End of week Elliott wave analysis expected Monday to begin with downwards movement to a short term target at 1,289 before the upwards trend resumed. Price has moved lower, but did only to 1,295.69 so far.

I have the same two Elliott wave counts for you today.

Summary: The short term target for upwards movement is 1,324. The mid term target for upwards movement to end is still 1,346 and this may be about two weeks away. On the way up movement will be very choppy and overlapping.

Click on charts to enlarge.

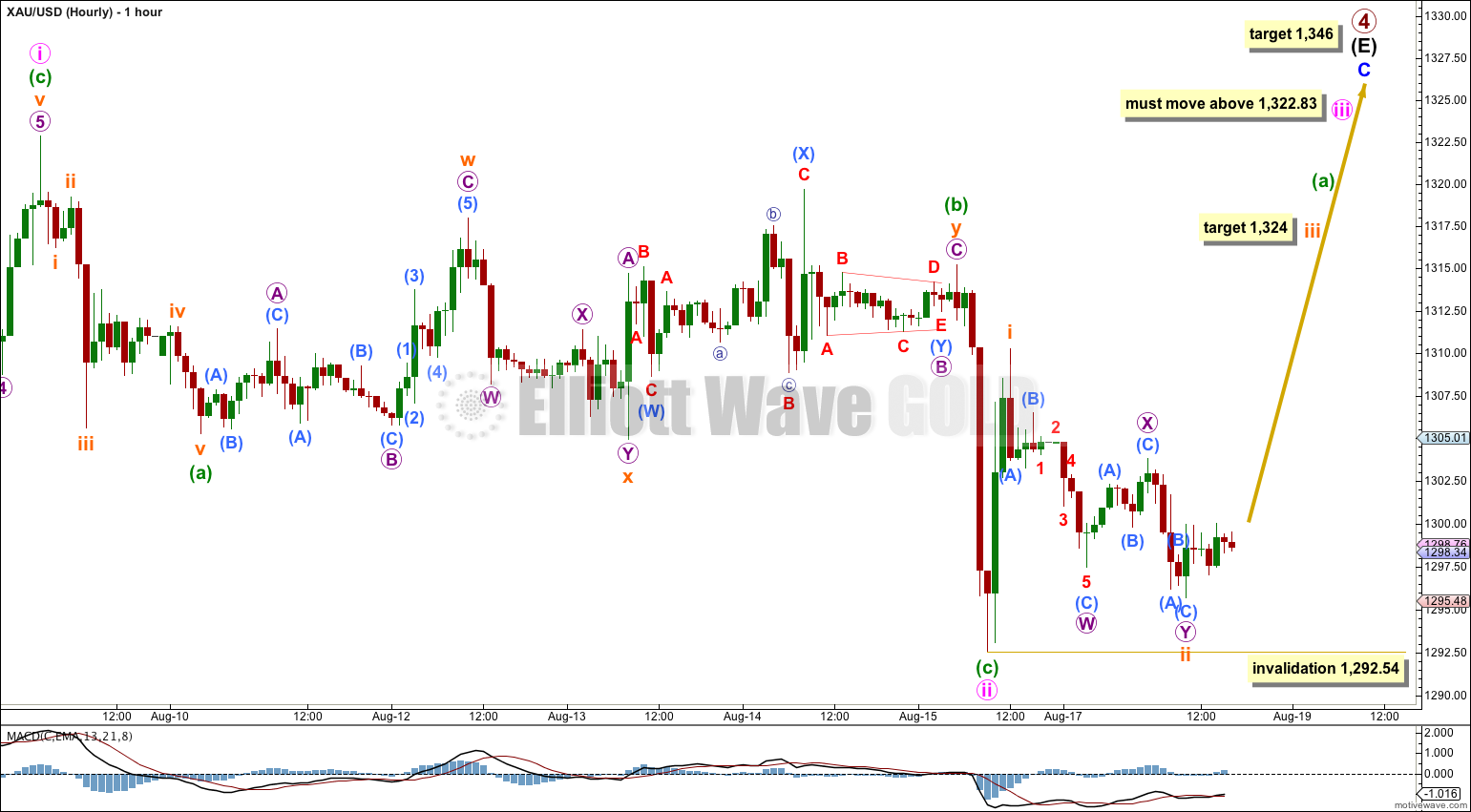

Main Wave Count.

Primary wave 4 is an incomplete regular contracting triangle. Primary wave 2 was a deep 68% running flat correction. Primary wave 4 is showing alternation in depth and some alternation in structure.

