Another small green candlestick overall fits the Elliott wave count. The alternate hourly wave count (with a small adjustment) is now much more likely, and so today I am swapping over the main and alternate hourly wave counts.

Summary: The short term target is 1,218. Overall I expect choppy overlapping slowing upwards movement for about another two or three days to complete a leading contracting diagonal. When that is done I expect to see a very deep second wave correction downwards. Alternatively, it is still possible that we may see a strong increase in upwards momentum in the next 24 hours, but this is now less likely. If that happens the target is now at 1,249.

Click on charts to enlarge

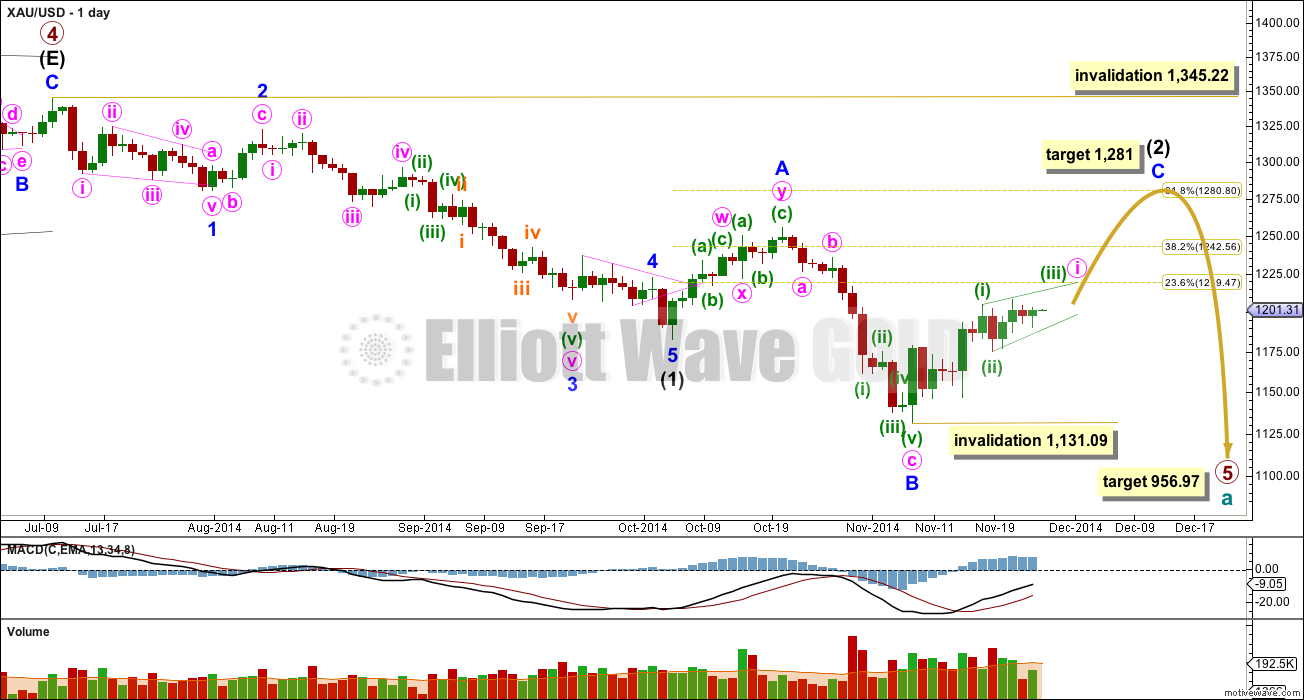

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Intermediate wave (1) lasted a Fibonacci 13 weeks. So far intermediate wave (2) has just begun its seventh week. I will expect it may continue for another two weeks at least to total a Fibonacci eight, and be 0.618 the duration of intermediate wave (1). Alternatively, intermediate wave (2) may last a total Fibonacci 13 weeks equalling the duration of intermediate wave (1).

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

*Note: I am aware (thank you to members) that other Elliott wave analysts are calling now for the end of primary wave 5 at the low at 1,131. I am struggling to see how this downwards movement fits as a five wave impulse: I would label the second wave within it (labelled minor wave 2) intermediate wave (1), and the fourth wave intermediate wave (4) (labelled as a double zigzag for minor wave A). Thus a complete impulse down would have a second wave as a single zigzag and a fourth wave as a double zigzag, which would have inadequate alternation. Finally, the final fifth wave down would be where I have minor wave B within intermediate wave (2). This downwards wave has a cursory count of seven, and I do not think it subdivides as well as an impulse as it does as a zigzag. If any members come across a wave count showing possible subdivisions of a complete primary wave 5 I would be very curious to see it.

