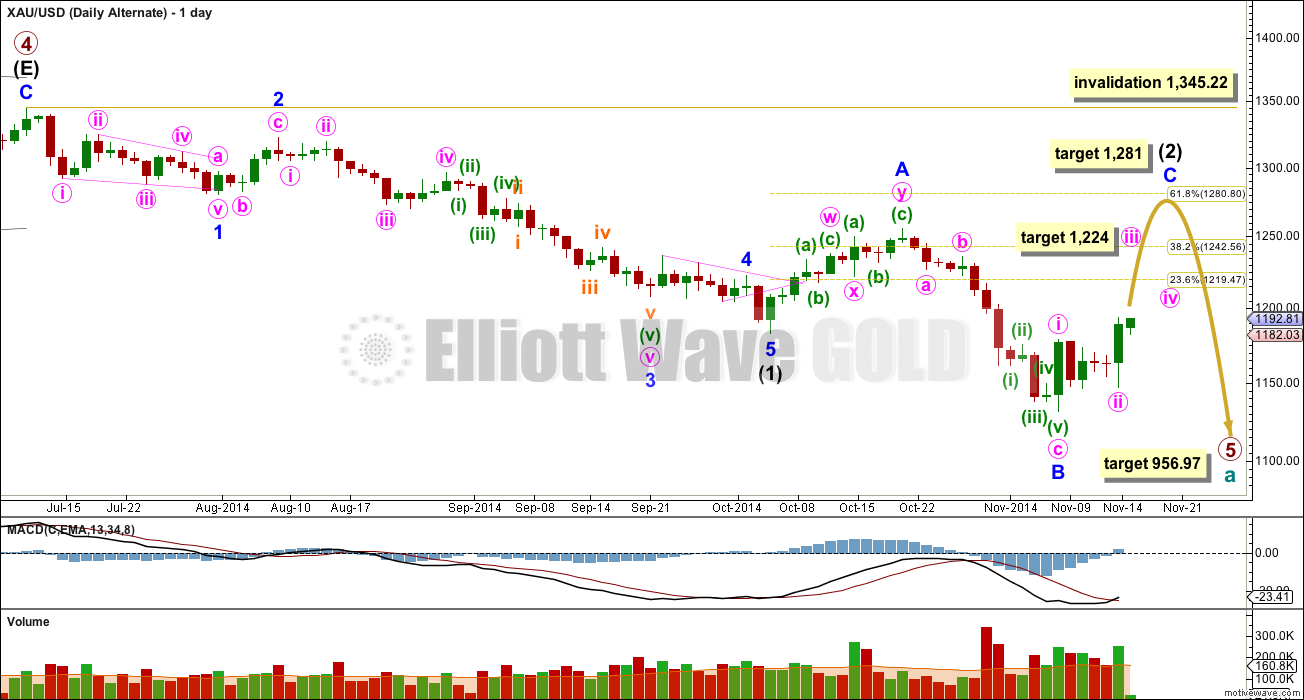

I have taken some time to try and see an alternate Elliott wave count which would expect more upwards movement.

If price does keep moving strongly higher, as many members seem to expect it will do, this is the wave count I would prefer. It would be confirmed with a new high above 1,255.40, but I would use this as a main wave count if the upper black trend line on the main wave count daily chart is breached, which would come before 1,255.40.

Click on charts to enlarge.

It is possible that intermediate wave (2) is incomplete as a more time consuming expanded flat correction. Minor wave A is a three, a double zigzag. Minor wave B is a single zigzag and a 172% correction of minor wave A. Minor wave B is comfortably longer than the maximum common length of 138% in relation to minor wave A, and this reduces the probability of this wave count.

At 1,224 minute wave iii would reach 1.618 the length of minute wave i.

At this stage this alternate wave count would be invalidated with movement below 1,146.98 as within minute wave iii no second wave correction may move beyond the start of its first wave.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22.

I did not give a probability yesterday… because it was just so hard to do so.

Now we have a new high for Gold today I am more confident that the alternate is correct. I will be looking carefully at both today and will give you a % for each.

I’m also looking for alternates.

The concept that price of Gold is affected by the US economy is a fundamental analysis concept. Elliott Wave treats each market as standing alone, that any one market does not affect the behaviour of any other market. I do know that this is a very contrarian and unpopular point of view today. But it is one I subscribe to, as I must if I am to do Elliott wave properly.

No worries.

It looks like the alternate is right. At least, today it has a better look and fit.

I’m concerned at the lack of momentum though. If this is a third wave… momentum should be increasing.

I’m looking very hard for alternate ideas. Including diagonals….

Dear Lara,

I’ve noticed you’ve been really good about posting targets and invalidation points for us who are trading gold. Question: the invalidation point of 1345.22– what does that mean to us traders? If intermediate 2 is invalidated would this change the view of the entire Primary 5 count?

I also have a suggestion: Since wave count notations are color coded, is it possible to color code the text on your target & invalidation remarks so they correspond to their appropriate wave?

I’m a little tired right now, hope this makes sense to you.

Cheers.

Thank you for taking time to relieving our anxiety. I notice London AM fix was at $1187. That was good news bellow Friday’s close. Since bginning of Gold bull trend London PM fix has been lower 90% of the time. Since now gold is in bear trend why it should be any different. I am expecting PM Fix to be lower. Will SEE.

I love this site and the wonderful work you do for us.

Regards

If 1,345.22 is breached that changes the wave count at primary degree. I would then expect Gold is in an upwards wave for cycle wave b. It should go up for one to several years overall, but not above 1,921.15.

I do not expect this to happen though. Primary wave 5 is an incomplete structure.

No, colouring text in wordpress is not simple and would add way too much complication and time to writing up the analysis. I refer to the names of degrees; print out the wave notation guide and refer to it every day until you learn which colour is which degree. It won’t take long.

Thank you Lara 🙂

Thanks for the update. What probability in terms of percentages to you see the main wave count vs the this new alternate wave count. Also, do you plan to publish your weekly update to the GDX today before the trading weeks beings?

With the ecomony moving strongly ahead, the USD breaking new technicals highs and low/zero foreseeable inflation, I have to believe that we will see nothing but downward movement in Gold.