Within the triangle of primary wave 4 intermediate wave (E) is unfolding as a zigzag: minor wave A is a five wave impulse and minor wave B downwards is a zigzag. Minor wave C must subdivide as a five wave structure.

At 1,346 minor wave C would move slightly above the end of minor wave A at 1,345.22 and avoid a truncation, and intermediate wave (E) would fall short of the (A)-(C) trend line.

There are three nice examples of triangles on this daily chart: within intermediate wave (D), within minor wave A of intermediate wave (E), and within minor wave B of intermediate wave (E). In all three examples the final subwave of the triangle ends comfortably short of the A-C trend line. This is the most common place for the final wave of a triangle to end and so that is what I will expect is most likely to happen for this primary degree triangle of primary wave 4.

Within minor wave C no second wave correction may move beyond its start below 1,280.35.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) above 1,392.30.

First Hourly Wave Count for Main Daily Wave Count.

I have adjusted the wave count slightly for most recent movement to have a better fit on the five minute chart. I expect that minute wave ii is over as a 0.71 correction of minute wave i, nicely within the common length of 0.66 to 0.81 for a second wave of a diagonal.

Within minute wave ii there is no Fibonacci ratio between minuette waves (a) and (b). Minuette wave (b) is a time consuming double combination: flat – X – zigzag. Within the second structure, the zigzag of subminuette wave y, micro wave C manages to just avoid a truncation, moving slightly beyond the end of micro wave A. The subdivisions have a perfect fit, better than my last attempt for this piece of movement.

Within an ending diagonal all the subwaves may only subdivide as single zigzags. The fourth wave should overlap back into first wave price territory. Ending diagonals are very choppy overlapping movements.

There is not normally a Fibonacci ratio between first, third and fifth waves of diagonals. When minuette waves (a) and (b) within minute wave iii have ended I will use the ratio between minuette waves (a) and (c) to calculate a target for minute wave iii to end.

Within minuette wave (a) at 1,324 subminuette wave iii would reach 1.618 the length of subminuette wave i. Subminuette wave iii should show an increase in upwards momentum.

Minute wave iii must move beyond the end of minute wave i above 1,322.83.

The final target for minor wave C to end remains the same at 1,346 where it would reach 0.618 the length of minor wave A.

Subminuette wave ii may not move beyond the start of subminuette wave i below 1,292.54.