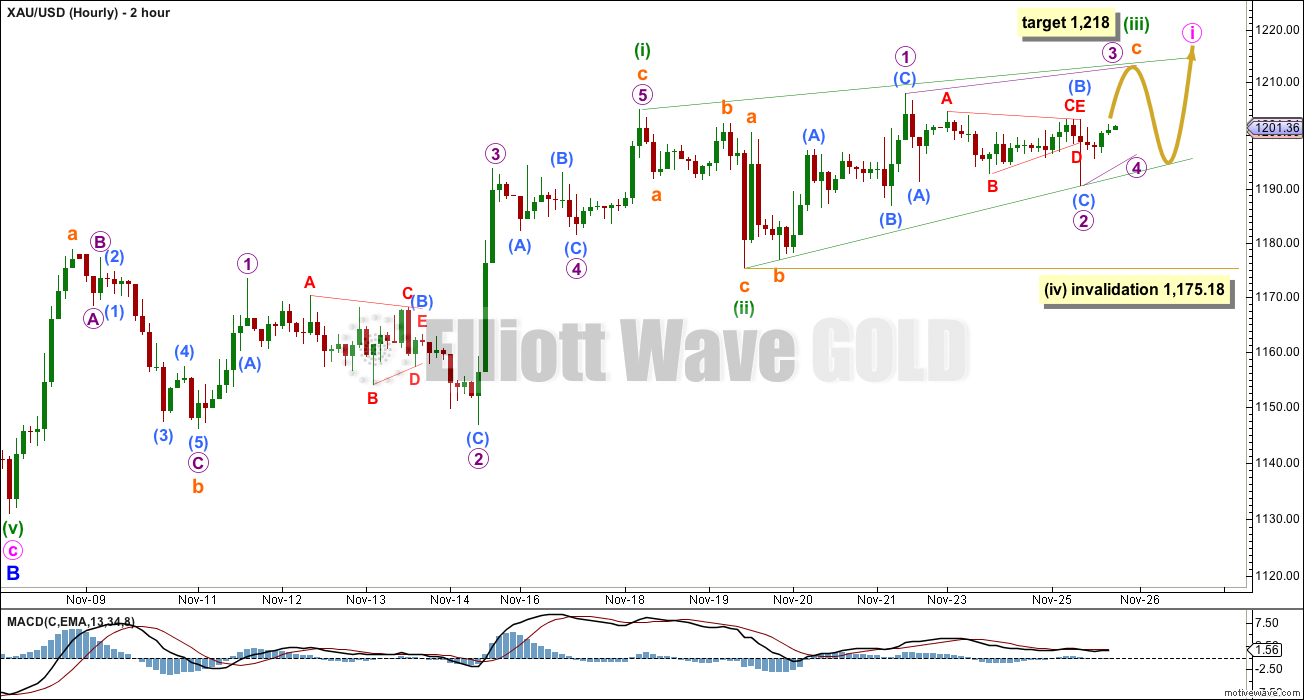

Main Hourly Wave Count

I will show hourly charts on a 2 hourly time frame today to fit all this movement in so you can see the differences between this main count and the alternate below.

This was yesterday’s alternate. It has increased in probability, mostly because the other wave count expected an imminent increase in upwards momentum which has not happened.

This main hourly wave count expects that minor wave C is beginning with a leading contracting diagonal for minute wave i.

Within this possible diagonal minuette wave (i) is a complete zigzag. Within leading diagonals the first, third and fifth waves are most commonly zigzags, but they may also be impulses.

Minuette wave (ii) is a complete zigzag, but much shallower than the common depth of between 0.66 to 0.81, at only 0.40 of minuette wave (i). This reduces the probability of this wave count, and is a good reason for seriously considering the alternate below.

Within the zigzag of minuette wave (iii) subminuette waves a and b are complete. Subminuette wave c looks like it may be completing as an ending contracting diagonal (it must subdivide as a five). At 1,218 subminuette wave c would reach 1.618 the length of subminuette wave a.

When minuette wave (iii) is a completed zigzag then minuette wave (iv) must overlap back into minuette wave (i) price territory, but may not move below the end of minuette wave (ii) at 1,175.18.

The diagonal is expected to be contracting, so minuette wave (iv) should be shorter than the length of minuette wave (ii) which was 29.59.

If this main hourly wave count is correct then when minute wave i is a completed leading contracting diagonal I would expect a following very deep second wave correction downwards for minute wave ii. When first waves unfold as leading diagonals they are normally followed by very deep second waves.

Alternate Hourly Wave Count

This is a variation on yesterday’s main wave count. Thanks to one of our members, Aleforex, for this idea.

This wave count sees minute wave i as over somewhat higher, as a five wave impulse. Ratios within minute wave i are: minuette wave (iii) is 1.01 short of equality with minuette wave (i), and minuette wave (v) has no Fibonacci ratio to either of minuette waves (i) or (iii). This movement fits with MACD, with minuette wave (iii) having the strongest upwards momentum.

There is a slight truncation at the end of minuette wave (ii): subminuette wave c failed to move below the end of subminuette wave a by 0.73. This slightly reduces the probability of this wave count.

