am confident that whenever this sideways movement is complete the breakout will be upwards. Minor wave C is an incomplete five wave structure because its fifth wave still needs to unfold.

Minute wave iv is most likely still incomplete. Minuette wave (y) may be an incomplete flat correction. This idea would see only more sideways movement with minute wave iv to end only very slightly below 1,304.93. If this happens then minute wave iv would be a double combination and have perfect structural alternation with the double zigzag of minute wave ii. Minute wave iv may not move into minute wave i price territory below 1,297.32.

Within the second structure of this double combination, minuette wave (y), its b wave must reach up to a minimum 90% the length of its a wave at 1,316.68. Subminuette wave b may make a new price extreme beyond the start of subminuette wave a above 1,317.99, and if minuette wave (y) turns out to be an expanded flat then its b wave may reach up to 1,318.64 or above.

Within the flat correction of minuette wave (y) its c wave is extremely likely to make at least a slight new low below the end of its a wave at 1,304.93 to avoid a truncation.

Draw the channel about minor wave C using Elliott’s second technique: draw the first trend line from the ends of minute waves ii to iv (wherever it ends), then place a parallel copy on the end of minute wave iii. I would expect minute wave v to end about the upper edge of this channel.

So far minor wave C has lasted nine days. If it continues for another four days it may end in a total Fibonacci 13 days.

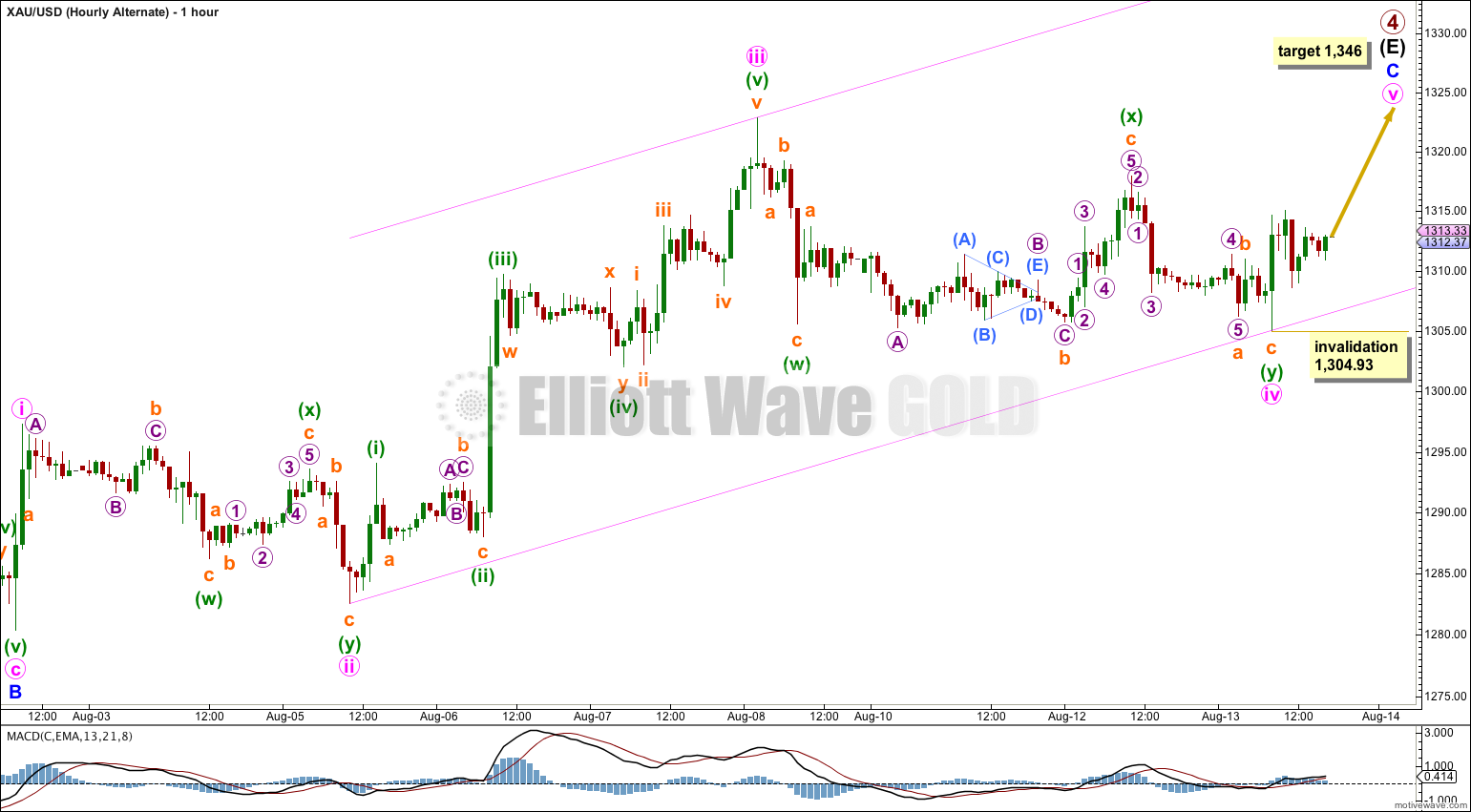

Alternate Hourly Wave Count.

If minute wave iv is over then the only structure which fits into this sideways chop is a double zigzag (I have considered and eliminated all other possibilities).

Minute wave ii was a deep 87% double zigzag. At this stage, if minute wave iv is complete then it fits only as a double zigzag because it is a very atypical double zigzag in that the second zigzag in the double does not deepen the correction and just moves the correction sideways. Minute wave iv does show alternation in depth of correction and is shallow at 44%.

Alternation is a guideline and not a rule which needs to be applied with flexibility. Occasionally, I have seen impulses with second and fourth wave corrections which appear to be the same structure (usually zigzags) and they show alternation within their structures. For example, within one zigzag the A and C waves may be close to equality, within the other they may have a 1.618 or 2.618 ratio to each other. We may be seeing a similar situation here in that minute waves ii and iv are the same structure but show alternation within their structures.

This alternate has a low probability because it sees minute waves ii and iv as the same structure, and minute wave iv is an atypical double zigzag. This must reduce the probability of this wave count to below 20%.

At 1,345.21 minute wave v would reach equality in length with minute wave iii. A 1,345.06 minor wave C would reach 0.618 the length of minor wave A. Because minor wave C is most likely to move at least slightly above 1,345.22 to avoid a truncation I leave the target at 1,346.

This analysis is published about 05:45 p.m. EST.

hello,

out of the triangle aiming to the target.. hope it stand still above 1314