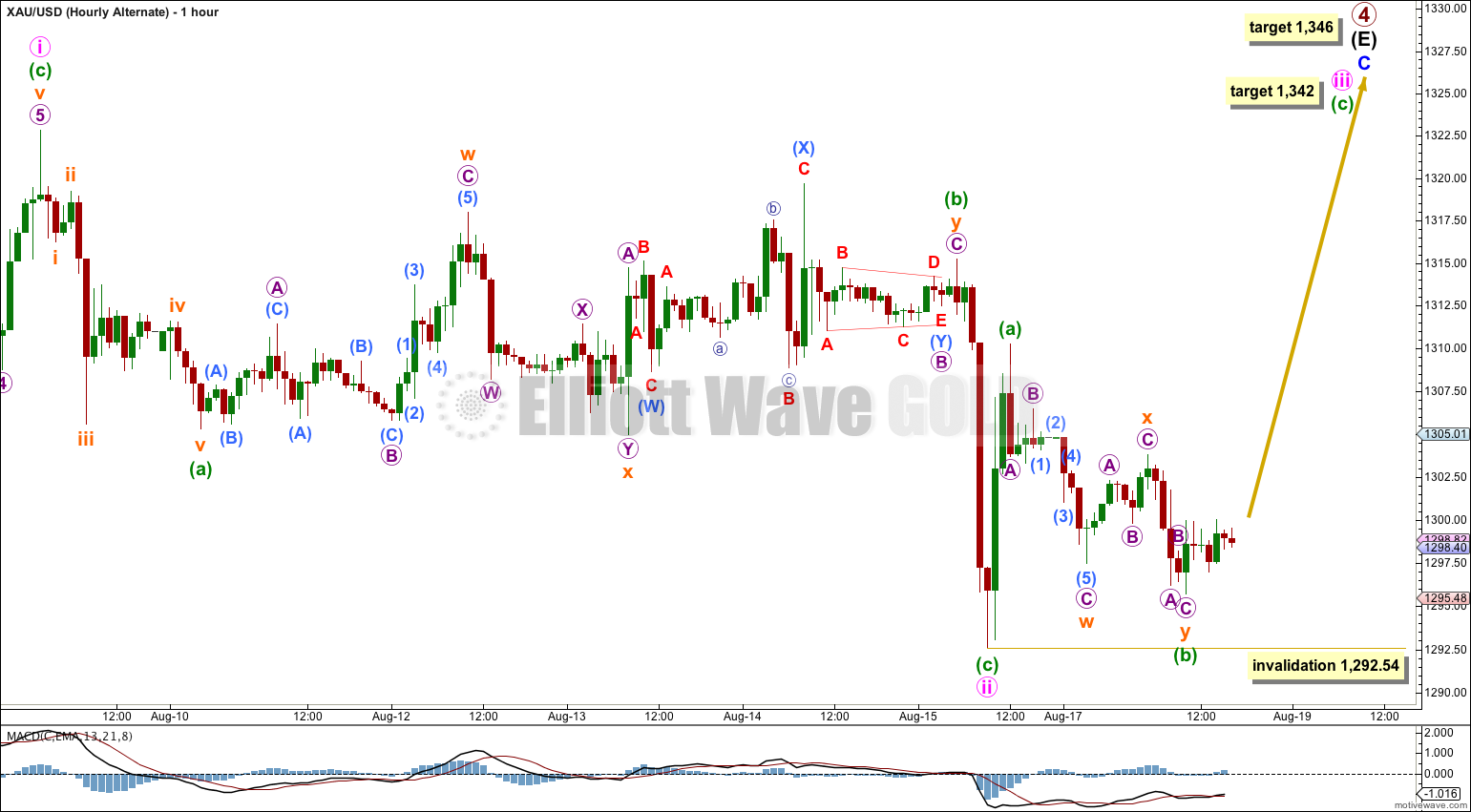

Second Hourly Wave Count for Main Daily Wave Count.

This alternate simply moves the degree of labeling within minute wave iii up one degree. It is possible that minuette wave (a) is complete and minuette wave (c) will be extended. At 1,342 minuette wave (c) would reach 2.618 the length of minuette wave (a). Minute wave iii would move comfortably beyond the end of minute wave i.

For this alternate idea the expected direction is exactly the same. If upwards momentum does not increase significantly this alternate may be more correct.

At this stage I would judge the main hourly wave count and this alternate to have an even probability. The length and momentum of the next wave up should tell us which one is correct.

Minuette wave (b) may not move beyond the start of minuette wave (a) below 1,292.54.

Alternate Daily Wave Count.

This wave count is one I have referred to before as a possibility, but have not published for you. In the interests of considering all possibilities after the invalidation of the last hourly wave count I will publish it now.

It is possible (but unlikely) that primary wave 4 is over.

If primary wave 4 is over then primary wave 5 downwards would reach equality in length with primary wave 1 at 956.97. Primary wave 1 was a remarkably brief 3 weeks duration. I would expect primary wave 5 to last some months, and is already longer than one month.

The only structure which fits for minor wave 1 is a leading contracting diagonal. While leading diagonals are not rare, they are not very common either. This slightly reduces the probability of this wave count.

Within diagonals the second and fourth waves are commonly between 0.66 to 0.81 the prior wave. Here minute wave ii is 0.61 the length of minute wave i, just a little shorter than the common length, slightly reducing the probability of this wave count. Minute wave iv is 0.66 the length of minute wave iii, just within the common length.

Leading diagonals in first wave positions are normally followed by very deep second wave corrections. Minor wave 2 is deep at 65% the length of minor wave 1, but this is not “very” deep. This again very slightly reduces the probability of this wave count.

The biggest problem I have with this wave count and the reason for it being an alternate is the leading diagonal following the end of the triangle for primary wave 4. When triangles end the first piece of movement out of the triangle is almost always very strong and swift. Diagonals are not strong and swift movements. To see a first wave out of a triangle subdividing as a diagonal is highly unusual and does not at all fit with typical behaviour. This substantially reduces the probability of this alternate wave count. I would judge it to have less than a 10% probability.

Within minor wave 3 no second wave correction may move beyond the start of its first wave above 1,322.83.

Only if this wave count is confirmed with a new low below 1,280.35 next week would I take it seriously. After that a clear breach of the lower (B)-(D) trend line of the primary wave 4 triangle would provide full and final confirmation of this alternate. A full daily candlestick below that trend line would provide me with 100% confidence in this wave count.

This analysis is published about 05:47 p.m. EST.

Hi Lara,

thank you very much for this. It would be great to get an update on Silver, (or even Oil and Gas)? Is there any other subscription with more then Gold?

Kindly

Ursula