Minute wave ii is a complete zigzag, but it is a shallow correction, only just below the 0.382 Fibonacci ratio of minute wave i. This is only a little unusual, and I would not actually judge it to be unusual enough to reduce the probability of this wave count by much at all.

The problem with this wave count is the same as previously. If the middle of a third wave is approaching we should expect to see a strong increase in upwards momentum. This alternate may yet redeem itself when upwards movement substantially increases in the next 24 hours. If that does occur I would use this again as a main wave count.

At this stage this alternate has an overlapping series of four first and second waves, and requires a strong increase in upwards momentum. At 1,249 minute wave iii would reach equality in length with minute wave i. I am using the ratio of equality to calculate the target because minute wave ii was shallow and minute wave i is long.

The adjustment to this wave count now sees downwards corrections mostly within the new base channel about minute waves i and ii. Only micro wave 2 spikes below the channel. This has a better overall look.

Micro wave 2 may not move beyond the start of micro wave 1 below 1,186.90.

This analysis is published about 06:42 p.m. EST.

Lara You have been asking for another EW analyst’s count. Here is one found on gold bug site.

http://www.kereport.com/2014/11/25/gold-silver-completing-wave-iv/

Few excerpt: Rest one can trad on the above link.

Last weekend, I noted that we were setting our target for wave IV in

the 114-116 region in the GLD. On our daily GLD chart, our minimal

target was the 114.78 level, which we came within 5 cents of striking on

Friday. On silver, it looks like we will be targeting the 16.65 region

for the top of this wave IV.

On Thursday night, I sent out an update that noted that there was no

imminent structure for the metals to break to the upside, as I was

expecting further consolidation or a break to the downside, which would

then set up the rally to the higher highs. In hindsight, that provided

to be quite prescient, as just hours later, the market dropped to

provide us a much better entry opportunity for the long trade we

expected to see for the c-wave of the 4th wave.

Thanks Papudi. Unfortunately theres just not enough detail in how he sees the subdivisions of the waves on that chart for me to see how he comes to that conclusion from an EW perspective.

The devil is in the detail.

Gold has been on SWZ vote schedule. Now considering the long weekend and Vote on Sunday. Monday appears to be the day gold’s impulse move may happen.

Hi Lara, if the low at 1131 is the end of intermediate wave (1) ( I know that you dont like it ), now intermediate wave (2) could be developping as a zigzag and at this moment ( 1194,78) we could be at the end of minor wave B.

This could be another possible alternate count…..

Please can you check if is it possible to count in 5 waves instead of 3 waves, the circled area in your chart attached ?

Thanks in advance!!…..and sorry for my english…

Yes that fits (if you see a five down complete at 1,131 which you’re right, I don’t like at all).

Yes we could be seeing a 5-3-5 zigzag up completing.

Strictly looking at periods of past major corrective waves 2 and 4 were 53 wks and 55wks long respectively. Impulsive major wave 3 lasted 38 weeks. The current major wave 5 should at least be in equal duration (?) 38 weeks. Currently wave 5 lasted 20 weeks.

Going forward 18 weeks remaining for wave 5 .!!!!

From previous posts gold’s target 956.90 will be met by January 2015. Has this time frame been revised?

Today’s post another great work!! Thanks.

Check technical analysis given November 11th said still had another 20 weeks to 956.97. I wish it was January. As per her charts it may suggest January but the chart is not to scale in the future.

Thanks Sir Richard. To confirm that’s the reason I asked the Q? on time schedule. Since Nov 11 waves have changed lot. Nov 11 report states: If it (wave (3)) lasts a Fibonacci 21 weeks it would be 1.618 the duration of

intermediate wave (1). So far intermediate wave (3) is in its third

week.

Wave (2) is still not complete for another two weeks and it was not complete then. Currently once the wave (3) begins it will last 21 weeks.

Interesting.

I’m struggling with this at the moment. Originally I used the triangle trend lines of primary wave 4 on the weekly chart; I extended the triangle trend lines out and the point at which they crossed over (the apex) I drew a vertical line down to touch the target at 956.97 and then calculated the number of weeks to get to that point on the weekly chart on a semi log scale. To see visually what I mean look at the Gold Historical analysis.

But…. now intermediate wave (2) looks like it will be rather time consuming. It looks now like it may last a total Fibonacci 13 weeks. This is going to mean it would be rather difficult for primary wave 5 to end in a total 26 weeks. Unless intermediate wave (3) is vertically down and very quick indeed.

This trick… sometimes works. But thats just sometimes. Not always, and not even very often.

So a better way to figure out when 956.97 may be reached would be to expect primary wave 5 to exhibit a Fibonacci number in weeks (because primary waves 1 through to 4 have Fibonacci durations or are very close to it). So primary wave 5 may total a Fibonacci 34 weeks. So far it is in its 20the week. Give or take one or two weeks either side of 34.