I will present only the one wave count for you today.

The second alternate from last analysis remains valid for GDX, but it is invalidated for Silver, and has a very low probability so I will not present it today.

Click charts to enlarge.

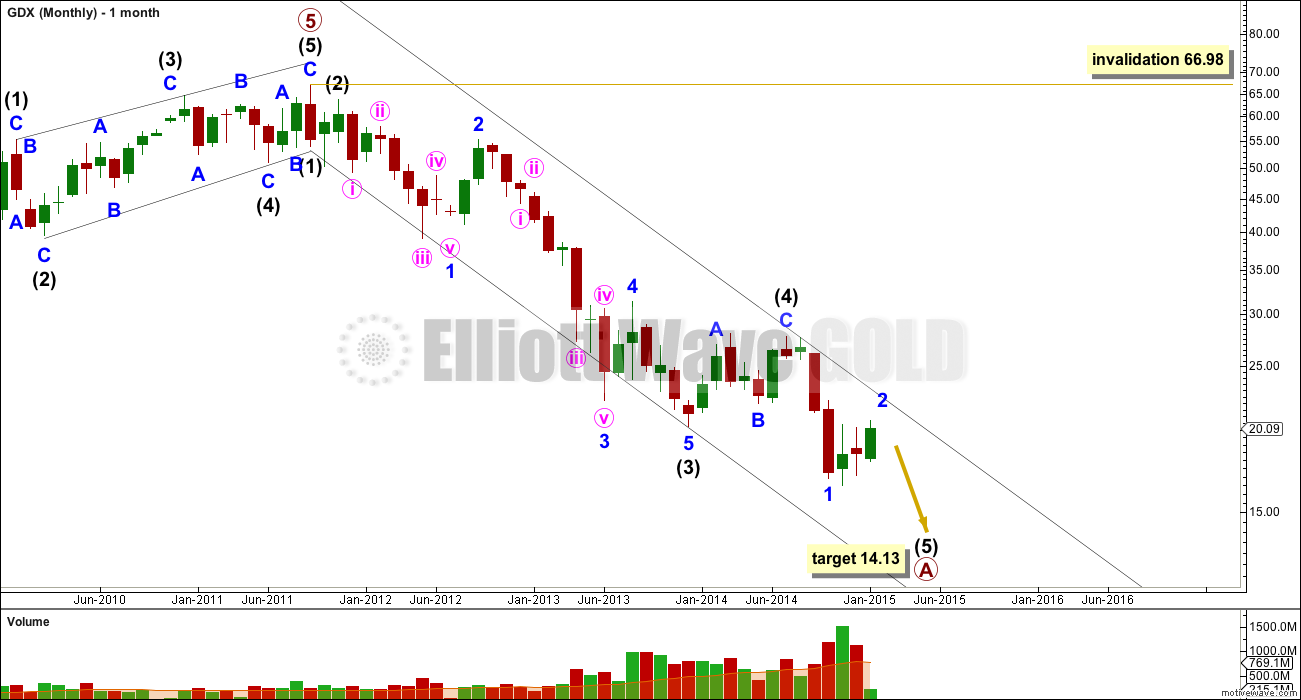

I see an incomplete five wave structure downwards. The final fifth wave for intermediate wave (5) is unfolding. At 14.13 intermediate wave (5) would reach equality in length with intermediate wave (1).

I have changed this monthly chart to a semi log scale to try and get the channel right. This channel is a best fit and may show where minor wave 2 upwards finds resistance.

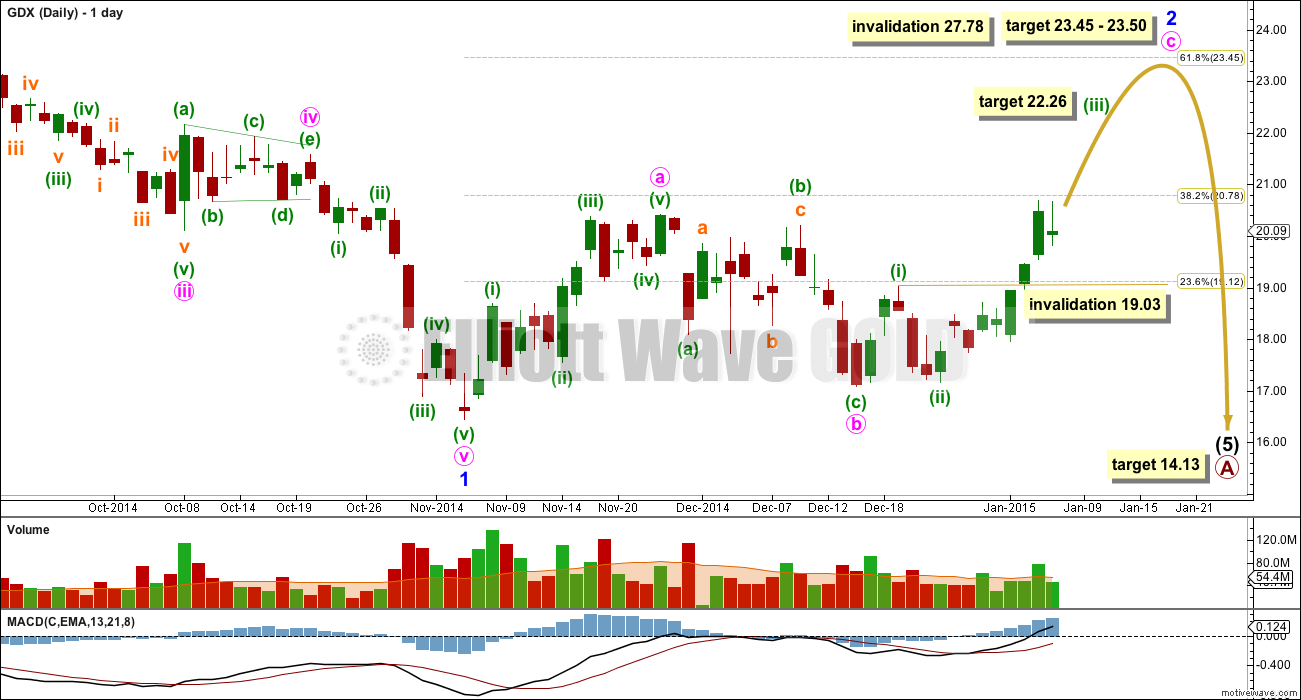

Minor wave 2 is a zigzag which subdivides 5-3-5.

Minute wave c must subdivide as a five wave structure. It looks like it may be an impulse. At 22.26 minuette wave (iii) would reach 2.618 the length of minuette wave (i).

The subsequent movement for minuette wave (iv) may not move back into minuette wave (i) price territory below 19.03.

At 23.50 minute wave c would reach 1.618 the length of minute wave a, and minor wave 2 would reach up to the 0.618 Fibonacci ratio of minor wave 1 at 23.45.

Minor wave 2 may not move beyond the start of minor wave 1 at 27.78.

HI Lara,

Is wave (iii) done at todays high??

Thanks!

I’ll take a look at GDX later today. Now I have to find food and take a walk in the mountains.

Will post a chart later while NY sleeps.

Thanks Lara!

An updated chart would be perfect

regards

Lara, is it possible that wave 4 ended in March instead of July? That would mean we are in wave 4 of final wave 5.

Lara, would you accept a flat in wave 2 of a “leading” diagonal, or does it have to be a zig-zag?

a flat is invalid

it must be a zigzag

good question!

Lara, thanks for GDX chart.

You’re very welcome Davey!